GST Returns Course (Live Working) : Get Certified Today

Deep Dive in GST Returns on GST Official Website,from Tax Payments, Refunds, ITC, PAN, TAN, TIN & DSC, GSTR 1 -11 & ....

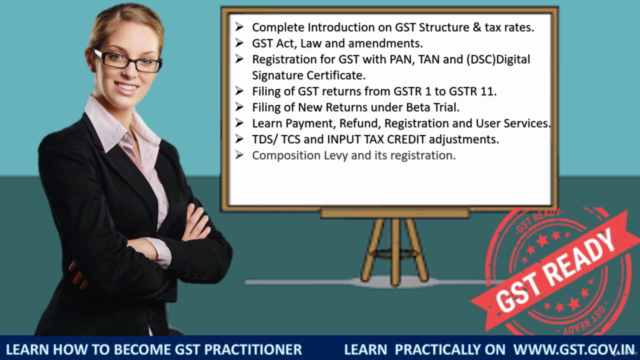

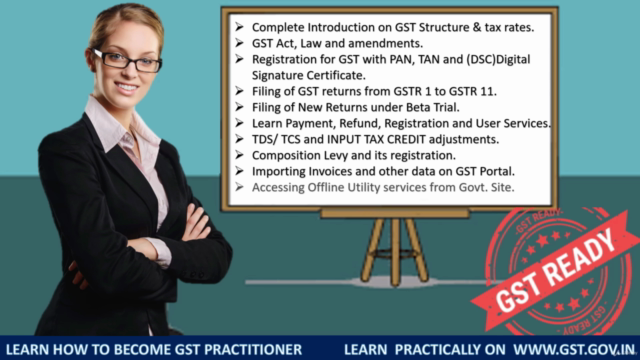

What you will learn

Learn GST Return Filing from GSTR1 to GSTR 11

Real time Application of Complicated GST services

GST Registration

Uploading Invoice on GST Portal

Using Offline and Online Utility Tool from GSTN

You will learn how to file GST Returns for Composition Dealer, Regular Dealer & more..

Payment of Tax and Refunds

Will give confidence for using GST portal personally

Input Tax Credit on GST Portal

How to Apply for PAN, TAN, TIN & DIN

And if there is anything you don't learn from the course and want to learn, you can always ask the instructor K.R. Gupta for help!

Why take this course?

Aim & Future Prospects:

The aim of the course is to help individuals, businessman, accountants, CAs and other professionals to upgrade their knowledge regarding the Goods and Services Tax by offering most of the real time practical knowledge on GST Portal in an updated and systematic approach that help them to accelerate their skills and knowledge required for self-employment & employment at industrial level as well.

Benefits of the course:

The course is specially focused & designed on "Real-Time Online"working model on GST Portal.

The course will help in an exponential growth of job opportunities available to individuals.

You can start your own consultancy services as well

The course will help to accelerate your skills and knowledge required for self-employment & industry both.

Course Contents:

Introduction to GST?

Deep Dive in GST Practical knowledge.

"Registration Services" on GST Portal.

"Ledger Services" on GST Portal.

"Returns Services" on GST Portal.

"Payment Services" on GST Portal.

"User Services" on GST Portal.

"Refunds Services" on GST Portal.

GST Law from GST Portal.

Real - Time "Download Services" on GST Portal.

"Searching Taxpayer Services" on GST Portal.

Are there any course requirements or prerequisites?

Basic Computer Knowledge

Who this course is for:

Non Accounting background students

Anybody wants to become Successful Accountant

Business Owners, Career Seekers

Who want to learn advance Accounting with GST in Tally

Note: And if there is anything you don't learn from the course and want to learn, you can always ask the instructor K.R. Gupta for help!

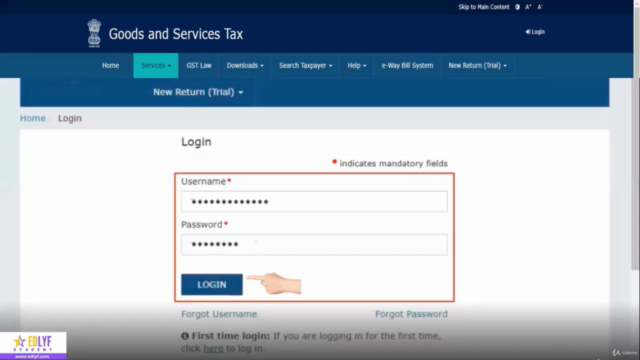

Screenshots

Reviews

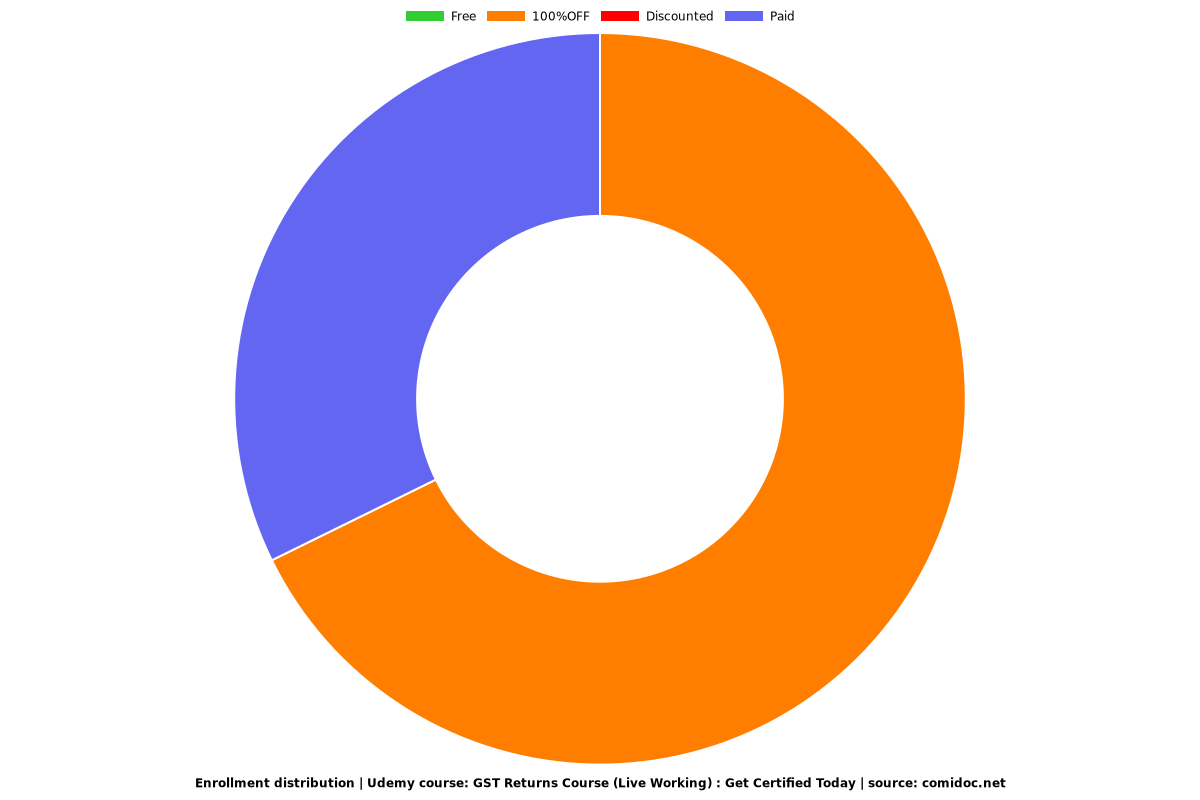

Charts

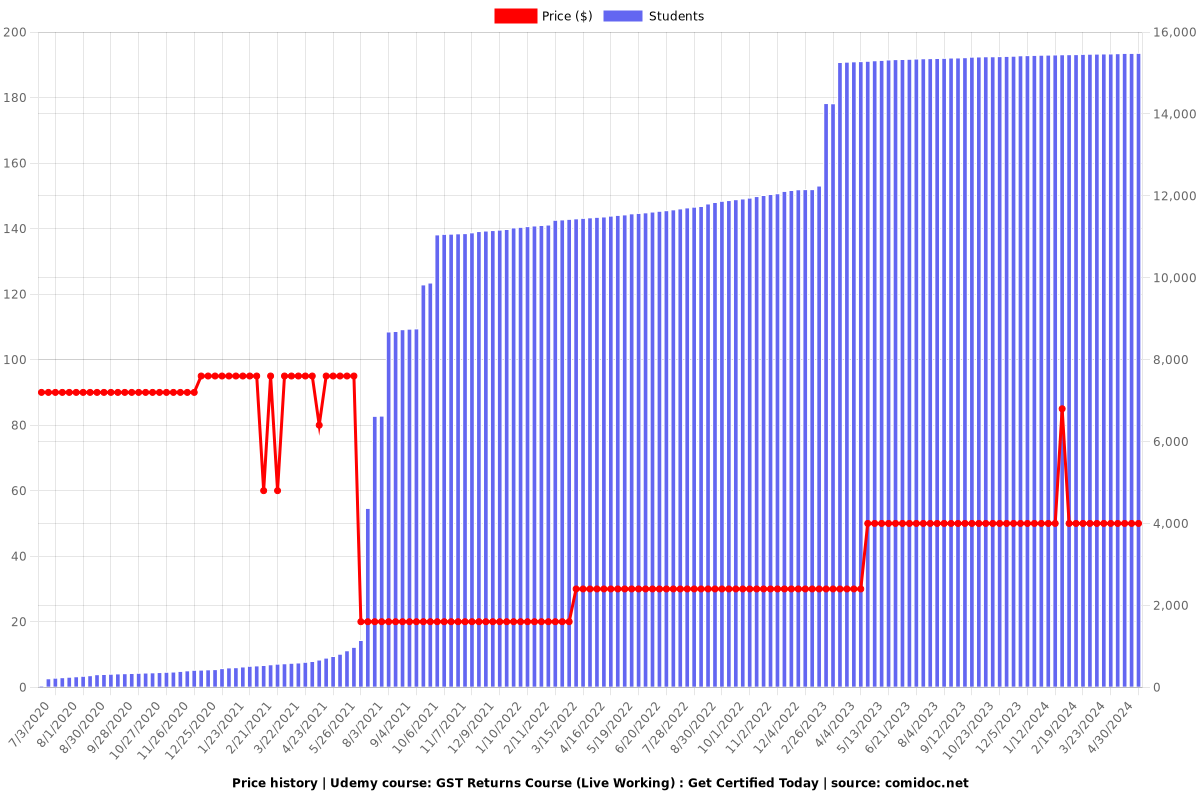

Price

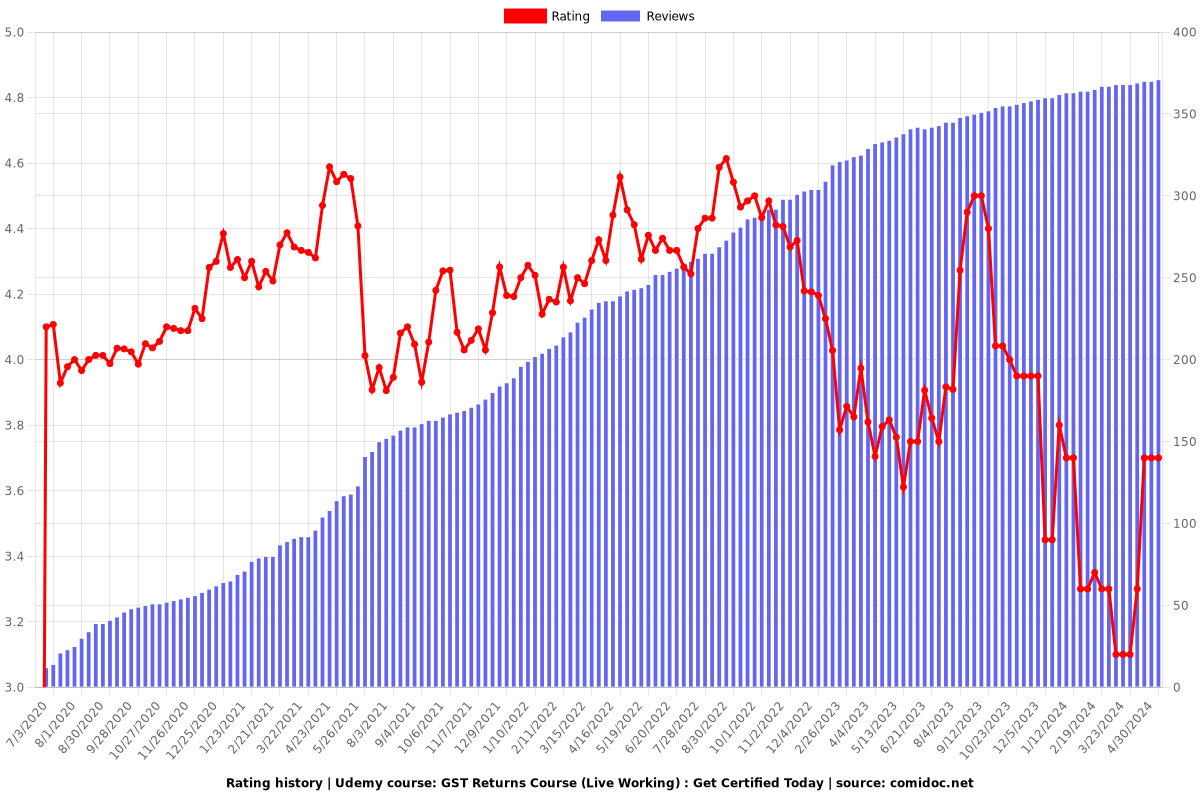

Rating

Enrollment distribution