Mastering Proper Risk Management in Trading

Optimize Trading Success: Learn Expert Risk Management for Masterful Trades. Enroll Now!

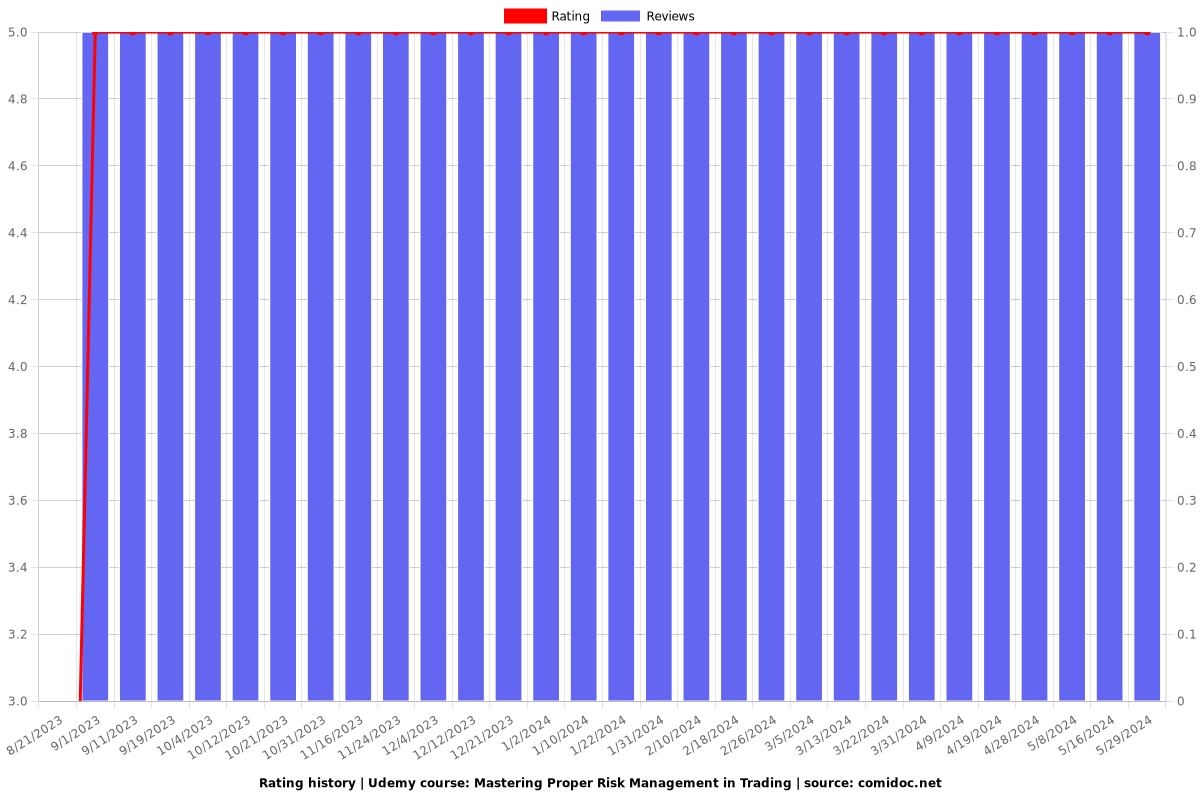

5.00 (1 reviews)

22

students

1 hour

content

Aug 2023

last update

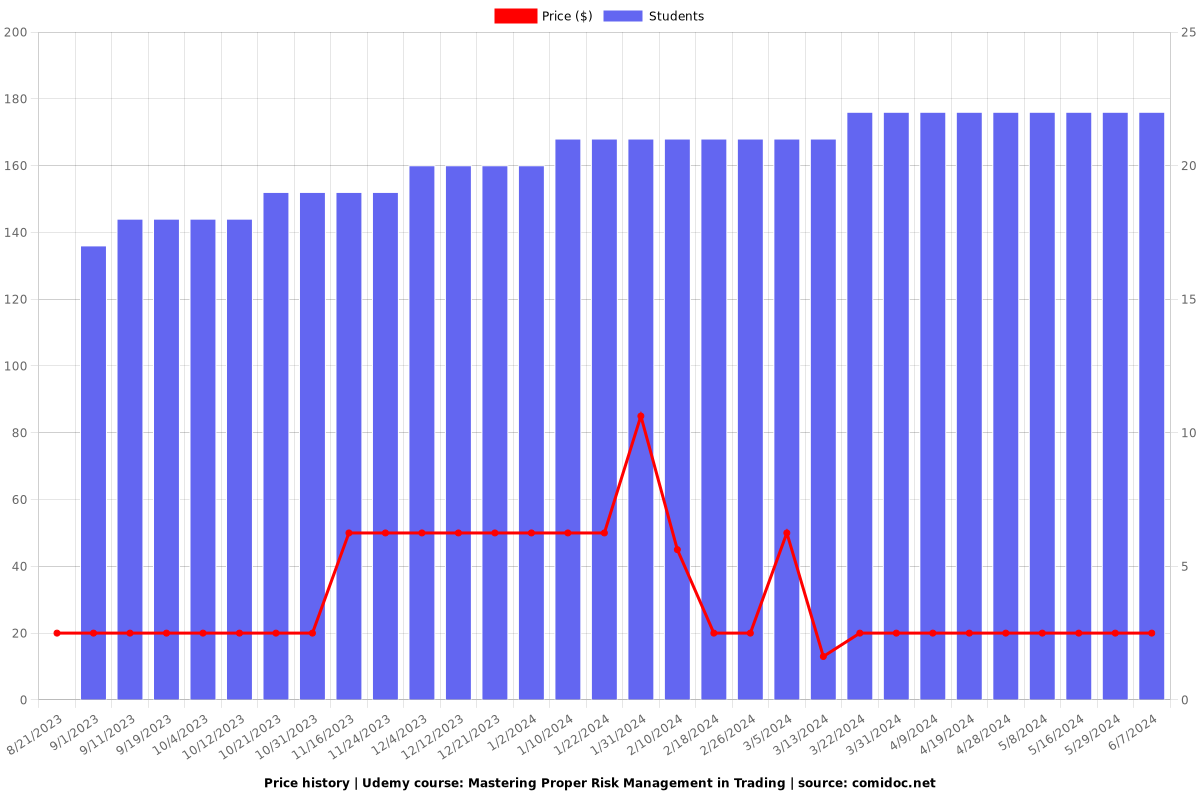

$19.99

regular price

What you will learn

Learn how to integrate risk management with technical analysis

Learn how to calculate and assess risk-reward ratios for potential trades

Recognize the impact of leverage on trading risk and how to use it wisely

Work through practical trading examples, applying wht you have learned throughout the course

Identify the key components of a comprehensive risk management plan

Learn to calculate position sizing based on risk tolerance and account capital

Recognize the inherent risks associated with trading and investment activities

Understand the psychological factors affecting risk management, such as fear and greed

Understand the fundamental concept of risk management in trading

Understand the concept of diversification and its role in managing trading risks

Master the skill of setting appropriate stop-loss levels to protect trading capital

Learn techniques to manage emotions and maintain discipline during trading

Explore various types of stop-loss strategies, such as trailing stops and fixed stops

Discover techniques for setting profit-taking targets and locking in gains

Understand the concept of drawdown and how to manage and recover from it

Master the art of adapting risk management strategies to changing market conditions

Develop a personalized risk management plan tailored to individual trading goals and risk tolerance

Why take this course?

🎓 **Mastering Proper Risk Management in Trading** 🚀

**Course Headline:** 🌟 Optimize Trading Success: Learn Expert Risk Management for Masterful Trades. Enroll Now! 🌟

---

Welcome to **"Mastering Proper Risk Management in Trading,"** the ultimate guide to mastering the critical aspect of trading that can make or break your success. This comprehensive course is designed to transform your approach to trading by equipping you with effective risk management strategies, enabling you to navigate the markets with confidence and precision.

**Course Description:**

Trading in any financial market can be fraught with uncertainties and risks. However, with the knowledge and tools provided in this course, you'll learn how to manage these risks effectively, turning potential dangers into opportunities for success. Risk management is not just a technical skill; it's an integral mindset that will serve as your compass in the dynamic world of trading.

---

**🔍 Course Highlights:**

- **Understanding the Foundation:** Gain a profound understanding of the essence of risk management and its critical role in trading. Learn to approach the markets with a balanced perspective that accounts for potential risks and rewards.

- **The Power of Risk-Reward Ratio:** Grasp the importance of maintaining a positive risk-reward ratio and learn how to assess opportunities to ensure your potential rewards outweigh the risks you take.

- **The Three Pillars of Risk Management:** Study the core principles of effective risk management – capital allocation, setting stop-loss levels, and defining profit targets. These pillars form the backbone of a solid trading strategy.

- **Integrating Risk Management with Technical Analysis:** Learn to combine risk management techniques with technical analysis for more precise and informed trading decisions. This integration will help you align trades with your risk tolerance and trading goals.

- **Emotions and Discipline:** Explore the psychological aspects of trading and how emotions like fear and greed can impact decision-making. Develop strategies to maintain discipline, manage your emotions, and uphold consistency in your trading approach.

- **Hands-On Application:** Apply what you've learned through practical trading examples, assessing risk-reward ratios, leveraging wisely, setting stop-loss orders, and defining profit-taking levels. Real-world application is key to solidifying your understanding and skills.

---

By the end of this course, you'll have developed a robust personalized risk management plan tailored to your trading goals and risk tolerance. Whether you are a novice trader or an experienced one looking to refine your techniques, this course will provide you with the essential tools and insights necessary to elevate your trading performance and achieve sustainable success.

**💡 Why You Should Enroll:**

- **Personalized Learning Experience:** Tailor the course content to fit your learning pace and style for a more effective educational journey.

- **Expert Guidance:** Learn from seasoned trading professionals who bring years of experience and a wealth of knowledge.

- **Interactive Content:** Engage with interactive tools, real-world examples, and practical exercises that bring the lessons to life.

- **Community Support:** Join a community of like-minded individuals and trade enthusiasts to share insights, experiences, and support.

Trading is not solely about chasing profits; it's about making informed decisions that protect your capital and set the foundation for long-term success. With "Mastering Proper Risk Management in Trading," you're not just taking a course; you're embarking on a transformative journey towards becoming a masterful, disciplined, and successful trader.

**📆 Enroll Now** and unlock your potential in the world of trading with expert risk management strategies! 🏆

Screenshots

Charts

Price

Rating

Enrollment distribution

5496430

udemy ID

8/11/2023

course created date

8/21/2023

course indexed date

Bot

course submited by