Equity Investments: CFA Smart Tips To Pass Your Level 1 Exam

Learn Preferred Stock Valuation, Justified Price To Earnings, Gordon Growth Model, 3 & 5 Factor Du-Pont Analysis & Beta

What you will learn

Identify the key concepts and components of equity investments.

Understand the formulas used for calculating the value of preferred shares.

Apply the Gordon Growth Model to estimate the intrinsic value of a stock.

Analyze and interpret the justified/fundamental price to earnings ratio for equity valuation.

Calculate and explain the Sustainable Growth Rate (SGR) using the three-factor Du-Pont analysis.

Utilize the five-factor Du-Pont analysis to assess the financial performance of a company.

Connect the equity formulas to the Weighted Average Cost of Capital (WACC).

Calculate the Cost of Common Equity using various methods.

Demonstrate how the equity formulas are relevant to portfolio management.

Derive the Beta formula and explain its significance in equity analysis.

Evaluate the risk and return characteristics of equity investments using Beta.

Apply different valuation techniques to assess the attractiveness of equity investments.

Analyze and interpret financial statements to identify equity investment opportunities.

Demonstrate an understanding of the relationship between risk and expected return in equity investments.

Evaluate the impact of market conditions and industry trends on equity investments.

Assess the liquidity and solvency of a company using equity analysis techniques.

Apply critical thinking skills to make informed investment decisions based on equity analysis.

Develop a comprehensive understanding of the CFA program and its significance in the finance industry.

Demonstrate effective study strategies and time management techniques for CFA exam preparation.

Evaluate the true value and benefits of pursuing a CFA designation in relation to career advancement.

Apply mnemonic devices and storytelling techniques to enhance understanding and retention of CFA concepts.

Analyze the role of engineers in the CFA program and the complexity of accountancy in the financial industry.

Assess the importance of work-life balance and effective study routines for successfully passing the CFA exams.

Explain the three levels of the CFA program and the requirements for obtaining a CFA charter.

Demonstrate the ability to ask insightful questions during interviews and Q&A sessions related to the CFA exams and industry.

Apply effective communication skills to present CFA-related topics and insights to others.

Analyze and evaluate different career paths available to CFA charterholders in the finance industry.

Demonstrate an understanding of exam strategies and tips for maximizing performance in the CFA Level 1 exam.

Evaluate the credibility and relevance of industry webinars and Q&A sessions for CFA exam preparation.

Create a personalized study plan tailored to individual strengths and weaknesses for the CFA Level 1 exam.

Why take this course?

Are you ready to conquer the CFA Level 1 exam and unlock new opportunities in the world of finance? Join me, Jhan Burger, a seasoned expert with over 20 years of experience in the business industry, as we embark on a transformative journey through the intricacies of Equity Investments. This comprehensive online course is designed to provide you with the smartest tips and strategies to not only pass your exam but excel in your CFA journey.

In today's competitive landscape, having a strong foundation in Equity Investments is essential for any aspiring finance professional. But let's face it, the CFA curriculum can be overwhelming, and self-study often falls short. That's where this course shines. It goes beyond traditional study materials and offers you a dynamic learning experience that is both engaging and effective.

Throughout the course, I will take you by the hand and guide you through the complexities of Equity Investments, breaking down key concepts into digestible pieces. We will start with a solid introduction to Equity Investments, ensuring you grasp the fundamentals before diving deeper. You will learn how to derive essential formulas, such as the Preferred Share (perpetuity) and Gordon Growth Model, Justified/Fundamental Price to Earnings Ratio, Sustainable Growth Rate (SGR), and the Three-Factor and five-factor Du-Pont Analysis.

But we won't stop there. We will continue building the Equity formula flow, connecting it to the Weighted Average Cost of Capital (WACC), Cost of Common Equity, and Portfolio Management content. You will gain a comprehensive understanding of beta formulas and their derivation, equipping you with the tools to navigate the world of Equity Investments with confidence.

But what sets this course apart from others? It's my unwavering commitment to your success. I understand the challenges you face as a CFA candidate, and that's why I bring my unique teaching style to the table. No boring Powerpoint slides here! Instead, I'll captivate you with engaging stories, mnemonics, tips, and tricks that make the learning experience enjoyable and memorable.

As you progress through the course, you'll have the opportunity to dive even deeper into the CFA world with additional resources. In an exclusive interview, I will share insights into the CFA exams, the industry, and provide valuable advice for your career. You'll gain a broader perspective on the true cost of pursuing the CFA designation, how it fits into your post-graduation plans, and the exciting possibilities it opens in the world of finance.

But it doesn't end there. To further support your learning, you'll receive a full workbook containing one-page worksheets for each lesson. These valuable resources will enhance your understanding, allowing you to reinforce key concepts and track your progress along the way.

Enroll now in "Equity Investments: CFA Smart Tips To Pass Your Exam Level 1" and empower yourself with the knowledge and skills needed to ace the CFA Level 1 exam. Whether you're a finance enthusiast, a recent graduate, or a professional looking to advance your career, this course is tailored to meet your needs. Join our community of motivated learners and let's embark on this transformative journey together. Your success starts here!

Screenshots

Charts

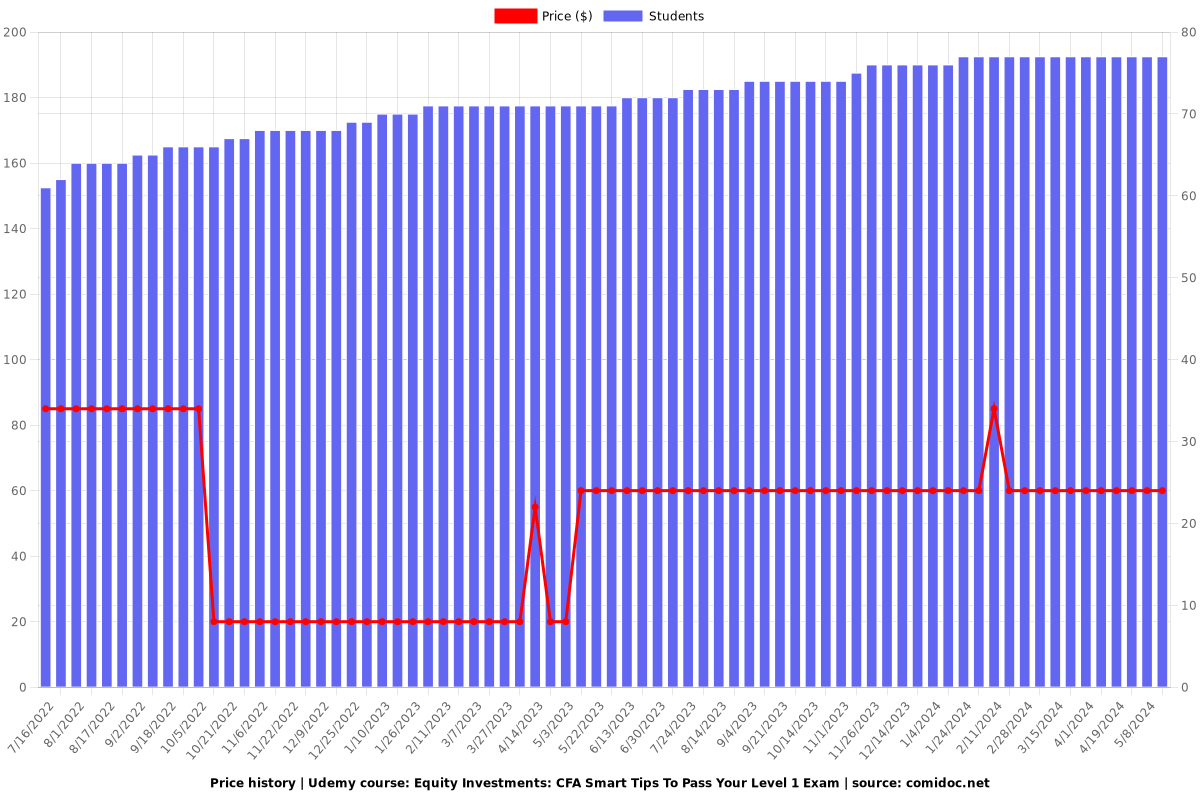

Price

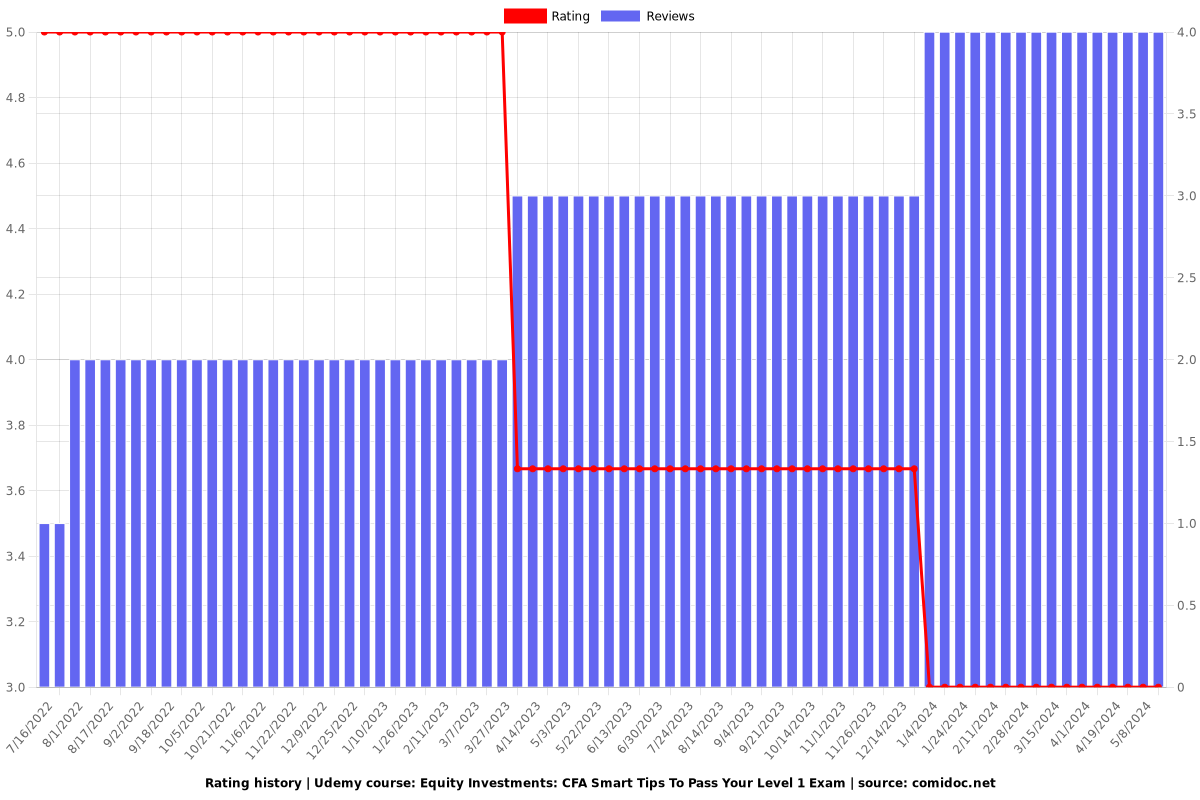

Rating

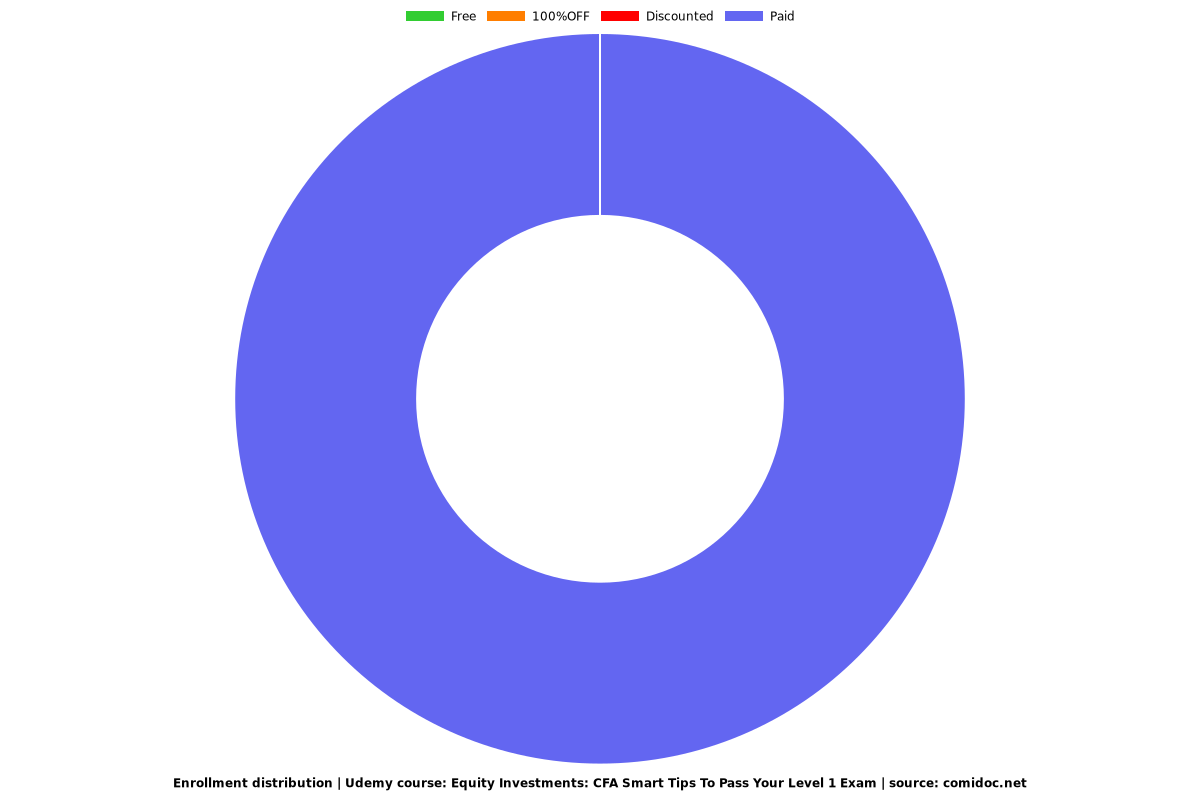

Enrollment distribution