Title

Financial Forecasting, Modeling, and Risk Management Course

Create your first financial forecasting model and learn the fundamentals of financial risk management with this bundle!

What you will learn

Come to understand the basics of financial modeling and forecasting

Know the purpose of financial forecasting

Build your first financial forecasting model

Learn how to build a sound financial model

Know the role of forecasting in strategic planning

Go through the three financial statements (balance sheet, income statement, and cash flow statement)

Learn how to define your forecasting objectives

Identify key variables and drivers

Analyze financial forecasts using ratio analysis

Learn about future trends in forecasting

Understand Financial Risk Management (FRM)

Distinguish between risk, uncertainty, and randomness

Distinguish between risk management and risk measurement

Understand the importance of risk governance

Describe risk budgeting and understand its role in risk governance

Realize the importance of managing people, processes, technology, and organizational structure for effective risk management

Recognize the difference between idiosyncratic and systematic risks

Define, classify, and distinguish between financial risks

Identify and understand the principles of credit, foreign exchange, interest rate, and operational risk

Distinguish between risk prevention and avoidance

Define and apply the concepts of self-insurance, risk shifting, and risk transfer

Realize insurance as a way to transfer risks

Recognize outsourcing and derivatives as two ways of shifting risk

Why take this course?

🌟 Financial Forecasting, Modeling, and Risk Management Bundle 🌟

Course Headline:

🔥 Create your first financial forecasting model and learn the fundamentals of financial risk management with this bundle! 🔥

About the Course:

Mastering the art of financial forecasting and understanding the nuances of financial risk management are essential skills for any financial professional. Whether you're an aspiring analyst, a seasoned CFO, or anyone in between, this two-course bundle is designed to equip you with the tools and knowledge necessary to make informed business decisions and manage financial risks effectively.

Course Breakdown:

Financial Forecasting Course 📈

- Understanding Financial Modeling in Excel: Begin your journey by grasping the basics of financial modeling and forecasting within the familiar environment of Microsoft Excel. You'll learn how to create a financial model from scratch, tailored to a fictional company. 🗝️

- Purpose and Objectives of Forecasting: Discover why financial forecasts are indispensable for strategic planning and how they can guide your decision-making process. 🤔

- Building Your First Financial Forecasting Model: Follow step-by-step instructions to construct a sound financial model, incorporating the three critical financial statements - balance sheet, income statement, and cash flow statement. 📊

- Forecasting Variables and Analysis: Learn how to identify key variables and drivers, analyze your forecasts using ratio analysis, and understand future trends in forecasting. 🔍

Financial Risk Management Course 🔐

- Risk vs. Uncertainty: Get to grips with the differences between risk, uncertainty, and randomness, and understand the importance of risk governance. 🌀

- Role of Risk Management: Dive into the role of risk management in financial decision-making and learn about risk budgeting within risk governance frameworks. 🛡️

- Understanding Financial Risks: Classify and distinguish between different types of financial risks, including credit, foreign exchange, interest rate, and operational risks. 🏦

- Risk Measurement Techniques: Recognize various risk measurement metrics such as probability, standard deviation, Value-at-Risk (VaR), and scenario analysis/stress testing. 📉

- Risk Transfer and Management Strategies: Explore how to transfer risks through insurance or outsourcing, and learn about the use of derivatives in risk management. 🧾

What's Included?

This comprehensive course bundle offers:

- Detailed Video Tutorials: Over 10+ hours of video content, broken down into 70+ individual video lectures, ensuring a clear and engaging learning experience. 📺

- Practical Exercise Files: Get hands-on with course and exercise files that allow you to practice what you've learned as you go. 🖥️

- Certificate of Completion: Earn a certificate to showcase your newfound expertise in financial forecasting and risk management. 🎉

Who is this course for? This course is designed for students with a basic knowledge of finance and accounting principles. Whether you're looking to enhance your career in finance, gain a competitive edge, or simply understand the financial side of business better, these courses will provide valuable insights into forecasting and managing financial risks. 🎓

Ready to take your first step towards becoming a financial forecasting and risk management expert? Enroll now and unlock a world of opportunities! 🚀

Reviews

Charts

Price

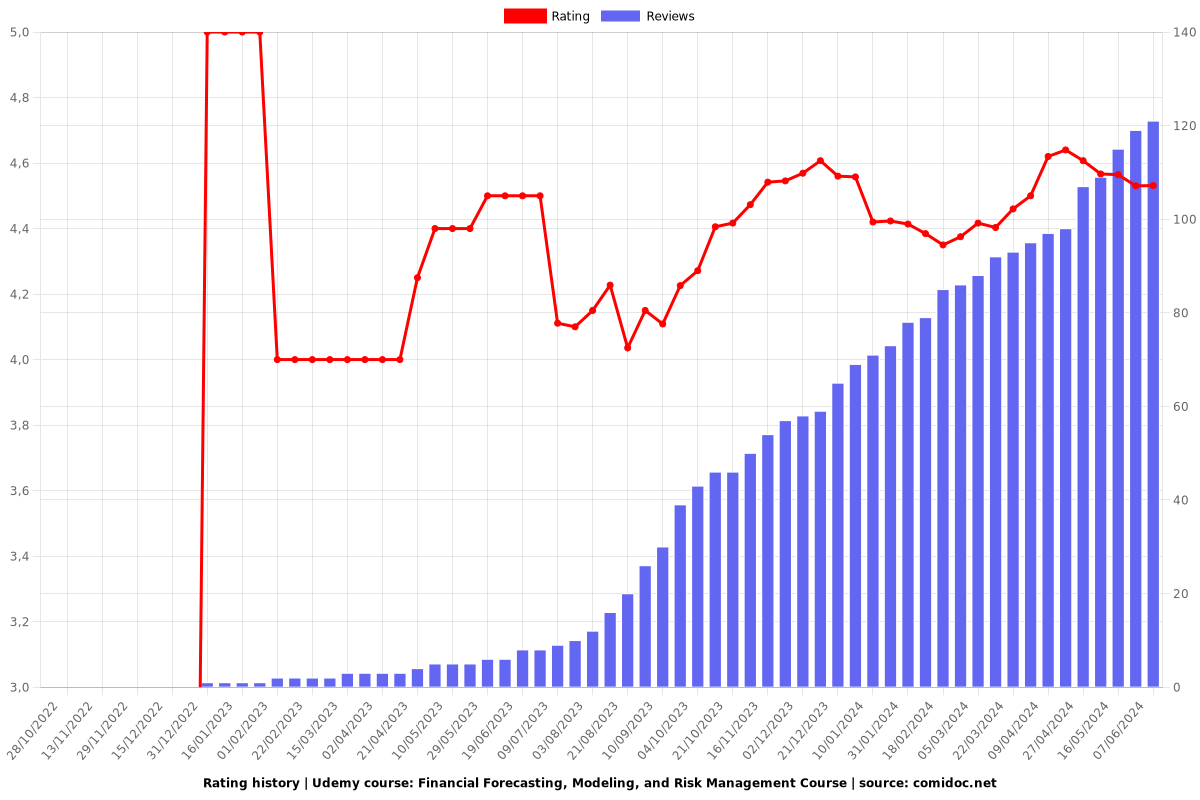

Rating

Enrollment distribution