QuickBooks Payroll - QuickBooks Online

Processing QuickBooks Online payroll for a small business, generating paychecks, processing payroll tax forms

What you will learn

List and describe payroll related legislation

Enter new employee information into QuickBooks and describe where to get the data necessary to add a new employee

Set up and calculate Federal Income Tax (FIT)

Describe the Federal Income Contribution Act and its components

Set up and calculate social security

Set up and calculate Medicare

Set up and calculate Federal Unemployment

Describe and calculate employer payroll taxes

Generate payroll journal entries from payroll reports

Generate and analyze Form 941 Employer's Quarterly Federal Tax Return

Generate and analyze Form 940 Employer's Annual Federal Unemployment (FUTA) Tax Return

Generate and analyze Forms W-2 & W-3

Reconciling year end payroll tax forms

Generate and analyze a payroll register and payroll reports

Describe mandatory and voluntary deductions and how they are entered into QuickBooks Online

List and describe types of retirement plans and how to set them up in QuickBooks Online

Enter comprehensive payroll problem into QuickBooks Online

Setup paid payroll in QuickBooks Online

Process payroll in QuickBooks Online

Why take this course?

QuickBooks Online payroll will describe the payroll process for a small business in detail, so bookkeepers, accountants, and business owners can better understand how to set up payroll, process payroll, and troubleshoot problems related to payroll.

This course will introduce the payroll set-up in the QuickBooks Online system, walking through payroll screens.

We will discuss payroll legislation that will affect payroll calculations within QuickBooks Online and list the payroll forms we will need to generate from Quickbooks Online.

The course will walk through the process of entering a new employee into the QuickBooks Online system and describe where the data would be received from in practice including Form W-4.

We will discuss Federal Income Tax (FIT) calculations within QuickBooks Online. The course will describe how FIT is calculated, what is needed for QuickBooks Online to calculate FIT, and how to enter the data into the accounting system.

The course will describe the Federal Income Contributions Act (FICA) and its components.

We will calculate social security and describe how QuickBooks Online will help with the calculations as we process payroll.

The course will calculate Medicare and describe how QuickBooks Online will help with the calculations of Medicare when we process payroll.

We will calculate Federal Unemployment (FUTA) and discuss how FUTA is related to state unemployment (SUTA).

The course will describe and calculate employer taxes and discuss which taxes are employee taxes and which taxes are employer taxes.

We will describe payroll journal entries and discuss how payroll data is populated in the QuickBooks Online reports and financial statements including the profit and loss and balance sheet.

We will discuss and enter both mandatory and voluntary deductions into the QuickBooks Online system.

The course will discuss retirement plan options, how to enter them into the QuickBooks Online system, and how they are used to calculate net income and payroll taxes.

We will work a comprehensive problem, processing payroll within QuickBooks Online. The comprehensive problem will use the paid QuickBooks Online feature.

The comprehensive problem will start very basic with one employee and will increase in complexity as we enter more benefits and payroll details each year.

Screenshots

Our review

Charts

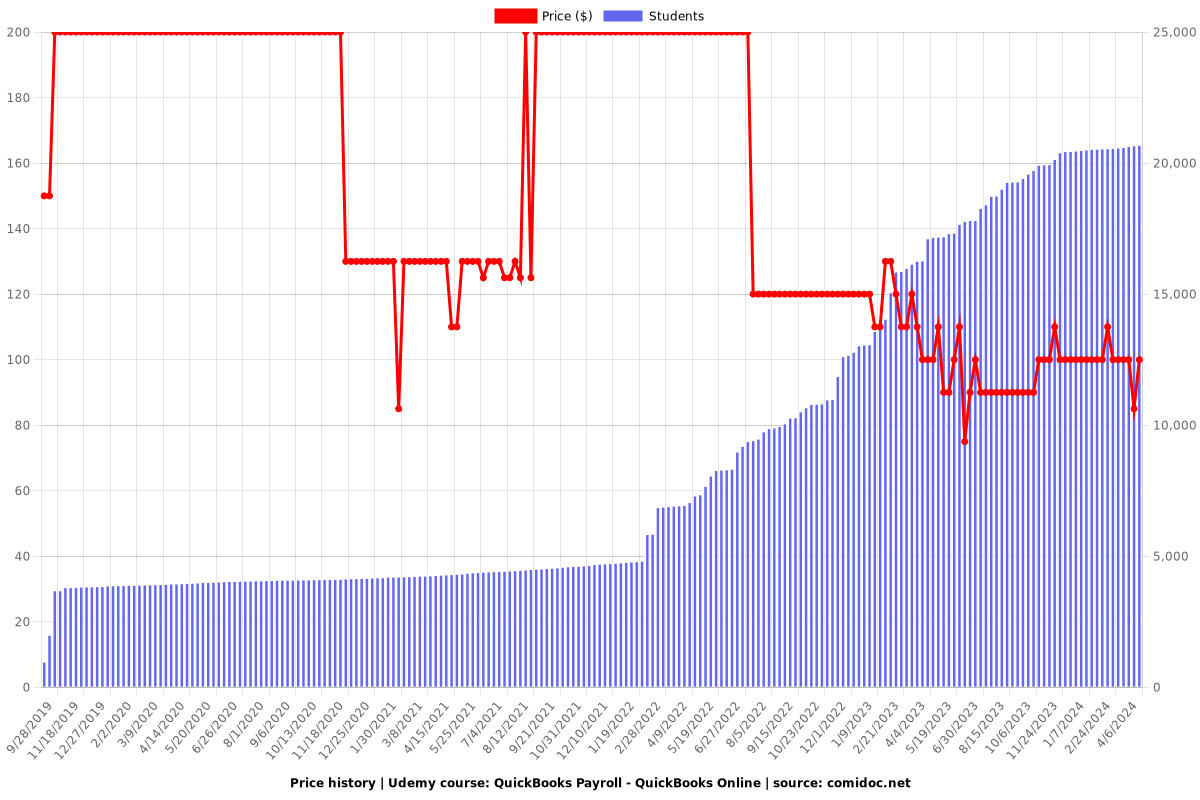

Price

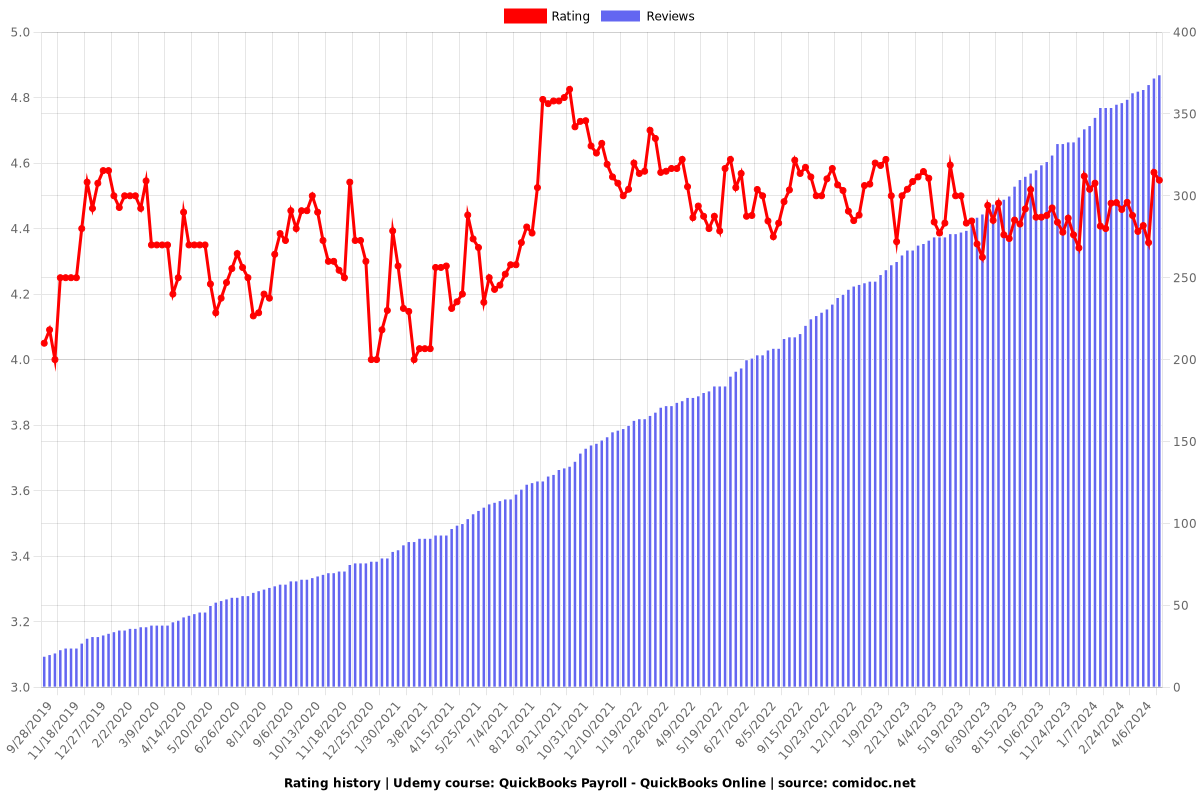

Rating

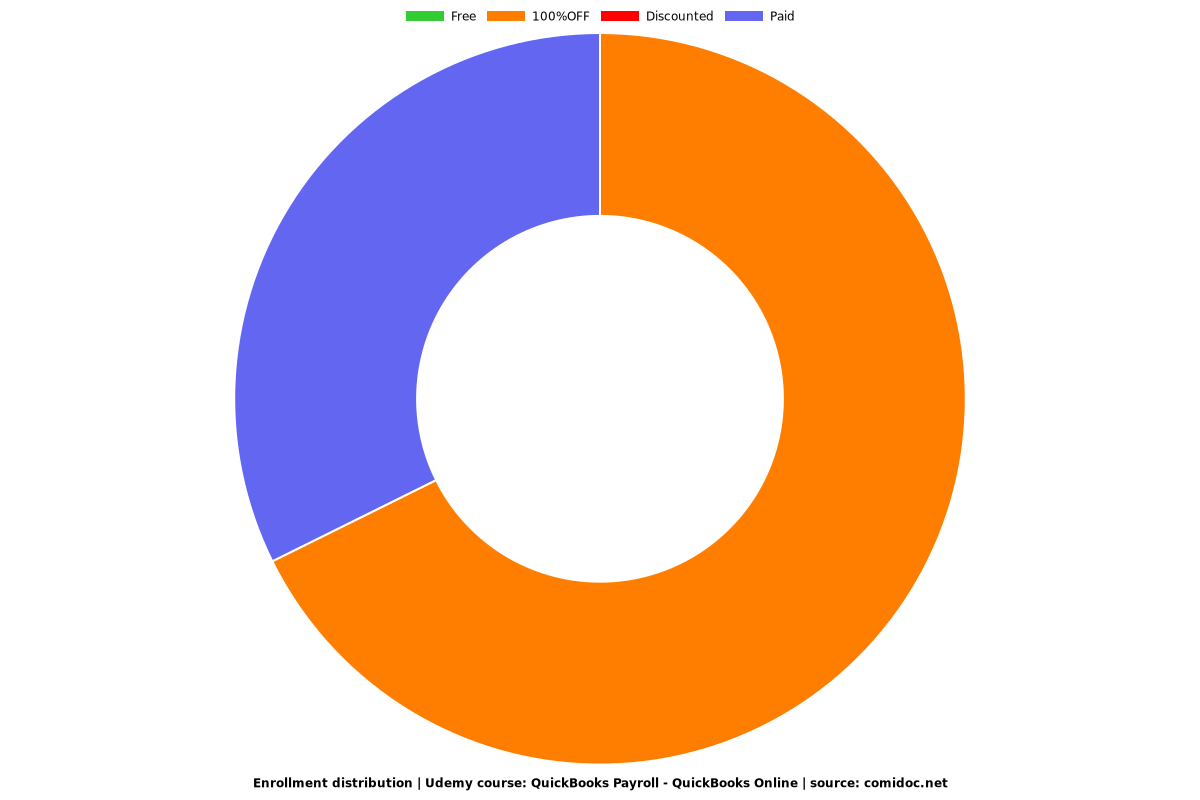

Enrollment distribution