Tax Preparation: Learn Fast! Prepare Taxes with Confidence!

Become a confident tax preparer by learning about taxes and applications over practical examples and scenarios.

What you will learn

Learn the filing basics

Learn the various filing status types

Learn who can claim personal exemptions

Learn who can claim dependency exemptions

Learn how to report income from wages, salaries, tips, and interest

Learn how to report business income

Learn how to report capital gains and losses

Learn how to report retirement income

Learn how to report income from Social Security Benefits

Learn how to make adjustments to income

Learn how to calculate adjusted gross income

Learn who can claim standard deduction

Learn who should take itemized deductions

Learn how to claim credit for child and dependent care expenses

Learn how to claim education credits

Learn how to claim American Opportunity Credit

Learn how to claim Lifetime Learning Credit

Learn how to claim Child Tax Credit

Learn how to claim other miscellaneous credits

Learn how to report Other Taxes

Learn how to report Payments

Learn how to claim the Earned Income Credit (EIC)

Learn about the Refund options and the Amount the taxpayer owe

Why take this course?

If for any reason you are not satisfied, get your money back. No Questions Asked.

This course will prepare you to be confident in preparing your own taxes and the taxes of others. This course will visually and logically explain the Tax Law and its applications through scenarios and examples. Tax Law is a very interesting topic. It is not a topic that can be easily memorized, but, however, it is a topic that requires constant research and reference to appropriate materials. This course will enable you to do exactly that.

You will find videos that explain the rules. These videos are followed by another set of videos with examples and scenarios that will help you understand the application of the Tax Law even better. All the materials that I am talking about in the course are FREE and I tell you where to find them and how to use them.

You can study the course at your own pace. However, I believe that you can finish it very fast since the videos are very descriptive. Get equipped with the proper materials, review the course, and start preparing tax returns!

I suggest that you take action now and enroll today!

Screenshots

Reviews

Charts

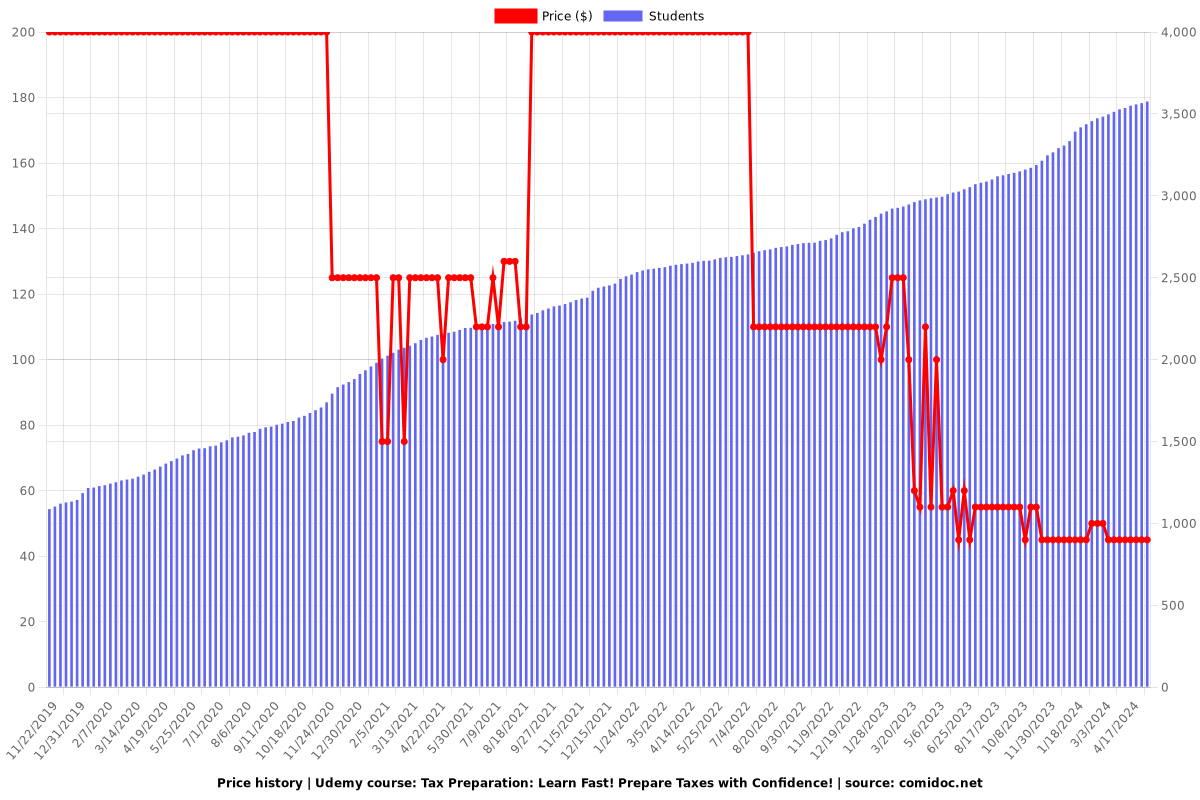

Price

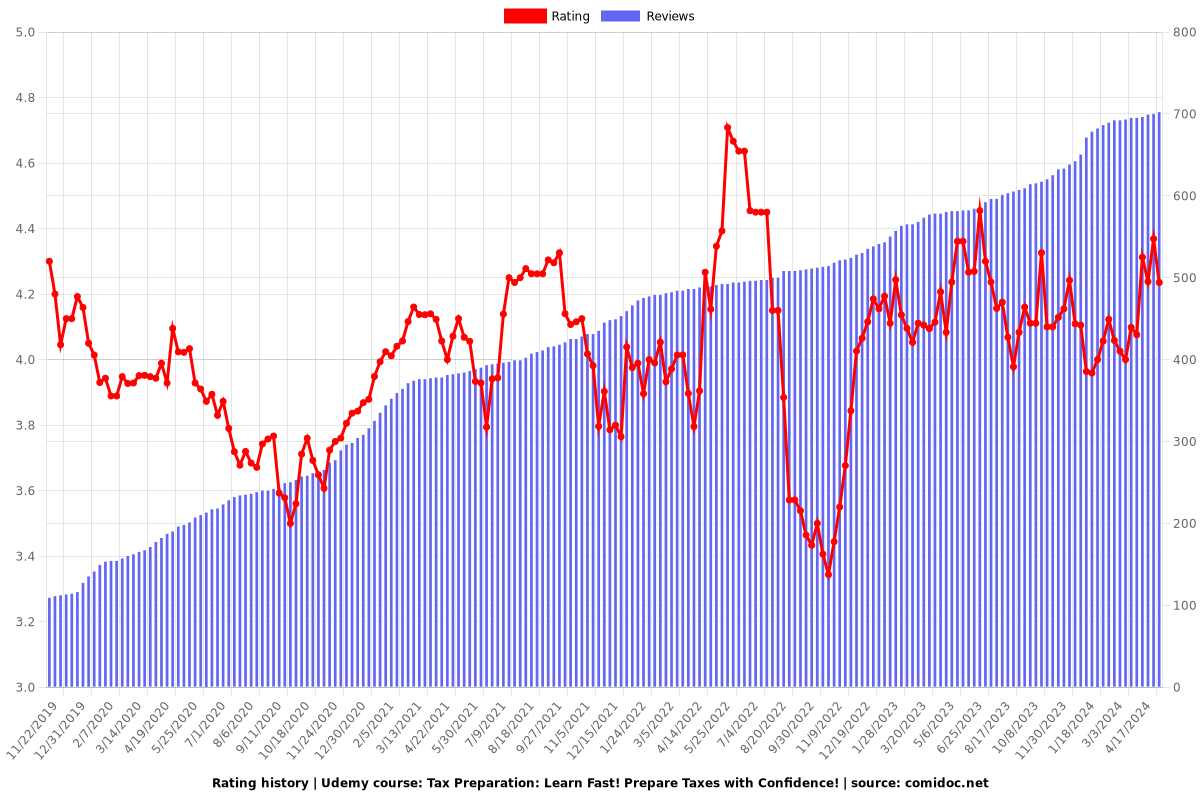

Rating

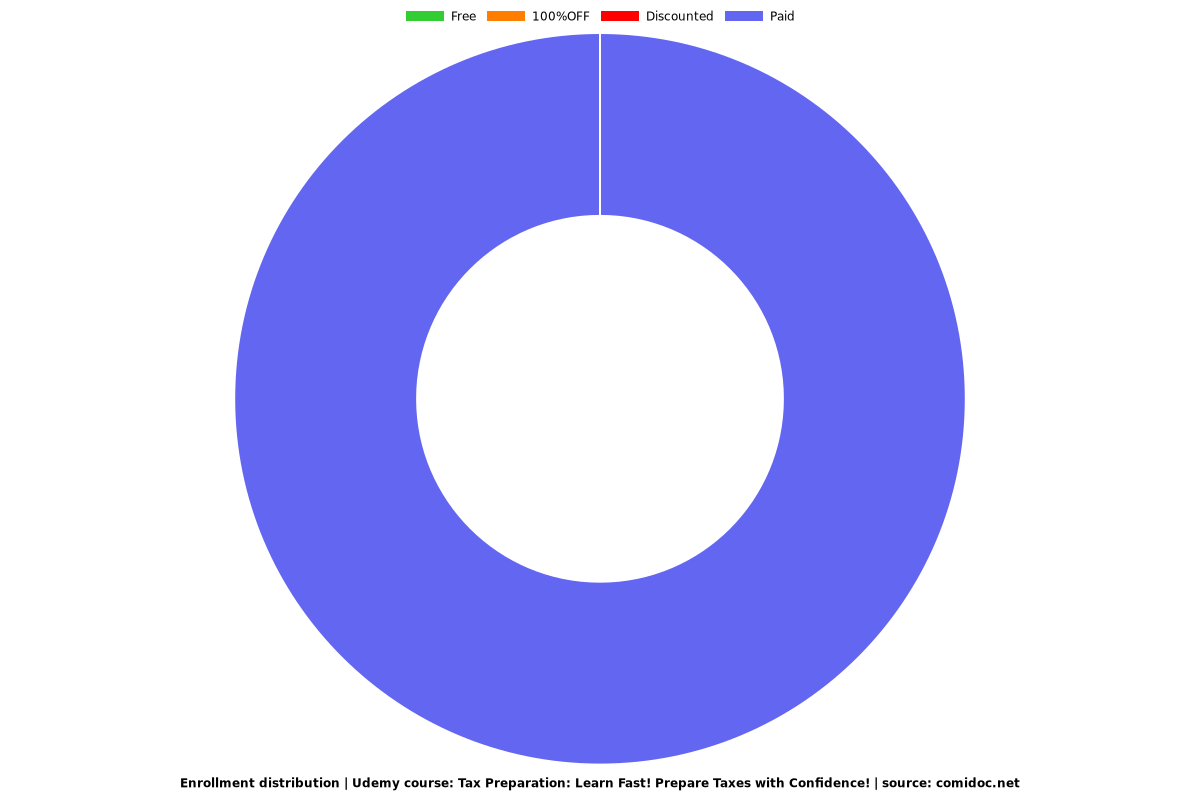

Enrollment distribution