Mathematical Option Pricing

Learn or refresh Mathematical Option Pricing with a full lecture, practical examples and 5 exercises and solutions.

What you will learn

Black Scholes Assumptions

Risk Neutral Probability

Derive the Price of a Call or Put Option

Vanilla Markets and the Volatility

Derive the Stock Process and Calculate the Forward

Black Scholes Equation

Derive the Local Volatility

Price a Barrier Option

Reflection Principle

Derive the Ornstein Uhlenbeck Process

Why take this course?

Are you a maths student who wants to discover or consolidate your Mathematical Option Pricing? Are you a professional in the banking or insurance industry who wants to improve your theoretical knowledge?

Well then you’ve come to the right place!

Mathematical Option Pricing by Thomas Dacourt is designed for you, with clear lectures and 5 exercises and solutions.

In no time at all, you will acquire the fundamental skills that will allow you to confidently manipulate financial derivatives. The course is:

Easy to understand

Comprehensive

Practical

To the point

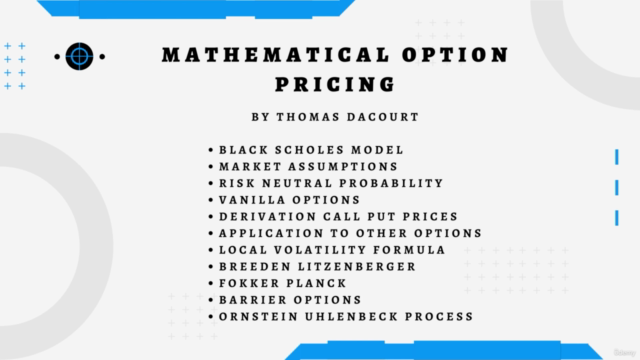

We will cover the following:

Black Scholes Assumptions

Risk Neutral Probability

Stock Process, Forward

Black Scholes Equation

Vanilla Options

Breeden Litzenberger

Fokker Planck Equation

Local Volatility

Barrier Options

Reflection Principle

Ornstein Uhlenbeck

These key concepts form the basis for understanding mathematical option pricing.

Along with the lectures, there are 5 downloadable exercises with solutions provided which are designed to check and reinforce your understanding.

The instructor

I am Thomas Dacourt and I am currently working as a senior quantitative analyst for a prestigious investment bank in London. I have held various quant positions in equity, commodities and credit in London over the last 10 years. I have studied mathematics and applied mathematics in France and financial engineering in London.

YOU WILL ALSO GET:

Lifetime Access

Q&A section with support

Certificate of completion

30-day money-back guarantee

Screenshots

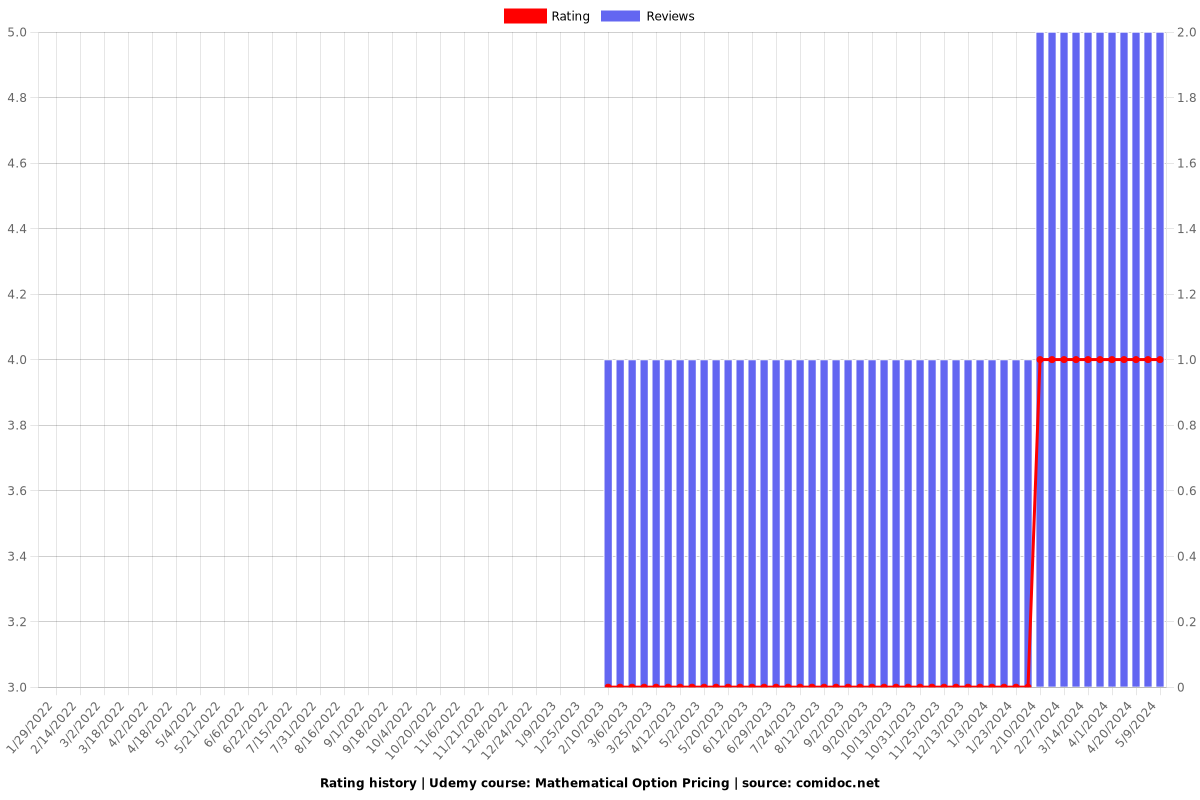

Reviews

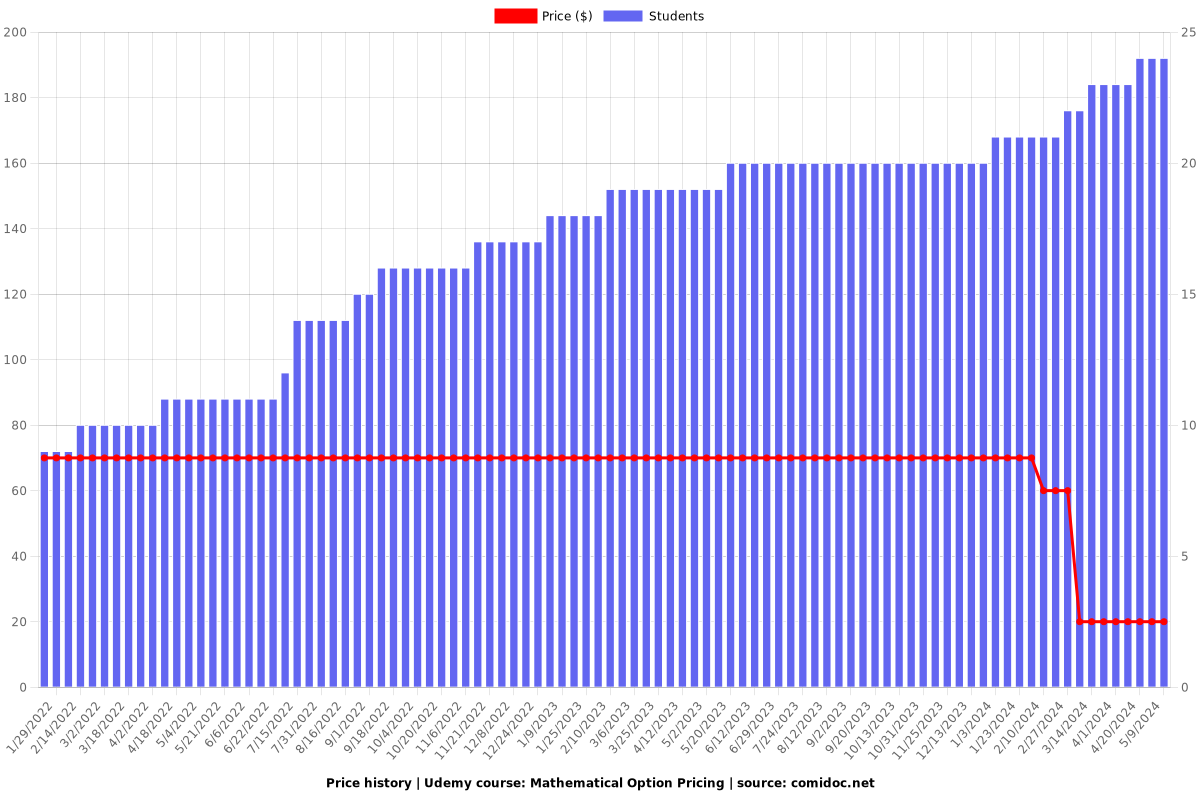

Charts

Price

Rating

Enrollment distribution