Financial Instrument - IFRS/Ind AS (IAS 32, IFRS 9, IFRS 7)

a. Recognition and derecognition accounting of Financial Assets, Financial Liabilities and Equity, b. Hedge accounting

What you will learn

Learn the latest IFRS standard IFRS 9 - Financial Instruments

Recognition and measurement of financial assets and liabilities

Learn different measurement methods such as amortised cost, fair value through profit and loss and fair value through other comprehensive income

Course includes several exercises / case studies to see how IFRS 9 applies to different situations.

Difference between hedging and hedge accounting

Classification of financial assets and liabilities

Financial Instruments used as hedging tools

Why take this course?

The course will cover the complete Financial Instruments - IFRS (IAS 32, IFRS 9, IFRS 7/Ind AS (Ind AS 32, Ind AS 109, Ind AS 107) - and is designed for both beginners and professionals. I have used several case studies, more than 100 practical questions, and the Annual Report to provide you with in-depth knowledge of Financial Instruments.

Also, I have resolved live queries of participants, which help you understand the concept properly, this course will help you clear DipIFRS exams.

Transaction in financial instruments is pervasive across many entities in India. Financial instruments include Financial Asset, Financial Liability, Equity Instruments, Compound Financial Instruments, etc. Under the IFRS/Ind AS framework, detailed guidance on recognition, derecognition, classification, measurement, presentation, and disclosure of Financial Asset, Financial Liability, and Equity Instrument is available in three IFRS/Ind AS

Topics to be covered:

a. Definition of Financial Asset, Financial Liability, and Equity

b. Recognition of Financial Asset, Financial Liability, and Equity

c. Derivatives and Embedded Derivatives

d. Derecognition of Financial Asset, Financial Liability, and Equity

e. Hedge Accounting

f. Annual Reports

An introduction to this chapter will note that classifications such as financial instruments, functional categories, maturity, currency, and type of interest rate are related to several different parts of the international accounts. It will also state the objectives of classification, namely to develop aggregates that (i) group similar items, and (ii) separate items with different characteristics and causes.

Screenshots

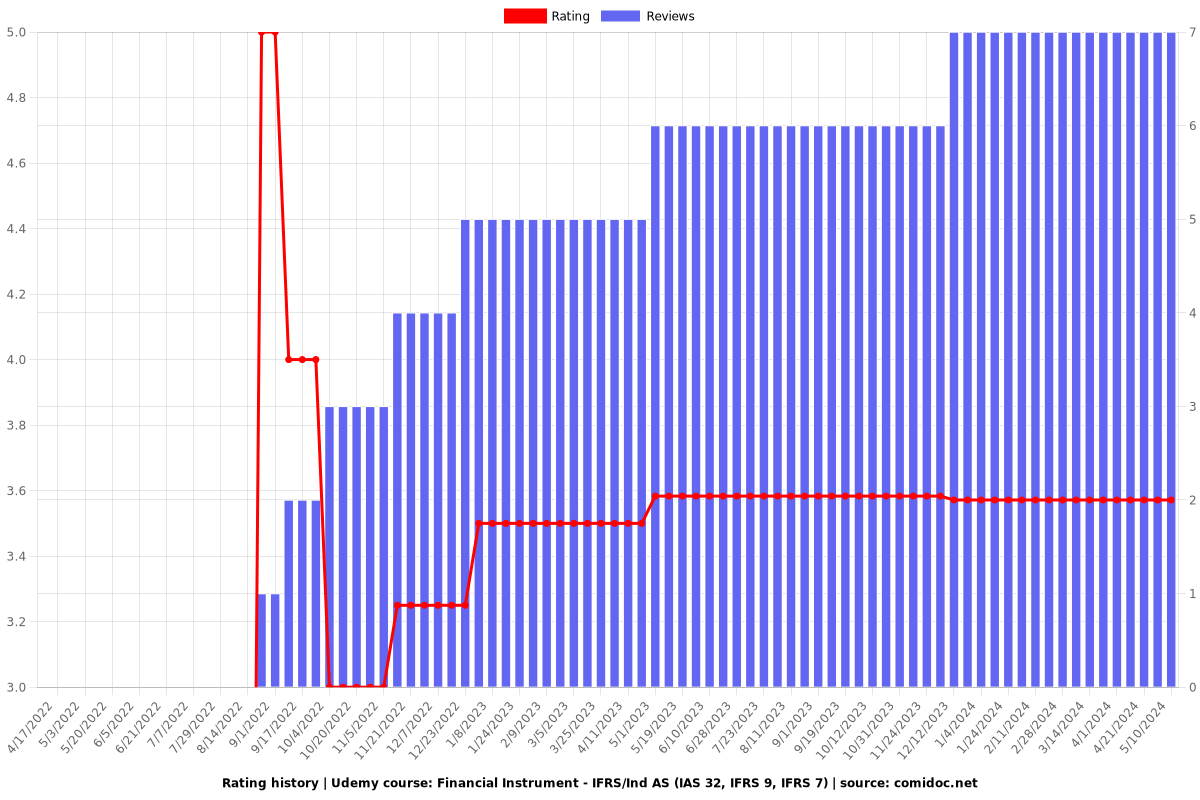

Reviews

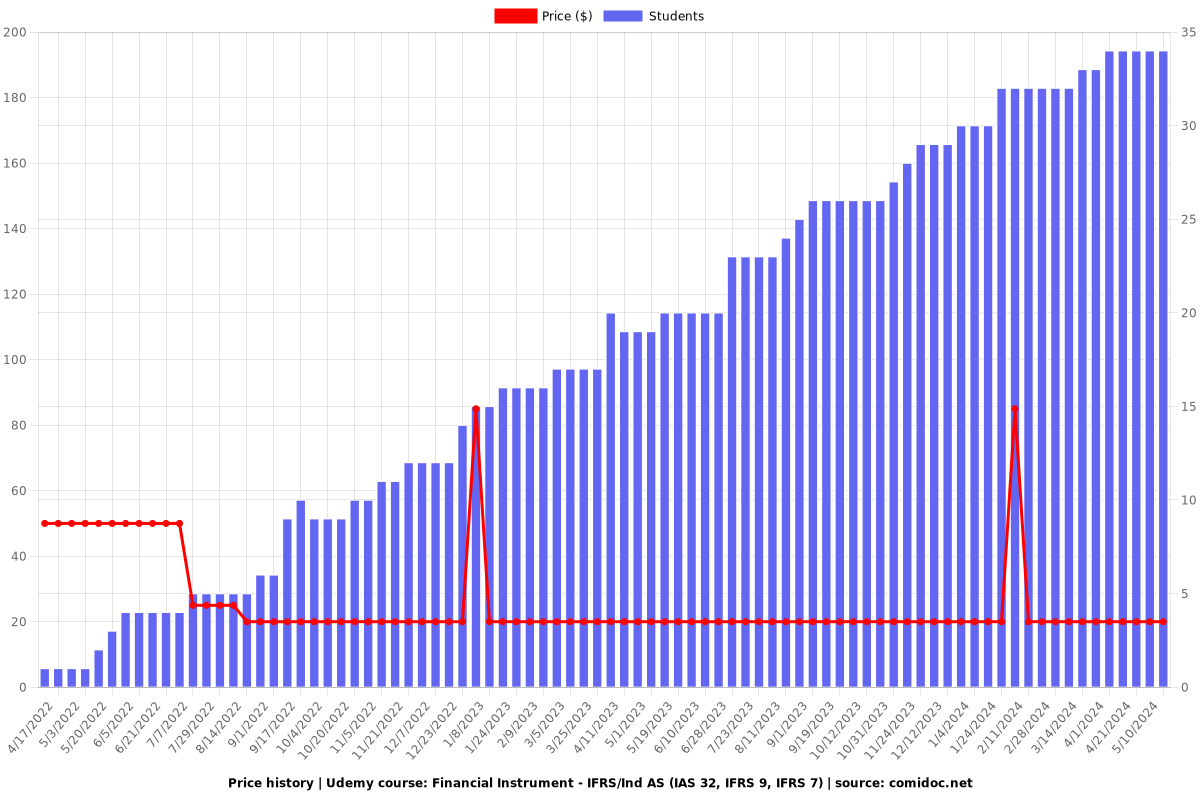

Charts

Price

Rating

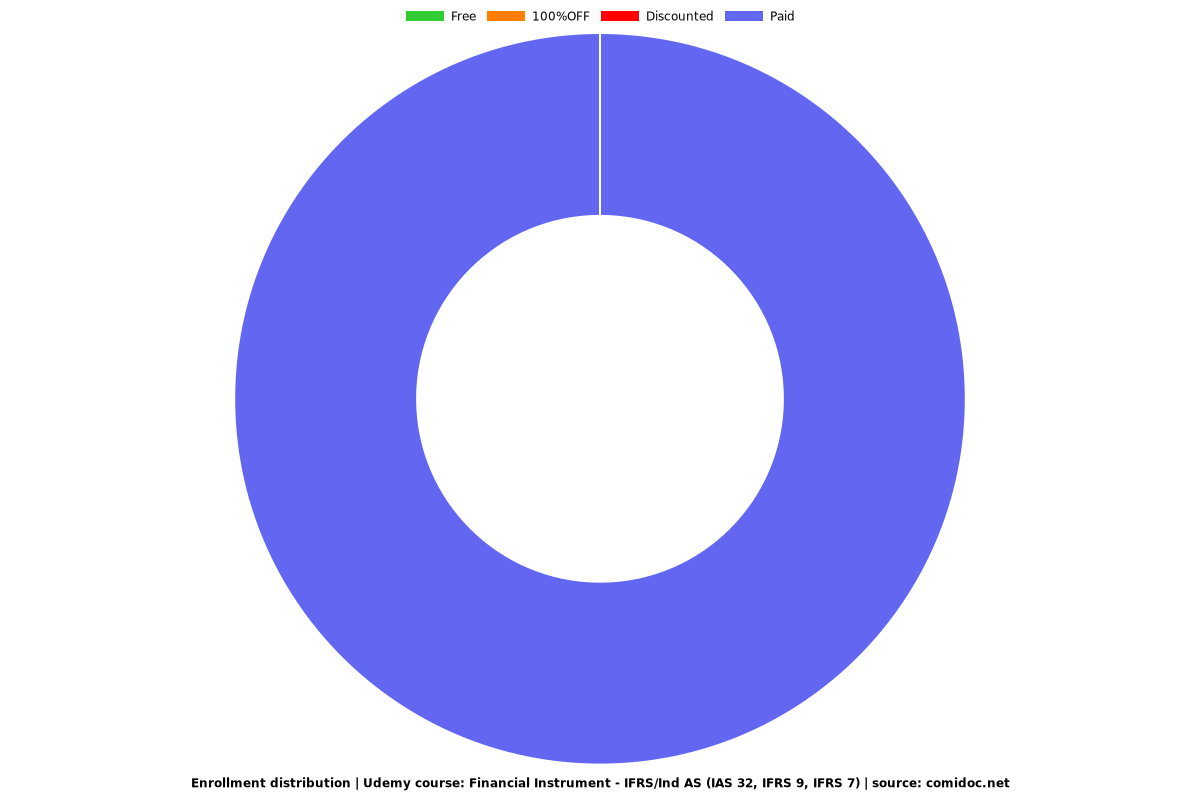

Enrollment distribution