Portfolio Management and the Capital Asset Pricing Model

Application of Portfolio theory to the CAPM model and to the Miller and Modigliani model

What you will learn

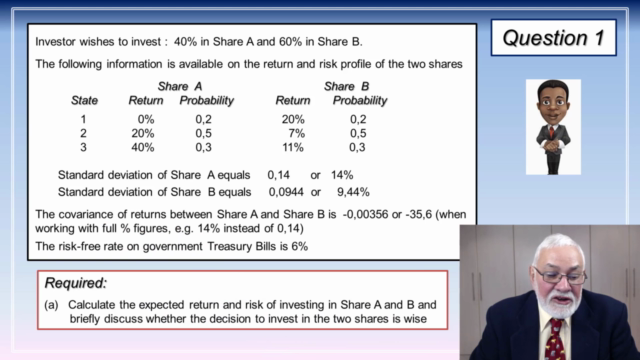

Students will learn how to calculate risk and return for a portfolio and a single asset investment. Also learn how to construct a Portfolio, CAPM and Miller Modigliani diagrams.

Why take this course?

This course has been designed for students studying Corporate Finance at the under-graduate or post-graduate level.

The topics covered are – Portfolio theory, Capital Asset Pricing model theory and Miller and Modigliani theory.

You will learn the following -

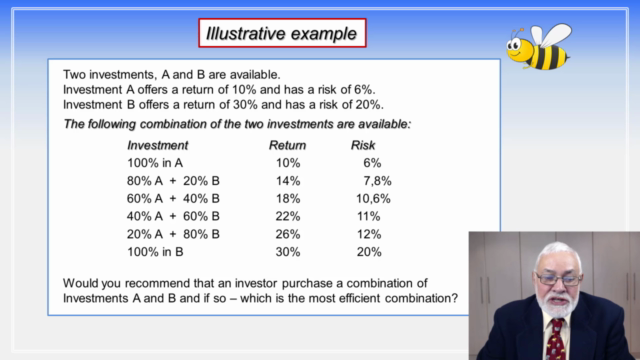

1. Construct portfolios for two projects and calculate their risk and expected return

2. Graphically illustrate the combination of two or more portfolios

3. Explain the derivation and rationale of the Capital Market Line

4. Explain why diversification lowers risk and the meaning of Beta

5. Explain the difference between the Capital Market Line and the Security Market Line

6. Construct the Security Market Line

7. Explain the difference between expected and required return

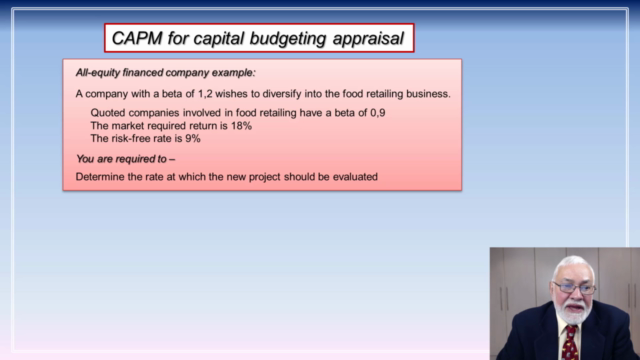

8. Discuss the limitations of CAPM for capital budgeting decisions

Screenshots

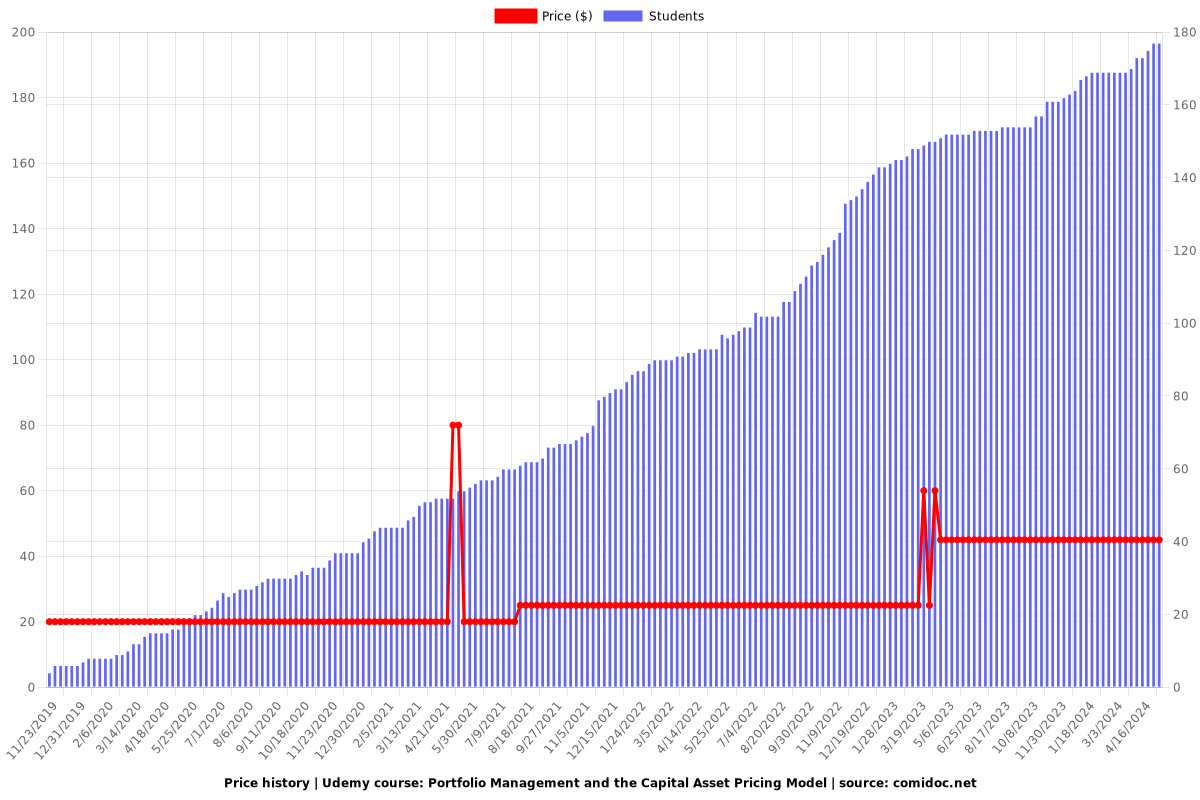

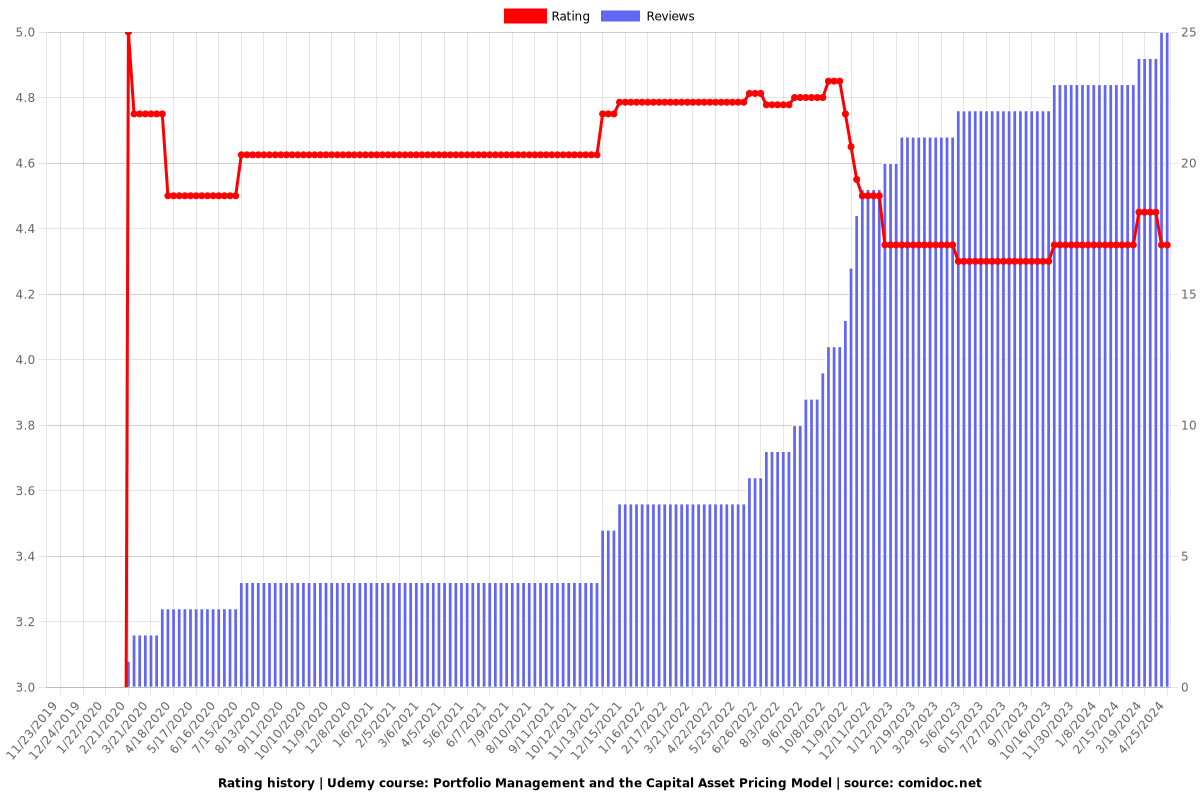

Charts

Price

Rating

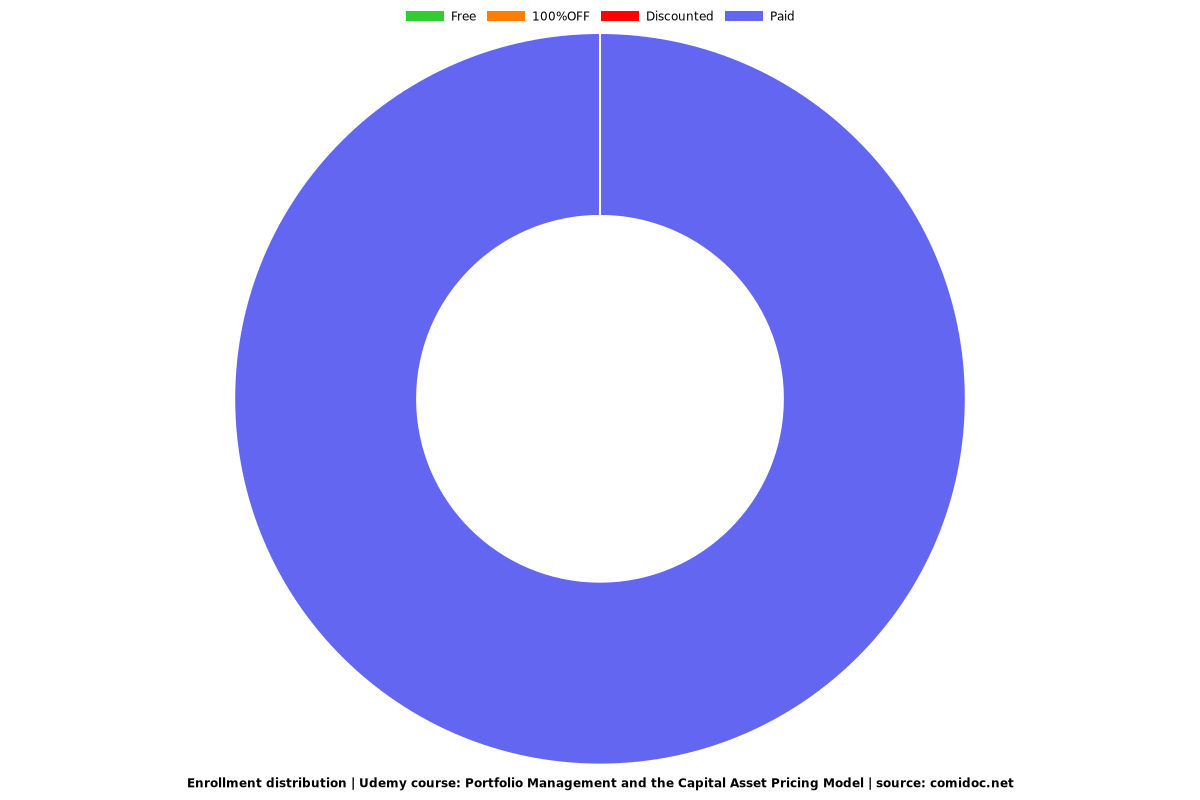

Enrollment distribution