Hands-on Financial Modeling (With 6 Excel Templates)

Learn Financial Modeling in Excel from a professional research analyst.

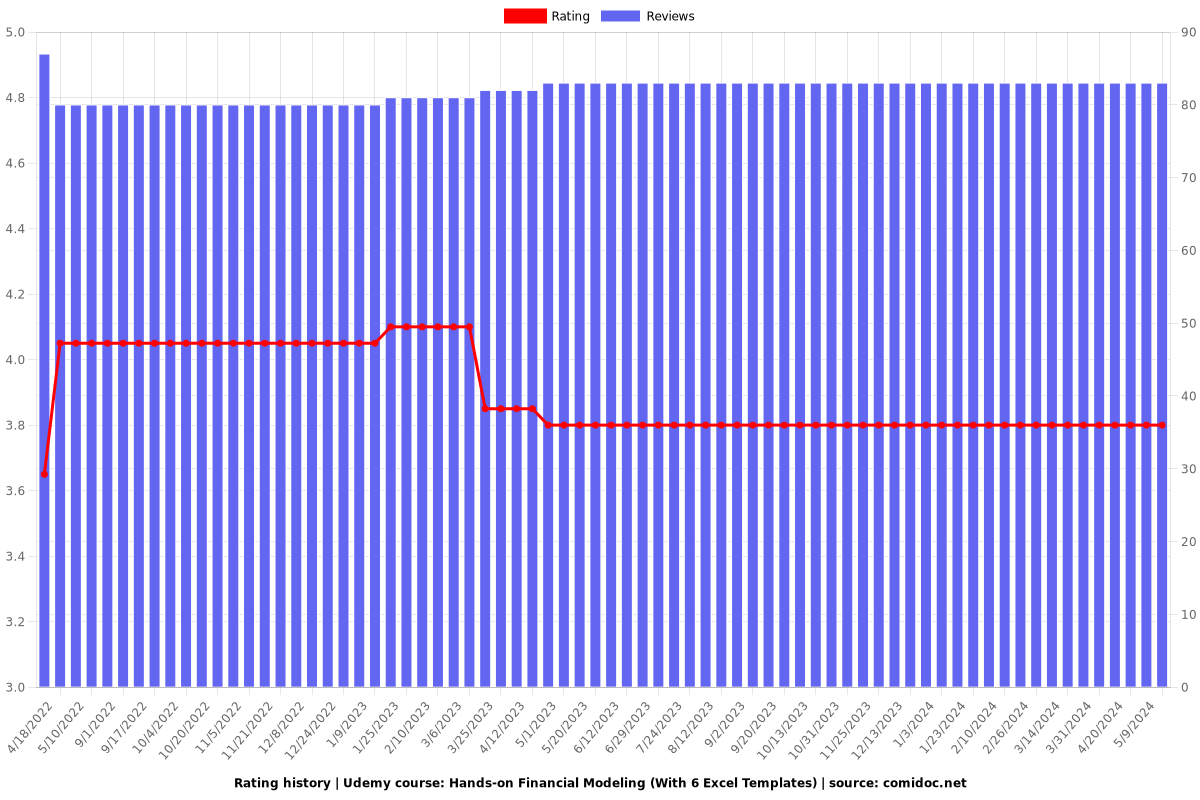

3.80 (83 reviews)

4,807

students

4 hours

content

Dec 2014

last update

$19.99

regular price

What you will learn

Learn how to built financial model in excel

See how financial model is being built in Excel in the real time by a professional research analyst.

Learn how to use DCF method.

Master multiples based analysis and sum of the parts valuation.

Get a guide on how to read financial accounts, what major changes in the key figures can mean and how to make assumptions when doing a forecast.

Do not allow anyone to fool you on the business valuations.

Why take this course?

- What is Financial Modeling?

- How to build a financial model in Excel?

- What is EBITDA?

- How to read the P&L?

- How to calculate WACC, ROIC, equity risk premium?

- How to use DCF?

- Every student will receive an Excel file with input data for Sample Company valuation, which will include both historical financial accounts and operating data for every business division (airline catering, events catering and RHL, or restaurants, lounges and hotel). The lecturer will first give detailed comments on the available historical information and will show you how to make assumptions for reconstruction of the missing data, required to start modelling of future financial items.

- Business modelling will start with forecasting of P&L items for each of the three divisions, which will then be combined into the Sample Company P&L. Afterwards the lecturer will model Cash Flow statement for the Sample and its Balance Sheet. All the forecasts are being built for the next 6 years.

- Once you get all financials forecasted you move to the most interesting part – DCF (or Discounted Cash Flows valuation) with deep plug into the calculations of WACC and its components (risk free rate, Beta and equity risk premium), Terminal Value and Discount Rate. You will learn how to apply logic to make the right assumptions as the ultimate result of every financial modelling is a matter of assumptions used.

- Special attention will be paid to the multiples-based analysis and sum of the part valuation.

- You will see how theory works in real business with every figure of Excel model created in front of your eyes. This is a unique experience not to be missed.

Screenshots

Reviews

Anita

April 21, 2022

I feel like I understand what I’ve learned. I really appreciate the additional exercises provided for further practice, for free within this course. The best quality of this course is that the classes aren't long and you can learn more efficiently.

Zhienalina

April 19, 2022

Некоторые темы я изучала впервые, поэтому приходилось пересматривать материалы несколько раз. Часть заданий я пока не сдала, но я в процессе их решения. Эксперты дают материал понятным языком, эмоционально и доступно.

Robert

November 28, 2018

Just took a similar course through Udemy. This one looks more like what I expected a course on financial modeling to be. will finish and keep you posted.

Lauria

September 30, 2018

I think the class is really good and ideal for beginners! It is basic (I don't mean easy), but it is useful indeed, differently of the majority of beginners classes that talks a lot and exercises almost nothing how the model is constructed and done in reality...

Michael

September 12, 2017

Interesting, but it goes fast and explications on calculus are thin. You'll have to do some digging and build the spreadsheet yourself to really understand what's going on in the modeling.

刘奉哲

July 31, 2017

Very detailed introduction in modeling and valuation. The attached Excel template is super considerate!

マスカワ

June 20, 2016

In this course, the instructor shows how to build DCF model from real data. It includes not only how to maneuver Excel, but also the philosophy behind it. She seems pretty professional. I recommend to those who needs not only to make DCF, but also to explain to others.

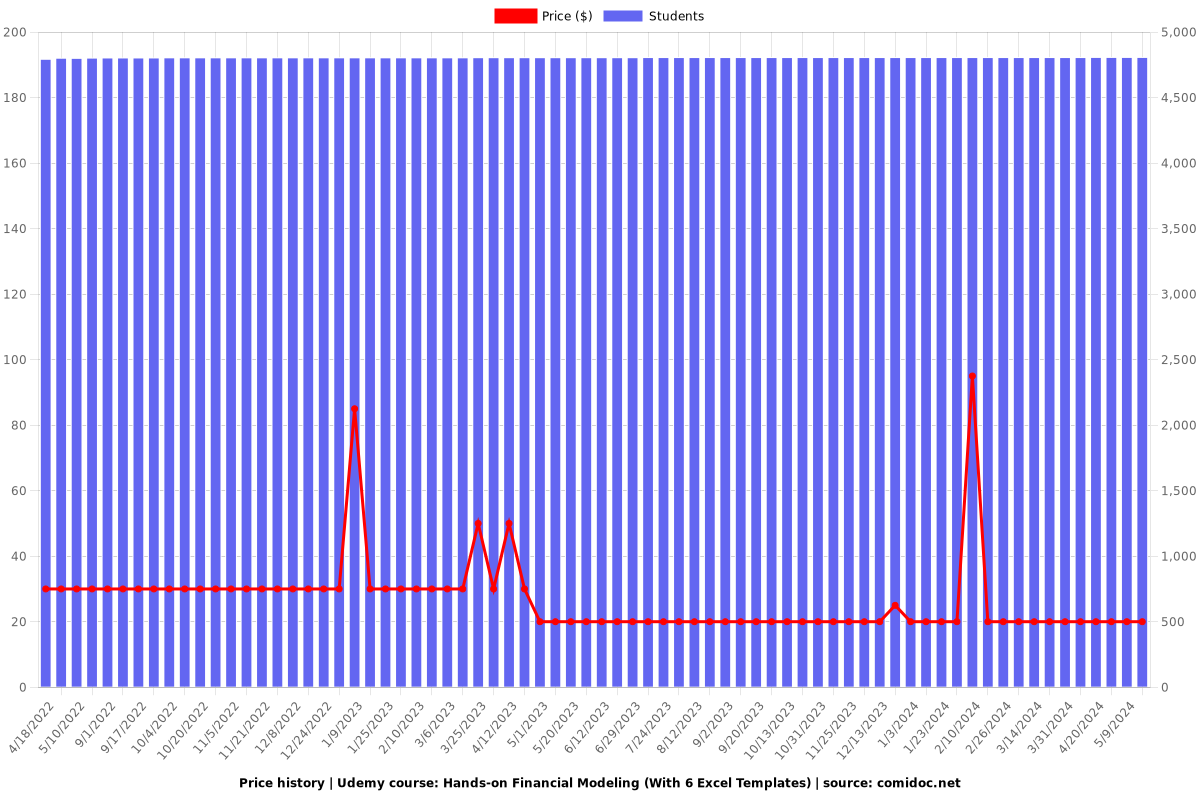

Charts

Price

Rating

Enrollment distribution

372234

udemy ID

12/17/2014

course created date

4/18/2022

course indexed date

Bot

course submited by