How Pre-Seed VCs Think About Startups with Sramana Mitra

Case Studies of Real World PreSeed Investors (Venture Capitalists, Angels); due diligence frameworks for Venture Capital

What you will learn

Through interviews with real-world investors you will come to understand investor-entrepreneur fit.

How you can think from an investor's point of view when pitching your startup.

What you can do to increase your chances of getting funded.

Where you can seek further mentorship regarding startup funding.

Why take this course?

The 1Mby1M Methodology is based on case studies. In this course, Sramana Mitra shares the tribal knowledge of tech entrepreneurs by giving students the rare seat at the table with the entrepreneurs, investors and thought leaders who provide the most instructive perspectives on how to build a thriving business. Through these conversations, students gain access to case studies exploring the alleys of entrepreneurship. Sramana’s synthesis of key learnings and incisive analysis add great depth to each discussion.

This course is primarily for entrepreneurs who want to learn how to think like an investor and increase their chances of getting funding for their startup.

For example, want to apply to Y Combinator? Listen carefully to Sramana’s conversation with Geoff Ralston, President of Y Combinator. He spells out very clearly what they are looking for in a startup application and why 98% of Y Combinator applications are rejected and how startups can increase their chances of getting in.

The early stage investment ecosystem has fragmented, it’s no longer just seed and Series A. The seed part has fragmented to friends and family financing, pre-seed, seed, post-seed, small Series A, and large Series A.

In this course, we will do a deep dive into the pre-seed stage.

What is the difference between pre-seed, post-seed and pre-Series A? This is not so simple anymore to understand. For entrepreneurs who are seeking financing for the first time, it’s not easy to understand where they fit in.

There is a lot of competition to get into some of the deals for Series A (and Series B). If you look at the numbers, there are 50,000 to 70,000 seed stage investments a year versus 1,200 to 1,500 Series A investments. Clearly there is a lot of companies in that pool that are not getting to Series A. Only a percentage of those are really the hot companies. The hot companies, by definition, are few and far between, which is why there is such a competition. There are a lot of companies in the middle.

Then there are the stranded businesses that don’t deserve Series A. That is irrelevant, because there are a lot of companies that do get seed investments and don’t really pan out. They shouldn’t be raising more money. That is not of concern to me because it makes sense that they shouldn’t get to Series A. But still, there is a big number of startups in the middle. They’re not the hottest companies, but they are good solid companies. Many of those are falling in the Series A crunch as well.

To keep up with the evolving nuances of startup financing, this course shares how several of the investors I’ve spoken with define “pre-seed.” You will also learn what kind of validation they are looking for in a startup before getting into a deal during our in-depth conversations.

The 1Mby1M courses are all heavily based on interview-based case studies on Innovation, Business Models, Go To Market Strategies, Validation Principles, and various other nuances of an entrepreneur's journey. We offer extensive opportunities for entrepreneurs to learn the lessons from the trenches from successful entrepreneurs who have done it before and Investors who support their ambition.

Screenshots

Reviews

Charts

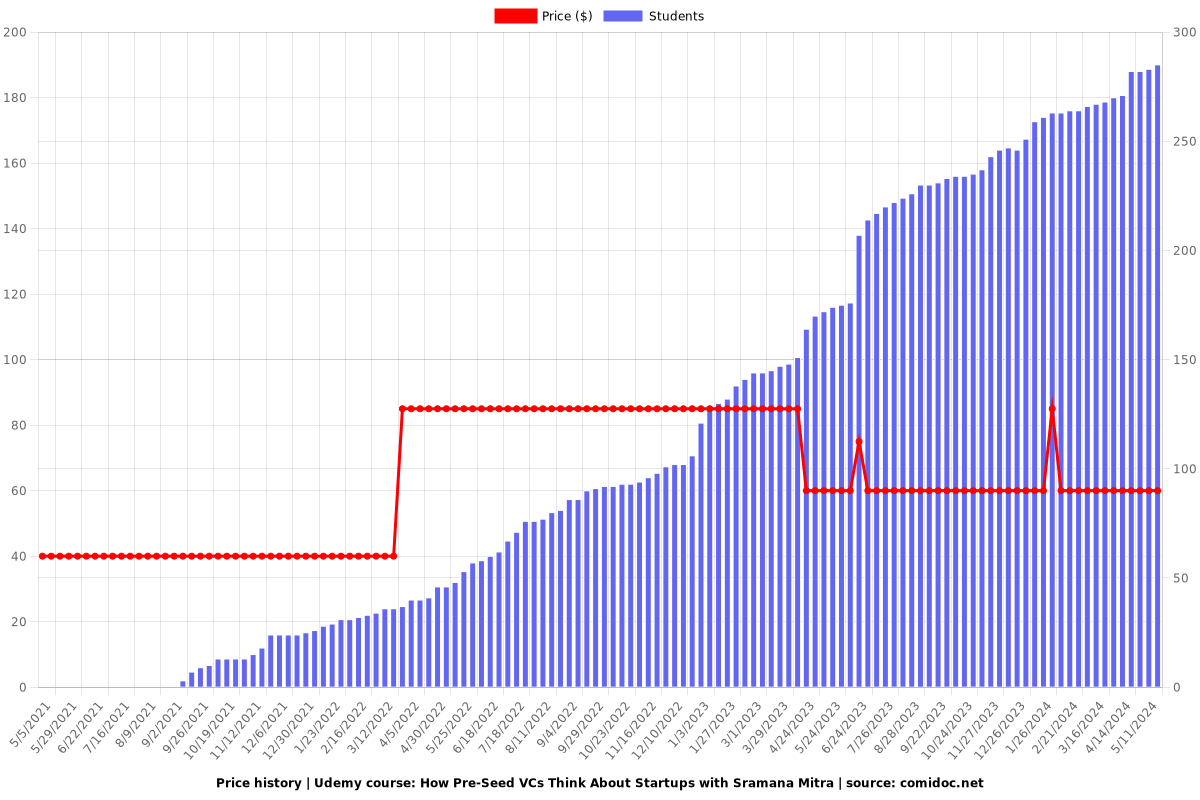

Price

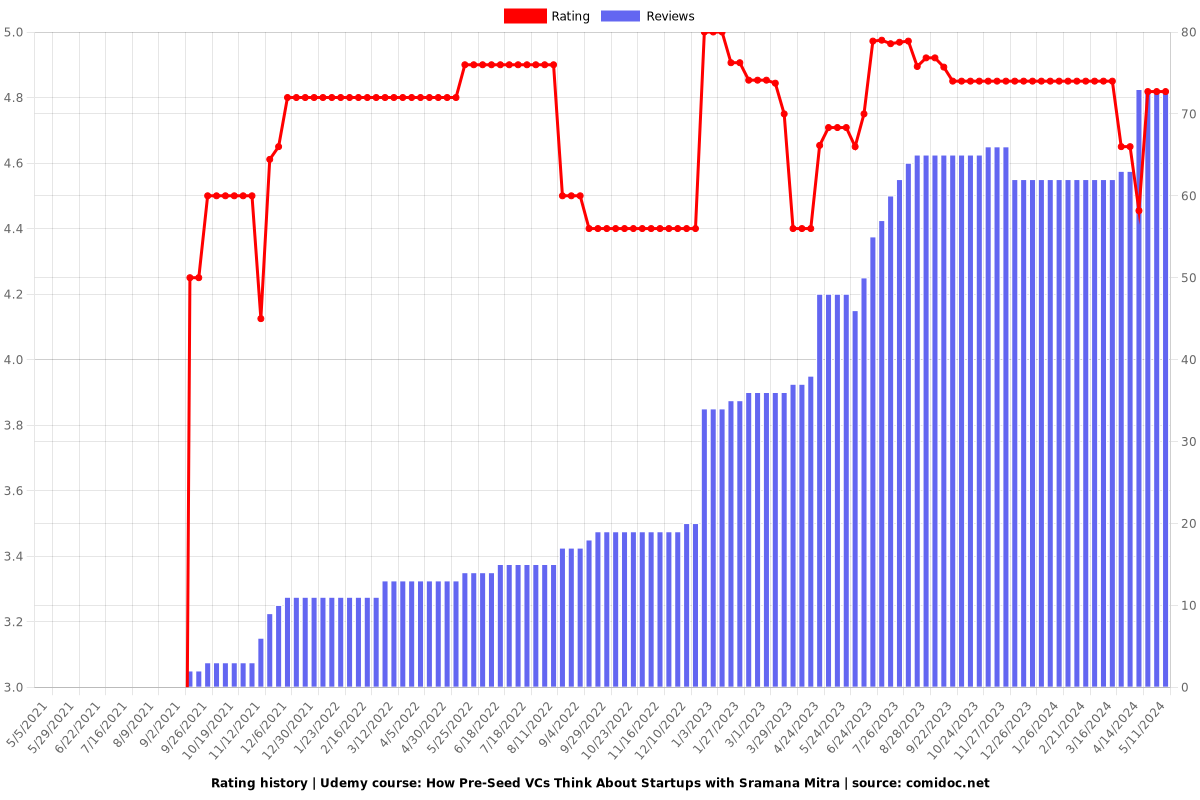

Rating

Enrollment distribution