Investment Analysis with Natural Language Processing NLP

Rigorously Leverage Python, Data Science & NLP Techniques for Sentiment Analysis and Financial Analysis | Core Finance

What you will learn

Build a robust, rigorous investment analysis system from scratch, leveraging the power of text and numeric data, maths, and statistics.

Discover how to transform your investment idea / thesis into a testable hypothesis (even if you don't know what a "testable hypothesis" is)

Explore the different types of data sources you can (and should) use, where you can find them, & how you should clean it to get it ready for investment analysis

Learn how to quantify firm level sentiment from scratch, using nothing but raw text data and the power of Python

Explore what Natural Language Processing (NLP) is, and how it's applied in Finance. Then leverage its power to drive new insights from raw text data.

Take control of the numbers and data; push the boundaries on what's possible with robust Python libraries including Pandas, NumPy, SciPy, NLTK, and more.

Why take this course?

Say hello to Sentiment Based Investment Analysis done right. Leverage the power of Natural Language Processing (NLP) techniques to exploit Sentiment for Financial Analysis / Investment Analysis (with Python), while rigorously validating your hypothesis.

Explore the power of text data for conducting financial analysis / investment analysis rigorously, using hypothesis driven approaches that are rigorously grounded in the academic and practitioner literature. All while leveraging the power of Python.

Discover what Natural Language Processing (NLP) is, and how it's applied in Finance, using Python for Finance.

Master the systematic 5 Step Process for Sentiment Analysis while working with a large sample of messy real world data obtained from credible sources, for free.

# =============================

# 2 PARTS, 9 SECTIONS TO MASTERY

# =============================

(plus, all future updates included!)

PART I: INVESTMENT ANALYSIS FUNDAMENTALS

Start by gaining a solid command of the core fundamentals that drive the entire investment analysis / financial analysis process.

Explore Investment Security Relationships & Estimate Returns

Discover powerful relationships between Price, Risk, and Returns

Intuitively explore the baseline fundamental law of Financial Analysis - The Law of One Price.

Learn what "Shorting" a stock actually means and how it works

Learn how to calculate stock returns and portfolio returns from scratch

Work with real-world data on Python and know exactly what your code does and why it works

Estimate Expected Returns of Financial Securities

Explore what "expected returns" are and how to estimate them starting with the simple mean

Dive deeper with "state-contingent" expected returns that synthesize your opinions with the data

Learn how to calculate expected returns using Asset Pricing Models like the CAPM (Capital Asset Pricing Model)

Discover Multi-Factor Asset Pricing Models including the "Fama French 3 Factor Model", Carhart 4 ("Momentum"), and more

Master the theoretical foundation and apply what you learn using real-world data on Python your own!

Quantify Stock Risk and Estimate Portfolio Risk

Examine the risk of a stock and learn how to quantify total risk from scratch

Apply your knowledge to any stock you want to explore and work with

Discover the 3 factors that influence portfolio risk (1 of which is more important than the other two combined)

Explore how to estimate portfolio risk for 'simple' 2-asset portfolios

Learn how to measure portfolio risk of multiple stocks (including working with real-world data on Python!)

Check your Mastery

So. Much. Knowledge, Skills, and Experience. Are you up for the challenge? - Take the "Test Towards Mastery"

Identify areas you need to improve on and get better at in the context of Financial Analysis / Investment Analysis

Set yourself up for success in Investment Analysis with Natural Language Processing (NLP) by ensuring you have a rigorous foundation in place

PART II: INVESTMENT / SENTIMENT ANALYSIS WITH NATURAL LANGUAGE PROCESSING (NLP)

Introduction to Natural Language Processing & Sentiment Analysis in Finance

Gain an overview of what Natural Language Processing (NLP) is in the context of Finance.

Discover the wealth of applications of Natural Language Processing (NLP) techniques in Finance, both in the academic and practitioner literature - for Context, Compliance, and Quantitative Analysis (aka, at least in principle, financial analysis / investment analysis).

Explore what Sentiment Analysis is, and learn about the Fervent 5 Step Sentiment Analysis Process to help you conduct sentiment investing in a rigorous and statistically robust manner.

Hypothesis Design & Exploratory Data Analysis

Learn how you can formally express your Finance investment ideas / investing thesis by transforming them into testable hypotheses that are short, ultra-specific, and measurable.

Explore the wealth of data sources available, and how you can let your financial hypothesis drive the choice of data.

Avoid the "GIGO Trap". See what it takes to really know your financial data with exploratory data analysis techniques designed to hold you in good stead when you get around to conducting sentiment-based financial analysis / investment analysis using Python.

Estimating Firm-Level Sentiment

Become a pro at quantifying sentiment/emotions of companies from scratch using Python, so you can use them for financial analysis / investment analysis.

Apply lexicon / dictionary based approaches to estimating sentiment on Python while critically evaluating alternative approaches (e.g. using "machine learning" based approaches and why they can't be applied in some cases).

Explore computations of sentiment "manually", leveraging the power of built-in methods inside Python's NLTK framework.

Estimating Sentiment Portfolio Returns

Link / merge your firm-level sentiment estimates with stock price and returns data on Python to evaluate relationships between sentiment and stock returns (reap the rewards of your hard work by finally conducting sentiment analysis!).

Discover how to merge daily data with annual data, while using the "ffill" method built into Python (Pandas) to maintain a daily dataset with ease.

Estimate quintile sorted sentiment portfolio returns and prep the data on Python for the final push.

Sentiment / Natural Language Processing (NLP) based Investment Analysis

Avoid guesswork by leveraging the power of statistics to rigorously test and validate your hypothesis in a robust manner on Python.

Gain a solid insight into why the statistics makes sense, including why we use a specific statistical test (the t-test)

Explore what to do when things don't quite go the way you expected them to. And finally, learn whether the sentiment of a stock actually matters for financial / investment performance.

DESIGNED FOR DISTINCTION™

We've used the same tried and tested, proven to work teaching techniques that've helped our clients ace their exams and become chartered certified accountants, get hired by the most renowned investment banks in the world, and indeed, manage their own portfolios.

Here's how we'll help you master financial analysis and sentiment analysis, and turn you into a PRO at Financial Analysis / Investment Analysis with Natural Language Processing (NLP) on Python:

A Solid Foundation

You’ll gain a solid foundation of the core fundamentals that drive the entire financial analysis / investment analysis process. These fundamentals are the essence of financial analysis and sentiment analysis done right.

Code-along Walkthroughs

Forget about watching videos where all the code's written out. We'll start from a blank Jupyter Notebook. And code everything from scratch, one line at a time. That way you'll literally see how we conduct rigorous financial analysis / investment analysis using Natural Language Processing (NLP) / sentiment as the core basis, one step at a time.

Loads of Practice Questions

Apply what you learn immediately with 100+ practice questions, all with impeccably detailed solutions. Plus, assignments that take you outside your comfort zone.

Proofs & Resources

Mathematical proofs for the mathematically curious, workable .ipynb and .py Python code – all included.

Reviews

Charts

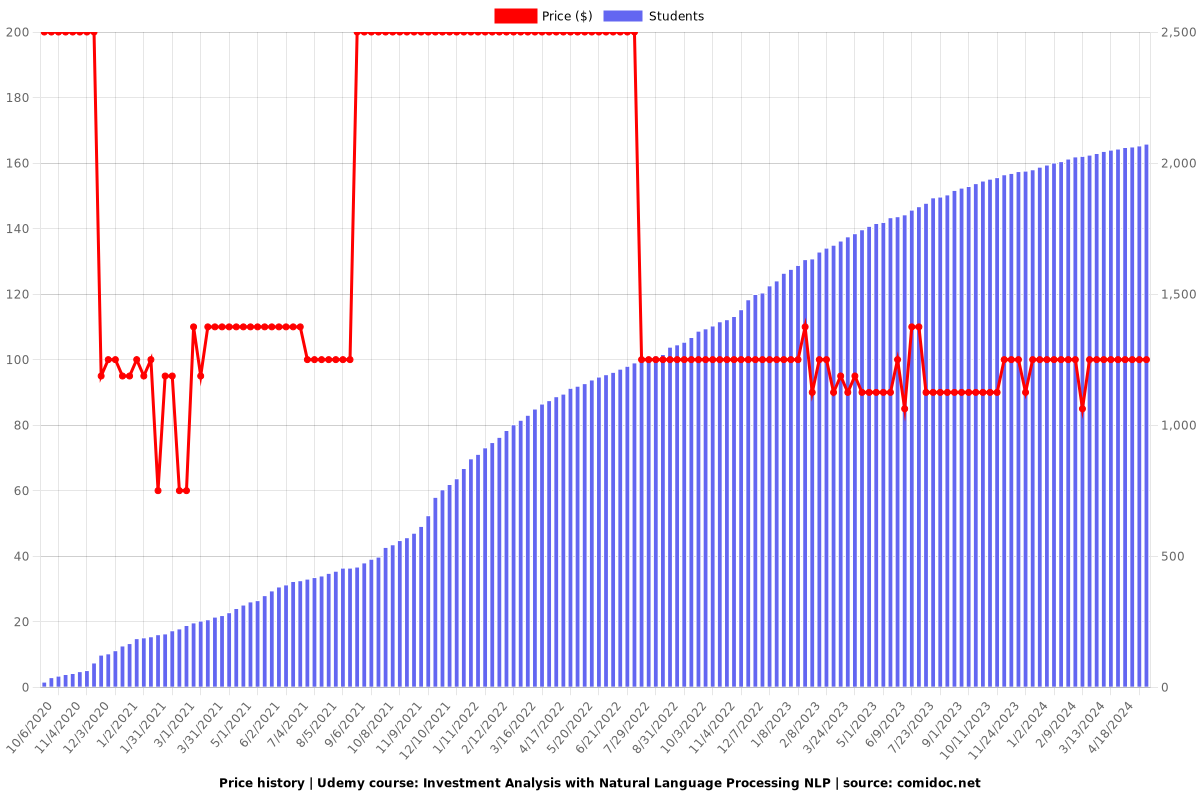

Price

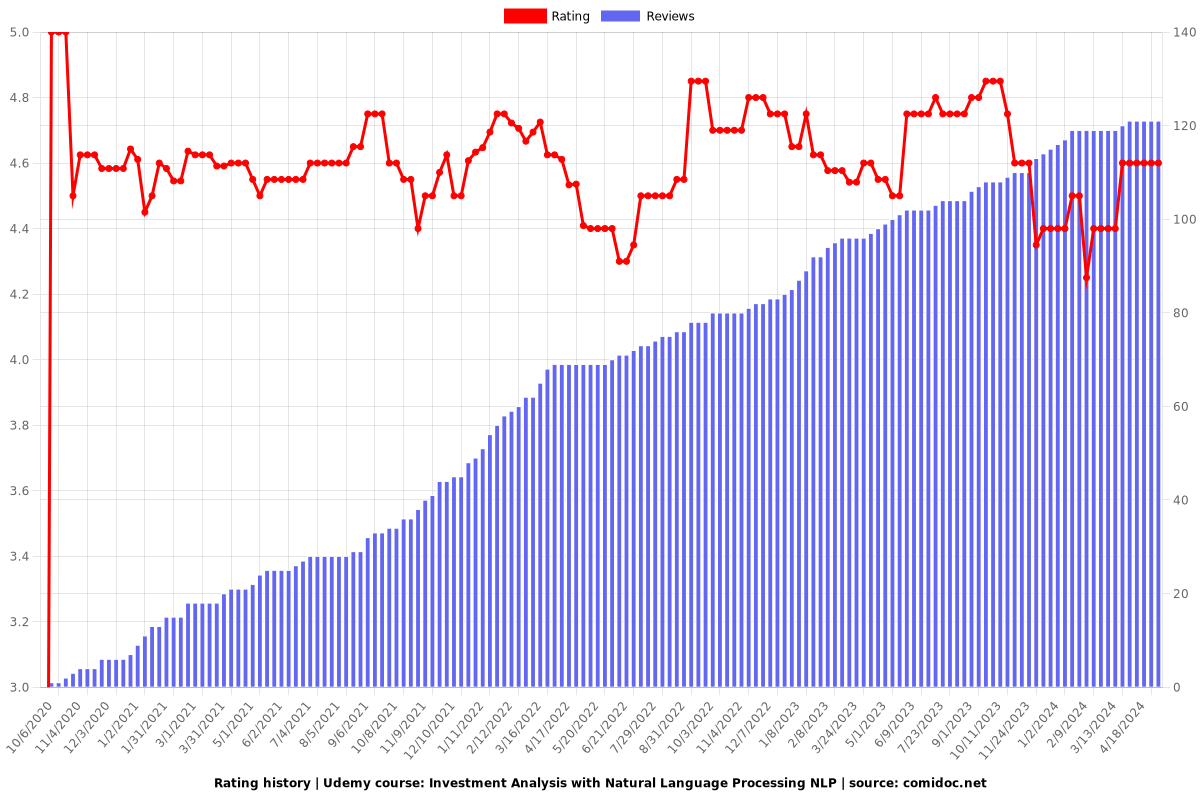

Rating

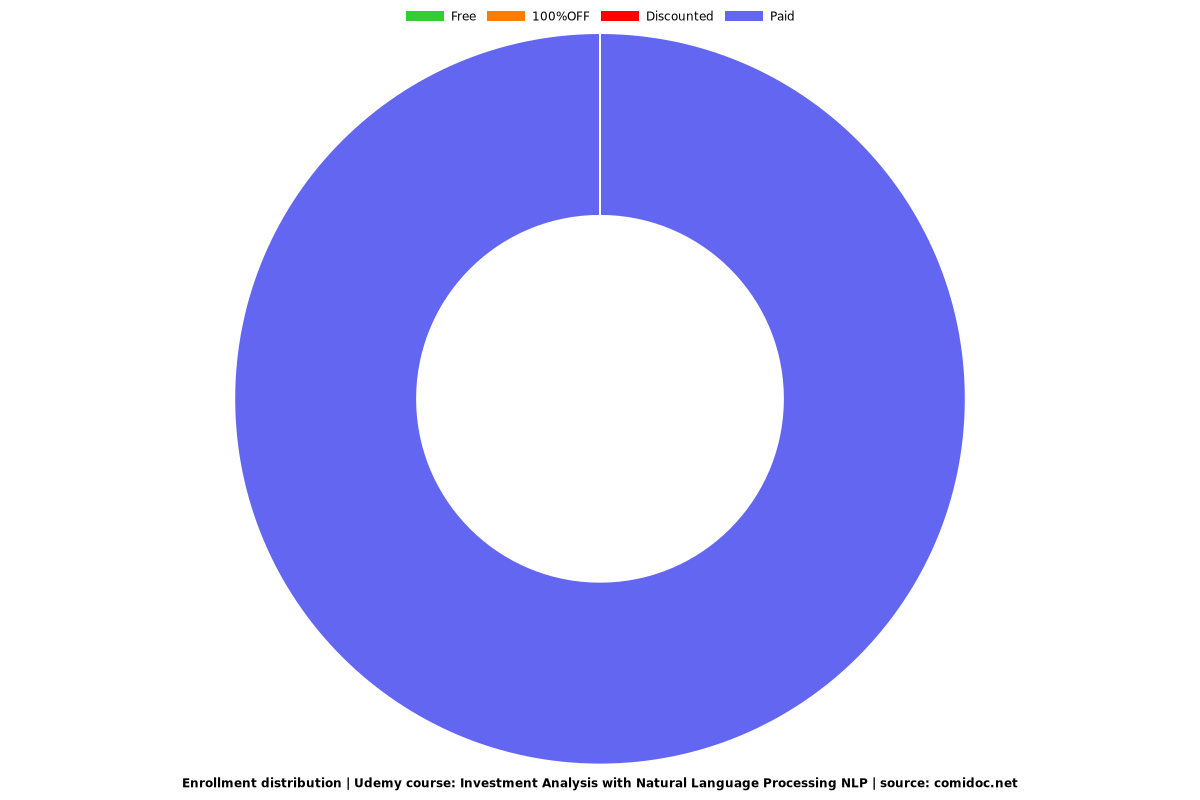

Enrollment distribution