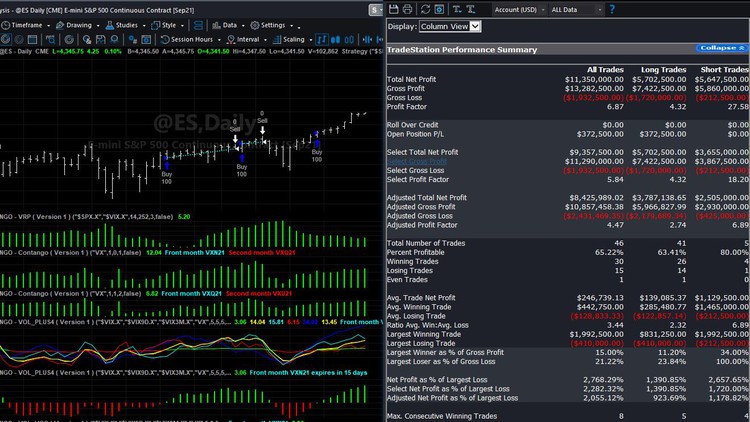

Professional Financial Market Vibration Analysis System

Learn the basic market structure before you invest. Emotionless but structured investing will put your on a success path

4.31 (8 reviews)

77

students

7.5 hours

content

Nov 2023

last update

$13.99

regular price

What you will learn

Looking at Stock Market Structure

Knowing how the market vibrations works - No guesswork

Track the price levels of Stocks or any acommodity

Time the market using simple timing mode - put time and price together for bias

Related Topics

2272012

udemy ID

3/14/2019

course created date

7/12/2021

course indexed date

Bot

course submited by