How to Build a Massive Retirement Plan from Scratch!

The CENSORED Truth About Workplace 401K Plans You Won't Read About in the Financial Media.

What you will learn

Arrange your employer sponsored 401k plan in the way regarded most efficient by finance professor holding doctorates and doing research in the area.

Maximize expected return by simply following the averages.

Minimize retirement destroying fees and expenses.

Why take this course?

ATTENTION: The CENSORED Truth About Workplace 401K Plans You Won't Read About in the Financial Media.

AS SEEN ON: NBC, ABC, CBS, and FOX!

Updated Monday, May 23, 2016, 10:41 A.M.

Have you seen the PBS FRONTLINE documentary “The Retirement Gamble" that aired on April 23rd of 2013? It struck a chord with Dr. Brown as he lay in his four poster bed in one of the most upscale neighborhoods in San Juan.

BULLET-PROOF 401K SUPERCHARGER teaches you how to employ his advanced doctoral knowledge of finance to avoid the pitfalls PBS journalists uncovered. It was eerie to watch PBS FRONTLINE correspondent Martin Smith realize that his retirement is underfunded in part because of the secret costs that come with a 401(k).

This scathing documentary reveals the problem you face — that Dr. Brown has been helping those close to him — as well as his MBA students at the University of Puerto Rico Graduate School of Business with for quite some time. Forbes succinctly summarizes this as "Our retirement plan system is rigged to rip off Americans struggling to save for retirement."

“The Retirement Gamble" identifies these dangers facing you today...

1. Just a minority of Americans have enough saved to cover a lengthy life as a retiree

2. Why our patchwork mess of retirement systems is a gold vein for financial predators in 401(k) and 403(b) plans.

Benefit #1: Squash Wall Street's cockroaches before they squash you

3. The U.S. government will not protect your retirement from Wall Street goons.

4. No retirement adviser is as trusted as yourself.

5. Many plan participants don't know what they are invested in.

Benefit #2: Learn why you should avoid annuities

6. The God Father of index funds, John Bogle of Vanguard fame, points out that a 7% yield collapses to 5% under a low 2% annual fee.

7. Diversify away from your employer plan into multiple IRAs you alone control. Here are some quick solutions...

Benefit #3: Plan Screening...

Check your 401(k) or 403(b) against this national database. Some employer sponsored plans are so bad you may want to consider not contributing. Doc Brown will show you a powerful alternative to your employer sponsored 401(k) or 403(b) plans fewer than 5% of Americans understand. Yet this alternative is available to all.

Inside Dr. Brown will teach you how to carefully determine whether you should just say "no" to your current employer sponsored 401(k) plan.

Even with a good plan you will contribute just up to the matching. Scott will teach you why you should never make the full contribution if you do not own the company.

Discover why you should never contribute to an employer sponsored 401(k) with no matching.

Alternative Retirement Accounts...

Discover how to sock away even bigger wads of hard-cash-money in a Roth IRA. Scott will show you a secret way to invest in a Roth IRA even if your accountant or financial planner (wrongly) tells you that your income is too high.

Dr. Brown has proven that it is possible with the results he has garnered for his own family.

How to Find Low Cost Funds...

He will show you how to identify the lowest-cost mutual funds in your plan. Imagine saving up to 9% per year in fees!

How to Pay Your Family Forward...

You may have tens or even hundreds of thousands of dollars in your portfolio that you have simply forgotten. Discover the most convenient steps to roll your old 401(k) or 403(b) retirement plans forward. How to get money laying around off your ex-bosses' tables and out of their sticky fingers from that that old job you didn't like.

Benefit #4: Develop a realistic approach to all of your retirement income streams.

How to Save, Save, and Save Even More...

How to set yourself up to take Social Security benefits.

Best Places to Retire...

He'll cover the best places to retire as you thrive in outliving your assets.

Benefit #5: Avoid bad countries and nasty living locations.

How to Escape the Retirement Gamble...

"The Retirement Gamble" made enough of a stir to prompt a "piece about the piece" on MoneyWatch. The author emphasizes that underhanded dealings range from "active funds that come with high fees and indecipherable disclosures" to annuities sold to financially unsophisticated teachers where guaranteed returns were misrepresented. MoneyWatch concludes that "The Retirement Gamble" discloses abuses Allan Roth sees every day.

He criticizes Christine Marcks, President of Prudential Retirement, of feigning ignorance of these abuses and hard evidence that indexing beats active investing.

In BULLET-PROOF 401K SUPERCHARGER you'll discover a series of steps that will both protect your money from a catastrophic market crash AND maximize your 401K in the process.

Forbidden 401K Secrets your Boss Doesn't Want You to Know!

More importantly, you will tap into...

Benefit #5: You'll be able to use the lowest cost strategy.

Garner the highest likely return, that has dramatically grown our plans over the years. You'll learn:

Benefit #6: A simple website to rank the cost of the selections in your 401K plan...

Benefit #7: How you can beat the actively managed mutual fund managers at their own game with simple low cost index funds...

Benefit #8: Why you should only invest up to the matching in your employer sponsored 401K...

Benefit #9: What to do with the rest...

Benefit #10: How to guarantee that your 401K survives the next wipeout...

Benefit #11: How you can open an individual 401K even if you only earn a salary...

Benefit #12: How to sidestep taxes on tens of thousands of dollars of otherwise taxable income per year with these simple tricks...

Benefit #13: The truth about so-called "emerging markets" -- and why you should avoid them like the plague...

Benefit #14: The only investment in your plan that will allow you to ride out the next crash without worry...

Benefit #15: How to spot the lowest cost indexed fund most likely to double, triple, or quadruple your 401K in this or the next bull market...

And much, much MORE...

Here's Your Elevator to the Leisure Class

In conclusion and in his own words:

"Join right now.I am waiting inside now to help you,

-Dr. Scott Brown

Associate Professor of Finance of the AACSB Accredited Graduate School of Business of the University of Puerto Rico."

P.S. 30 DAY UNCONDITIONAL MONEY BACK GUARANTEE!

Screenshots

Reviews

Charts

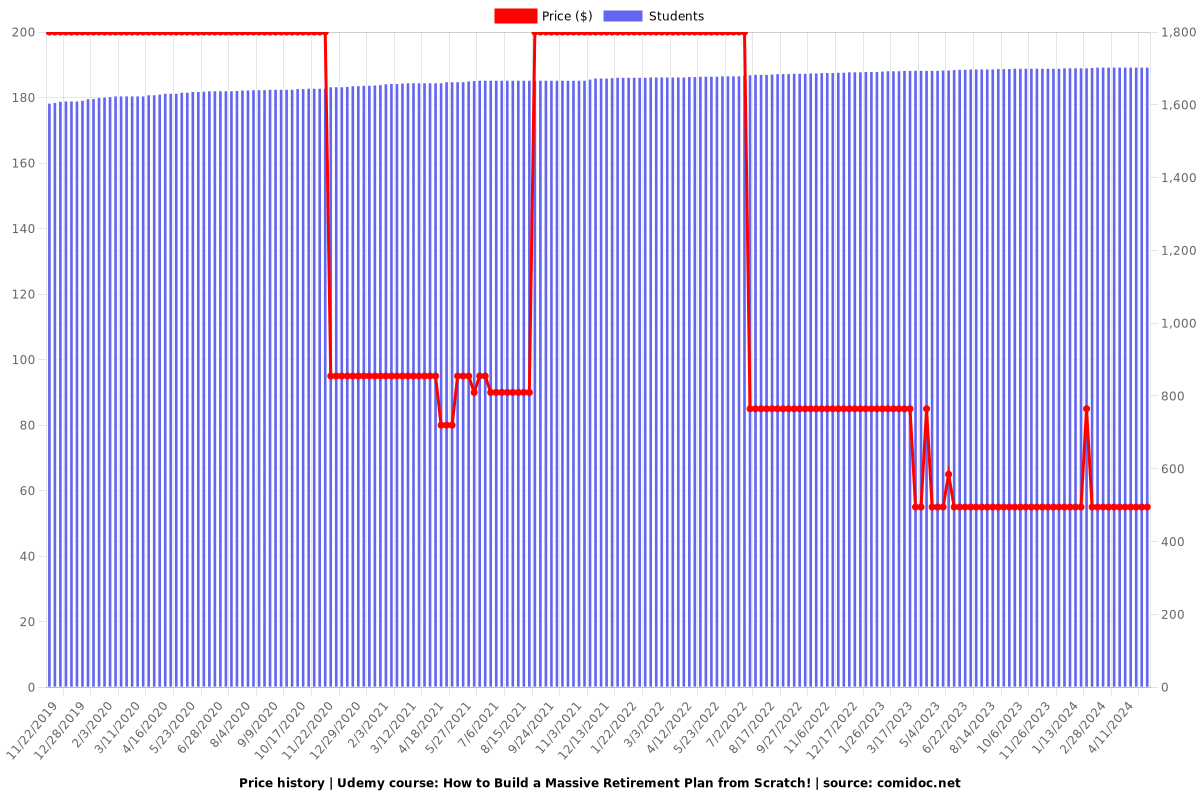

Price

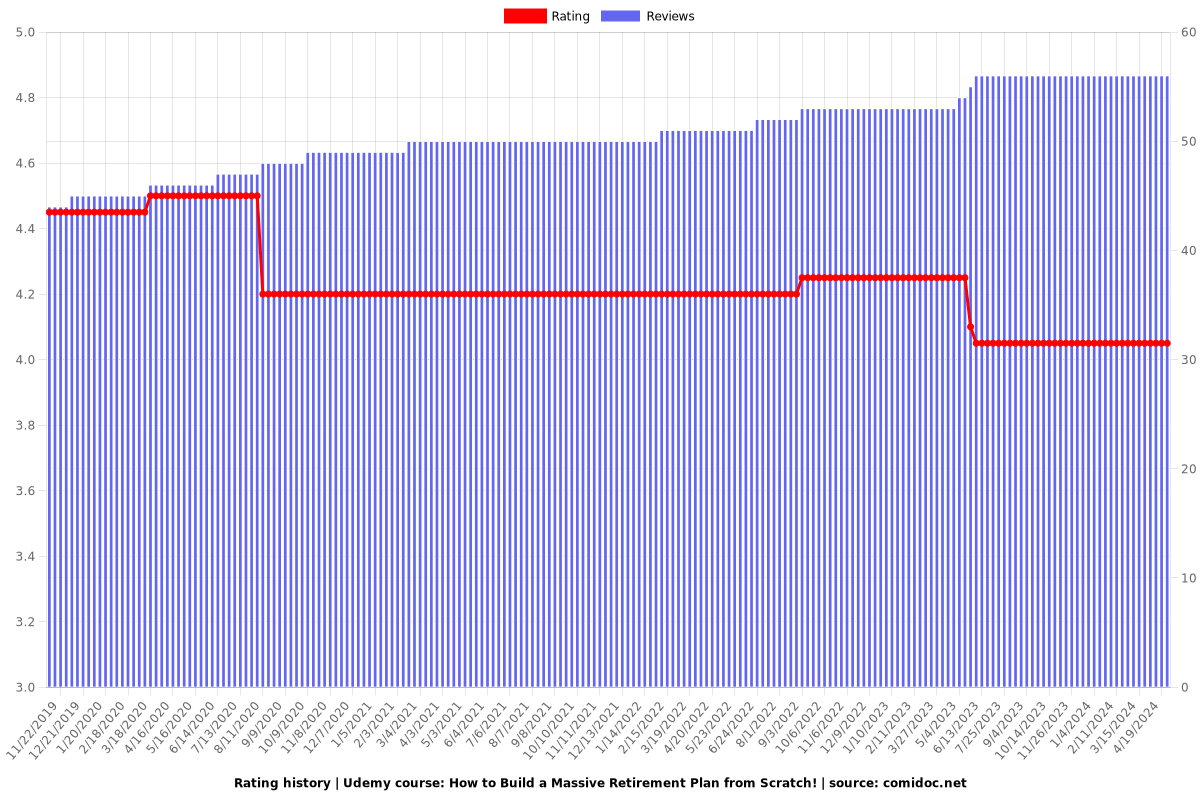

Rating

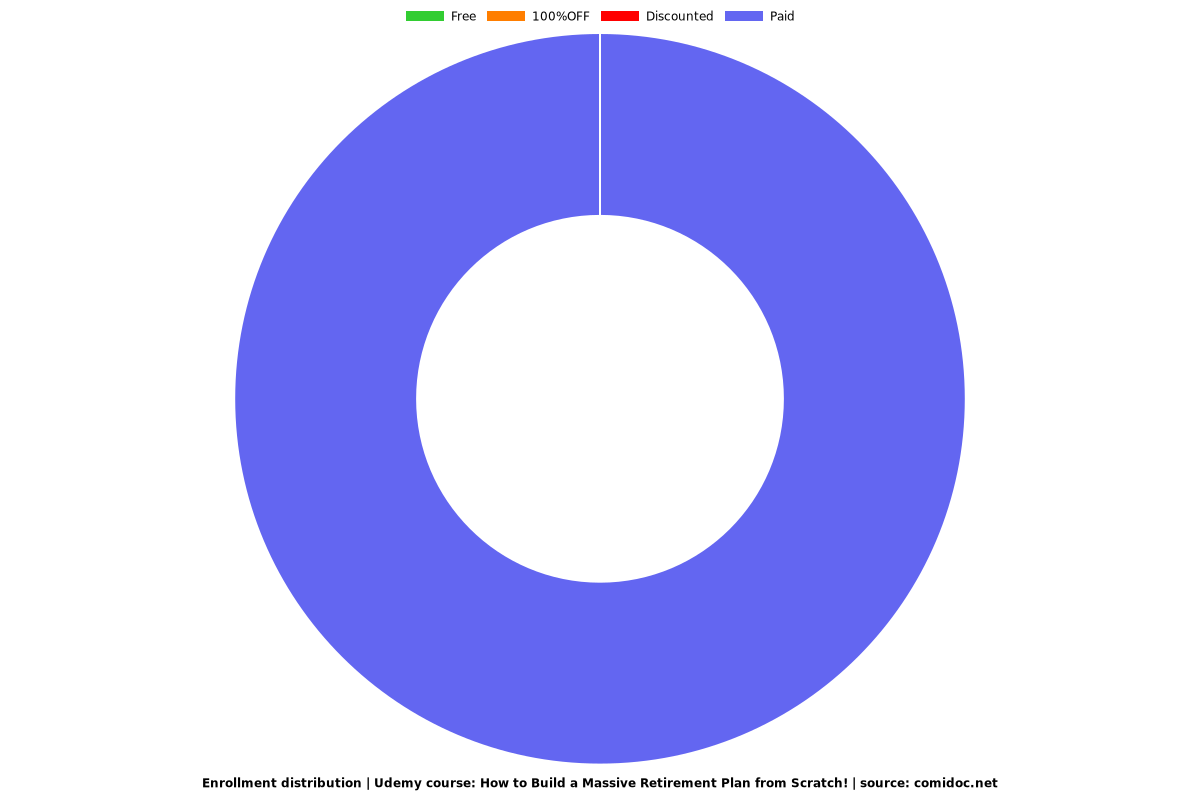

Enrollment distribution