Title

Operational Risk Management Professional Masterclass

All what you need to know and best practices to better Understand, Identify, Assess, Respond and Report on key risks

What you will learn

Understand the origin of Operational Risk and why it is important for organizations' survival and how it evolved over time to serve changing environment.

Understanding key terms and definitions: including Risk Taxonomy, Risk Appetite, Risk/Reward, Risk Tolerance and many other terms essential in your risk vocab.

Understanding the key types of risk including: Credit risk, Market risk, operational risk, liquidity risk and Reputational risk

Breakdown the Risk management process from: Risk Identification, Risk Evaluation and Assessment, Risk Response, Risk Monitoring and Reporting

Gain in-depth understanding of how to assess the effectiveness of existing controls and how to design effective ones (detective, preventive & reactive controls)

Gain in-depth understanding of the operational risk framework and how to apply that to your organization

Understanding what Risk Culture Means and how a robust risk culture should look like to nurture an effective risk practices in the organization

Deep dive in what an effective Risk Management Program should include key practices and how to effectively establish those practices in your organization

Understanding the Three Lines of Defense model in effective risk management and how the roles and responsibilities of each line of defense look like and why?

Gain in-depth understanding of best practices in Risk management including: BASEL, ISO and COSO framework accords

Understanding what Inherent risk VS Residual risk means and how effective controls contribute to the residual risk severity

in-depth analysis of the key Risk Mitigation strategies like: Risk acceptance, Risk reduction, Risk sharing, Risk transfer and Risk Avoidance

Deep-dive into key risk management strategic reports including: RCSA report, Loss event report, KRI metric and Risk Heatmap

Understanding Why Risk Management fails and the most 7 Common Risk Management Mistakes and How to Avoid Them

Understanding How to establish a robust risk management function in your organization

What Makes a Good Operational Risk Manager? and the 8 most respected personal and professional skills that will get you to be a Highly Effective Risk Manager

Why take this course?

🎓 Master the Art of Operational Risk Management with Eslam Eldakrory's Professional Masterclass!

Hello colleagues,

You've arrived at the right place if you're eager to delve into the intricacies of operational risk management and fortify your organization against risks that could disrupt business continuity. This Operational Risk Management Professional Masterclass is a meticulously crafted journey that will guide you from the foundational concepts all the way to mastering the evaluation, response, and monitoring and reporting procedures.

🔥 Module 1: The Gateway to Operational Risk Management Discover the history of operational risk, learn from real-world examples where poor risk management has led to organizational downfall, and get acquainted with the pivotal terminologies that form the backbone of risk management. Plus, I'll share some innovative learning techniques that have proven effective over my 18 years of experience.

🌍 Module 2: A Comprehensive Overview of Risk Management Standards Explore the international risk governance standards including Basel and COSO frameworks, and understand the ISO 31000 standards that shape effective risk management practices. This module will equip you with the knowledge to align your organization's policies with global best practices.

📊 Module 3: Performance Boosters Learn from my extensive experience on how risk management can be effectively implemented and improved within an organization. I'll share insights into why risk management sometimes fails, case studies of successful risk functions, and personal traits that make a great risk manager. You'll also learn the skills necessary to excel in your career and stand out as a leader in this field.

🔍 Module 4: Key Risk Management Monitoring and Reporting Programs Gain expertise in establishing effective monitoring reports like the RCSA, ORLE, KRIs dashboard, and risk heatmap profile. These tools are essential for maintaining a comprehensive view of your organization's risk exposure and will help you make informed decisions to navigate uncertainties confidently.

🌟 Why Choose This Masterclass?

- Expert Instruction: Learn from Eslam Eldakrory's 18 years of practical experience and a wealth of real-world case studies.

- Interactive Learning: Engage with the content through interactive modules that facilitate a deeper understanding.

- Global Standards Alignment: Understand how international standards like Basel, COSO, and ISO 31000 can be applied in your organization.

- Career Advancement: Acquire the skills and knowledge to advance your career in risk management.

- Risk Management Excellence: Learn how to establish a robust risk management function that contributes significantly to your organization's success.

Embark on this journey with confidence, knowing that you're investing in your professional development and the future of your organization. Enroll today and become an expert in operational risk management! 🌟

Enroll Now and Elevate Your Risk Management Career to New Heights with Eslam Eldakrory's Masterclass! 🚀

Screenshots

Our review

Overview of the Course: "Operational Risk management"

The online course on Operational Risk Management has garnered a high rating of 4.49 from recent reviewers, indicating a strong positive reception among learners. The course is commended for its detailed content, practical examples, and structured presentation that facilitates a deep understanding of the subject matter. Eslam, the instructor, is praised for his talent in sharing knowledge on operational risk and for providing a comprehensive coverage of the topic.

Pros:

- In-depth Content: The course material is described as detailed and complete, offering a thorough understanding of the Operational Risk Management (ORM) framework.

- Practical Application: Reviewers appreciate the practical scenarios and case studies included in the course, which help to cement the concepts learned.

- Well-Structured: The organizational layout of topics is acknowledged as good, with the instructor's presentation being easy to follow and presented in a clear and concise manner.

- Comprehensive Coverage: The course is considered an incredible resource, covering lots of material and topics in manageable chunks with great visuals.

- Educational Approach: Eslam's approach is commended for not only teaching facts and knowledge but also for inspiring the right mindset for operational risk management professionals.

- Real-world Relevance: The course content is relevant to those from operations backgrounds and avoids using excessive jargon, making it accessible and relatable.

- Mindset Development: The instructor encourages learners to think about how their organization can improve its risk practices and provides tips for tackling problems more effectively.

Cons:

- Video Quality: Some reviewers suggest that the video of the instructor occasionally covers up portions of the content on the screen, which could be improved by turning off the self-video.

- Technical Issues: A few learners faced difficulties playing the course on their computers, but managed to do so on their phones.

- Pedagogical Enhancements: Some reviewers suggest adding more questions to the quizzes and providing more detailed explanations of risk appetite and tolerance early in the course for those less familiar with risk management.

- Typos in Subtitles: A minor point mentioned is that there are some spelling mistakes in the subtitles, which should be addressed for clarity.

- Additional Content Desired: Some users would have liked more information on specific sections, such as Risk Governance, and more detailed explanations in certain areas.

Additional Feedback:

- Course Structure: The course is described as exceptionally well-structured and succinct, with several reviewers noting its helpfulness for professional development.

- Future Learning: Many learners express their intention to follow more courses by the instructor, Eslam, due to the quality of instruction and content provided.

- Revisiting Material: To fully grasp all the information imparted, some users recommend revisiting the course material multiple times.

Conclusion:

The Operational Risk Management course is highly recommended for its comprehensive coverage of the topic, practical examples, and structured presentation. While there are minor technical issues and areas for improvement, the overall reception indicates that this course is an excellent resource for professionals looking to develop their skills in operational risk management. The positive feedback from users underscores the value of the course for both personal learning and professional development.

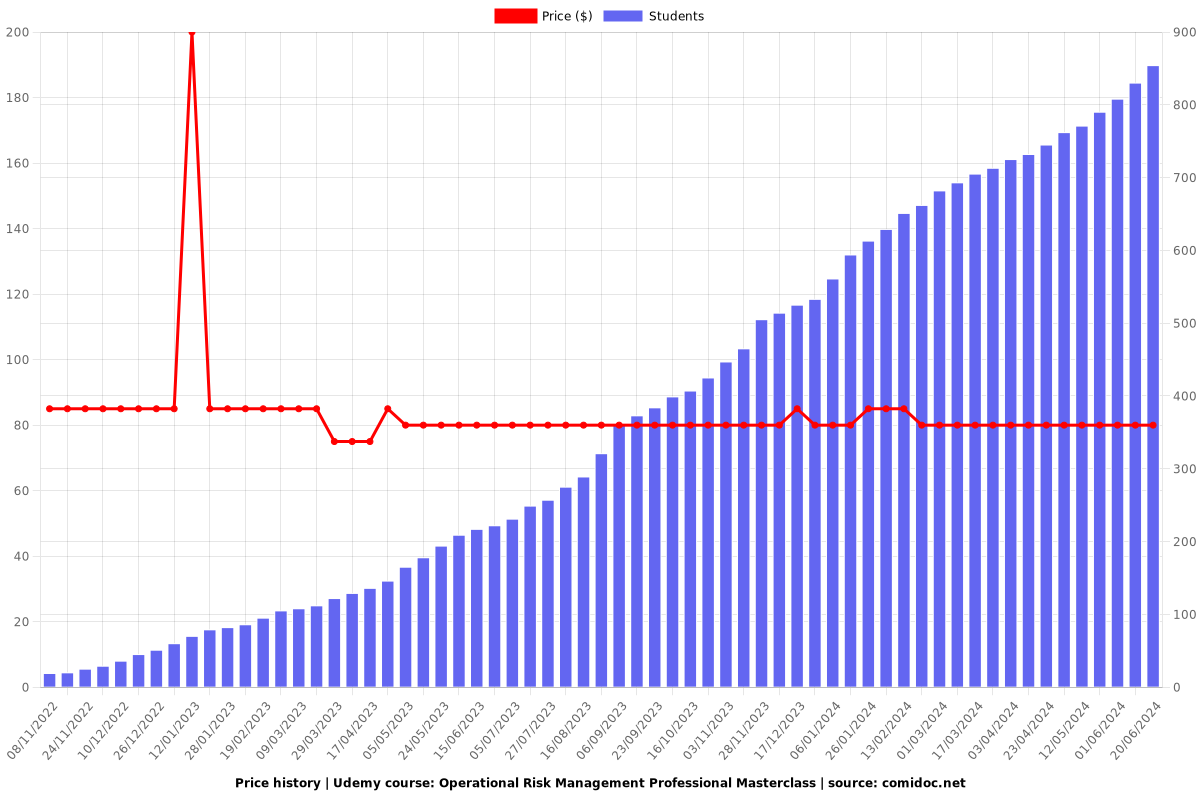

Charts

Price

Rating

Enrollment distribution