Engineering Your Tax-Free Retirement

Strategize and implement a tax-free retirement plan.

What you will learn

How to chart your roadmap to a tax-free retirement

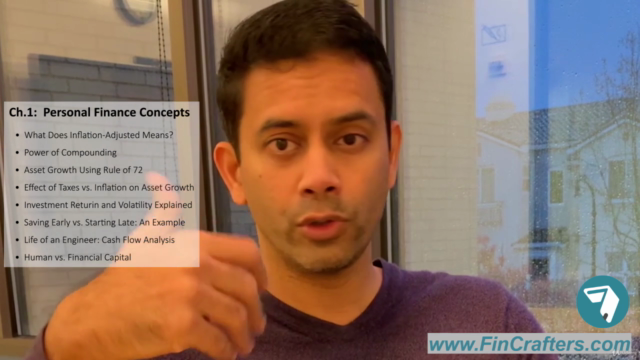

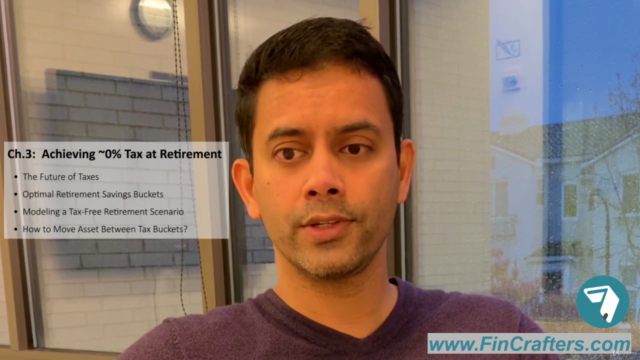

Topics covered include personal finance concepts, framework for achieving ~0% tax rate, and investment options

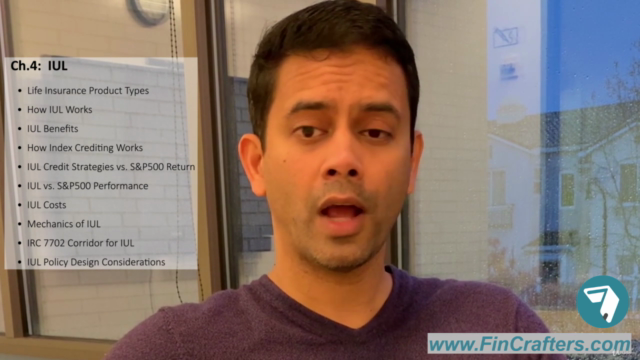

Deep dive into IUL, Annuity and LTC investments

McKinsey-grade presentation material, available for download

Retirement planning calculator, available for download

Fact-based learning and insights derived from quantitative approaches

Why take this course?

Investment return/risk and tax efficiency, though not correlated factors, both affect the growth of investment assets and income. In investment planning, investment return/risk usually receives all the attention, but, in reality, when strategizing and planning for long-term asset growth, both factors are equally important. Even in today’s historically low-tax environment, a single person (who is a CA resident and pulling at least 160K in retirement income) will pay 40 cents on the dollar in marginal tax rate when withdrawing from their 401k or traditional IRA account during retirement.

But did you know that you can optimize your tax rate in retirement to nearly zero?

In this course, we will establish a foundation for the goal of achieving optimal tax efficiency during retirement, and then we will take an in-depth look at investment options that work best in achieving this goal. In particular, we will look at investment options that mimic market growth, protect principal, scale performance to the risk incurred, and that provide a lifelong pension while also growing in value, and from which distributions may be taken tax-free.

We will learn how inflation, taxes, compounded growth, and volatility each affects investment income and growth. We then look at a macroeconomic view at Social Security and Medicare. Based on our understanding of all these factors, we will develop a framework for how to optimally allocate your savings into various tax buckets. And we will again review investment options designed to generate tax-free stable income streams during retirement. As a practical exercise, using an engineer as a sample working professional, we will go through the investment profile of a work and retirement life, as it responds to various changes in income and expenses.

Screenshots

Reviews

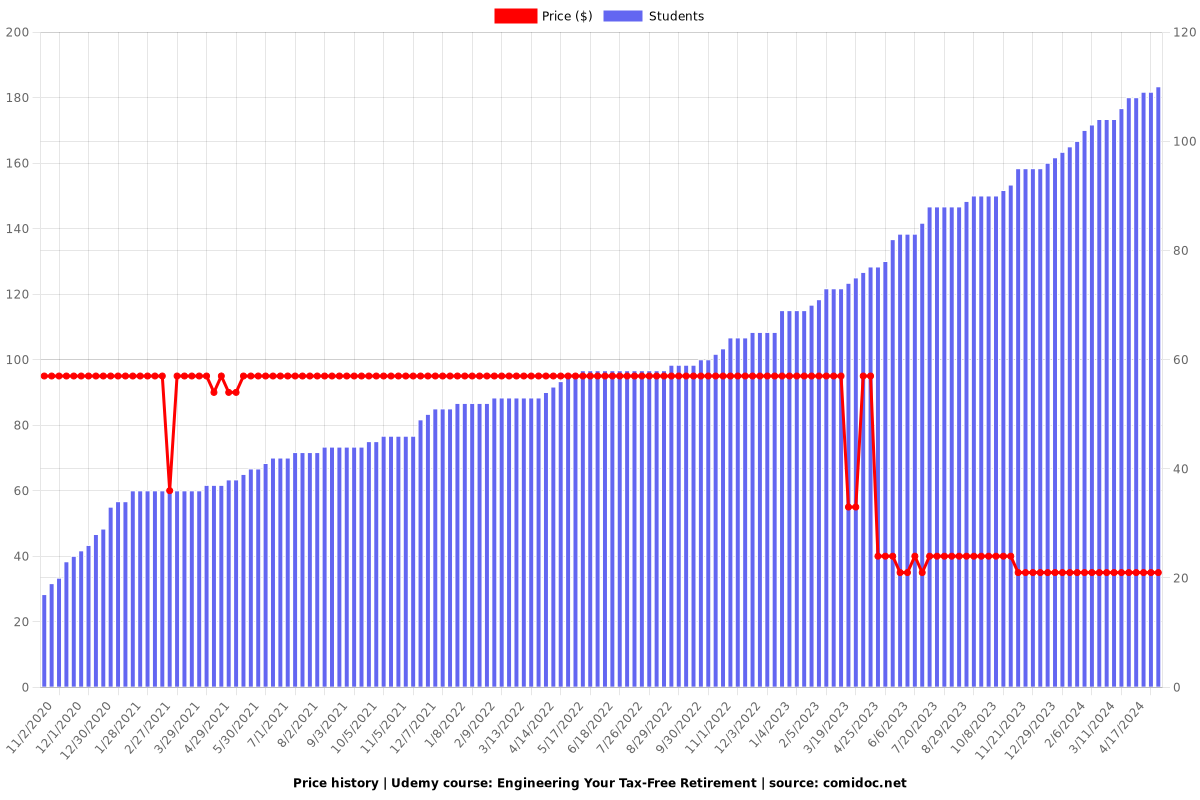

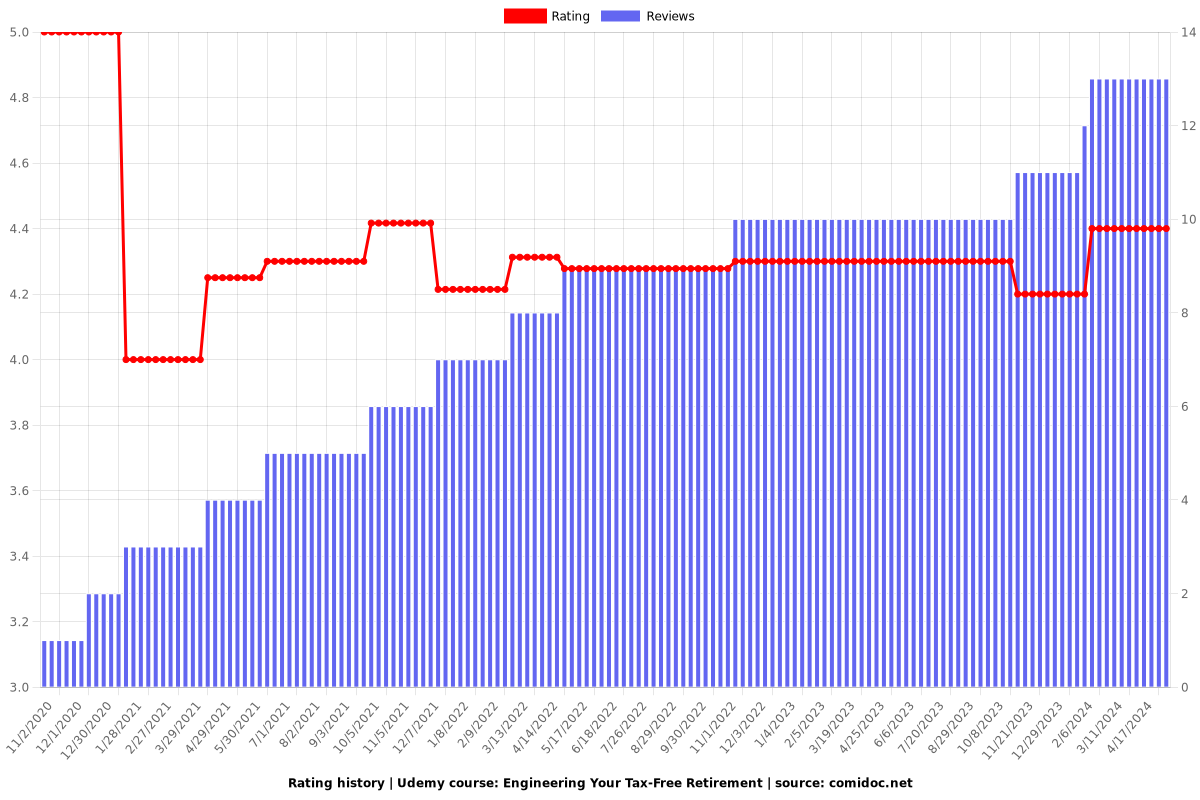

Charts

Price

Rating

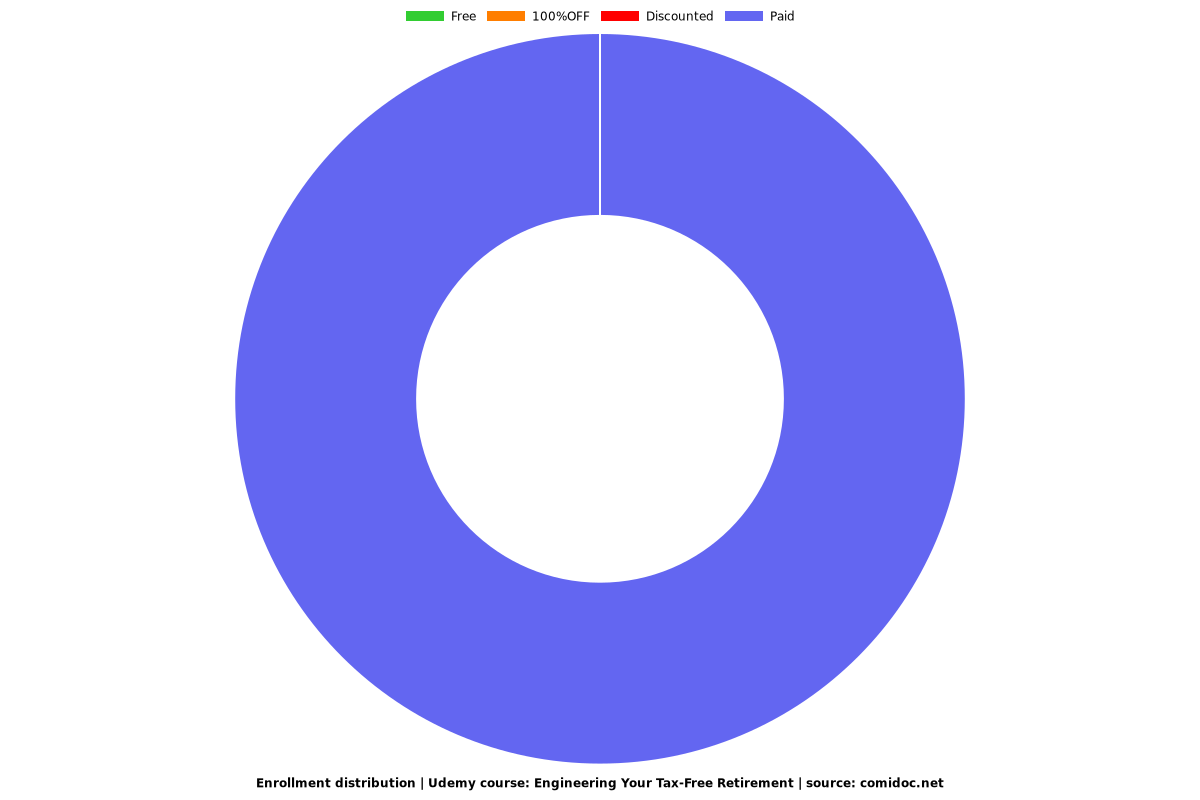

Enrollment distribution