How Seed VCs Think About Deep Tech Startups | Sramana Mitra

Case Studies of Deep Tech Seed Investors (Angels and Venture Capitalists) on Venture Capital Fund Raising

What you will learn

Through in-depth interviews with prominent investors, gain insights on how investors analyze deep tech startups.

When Venture Capitalists are likely to fund deep tech startups.

What investor-entrepreneur fit is and how to achieve it.

Why 99% of entrepreneurs who seek funding get rejected by VCs.

What some of the key considerations are for investors when they evaluate startups.

How entrepreneurs can position themselves for success.

What are some of the common mistakes that entrepreneurs make when pitching their startups to VCs.

The fastest way to find the relevant sources of funding while building deep tech startups.

Why take this course?

Raising money is a low probability game. You need to understand how investors think to be able to raise money successfully for your startup.

During this course, I will be teaching how seed investors think about and analyze deep tech startups. We will have in-depth conversations around startups with several real world investors.

Designed for tech entrepreneurs and aspiring entrepreneurs interested in building deep tech startups, this course provides insights into the minds of several seed investors operating in this space for many years in their own words.

As you may have already learned in my courses, the early stage investment ecosystem has fragmented, it’s no longer just seed and Series A. The seed part has fragmented to friends and family financing, pre-seed, seed, post-seed, small Series A, and large Series A.

In this course, we will do a deep dive into the seed stage of deep tech startups

If you want introductions to Angels and VCs, a fundable and validated business is a must.

A fundable business with warm introductions is the fastest way to get funded. We can introduce you to angels and VCs, if your idea is fundable and validated. Sadly, less than 1% of businesses are fundable. What that means is more than 99% of the entrepreneurs waste their energy on pitching their unfundable businesses to investors. Hugely unproductive and unhealthy.

There is a reason why savvy entrepreneurs have been using the Bootstrap First, Raise Money Later strategy.

However, deep tech is often an expensive startup category to build. How do you do it? How do investors consider funding concept-stage deep tech?

This course is designed to help deep tech entrepreneurs understand the thought process of seed investors.

The 1Mby1M courses are all heavily based on interview-based case studies on Innovation, Business Models, Go To Market Strategies, Validation Principles, and various other nuances of an entrepreneur's journey. We offer extensive opportunities for entrepreneurs to learn the lessons from the trenches from successful entrepreneurs who have done it before and Investors who support their ambition.

Screenshots

Reviews

Charts

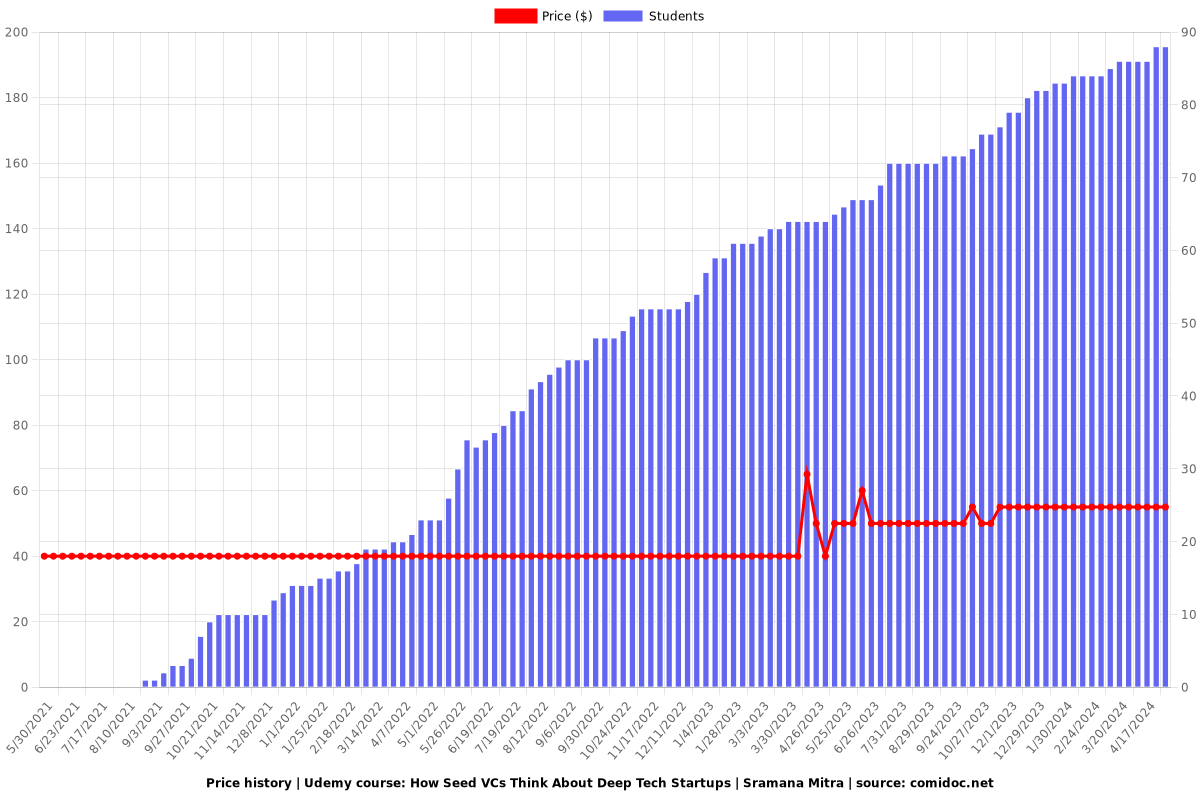

Price

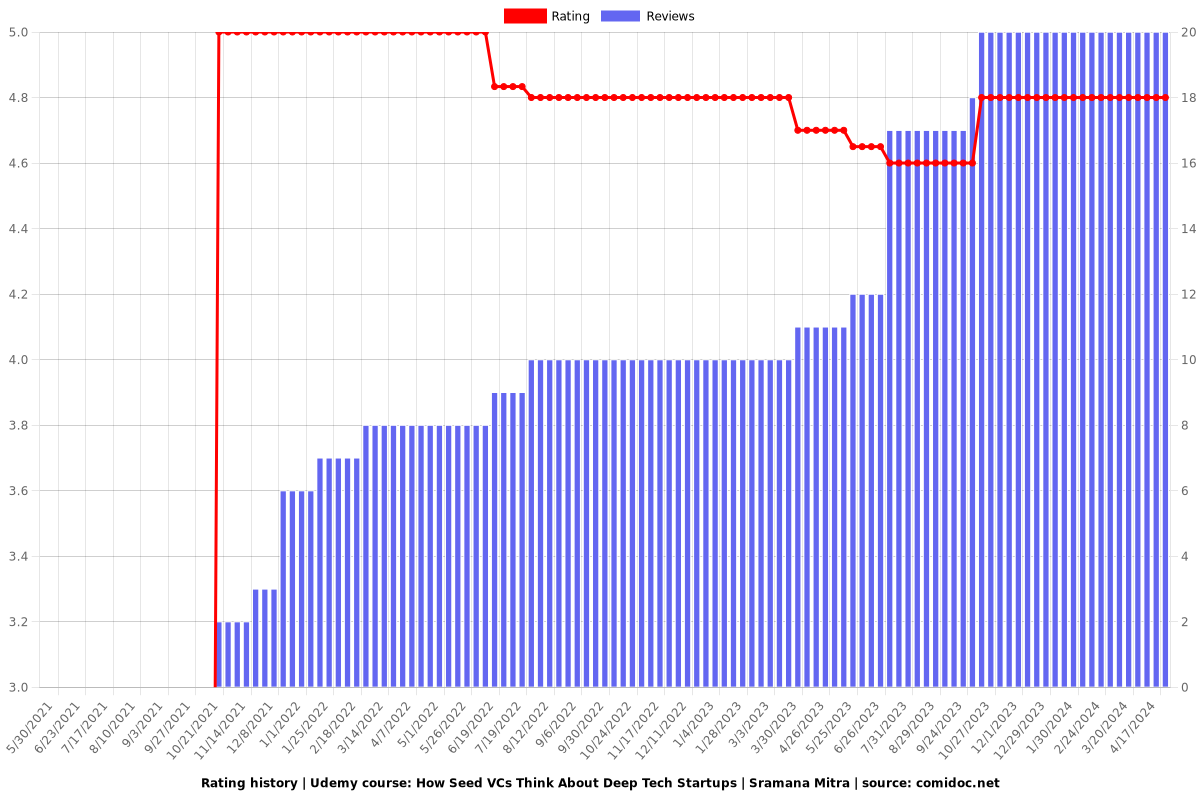

Rating

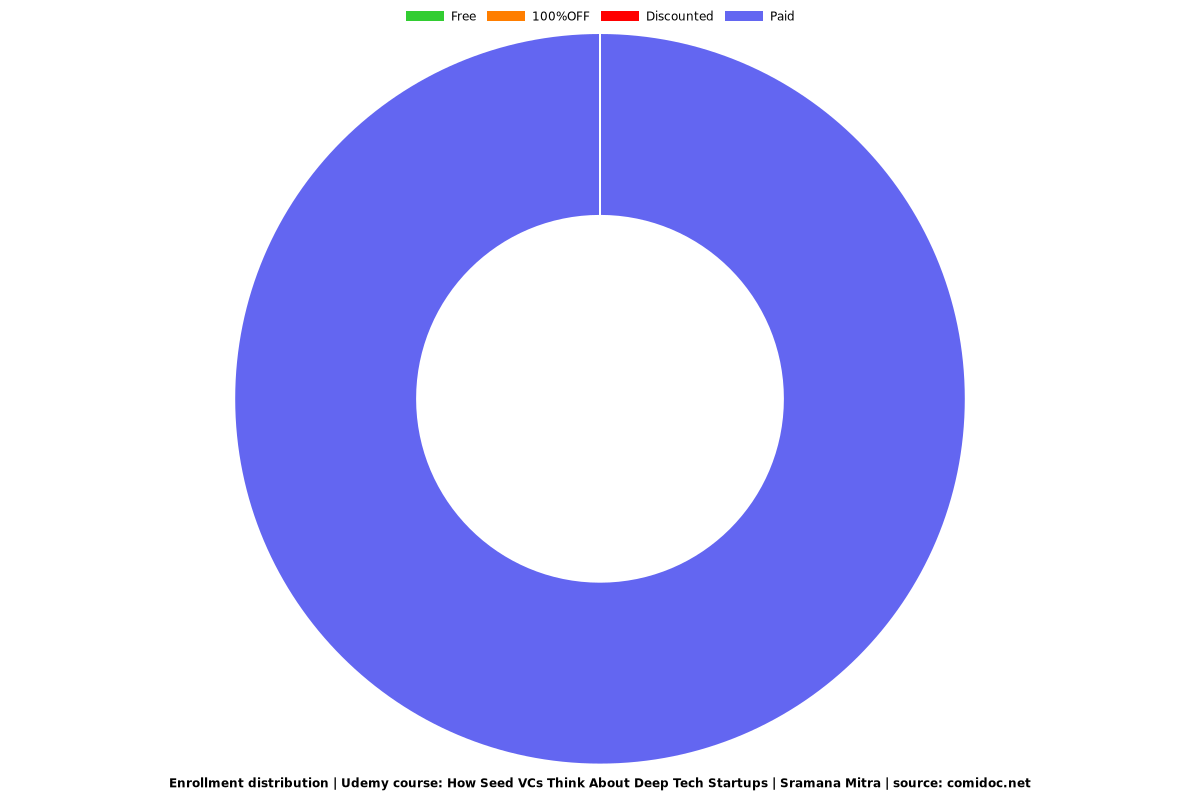

Enrollment distribution