Goods and Services Tax Registration

A simple course on GST registration process in India

4.30 (371 reviews)

9,424

students

1 hour

content

Jul 2017

last update

FREE

regular price

What you will learn

This course teaches you the step by step process of GST registration

Why take this course?

📚 **Course Title:** Goods and Services Tax Registration 🇮🇳

🚀 **Course Headline:** Master the GST Registration Process in India with Ease! 🧠✨

Are you a business owner, entrepreneur, or professional looking to navigate the intricacies of the Indian tax system? Look no further! Our comprehensive online course "**Goods and Services Tax (GST) Registration**" is designed to demystify the GST registration process for you. 🖥️✅

### **Course Description:**

📑 **Understanding GST:**

Goods and Services Tax, or GST, is a revolutionary tax reform that has transformed the way taxes are levied and collected in India. Introduced on July 1, 2017, GST has become a cornerstone of efficient tax collection and has affected businesses across the country. As an indirect tax that's applied at every point of sale, GST impacts the supply chain from production to consumption.

🏗️ **Why Register for GST?**

Understanding GST is crucial for any business entity in India. Registration under GST is not just a compliance requirement; it's a gateway to legally conduct your business, collect tax from your customers, and avail of input tax credits on the purchases you make. Without proper registration, your business could face legal hurdles and financial setbacks.

🎓 **Who Should Take This Course?**

This course is tailored for:

- Small and medium-sized enterprise (SME) owners

- New entrepreneurs

- Tax professionals and accountants

- Business consultants

- Anyone interested in understanding the GST registration process in India

🔍 **What You Will Learn:**

- The basics of GST and its significance in the Indian tax system.

- The step-by-step process for registering for GST, including the required documentation and application procedures.

- How to apply for different types of GST registrations, such as regular, composition, and online schemes.

- Best practices for maintaining compliance with GST regulations.

- Tips on claiming input tax credits and managing your finances under GST.

🔑 **Key Takeaways:**

- A clear understanding of the GST framework in India.

- Knowledge of the different types of GST registrations available to businesses.

- The ability to successfully navigate the online GST registration process on the official GST portal.

- Strategies for maintaining an efficient and compliant financial system within your business.

📆 **Course Structure:**

The course is structured into modules that cover:

1. Introduction to GST and its objectives in India.

2. Detailed walkthrough of the GST registration process.

3. Compliance, documentation, and input tax credit system.

4. Real-life case studies and examples for better understanding.

5. FAQs and common challenges faced during GST registration.

🎯 **By completing this course, you will be well-equipped to register your business under the GST regime, comply with all the necessary regulations, and manage your tax liabilities effectively.**

Enroll now and take the first step towards a seamless GST experience! 🚀📚

---

**Don't miss out on this opportunity to streamline your business operations under GST. Sign up today and join thousands of satisfied learners who have mastered the GST registration process with our course.** 🎉💼

---

**Enroll Now: [Your Enrollment Link Here]**

"This course is a game-changer for anyone looking to get their head around GST. Highly recommended!" - Satisfied Learner

Our review

---

**Course Review: Understanding & Registering for GST**

**Overall Rating:** 4.3/5

**Pros:**

- **Informative Content:** The course provides a comprehensive understanding of the Goods and Services Tax (GST), its concepts, and the registration process.

- **Educational Approach:** The instructional style is clear and easy to follow, making complex topics more accessible to learners.

- **Real-World Application:** Students can begin the GST registration process or understand how to assist others with their GST registrations after completing the course.

- **Clarity in Instruction:** Some videos are concise yet cover the necessary aspects of GST, providing a clear understanding of the concepts and reasons behind them.

- **Confidence Building:** The course helps learners develop confidence in their knowledge of GST and its implementation.

**Cons:**

- **Assumed Knowledge:** The course assumes a certain level of familiarity with India's taxation system, which may not be present for all students.

- **Clarification Needed:** Some terms such as 'constitution of business', 'casual taxable person', and 'exemption from threshold limit' require further explanation.

- **Example Illustrations:** The course could benefit from real-life examples or comparisons between GST and old tax systems to enhance understanding.

- **Video Content Evaluation:** A few reviews suggest that the course, as it stands, may not be comprehensive enough, with some learners preferring external resources like YouTube videos for a more complete understanding of GST.

- **Terminology and Terminology Clarification:** The instructor's reading of the format and use of terms could be improved by adding a few lines to define them clearly, especially for beginners.

**Additional Feedback:**

- **Video Recommendations:** One reviewer noted that while the course was helpful, they found an external video more informative regarding the subject matter. This suggests that the course could be enhanced by integrating multimedia resources effectively.

- **Audience Consideration:** The content should cater to a broad audience, from those unfamiliar with Indian taxation systems to those seeking to deepen their knowledge of GST.

**Course Experience Summary:**

The course "Understanding & Registering for GST" is generally well-received by learners, with many finding it informative and beneficial for grasping the basics of GST and its registration process. The clear explanations and concise delivery are highlighted as strengths, yet some learners indicate a need for additional examples and clarifications on key terms to improve understanding. The course's effectiveness in building confidence among students regarding GST is commendable. However, there is room for improvement in terms of assuming less prior knowledge and ensuring all concepts are explained thoroughly to cater to beginners and those seeking a more comprehensive understanding of the subject.

---

**Final Verdict:**

This course serves as a solid starting point for those new to GST or looking to register for it. With some additional attention to detail in terms of explanations and examples, it could be an even more valuable resource for anyone interested in navigating India's GST system. It is recommended that the instructor considers incorporating learner feedback to enhance the course material, making it more inclusive and comprehensive for a wider audience.

Charts

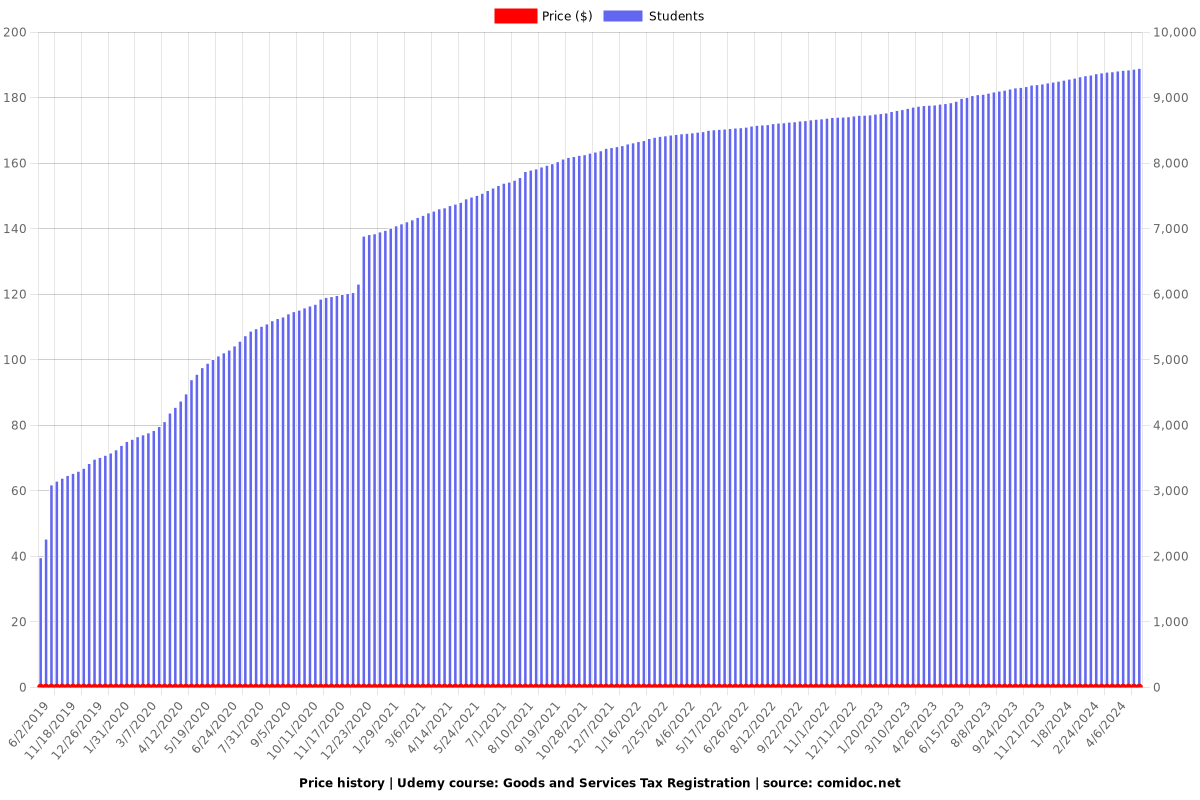

Price

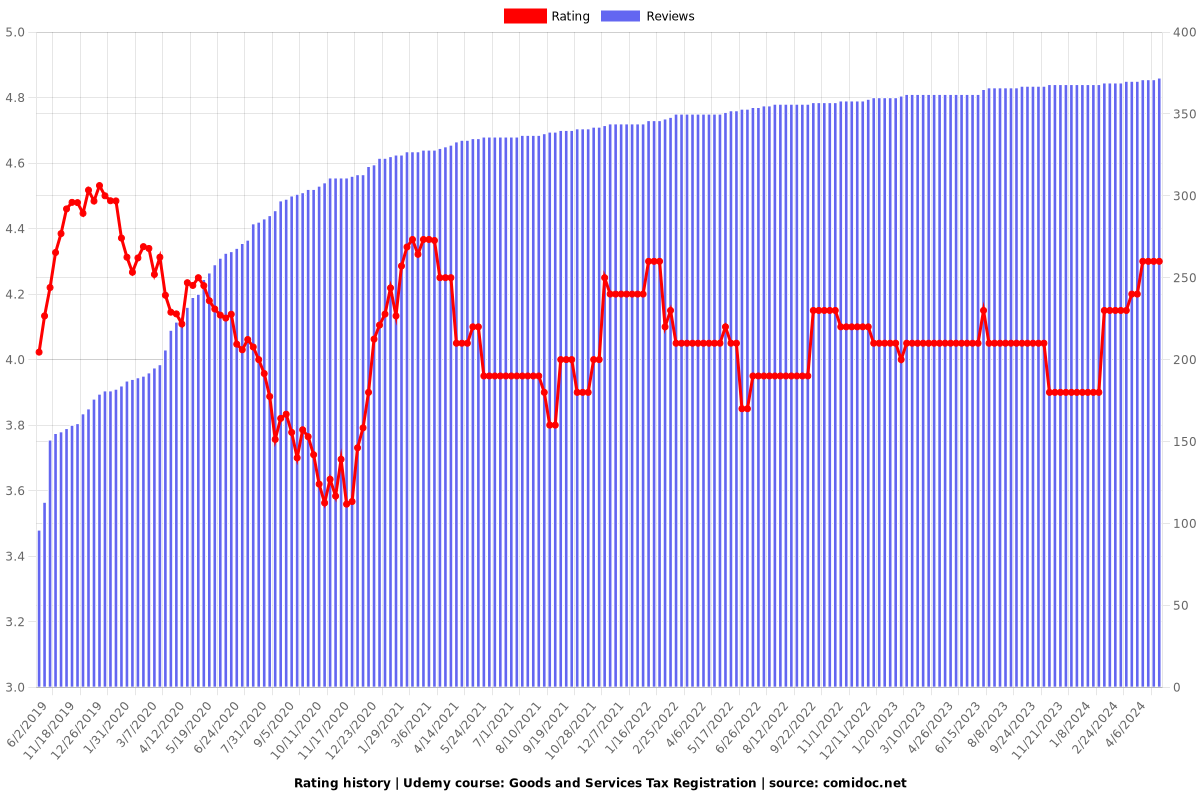

Rating

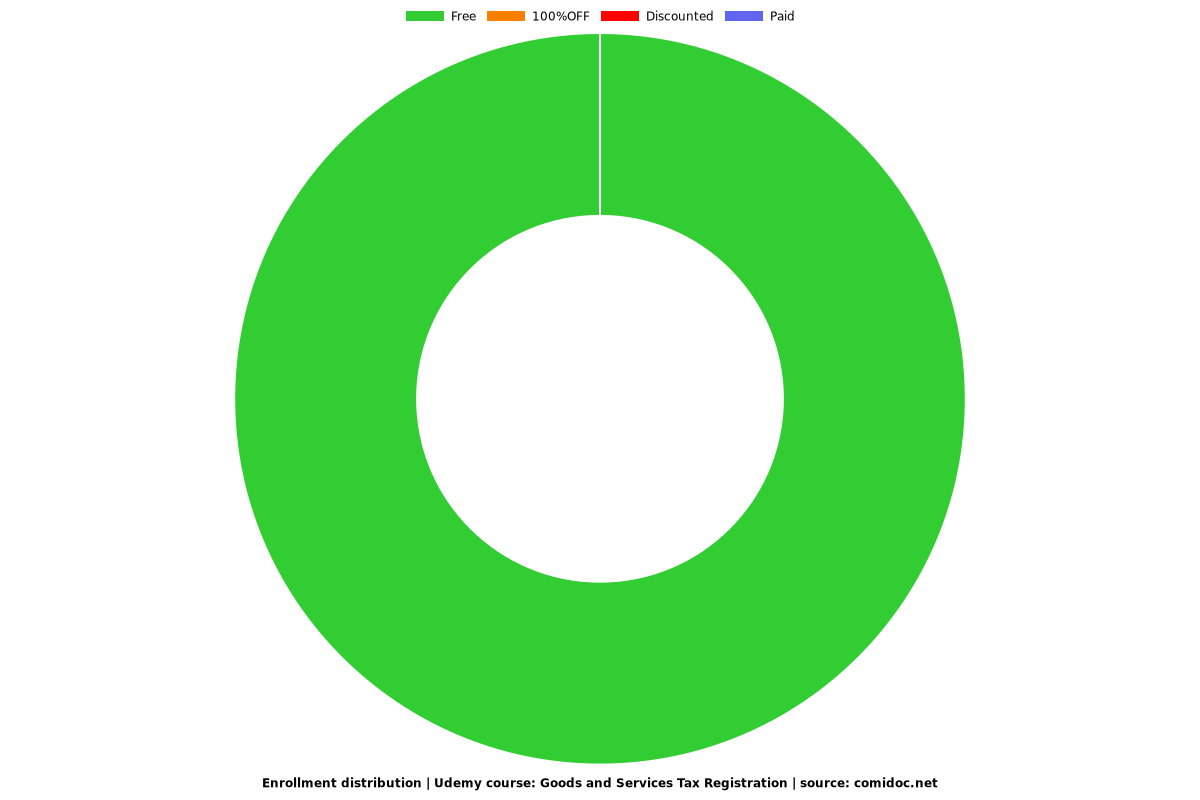

Enrollment distribution

Related Topics

1303548

udemy ID

7/25/2017

course created date

6/2/2019

course indexed date

Bot

course submited by