Options Trading MasterClass: Options With Technical Analysis

Learn Options Strategies Options Basics & Greeks (3-Course Bundle) For Stock Trading & Day Trading By Technical Analysis

What you will learn

Learn to make money by trading in Options with Technical Analysis

Learn the Basics of Options

Learn the Benefits of Trading Options

Understand the calculations for different Options Strategies

Understand and learn trade set up conditions for different options strategies

Understand and Learn to apply the Basic to Advanced Options Strategies

learn to create your own optimum Strategies according to risk profile

Learn how to make Options Spreads and know the Right time to execute them

Why take this course?

**Transform Your Trading Game With Options!** Gain the ability to make big profits with small investments through mastering Options Trading by enrolling in this comprehensive course. 🚀

"Options are powerful tools that can enhance your portfolio by providing effective hedging against market declines and generating recurring income. When used correctly, they offer many advantages over trading stocks alone."

Derivatives, such as options, are securities derived from the price of something else—like how butter is derived from milk or diesel from crude oil. A stock option is a derivative of a stock, and understanding it can be your key to unlocking a whole new realm of trading possibilities.

Despite their potential, many traders shy away from options due to the perceived complexity, often due to a lack of proper training. This course bridges that gap, making even the most complex options strategies approachable and understandable for beginners and seasoned traders alike.

With Jyoti Bansal, a NCFM & NISM Certified Technical Analyst & Investment Adviser, you'll embark on a journey through the nuances of Options Trading. Learn the ins and outs of Options Basics, Options Greeks, spreads, bearish and bullish strategies, and neutral and volatile strategies.

Whether you are a novice or an experienced trader, this course is designed for all who aspire to master the art of making money with options in every market situation—uptrend, downtrend, or sideways movement.

Many professionals in the field have spent years trying to grasp these concepts. This course streamlines that learning process, offering you lifetime access to over 4+ hours of HD video tutorials, covering everything from the basics to advanced strategies.

Here's why you should consider this course:

- **Risk Management:** Learn how to use options to manage risk effectively. - **Income Generation:** Discover how to generate income with options. - **Strategic Mastery:** From simple payoff diagrams to complex options strategies, understand the mechanisms behind each decision. - **Expert Guidance:** Benefit from Jyoti Bansal's years of experience in investment and finance.With a focus on practical application, this course includes live examples and real-world scenarios to solidify your understanding.

Inclusive Content: - Options Greeks (Delta, Gamma, Vega, Theta) - Intermediate Spreads - Pro Neutral and Volatile Strategies - And much more!

30-Day Money-Back Guarantee: If for any reason this course doesn't meet your expectations within 30 days, Udemy offers a full refund. The risk is on us, not you.

--- ### **Course Curriculum Overview** 📚 1. **Introduction to Options and the Stock Market** - What are options? - How do options fit into trading strategies? 2. **Options Trading Basics** - Types of options: calls vs. puts - Strike price and expiration date 3. **Option Pricing** - Understanding the pricing models - Intrinsic vs. extrinsic value 4. **Pay Off Diagrams** - Visualizing option payoffs for different scenarios 5. **Basic Options Strategies** - Covered calls, protective puts, straddles, and strangles 6. **Options Greeks** - The impact of time, volatility, and other factors on options pricing and value 7. **Intermediate Options Spreads** - Iron condors, butterfly spreads, and more 8. **Advanced Neutral and Volatile Strategies** - Long and short gamma strategies, rolling strategies, and volatility positioning 9. **Live Examples & Case Studies** - Applying concepts in real-world scenarios --- ### **Ready to Transform Your Trading Skills?** 🚀Do you want to learn how to make money in the stock market via options trading and technical analysis, the safest way possible?

Are you looking to make big money with a small investment?

Are you eager to discover essential options trading strategies that even seasoned traders often don't fully understand?

If your answer is 'yes' to any of these questions, this course could be the key to unlocking your success in options trading. With over 9 years of experience in investment and finance, I am confident that this course will provide immense value to you.

--- ### **Legal Disclaimer** 🔒Please note: The Authors, or any related party to this course or its contents, will not be responsible for any kind of loss to anyone in any way due to this course. It is your responsibility to understand the risks and conduct due diligence before engaging in any trading activities.

--- Embark on your journey to becoming a savvy options trader today! 🌟 Enroll now and take the first step towards mastering options trading with technical analysis. Let's trade smarter, not harder!Our review

Charts

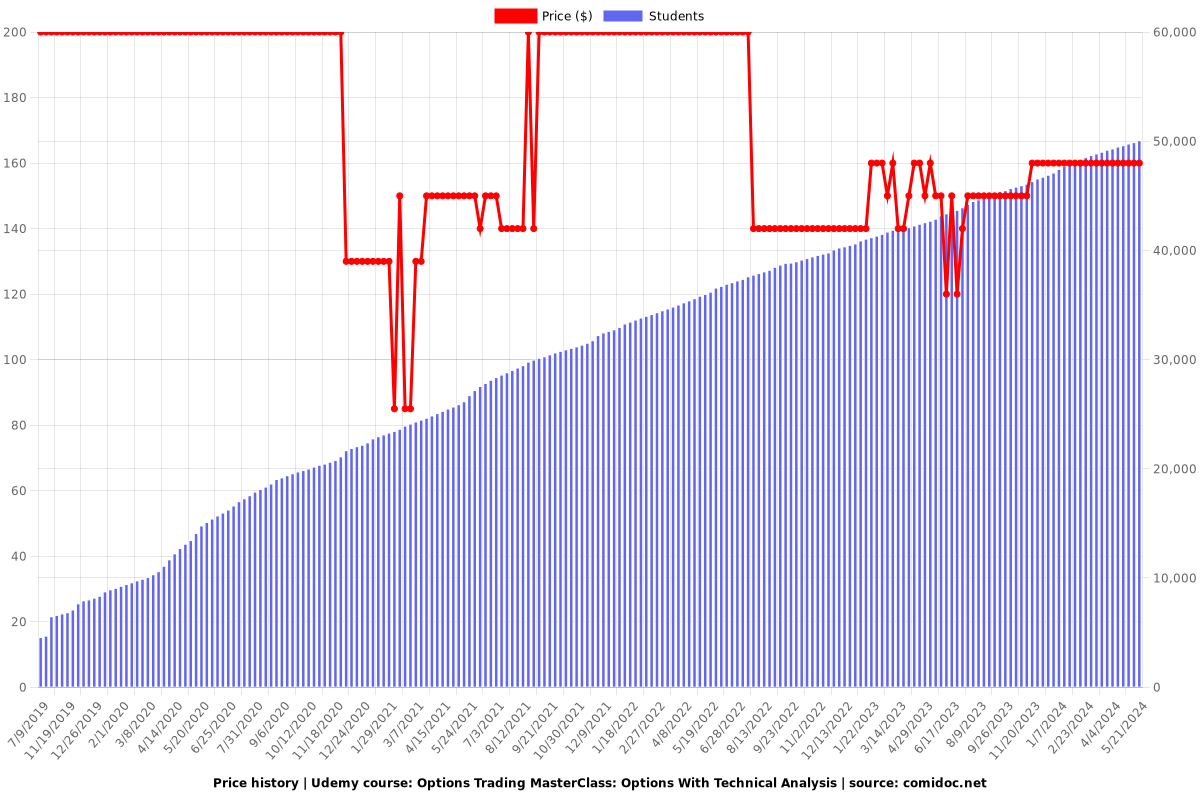

Price

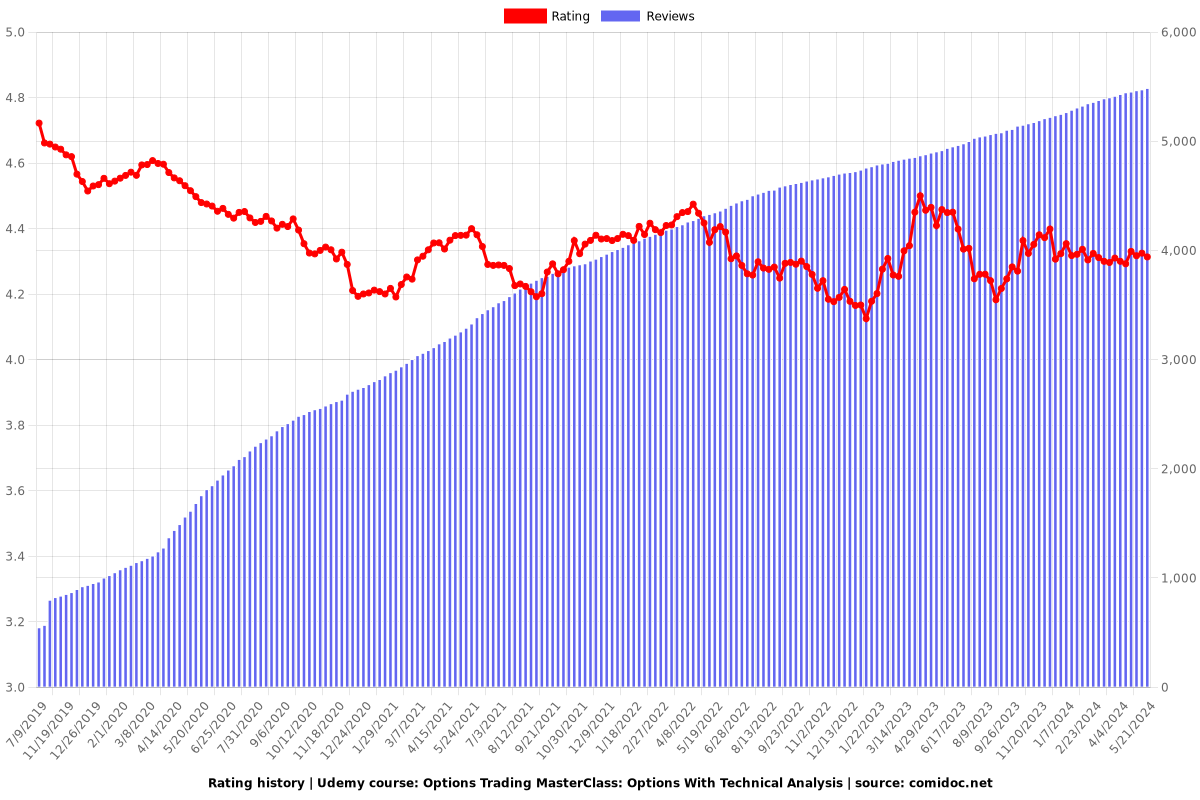

Rating

Enrollment distribution