Investing Internationally into Real Estate, Stocks and Bonds

A-Z guide to overseas investments covers major themes of property, equity, and debt.

What you will learn

Minimize predatory political expropriation of your family overseas assets by international despots.

Reduce your taxes far below what would otherwise be possible with a pure domestic investment strategy.

Choose your lifestyle as simply and surely as flipping through episodes of hit HGTV show “International Hose Hunters!”

Why take this course?

WARNING: DON’T EVEN THINK OF BUYING REAL ESTATE IN MEXICO UNTIL YOU COMPLETE THIS COURSE!

Updated Monday, May 23, 2016, 10:41 A.M.

Your investing fate overseas need not be in the hands of ultra-nationalist machete wielding drunks, Chavista sex addicts, and French Civil Code imbeciles…

And your problems don’t stop there. Even in “safe Europe” one of the PIGS [Portugal, Italy, Greece, or Spain] can expropriate your home or business in postcard perfect seeming locations such as the scenic South of Umbria. And then there are the bleeding liberals in the Northern “civilized” countries of Germany, Denmark, Sweden, Finland and Norway that have no problems hammering your returns with pork belly VAT taxes.

Let’s face it, international investing is not a cakewalk without a guide.

WHAT YOU GET AND HOW IT WORKS!

This course offers you a concise overseas investing training based on fact from the halls of such erudite places as Harvard.

- Section 1: The General Themes of International Investing

- Section 2: International Real Estate

COURSE UPDATE SCHEDULE

February 15 & 29:

- Section 3: International Stock Markets [Forthcoming February 15 2016 — Tuition Increases to $49.99]

- Section 4: International Bond Markets [Forthcoming February 29 2016 — Tuition Increases to $99.99]

March 15 & 31:

- Section 5: Tax Arbitrage [Forthcoming March 15 2016 — Tuition Increases to $199.99]

- Section 6: International Portfolio Management [Forthcoming March 31 2016 — Tuition Increases to $299.99]

I am not just a professor of finance at major state university but I am also a seasoned international investor with decades of experience since childhood. Read my Udemy profile for more detail regarding my credentials.

The Benefits of this Course are Tangible!

- Identify the markets with the best investor protection of your hard earned savings — shown by Ivy League economics research to offer highest expected returns.

- Identify to avoid the markets most likely to give you bigger headaches and lower returns — that must be pondered with regard to local lifestyle rewards.

- Find for yourself the safest markets and methods of overseas investing that best matches your personality and goals.

Here is just the tip of the iceberg of the buzz about my top rated teaching approach on Udemy ...

- “I love this! It's most powerful and effective when concepts are woven around a story, and this looks like it does just that. So much of investment advice seems like scattered bits and pieces, like studying history by memorizing a random bunch of dates and events. Without a narrative to tie it all together it has no meaning.” -Dr. Joel Wade, California 1/19/2016

Enroll now and get an amazing lifetime membership to guide your journey over the coming decades in international investing.

Your tuition is protected by an ironclad 30-day money-back guarantee fulfilled by Udemy as third party.

Enroll now before the next tuition hike on this course. You are missing international investment opportunities with every day that passes.

ENROLL NOW!

You can sit where you are right now like a mushroom in the dark. Or you can come out into the light of knowledge and reason when it comes to international investing overseas.

Enroll now! I am waiting inside to guide your investment education,

-Dr. Scott Brown

Associate Professor of Finance of the AACSB Accredited University of Puerto Rico Graduate School of Business

P.S. Enroll now. Remember that as time passes you miss opportunity to ask questions of a major state finance professor regarding investing topics. This alone is worth $1,999 per year at the most conservative world estimates. Enroll now.

Screenshots

Reviews

Charts

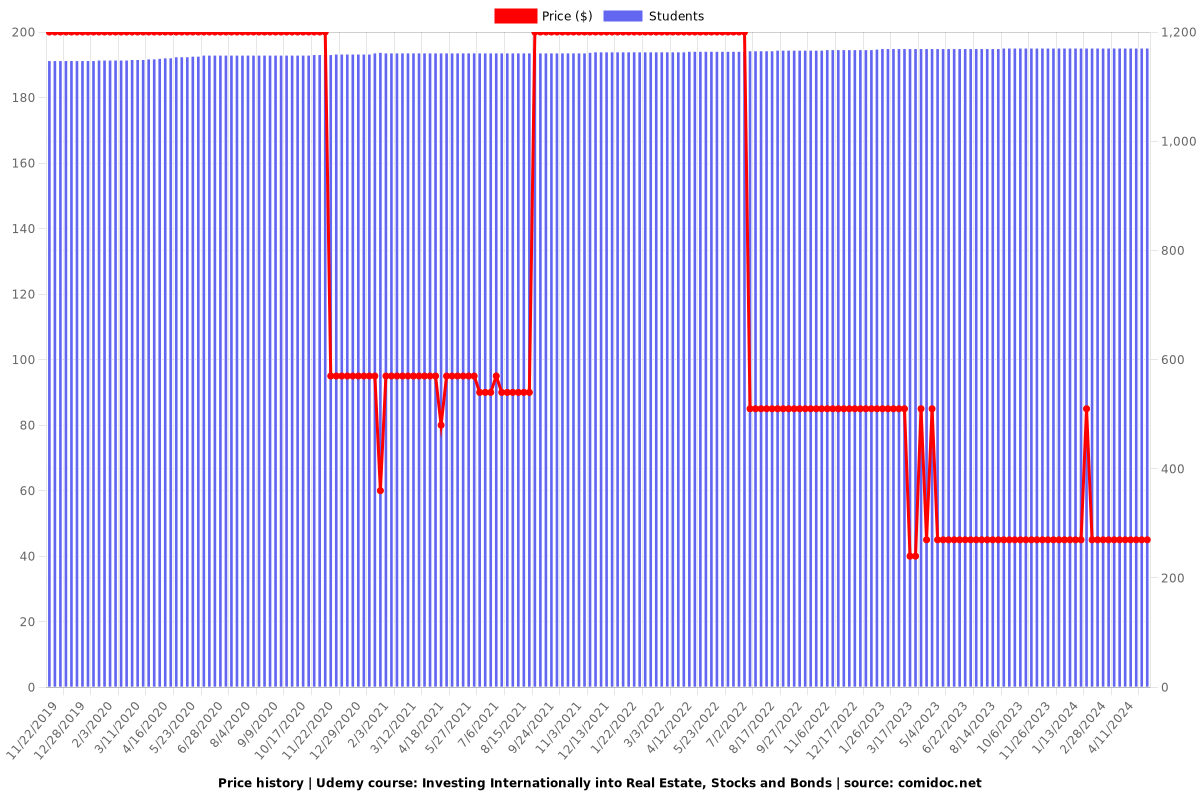

Price

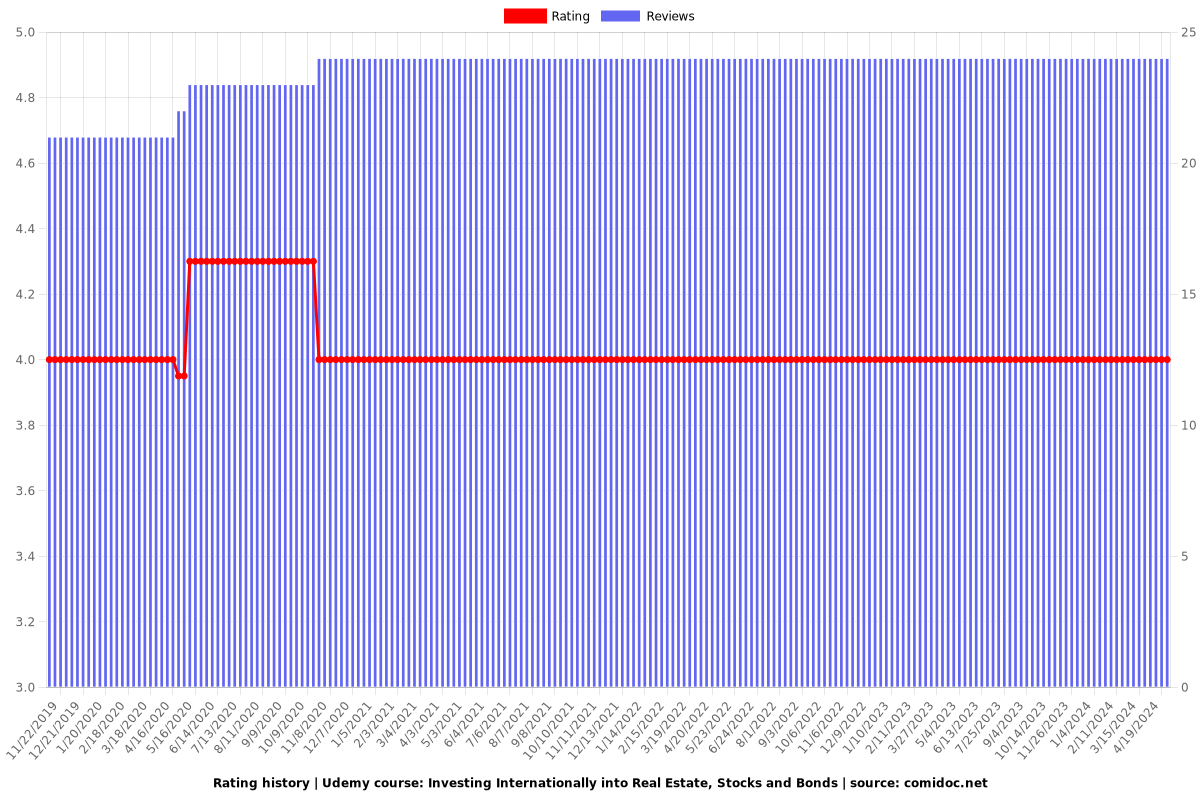

Rating

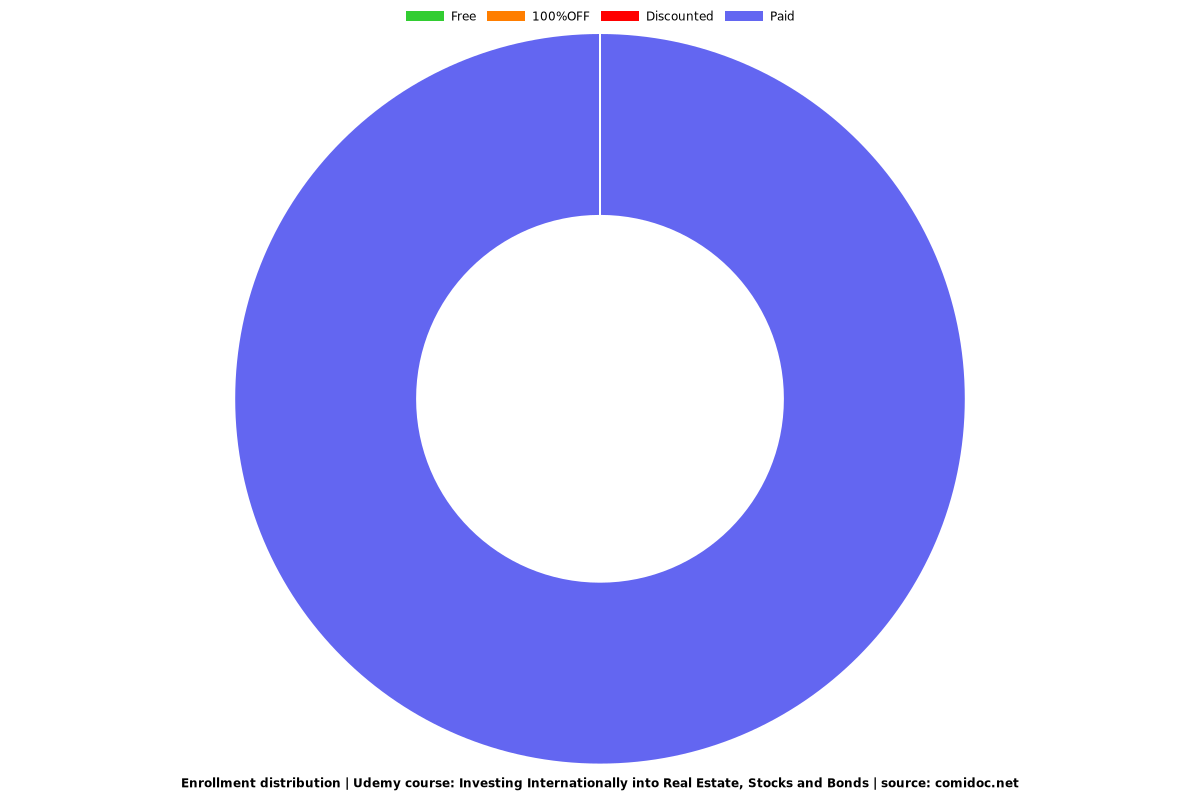

Enrollment distribution