The Goods & Services Tax Certification Course

Empowering Knowledge an Employability

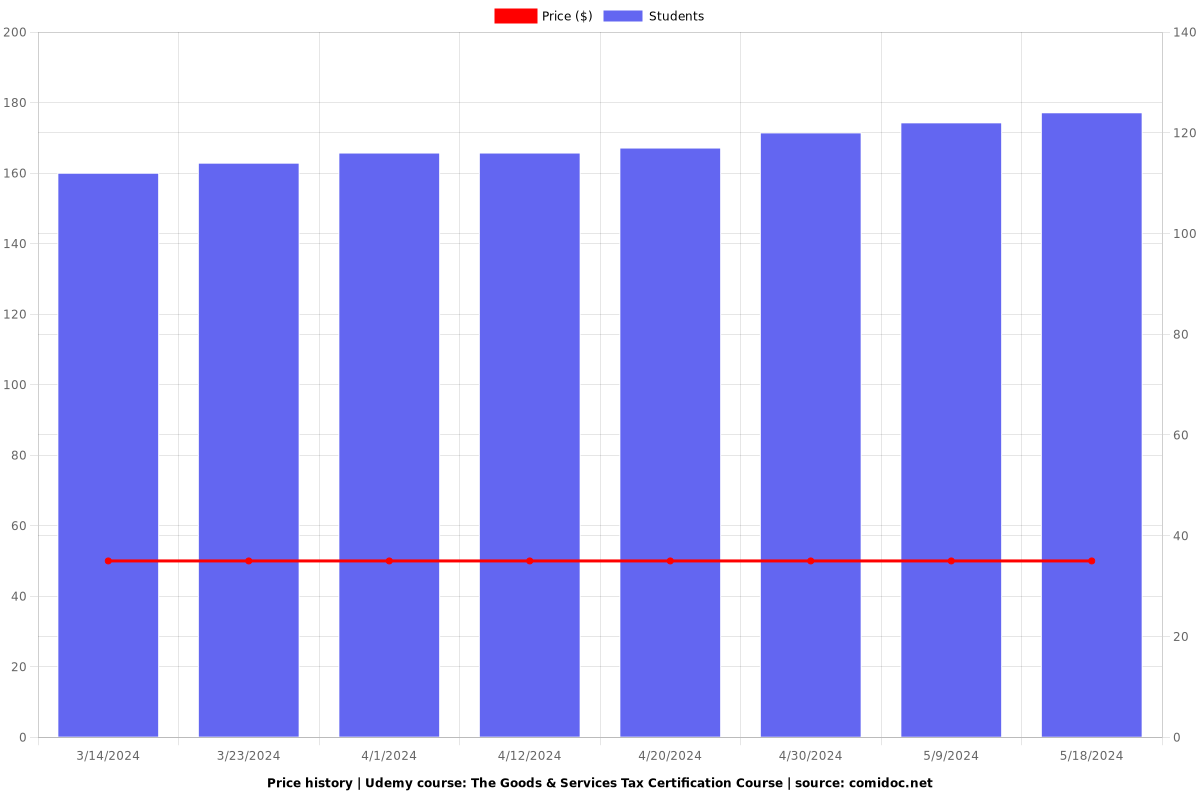

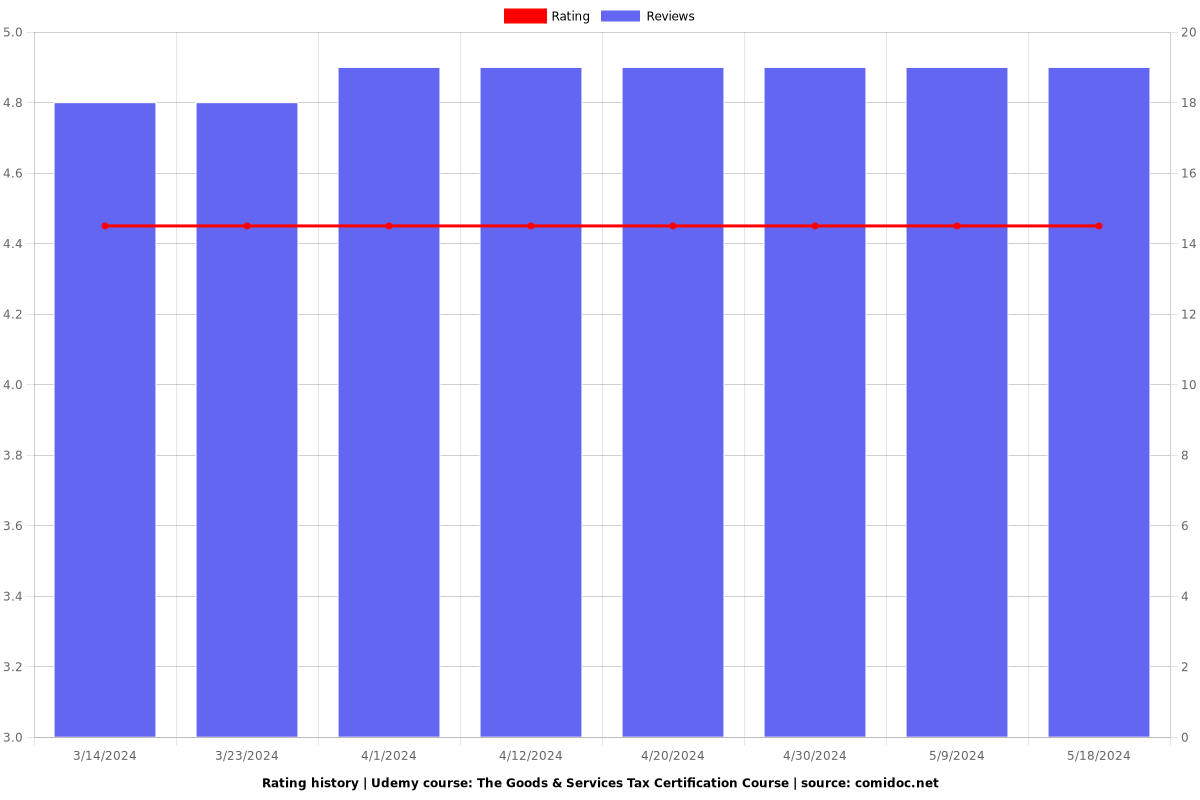

4.45 (19 reviews)

120

students

36 hours

content

Aug 2021

last update

$49.99

regular price

What you will learn

Getting practical knowledge of the legal provisions, procedures, their applicability, and major issues chronologically as per the provisions under GST.

Developing skill-sets to mitigate and handle issues under GST.

Live Examples based on prominent issues being or likely to be faced by the industry.

Getting ready to be a thorough GST professional.

Why take this course?

---

**The Goods & Services Tax Certification Course by Hiregange Academy**

🏫 **Empowering Knowledge and Employability**

**Course Headline:**

🚀 **Elevate Your Expertise in GST - A Comprehensive Learning Journey**

---

**Course Description:**

The Goods & Services Tax (GST) revolutionized the Indian economic landscape when it came into effect on July 1, 2017. This transformative tax reform has been the subject of rigorous study and continuous evolution, presenting both challenges and opportunities for professionals across various industries. For students of Commerce and Business Administration, GST has become a cornerstone in their academic journey; however, its practical application is often overshadowed by theoretical teachings, leaving many with an incomplete grasp of this complex subject.

📘 **Why This Course?**

This course is meticulously designed to bridge the gap between the theoretical underpinnings and the practical application of GST. Whether you're a student seeking to solidify your academic learnings or a working professional aiming to enhance your skill set, this course offers a deep dive into the intricacies of GST that will undoubtedly enrich your understanding and employability in the field.

---

**Course Structure:**

Hiregange Academy's **GST Certification Course** is structured into two comprehensive modules:

1. **Basic Module** - This foundational segment lays down the bedrock of GST knowledge, ensuring you are well-versed with the fundamentals.

2. **Procedural Aspects Workshop Module** - A hands-on workshop that provides real-world application and practical expertise in dealing with the procedural aspects of GST.

---

**Module Breakdown:**

**Basic Module:**

An exhaustive exploration of the key concepts under The Goods & Services Tax, this module covers:

- The practical interpretation of laws, statutes, and how they apply to your business operations.

- A comprehensive understanding of GST, including its major topics from the ground up.

- Real-life issues and practical problems, complete with workable solutions.

**Procedural Aspects Workshop Module:**

This module is a hands-on experience that delves into the practical aspects of GST, teaching you:

- How to break down complex legal texts and navigate their implications in your daily tasks.

- The skills to read and interpret tax laws effectively.

- Strategies to apply statutes in real-world scenarios.

---

**What You Will Learn:**

- **Real-World Applications:** Gain insights into how GST affects businesses and consumers, and understand the practical implications of taxation policies.

- **Expert Guidance:** Learn from industry veterans with over 15 years of experience who will share their knowledge and real-life challenges faced in the application of GST laws.

- **Practical Solutions:** Acquire a set of tools and strategies to address the complexities and intricacies of GST, ensuring you are well-prepared for any challenge that comes your way.

---

**Advance Your Career Further:**

For those looking to delve deeper into the world of GST, we offer an **Advanced Certification Course**. This course serves as a stepping stone for those who have completed the Basic Module and are ready to tackle advanced concepts and scenarios.

---

Embark on a learning journey that will not only enhance your understanding of GST but also boost your career prospects. Enroll in the **Goods & Services Tax Certification Course** by Hiregange Academy today and unlock a world of opportunities! 🌟

Reviews

Diptojit

July 2, 2023

As a online class there is or are no option to interact then clarification has to be better. Like in which case how much GST needs to be charged. There are several areas where as a audience questions will be arise that -"then how much GST will be lavy?" But it left with no answer. That is disappointing.

Charts

Price

Rating

Enrollment distribution

Related Topics

3845556

udemy ID

2/13/2021

course created date

3/14/2024

course indexed date

Bot

course submited by