When to Buy in value investing

Value investing, Stock Basics, International Markets and Basics of Value Investing

1.00 (1 reviews)

304

students

30 mins

content

Feb 2024

last update

FREE

regular price

What you will learn

Value Fundamentals

Market Trends

Portfolio-Management

Decision-Making

Why take this course?

🌟 **Course Title:** When to Buy in Value Investing

🚀 **Course Headline:** Dive into the World of Value Investing with Our Expert-Led Online Course!

📘 **Course Description:**

Welcome to "Mastering the Buy: A Value Investing Approach" – your ultimate guide to mastering one of the most disciplined and enduring investment philosophies in the financial markets. This course is part of our comprehensive series, "Value Investing 101," and is designed to take you on a journey through the core principles of value investing. 📈

**Understanding Value Investing:**

Value investing, as pioneered by legendary investors like Benjamin Graham and Warren Buffett, is a strategy that focuses on selecting stocks trading for less than their intrinsic value. The goal is to invest in these undervalued companies with the expectation that, over time, market perceptions will adjust, and the true value of the stock will be recognized, leading to capital appreciation.

**Course Highlights:**

- **Fundamentals of Value Investing**: Discover the bedrock principles of value investing, including the concept of intrinsic value, and learn to analyze a company's financial statements like a pro.

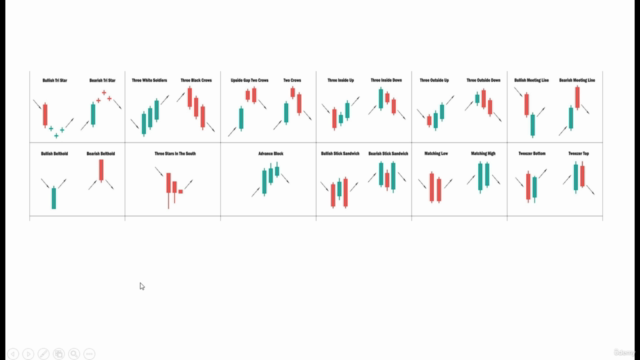

- **Market Analysis**: Decipher market trends and economic indicators that can provide critical insights into making informed investment decisions.

- **Stock Valuation Techniques**: Become adept at various valuation techniques such as Price-to-Earnings (P/E) ratios, Price-to-Book (P/B) ratios, and Discounted Cash Flow (DCF) analysis to identify undervalued stocks with high growth potential.

- **Timing the Market**: Master the art of market timing by recognizing market cycles and determining the most opportune times to buy stocks in alignment with value investing tenets.

- **Risk Management**: Learn strategic ways to mitigate risks and protect your investments through effective diversification and sound investment strategies.

- **Real-World Case Studies**: Analyze case studies of successful value investments and gain insights from past decisions made by the great investors.

🎓 **Who Should Enroll:**

This course is tailored for:

- Individual investors eager to enhance their investment portfolio with a value investing approach.

- Financial analysts seeking to deepen their understanding of value investing principles.

- Portfolio managers looking to apply value investing strategies for better returns.

- Anyone intrigued by the potential of value investing to improve their decision-making in the stock market.

✍️ **Course Outline:**

1. 📚 **Fundamentals of Value Investing** – Learn about intrinsic value and how to analyze a company's financial health.

2. 📊 **Market Analysis** – Understand market trends, economic indicators, and their impact on investment decisions.

3. 💡 **Stock Valuation Techniques** – Master various valuation methods to identify undervalued stocks.

4. ⏰ **Timing the Market** – Learn how to recognize market cycles and make timely stock purchases.

5. 🛡️ **Risk Management** – Understand how to protect your investments through diversification and strategic planning.

6. 🔍 **Real-World Case Studies** – Examine real examples of successful value investments and their lessons learned.

📅 **Enroll Now:**

Take the first step towards smarter investment choices with "Mastering the Buy: A Value Investing Approach." This course is your gateway to building wealth, enhancing your professional skills, and excelling in the dynamic world of investing. 🌟

Remember, CFDs (Contracts for Differences) are complex financial instruments that come with a high risk of losing money rapidly due to leverage. A high percentage of retail investors lose money when trading CFDs. This course focuses on fundamental investment strategies and is not promoting trading in CFDs or similar products. Enroll today to embark on your value investing journey! 💼💰

Screenshots

5815002

udemy ID

2/11/2024

course created date

2/20/2024

course indexed date

Bot

course submited by