Tax Accounting Made Easy to Understand

Finally, an easy to understand tax accounting course. Taxes explained step by step.

What you will learn

Describe and apply the tax law

Distinguish between Tax Avoidance and Tax Evasion

Identify the social, poltical, and economic factors influencing the tax law

Contrast Primary and Secondary Sources

Research the tax law and apply the appropriate procedures

Know the statutes of limitations and penalties imposed

Interpret the tax formula and its components

Determine personal and dependency exemptions

Determine the filing status of a taxpayer

Identify a qualifying child and a qualifying relative

Interpret multiple support agreements

Understand the special rules for dependents

Identify what is included in gross income

Differentiate between legal income and accounting and economic income

Apply the constructive receipt doctrine

Apply the assignment of income doctrine

Apply the economic benefit doctrine

Identify the items specifically excluded from gross income

Contrast between deduction and exclusions

Treatment of fringe benefits

Deductions FOR and FROM AGI

Apply trade or business deductions

Deductions for losses

Understand the rules for limitations of deductions

Identify the disallowed deductions

At Risk rules and passive activity losses

Material VS. Active Participation

Casualty and Theft Losses

Rules for Net Operating Losses

Know the rules for Hobby Losses, Home Office Expenses, Vacation Home Expenses

Apply the rules for itemized deductions and the appropriate treatment

Treatment of charitable contributions

Various credits available

Determine realized and recognized gains and losses

Determine adjusted basis of property

Determine adjusted basis of property (Gift and Inheritance)

Differentiate between ordinary, capital , and 1231 assets

Determine the holding period

Rules for determining taxable income (Capital Gains and Losses)

Rules for Section 1231 Assets (Section 1245 and Section 1250)

Depreciation Recapture

Tax Accounting (Methods, Rules, Accounting Periods)

Why take this course?

Learn everything about Tax Accounting in 2 hours.

What are my students saying:

"Much better than my $4,000 graduate course. Very interesting videos with a lot of information. I particularly like the videos for applying what I learned. Those questions are very good for understanding better."

"Thank you for an amazing course. I was so interested in tax accounting (strange, right?) I just kept pushing play. Great videos, very informative and engaging. I was not bored for even a minute. Most importantly, I learned a lot."

"The course is really informative. I like that the lectures are made with very interesting drawings and great visuals, instead of someone reading a power point. Good course."

"This course is very engaging, and surprisingly for a tax accounting, not boring at all. I wish I had courses like this during my college days. High quality videos, great exercises and application. This is a 10 stars course!"

"Wow! I cannot even begin to compare this course to the tax course I am taking at my university. Everything is very well explained, and not one information is omitted. I am so glad I found this course. Much, much easier to understand."

More about this course:

I believe that you should not fall asleep when learning something new. You need to be encouraged and excited instead. In order to be excited about learning, you need to understand easily. I have implemented a new way of teaching. Animated videos which are easy to understand. Learning has never been so exciting.

In this course you will find everything explained with a video lecture. The type of lectures are animated (cartoon) videos that break down the most difficult concepts used in tax accounting.

Depending on your commitment, this course can take you somewhere from a week to few weeks to complete. The curriculum is designed as such, so that you will retain the information you will receive.

Whether you are a business owner, manager, or a student, you need this course. This course will provide you with great tools and information about tax accounting, tax law and its application.

Screenshots

Reviews

Charts

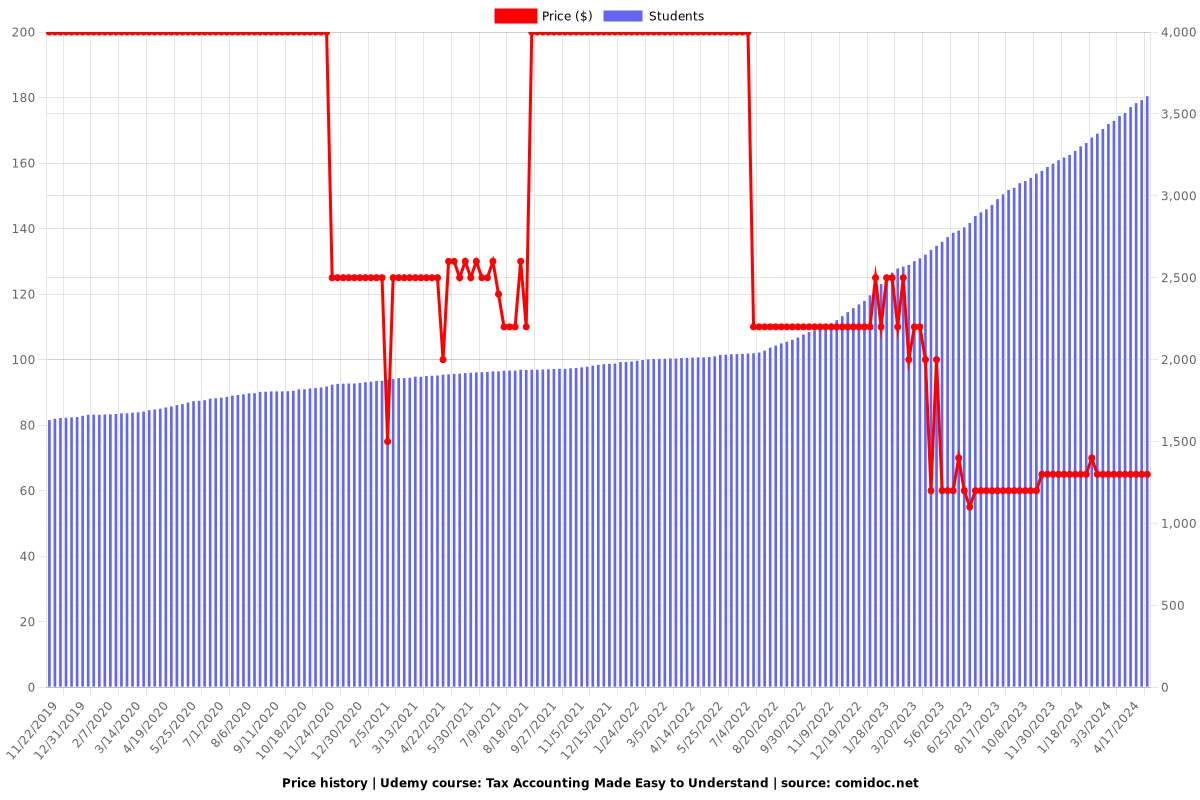

Price

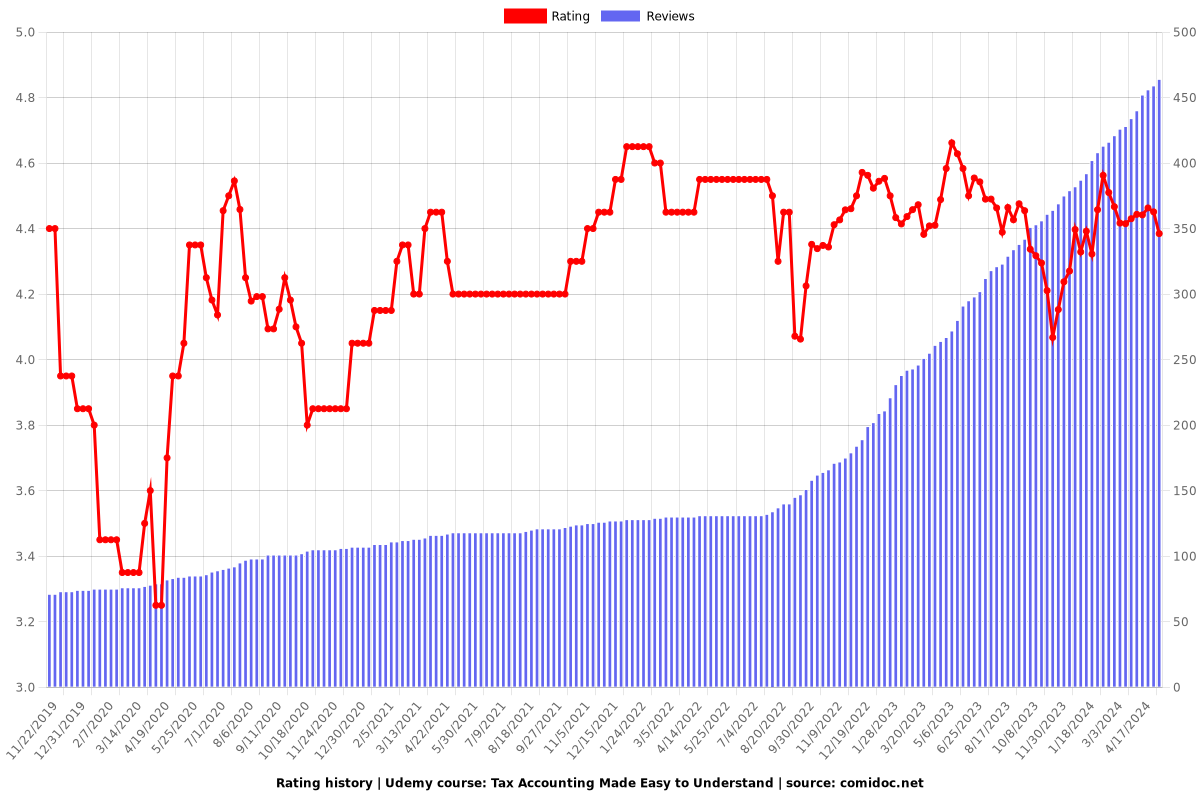

Rating

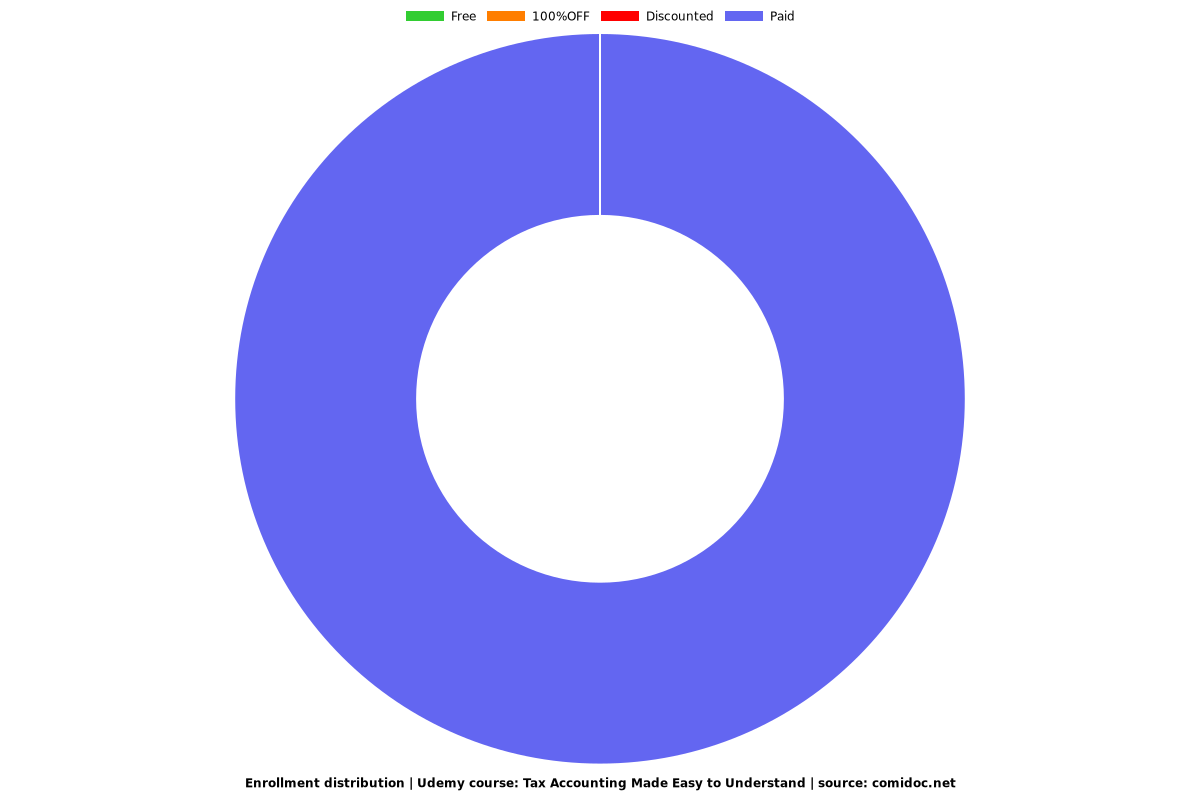

Enrollment distribution