IFRS 16 Leases - Learn from Industry Data and Annual Reports

New lease accounting in the books of Lessor and Lessee including all the amendments as per IFRS 16/Ins AS 116

What you will learn

Understanding of leases

Lease liability and Right of use of asset

Fixed and in-substance fixed lease payments

Guaranteed and Unguaranteed residual value

Lease Exemptions

Lessor accounting and disclosure

Lease Term

Discounting Rate

Variable Lease Payments

Lease Accounting and Disclosure

Lease Classification

Lease Modifactions

Sale and Lease Back Accounting

Why take this course?

The objective of IFRS 16 is to report information that (a) faithfully represents lease transactions and (b) provides a basis for users of financial statements to assess the amount, timing, and uncertainty of cash flows arising from leases. To meet that objective, a lessee should recognize assets and liabilities arising from a lease.

IFRS 16 introduces a single lessee accounting model and requires a lessee to recognize assets and liabilities for all leases with a term of more than 12 months unless the underlying asset is of low value. A lessee is required to recognize a right-of-use asset representing its right to use the underlying leased asset and a lease liability representing its obligation to make lease payments.

Under IFRS 16, a lease is defined as a contract granting an entity the right to utilize a specific asset for a prescribed period of time in exchange for agreed-upon consideration. To determine whether a contract grants control of the asset to the lessee, the agreement must provide the following to the lessee:

The right to substantially all economic benefits from the use of the asset

The right to dictate how the asset is used by the entity

At times, an organization may have a contract that seems to meet the definition of a lease but does not fall within the scope of IFRS 16. Situations where this may occur include but are not limited to:

Leases of biological assets

Leases for the exploration of non-regenerative resources such as oil, gas, etc.

Service concession arrangements

Licenses of intellectual property

Concurrently, lessees reporting under IFRS 16 may choose to take advantage of practical expedients that exclude certain types of leases from capitalization. These include:

Short-term leases, defined as having a term of 12 months or less at commencement and no option to purchase the leased asset

Leases of low-value assets, defined as leases for which the underlying asset’s fair value (when the asset is new) is generally less than $5,000

Screenshots

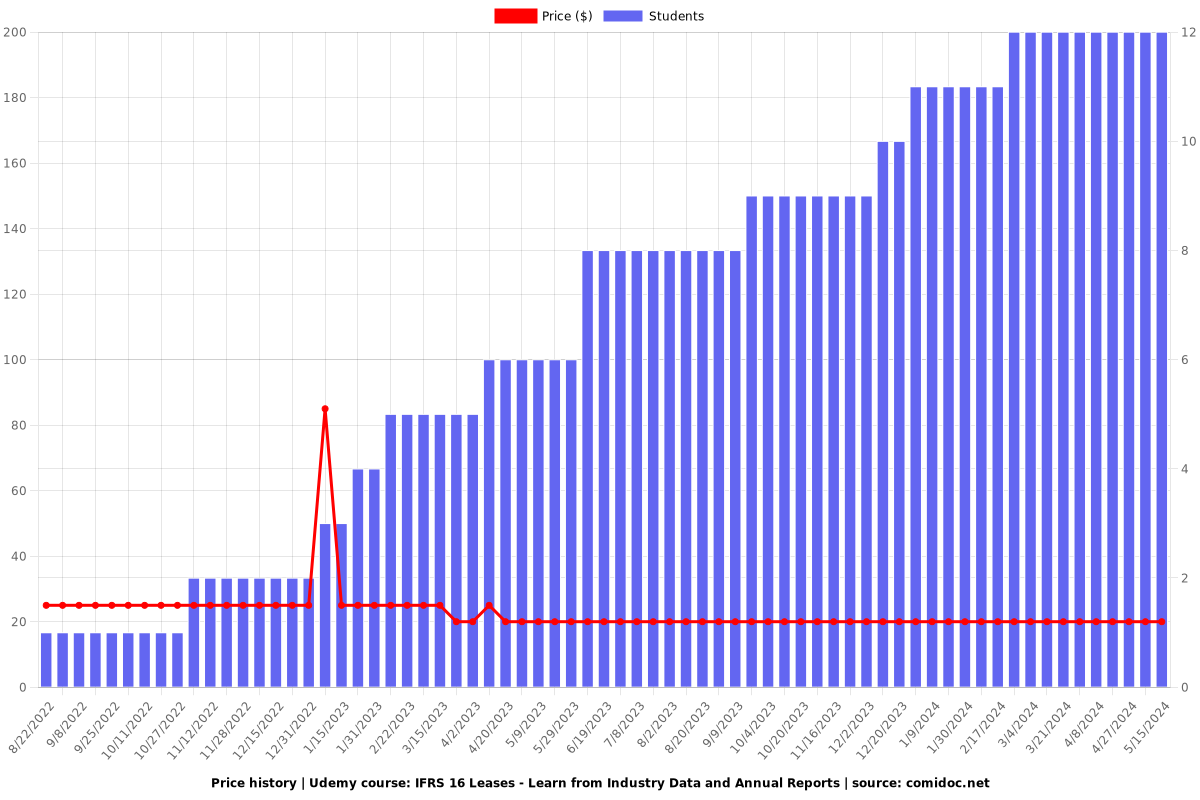

Charts

Price

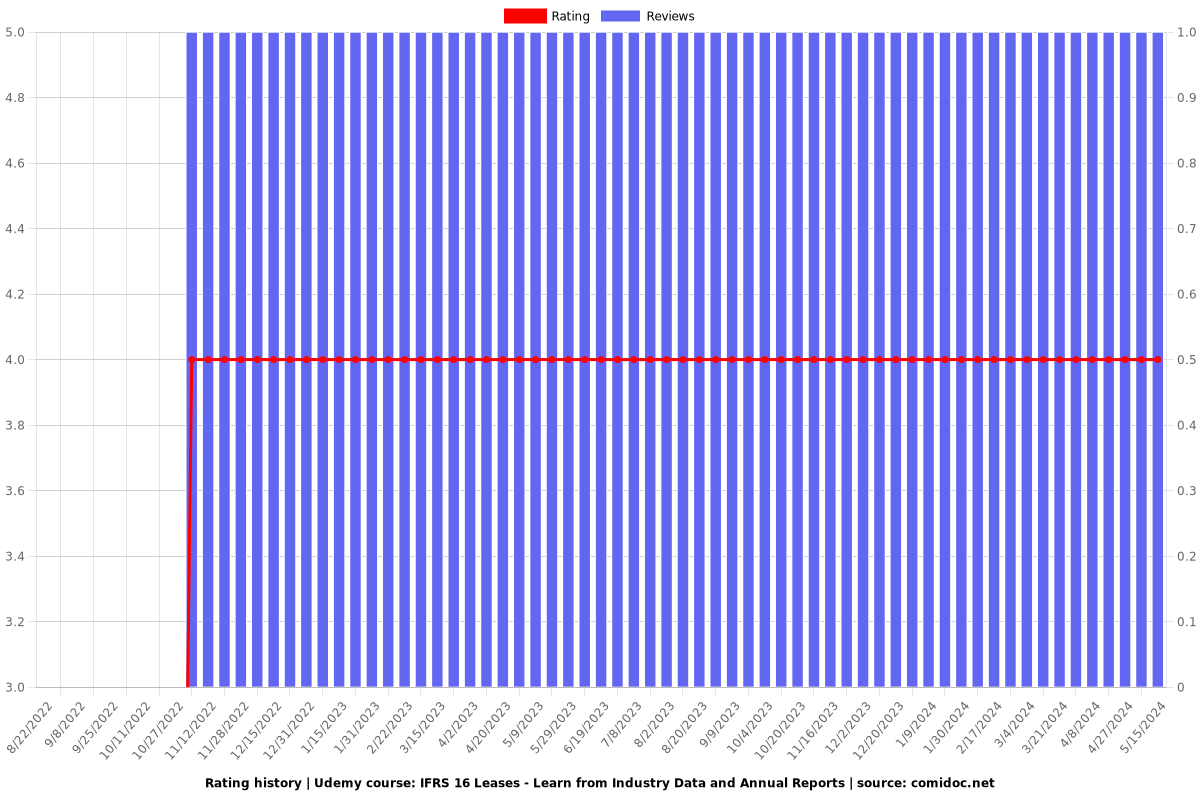

Rating

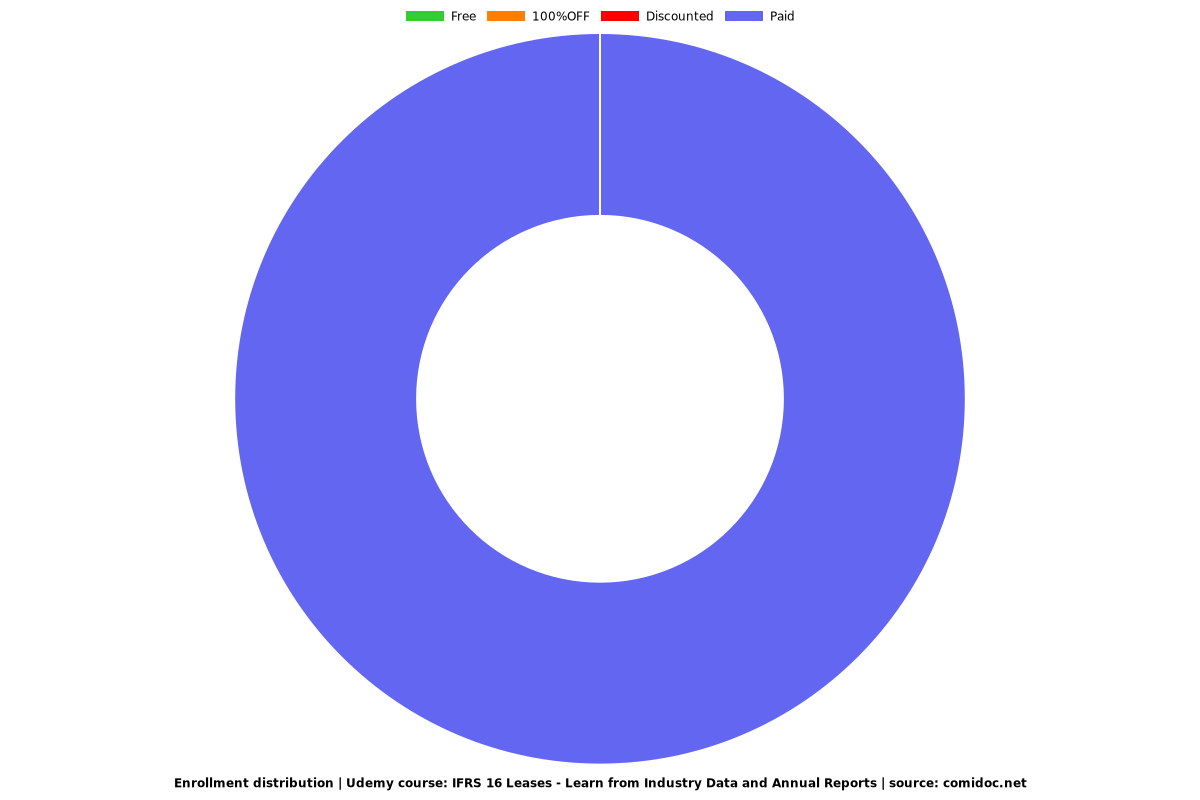

Enrollment distribution