Engaging SARS - SARS Requests and Turnaround Times

Basic concepts and ideas to help you get started with the SARS objection process.

What you will learn

Compiling and submitting your ITR12 or ITR14

Types of Communications that SARS can issue?

Effective communication with SARS: how much time do you have?

Engaging SARS –what does the (TAA) Tax Administration Act say?

SARS delaying refunds to taxpayers, what can you do?

SARS issued a letter of demand/verification –what happens if you do nothing?

SARS issued an additional assessment – what do you do now?

Objections 101 – getting started – the basics you need to know.

South African Tax

Why take this course?

****Please note that this course is based on South African Tax****

There are ways to reduce frustration, save time and costs when engaging with SARS. With tax filing season in full swing, many taxpayers are dealing with the reality of challenging a SARS assessment. However, the Office of the Tax Ombud recently found that roughly 94 percent of certain assessments raised by SARS over the period investigated lacked merit. This means that taxpayers should not have had to pay or otherwise deal with the consequences of an additional assessment.

This course incorporates basic concepts and ideas to help you get started with the objection process and will help you understand your rights when dealing with SARS, give you valuable insight into what SARS is looking for and how to structure a “notice of objection” to give you the best chance of success for yourself and your clients.

Topics Discussed:

Compiling and submitting your ITR12 or ITR14

Compiling your information

Types of Communications that SARS can issue?

Audit

Review

Effective communication with SARS: how much time do you have?

Turnaround times as per the TAA

Engaging SARS –what does the (TAA) Tax Administration Act say?

Applicable sections in the TAA to help you compile your objection.

SARS delaying refunds to taxpayers, what can you do?

SARS issued a letter of demand/verification –what happens if you do nothing?

SARS issued an additional assessment – what do you do now?

Objections 101 – getting started – the basics you need to know.

High level view

Drafting the letter to SARS

Suspension of Debt

Building your case

All Included:

Video presented course

Downloadable course material

Certificate of training

SAIT Accredited - 4 verifiable CPD points

--------------------------------------------------------------------

About the Presenter:

Daniel van Tonder

Daniel van Tonder is the Head of Taxation at FinSolve Accounting and Taxation – situated in Durbanville Cape Town.

He completed his B- Compt degree in Financial Accounting while still busy with his articles at Diemont, Zimmerman & Bolink Auditors in Polokwane.

After his articles he entered the private sector to gain valuable experience as a Group Finance Manager and Group Internal Tax Practitioner.

He is currently busy with his post graduate diploma in taxation through Unisa.

Daniel is a registered tax practitioner and a proud member of the South African Institute of Taxation.

Reviews

Charts

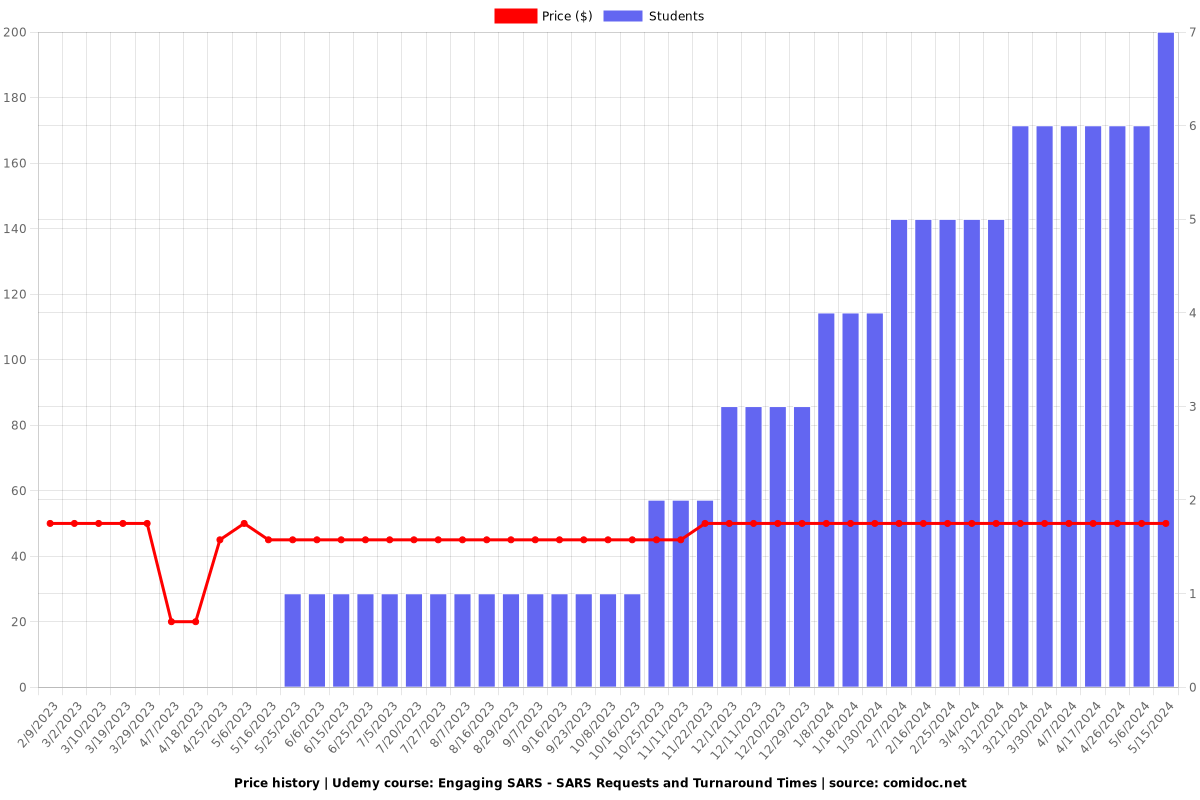

Price

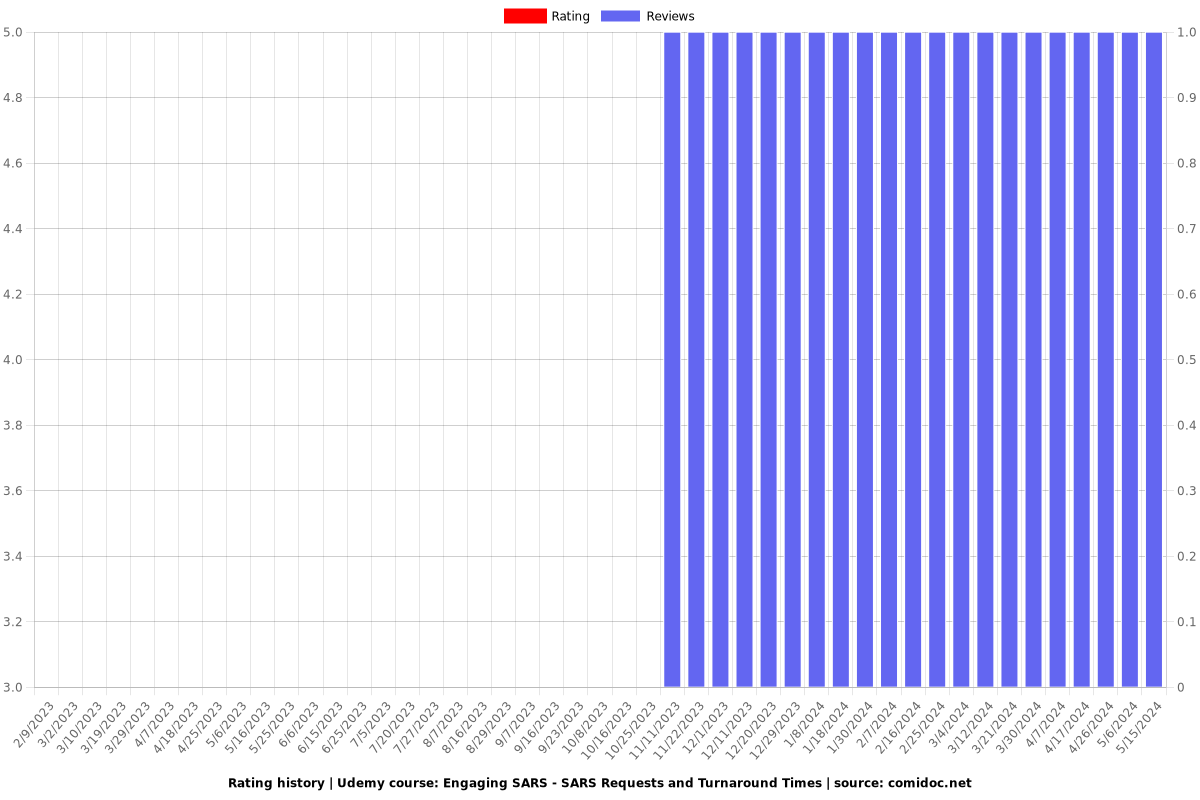

Rating

Enrollment distribution