Financial Derivatives Basics

The Course is structured to help students understand structure of Derivatives instruments

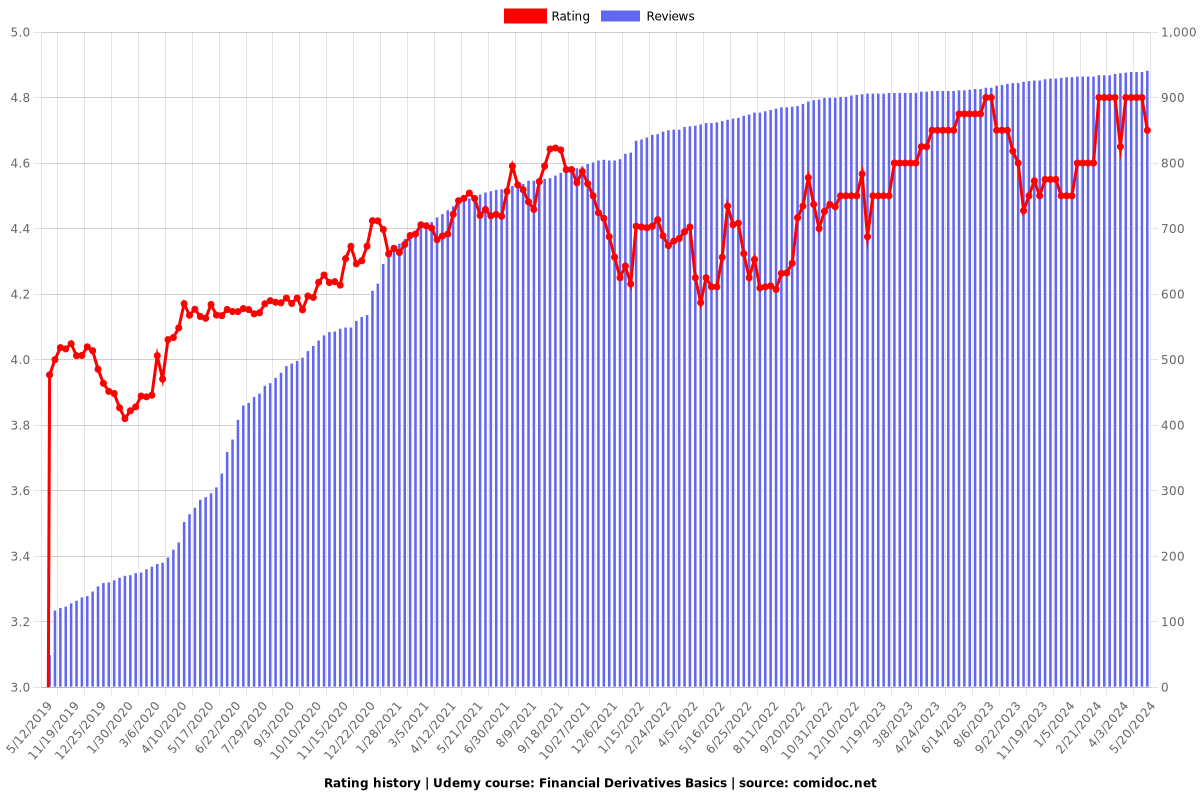

4.80 (940 reviews)

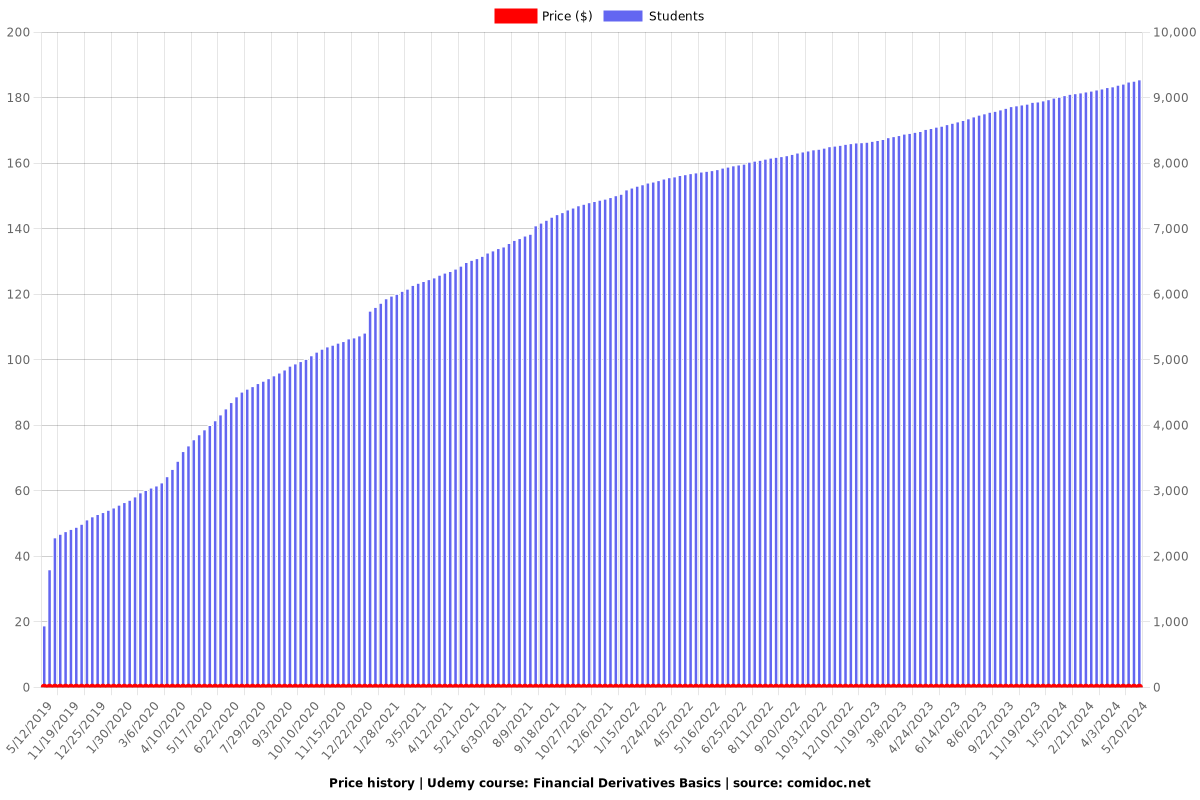

9,239

students

1 hour

content

May 2019

last update

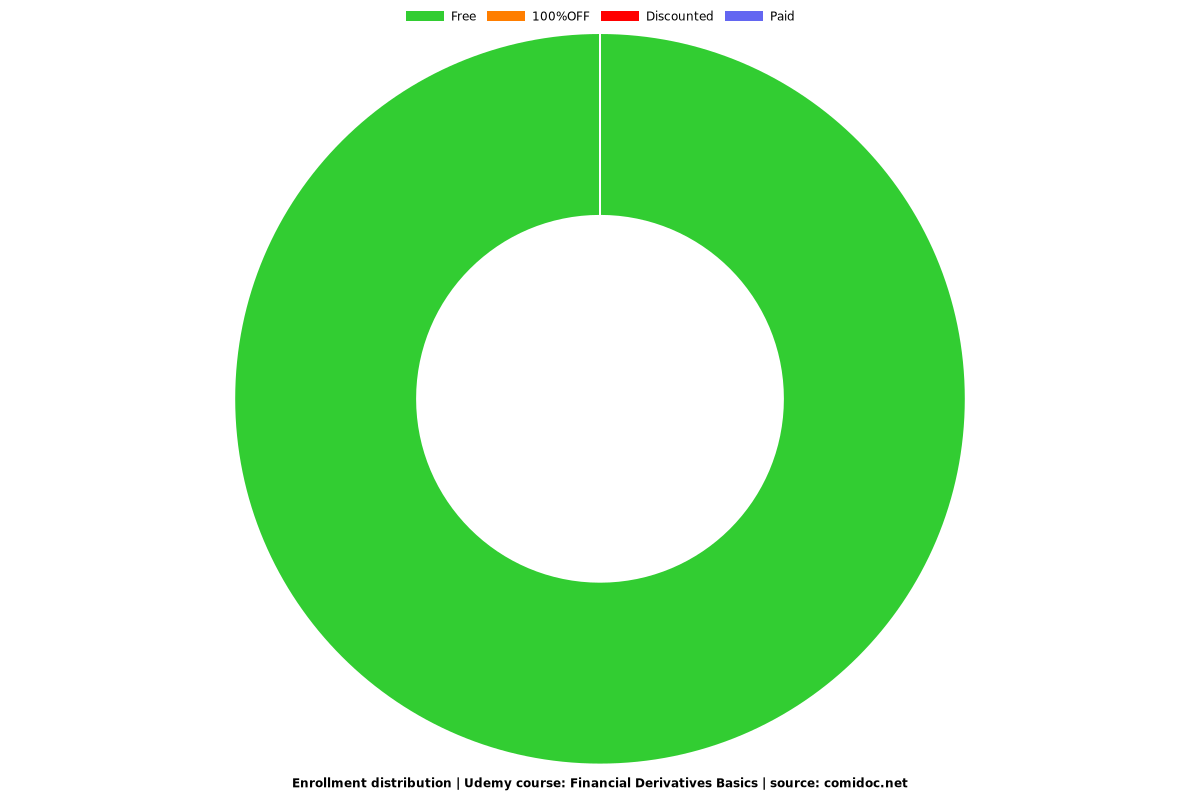

FREE

regular price

What you will learn

Derivative Markets and Instruments, forwards, futures, swap and options.

Why take this course?

🎓 **Course Title:** Financial Derivatives Basics 🚀

**Headline:** Unlock the World of Financial Derivatives with Ease! 🌟

## Course Description

### What you will learn? 🤔

- **Types of Derivative Instruments and Markets** 📈

- Understand the various categories of financial derivatives and the markets where they are traded.

- **Definitions and Terminologies** 📚

- Grip the essential terms and concepts that form the foundation of financial derivatives.

### Requirements 🏗️

- **None** 🎉

- This course is designed for beginners with no prior knowledge required!

### Description 📊

If you're a finance novice or simply looking to deepen your understanding of financial derivatives, this comprehensive course has got you covered from the ground up. With a focus on clear and accessible explanations, CFINACC Trusted Mentor in the Field of Finance & Accounting will guide you through the complexities of financial instruments with ease.

### Why you should take this course? What value it will add? 🤔

Financial derivatives can be one of the most daunting subjects within finance due to their complexity and abstract nature. Here's why this course stands out:

- **Strong Foundations in Finance** 📈

- Complementary lectures to ensure you have a solid grasp of finance fundamentals relevant to financial derivatives.

- **Clear Linkages Between Concepts** 🔗

- Each concept is broken down and explained in isolation before showing how it fits into the broader picture.

- **Real-Life Examples** 🌍

- Practical scenarios help you understand and remember complex financial instruments better.

- **Plain Language** 🗣️

- Complex concepts are made understandable through plain language and simple explanations.

### Course Structure 📖

This course is divided into three easy-to-follow sections:

1. **Introduction** 🚪

- Set the stage for your derivatives education.

2. **Forward & Futures** ➡️

- Dive deep into the world of forwards and futures contracts.

3. **CDS, Options and SWAPs** 🎫

- Explore credit default swaps, options, and swap agreements in detail.

### Watch the Videos in Order! ▶️

The videos are carefully sequenced to build upon each other. For the best learning experience, please follow the order provided.

### Who this course is for? 🎯

This course is perfect for:

1. **CFA Level 1 Candidates** 🏢

- A must-take for those embarking on their journey towards becoming Chartered Financial Analysts.

2. **University-Level Students** 🎓

- Ideal for students interested in studying financial derivatives at a higher academic level.

Whether you're preparing for an exam, expanding your professional knowledge, or simply curious about the intricacies of finance, this course will provide you with the tools and understanding needed to master financial derivatives. 🎓🚀

Enroll now and embark on a journey to financial expertise with CFINACC Trusted Mentor in the Field of Finance & Accounting! 🎉

Our review

---

**Overall Course Review**

The online course on Financial Derivatives has received an impressive global rating of 4.80, with all recent reviews contributing to its high score. The majority of reviewers found the content informative and the explanations clear, particularly appreciating how complex financial concepts were simplified for easier understanding.

**Pros:**

- **Informative Content:** Reviewers agreed that the course provided valuable knowledge about financial derivatives, which was both accessible and comprehensive.

- **Clear Explanations:** The lecturer was commended for their ability to explain difficult concepts in simple terms, making complex subject matter understandable.

- **Real-Life Examples:** Many found the inclusion of real-life scenarios within examples to be highly beneficial for grasping practical applications of the concepts taught.

- **Structured Presentation:** The course's structure was appreciated for its logical flow and the way it facilitated learning about different contract types and underlying assets.

- **Supportive Learning Materials:** A suggestion for a detailed map of all types of derivatives and underlying assets was seen as an opportunity to further aid learners, especially beginners.

**Cons:**

- **Audio Transcription Issues:** Several reviewers pointed out significant errors in the audio transcription, including grammatical and punctuation mistakes, which could be a barrier for learners not fully proficient in English.

- **Audio Quality Concerns:** The instructor's heavy accent, combined with poor audio quality in some cases, presented additional challenges to comprehension.

- **Supplementary Learning Required:** Some reviewers felt that the course lacked information and that they had to use additional resources to fully grasp the concepts taught.

- **Technical Distractions:** One reviewer was distracted by a smoke detector beeping during the lectures, suggesting it may have been a safety issue or an annoyance.

- **Room for Improvement in Presentation:** A few reviewers believed that while the explanation method was good, there was still room for improvement to make the learning experience even better.

**Additional Feedback:**

- **Content and Practical Application:** Reviewers expressed a desire for more advanced courses on related financial topics such as Mutual funds, hedge funds, equity, and bonds, indicating a demand for further education in this field.

- **Course Experience:** The overall course experience was positive, with many learners finding the course to be worth the investment, even if it were paid, due to its high educational value.

- **Instructor Appreciation:** There was gratitude expressed towards Udemy for offering the course for free, recognizing its significant value as an educational tool for beginners.

**Conclusion:**

The Financial Derivatives course has been generally well-received, with strong praise for its informative content and clear explanations. However, some technical issues with audio transcription and quality, along with a need for more advanced content, have been noted. Despite these concerns, the course remains a highly regarded educational resource for those new to financial derivatives or looking to deepen their understanding of the subject.

Charts

Price

Rating

Enrollment distribution

Related Topics

2353362

udemy ID

5/5/2019

course created date

5/12/2019

course indexed date

Bot

course submited by