Real Estate Acquisitions 101

How To Identify Commercial Properties, Run Due Diligence, Raise Capital, and Close Commercial Real Estate Transactions

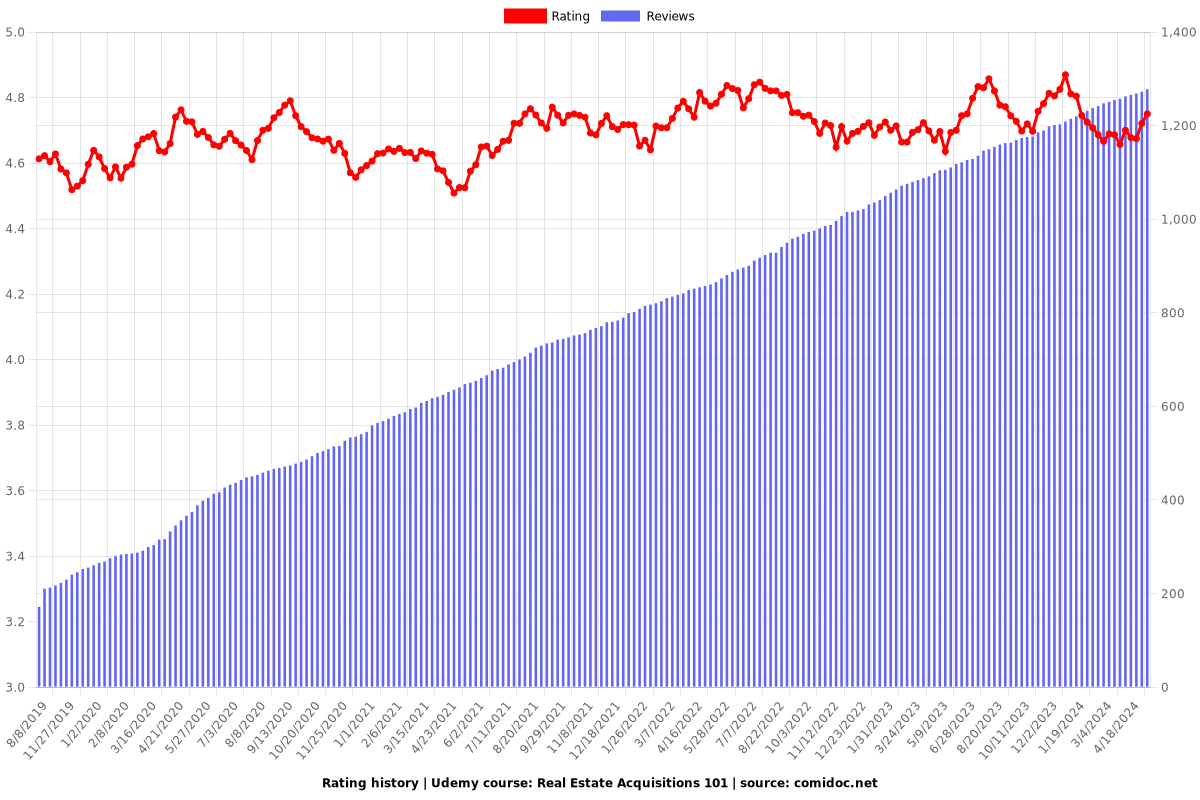

4.67 (1270 reviews)

8,689

students

3.5 hours

content

Apr 2024

last update

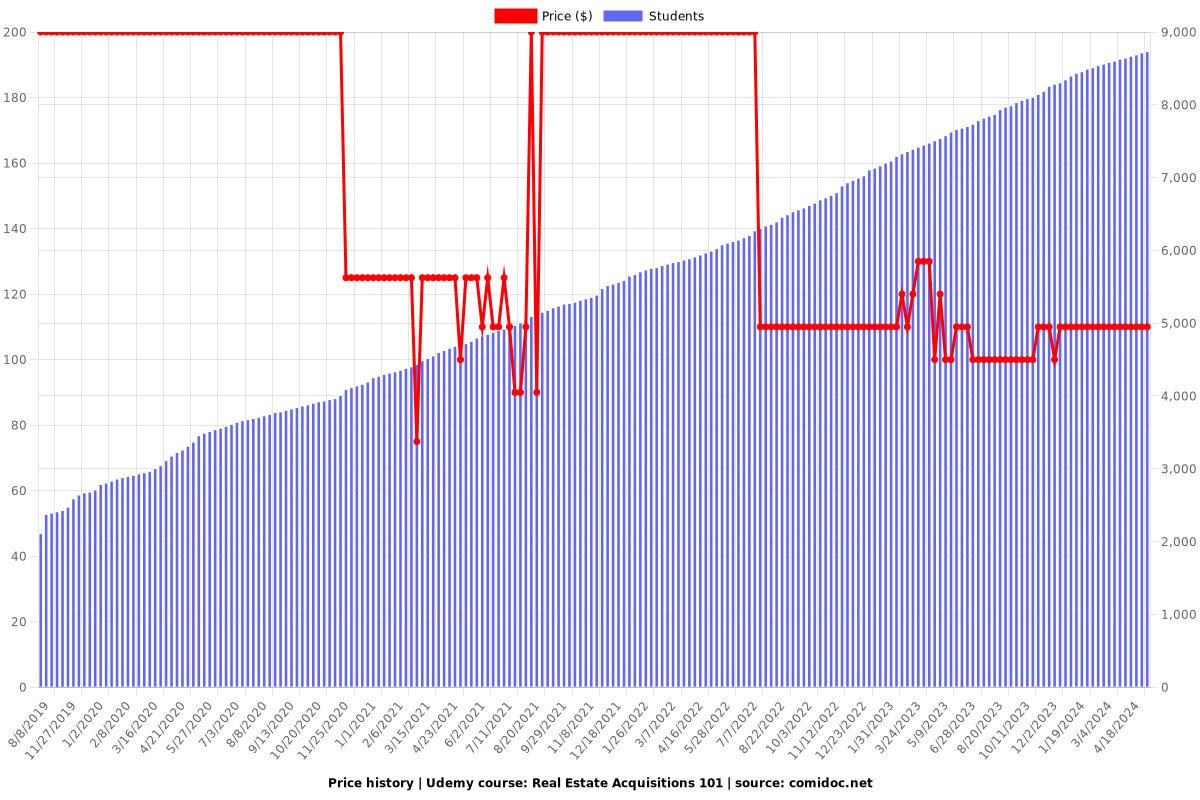

$109.99

regular price

What you will learn

Understand the entire process of purchasing a commercial real estate property from start to finish

Learn the key components of physical and financial due diligence, capital raising, and closing of a commercial real estate transaction

Understand how fee and waterfall structures work in a commercial real estate transaction, and how investors and private equity firms earn "sweat equity"

Understand the acquisitions career path, including compensation structures, career progression, and long-term opportunities in this sector

Why take this course?

🏢 **Real Estate Acquisitions 101: Master Commercial Property Transactions** 🏘️

---

**Course Headline:** 🚀 *Unlock the Secrets of Commercial Real Estate Investments with "Real Estate Acquisitions 101"*

Are you ready to dive into the world of commercial real estate transactions? Whether you're an aspiring investor, a seasoned real estate professional, or someone eager to expand your understanding of the industry – this course is your golden ticket! 🗝️

---

**What You'll Learn:**

- **Mastering the Acquisitions Process:** Discover how to confidently navigate every step of purchasing commercial real estate, from property identification to closing the deal. 🔍

- **Minimize Risk & Maximize Profit:** Gain insights into fee and waterfall structures, JV equity partnerships, and learn how to structure deals to minimize your investment while maximizing profit potential. 💰

- **Career Path Exploration:** Determine if a career in real estate acquisitions aligns with your financial goals and long-term objectives. 🛣️

---

**Course Curriculum:**

- **Identifying Commercial Properties:** Learn to spot promising opportunities in a variety of markets, from apartment buildings to retail centers and beyond. 🏢➡️🏫➡️🛍️

- **Conducting Due Diligence:** Understand the critical components of both physical and financial due diligence, ensuring you're making informed decisions. ✅

- **Equity Raising Essentials:** Get an in-depth look at how investors approach equity raises and what lenders are looking for in your deal. 💼

- **Partnership Structures:** Explore various partnership models and learn how to structure deals that create "win-win" scenarios for all parties involved. 🤝

---

**Real-World Application:**

This course is designed to provide a comprehensive understanding of the commercial real estate acquisition process, suitable for both individual investors and those working within real estate investment, development, or brokerage firms. 🌐

---

**Student Testimonials:**

🚀 "Clear and to the point. Love that he does not waste time. Lays it out simply and clearly."

🌟 "A great high-level introduction to syndicating real estate deals! Justin's course has been invaluable for my work at a small commercial real estate development/management company."

🏗️ "This is an excellent overview of real estate syndication deals and the transaction elements of a typical commercial real estate acquisition. The material is presented in a logical, easy-to-follow manner from start to finish of the deal cycle."

---

**Join Us:**

Whether you're looking to do deals on your own or simply gain a deeper understanding of what goes on behind the scenes at your company, this course will equip you with the knowledge you need to succeed. 🎓

Don't miss out on the opportunity to transform your approach to commercial real estate acquisitions! Enroll in "Real Estate Acquisitions 101" today and step into a world of informed decisions, strategic partnerships, and profitable investments. 💼✨

Enroll now and take the first step towards becoming a commercial real estate acquisition expert! 🚀🏗️

Screenshots

Our review

---

**Course Review for Commercial Real Estate Acquisitions**

**Introduction**

The course on Commercial Real Estate (CRE) Acquisitions has garnered a global rating of 4.68, with all recent reviews being positive. The course is well-regarded for its ability to provide a high-level understanding of real estate syndication and the acquisition process, as evidenced by the reviews below.

**Pros:**

- **Comprehensive Content**: The course offers a **thorough** and **detailed** overview of the CRE acquisitions process, suitable for beginners as well as seasoned professionals looking to refresh their knowledge.

- **Step-by-Step Guidance**: It provides **step-by-step directions**, which are **clear** and **precise**, making complex elements easy to understand.

- **Real-World Application**: The course includes **financial models** and **tools** that are immediately **usable** in real-world scenarios, such as setting up everything needed for an acquisition on day one.

- **Expert Instructors**: The instructor is noted for having a **vast amount of experience** in the field, which is reflected in the quality of the content.

- **Highly Recommended**: The course is **"highly recommended"** by both beginners and experienced professionals for its **"excellent"**, **"crystal clear"**, and **"very solid"** approach to teaching fundamentals.

- **Practical Resources**: Students appreciate the inclusion of **sample materials**, **case studies**, and **real examples** that complement the course content.

- **Flexible Learning**: The course structure allows for learning at one's own pace, with short videos that are **easy to follow** and can be watched during activities like working out.

- **Adaptability**: The course is adaptable for different types of properties, with some reviews suggesting it would be beneficial to have more specific examples or checklists tailored to different property types, such as hotels versus office buildings.

**Cons:**

- **Visual Aids**: Some reviewers pointed out that the slides could be more **visually illustrative**, especially for a topic that can be very visual in nature.

- **Gender Representation**: There is one notable comment regarding the lack of female representation in the course imagery, which could give an impression that the field is not inclusive or appropriate for women. It is recommended to include more diverse examples to ensure all potential students feel represented and welcomed.

- **Specificity in Content**: A few reviews mentioned a desire for more specific advice on what to focus on during due diligence (DD) for different types of properties, such as hotels or offices.

**Conclusion:**

Overall, this course is an **"excellent"**, **"compact overview"** of a subject that is **very complex**. It is a **perfect crash course** for beginners and offers valuable insights for those looking to deepen their understanding of CRE acquisitions. The course content is **"outstanding"**, offering guidance to close one's first commercial real estate investment successfully. It is highly recommended for anyone interested in breaking into the industry, especially if they are considering a career in acquisitions or will be interfacing with acquisitions professionals.

---

**Recommendations for Improvement:**

- Enhance visual aids to complement the detailed text descriptions and make the learning experience more engaging.

- Include diverse representation in imagery and examples to ensure all learners feel included.

- Provide more specific content for due diligence processes tailored to different types of commercial properties to cater to a broader range of needs.

**Final Verdict:**

This course is an essential resource for anyone entering or already working in the field of Commercial Real Estate Acquisitions. With its high-quality content and practical application, it is a valuable tool for learning and professional development.

Charts

Price

Rating

Enrollment distribution

Related Topics

1518034

udemy ID

1/20/2018

course created date

8/8/2019

course indexed date

Bot

course submited by