Corporate Finance Management - From Beginner to Advanced

Types of Financing, Ratio Analysis, Time Value of Money, Cost of Capital, Capital Structure, Leverage, Capital Budgeting

What you will learn

Understand Meaning and Concepts of Finance Management

Identify and understand different Sources of Finance and Types

Types of Long Term and Medium Term finance

Types of Equity Share Capital and Preference share capital

What is Debentures/ Bonds ? Types of Debentures and Bonds

Venture Capital Financing

Asset Securitisation

Lease Financing - Explanation of concept and types of lease

Depository Receipts - ADR (American Depository Receipts), GDR (Global Depository Receipts) , IDR (Indian Depository Receipts))

Trade Credit

Accrued Expenses

Deferred Income and advance from customers

Short Term Bank advances and its types

Bridge Financing

Commercial Paper

Treasury bills and Certificate of Deposits

Different Types of Financial Ratios - Calculation and Analysis along with illustrations

Types of Liquidity Ratios / Short Term solvency Ratios - Calculation and analysis along with illustrations

Current Ratios

Quick Ratio / Acid Test Ratio

Cash Ratio / Absolute Liquidity Ratio

Interval Measure Ratio

Types of Leverage Ratios / Long Term solvency ratios - Calculation and analysis along with illustrations

Equity Ratios

Debt Ratio

Debt To Equity Ratios

Debt To Total Assets ratios

Proprietary Ratio

Capital Gearing Ratio

Debt Service Coverage Ratio

Dividend Coverage Ratio

Interest Coverage Ratio

Fixed Charges Coverage Ratio

Types of Activity Ratios / Turnover Ratios/ Efficiency Ratios / Performance Ratios - Calculation and analysis along with illustrations

Total Assets Turnover Ratio

Fixed Assets Turnover Ratio

Net Assets Turnover Ratio

Current Assets Turnover Ratio

Working Capital Turnover Ratio

Inventory Turnover Ratio

Receivables Turnover Ratio

Payables Turnover Ratio

Profitability Ratios - Calculation and analysis along with illustrations

Gross Profit Ratio

Net Profit Ratio

Operating Profit Ratio

Expenses Ratio - COGS Ratio, Office and Administration Expenses Ratio, Selling and Distribution Expenses Ratio, Operating Expenses Ratio

Return on Investment (ROI)

Return on Asset (ROA)

Return on Capital Employed (ROCE)

Return on Equity (ROE)

DuPont Analysis on ROI, ROA and ROE

Earning Per Share (EPS)

Dividend Per Share (DPS)

Dividend Payout Ratio

Price Earning Ratio

Dividend and Earning Yield Ratio

Market Value by Book Value (MVBV)

Q ratio

Time Value of Money - Concept and Use of Time value of Money

Simple Interest and Power of Compounding

Present Value and Future Value of Single Cash Flow

What is Annuity and Types of Annuity

Present Value and Future Value of Annuity

Annuity Factor and Discount Factor

Internal Rate of Return (IRR)

Cost of Capital

Cost of Redeemable and Irredeemable Debts

Cost of Zero Coupon Bonds using IRR method

Cost of Ammortised Bonds using IRR Method

Methods to Calculate cost of Equity

Gordon's Growth Model

Capital Asset Pricing Model (CAPM)

Cost of Preference Shares

Weighted average cost of Capital

Marginal Cost of Capital

What is Leverage ?

Operating Leverage, Financial Leverage and Combined Leverage

Break even Analysis- Operating Break even Point and Financial Break even point

Margin of Safety and Operating Leverage

Financial Leverage - Trading on Equity

Financial Leverage - Double edge Sword

Capital Structure Meaning and Theories

Net Income Approach

Traditional Approach

Net Operating Income Approach

Modigliani and Miller Approach

Arbitrage - Meaning and illustrations

Trade off Theory

Pecking Theory

EBIT- EPS - MP analysis

Return on Asset , Fixed Costs and EPS analysis

Financial Break even analysis

Indifference Points

Over Capitalisation and Under Capitalisation

Capital Budgeting - Meaning and Process

Types of Capital Investment decisions

Replacement and Modernization decision

Expansion Decision

Diversification Decision

Mutually Exclusive Proposals Decision

Accept or Reject Decision

Contingent Decision

Difference between Accounting Profit and Cashflow

Meaning of Incremental Cashflows

Depreciation and Tax Benefit on Depreciation

Opportunity Cost and Sunk Cost

Working Capital Cost

Allocated Overhead costs

Types of Cashflow for New Projects and Replacement Projects

How to Calculate Cashflows

Block of Assets and Depreciation Principle

Treatment of Financing Costs

Post Tax Principles

Capital Budgeting Techniques

Payback Period Method - Meaning, Illustrations advantages and Disadvantages

Payback Period Reciprocal Method

Accounting Rate of Return Method (ARR) - Meaning, Illustrations advantages and Disadvantages

Discounted Payback Period Method - Meaning, Illustrations advantages and Disadvantages

Profitability Index Method (PI) - Meaning, Illustrations advantages and Disadvantages

Net Present Value Method (NPV) - Meaning, Illustrations advantages and Disadvantages

Internal Rate of Return (IRR) - Meaning, Illustrations advantages and Disadvantages

Internal Rate of Return (IRR) and Net Present Value Method (NPV) Reinvestment Assumption

Multiple Internal Rate of Return (Multiple IRR)

Modified Internal Rate of Return (MIRR) - Meaning, Illustrations advantages and Disadvantages

Capital Rationing

Divisible and Non- Divisible Projects

Methods to analyze Mutually Exclusive Projects with different tenures

Replacement Chain Method

Equivalent Annualized Criterion Method

Risk analysis in Capital Budgeting

Project Specific Risk

Company Specific Risk

Industry Specific Risk

Competition risk

Risk due to economic factors

International risk

Market risk

Types of Risk Analysis Techniques

Risk Analysis Technique - Statistical Technique - Probability

Risk Analysis Technique - Statistical Technique - Standard deviation and Variance

Risk Analysis Technique - Statistical Technique - Coefficient of Variation

Risk Analysis Technique - Conventional Technique - Risk adjusted discount Rate

Risk Analysis Technique - Conventional Technique - Certainty Equivalent

Risk Analysis Technique - Sensitivity Analysis

Risk Analysis Technique - Scenario Analysis

Dividend decisions - Introduction and significance

Forms of Dividend - Cash Dividend and Bonus Shares (Stock Dividend)

Relationship between Retained earnings and Growth

Factors affecting Dividend decisions

Dividend Policy - Mature Company and Growth Company

Theories of Dividend Policy

Modigliani and Miller Hypothesis

Walter's Model

Gordon's Growth Model

Dividend Discount Model

Graham and Dodd Model

Linter's Model

Stock Splits

Meaning ,Significance and Types of Working Capital

Optimum Working Capital

Approaches for Working Capital Investment

Working Capital Cycle or Operating Cycle - Concept and calculation

Raw Material Storage Period

Work in Progress holding period

Finished Goods Storage Period

Receivables Collection Period

Payables Period

Working Capital Estimation

Working Capital on Cash cost basis

Impact of Double Shift on Working Capital

Treasury and Cash Management

Cash Budget

Accelerating Cash Collections and Controlling Payments

Cash Management Models

William J Baumol EOQ Model

Miller Orr Cash Management Model

Management of Marketable securities

Inventory Management Basics

Reorder Level

Reorder Quantity

Minimum Stock Level

Maximum Stock Level

Average Stock Level

Danger Level and Buffer Stock

Management of Debtors - Meaning and Objective

Factors determining Credit Policy

Approaches to evaluation of credit policies - Total Approach and Incremental Approach

Financing Receivables

Factoring Services evaluation

Forfaiting

Management of Payables and Cost of Payables

Working Capital Finance

Spontaneous Sources of Finance

Inter Corporate Loans and Deposits

Commercial Papers

Bills Discounting, Rediscounting and Factoring

Forms of Bank Credit

Why take this course?

Hi

This is a Corporate Financial management course from beginners to advanced level. It begins with understanding basic concepts and terms of financial management to application of the financial management in decision making. The course consists of video lectures along with solved illustrations and Quiz that provides better understanding of concept. It is logically divided into various Sections :

Module 1 : Introduction

(Includes Section 1)

Introduction and understanding the meaning of financial management.

Module 2 : Sources of Finance

(From Section 2 to Section 6)

Here we are identifying and understanding different sources of Finance. This includes all long term finance and medium term finance such as Equity and Preference share capital , Bonds and Debentures, Venture Capital, Asset Securitization, Lease Financing, Depository Receipts, Trade Credit and accrued expenses. It also includes all short term finance such as Bridge Finance, Treasury Bills, Certificate of Deposits, Commercial paper etc. All the sources of finance are explained in video lectures along with illustrations.

Module 3 : Financial Ratios and Analysis

(From Section 7 to Section 11)

Here We discuss about different types of Financial Ratios such as Liquidity Ratios (Short term solvency ratios) , Leverage Ratios (Long Term solvency ratios) ,Activity Ratios (Turnover ratios) and Profitability Ratios.

Liquidity Ratios includes current ratio, quick ratio, cash ratio and Interval measure ratio. Each ratio is explained in video lecture along with illustrations.

Leverage Ratios include equity ratio, debt ratio, debt to equity ratio, debt to total assets ratio, proprietary ratio, capital gearing ratio, debt service coverage ratio, dividend coverage ratio, interest coverage ratio, fixed charges coverage ratio etc. Each ratio is explained in video lecture along with illustrations.

Turnover ratios include fixed assets turnover ratio, net assets turnover ratio, current assets turnover ratio, working capital turnover ratio, inventory turnover ratio, receivables turnover ratio, payables turnover ratio etc. Each ratio is explained in video lecture along with illustrations.

Profitability ratios include gross profit ratio, net profit ratio, operating profit ratio, expenses ratio, return on assets, return on capital employed, return on equity, earning per share, dividend per share, dividend payout ratio, price earning ratio, dividend and earning yield ratio, market value by book value ratio, Q ratio. Each ratio is explained in video lecture along with illustrations.

DuPont Analysis on ROI (Return on Investment) , ROA (Return on Assets) and ROE (Return on Equity)

This module also includes a comprehensive solved illustration that explains how to calculate all types of ratios and how to use these ratios for analysis and decision making.

Module 4 : Time Value of Money

(From Section 12 to Section 15)

Here we discuss about the concept of Time Value of Money and how to use concept of time value of money. The relationship between inflation, purchasing power and Time value of money is separately discussed. Other topics included are Difference between Simple interest and compound interest, Present value and Future value of money, Formula for present value and future value, Discount Factor, Annuity, Present Value and Future Value of Annuity. All topics are explained in video lecture along with examples.

Module 5 : Cost of Capital

(From Section 16 to Section 19)

Here we will learn how to calculate cost of capital for individual capitals i.e Cost of Debentures/ Bonds, Cost of Preference shares , Cost of Equity shares and then How to calculate total cost of capital.

Cost of debt/Bonds and debentures includes calculation of Cost of Redeemable and Irredeemable debts using approximation method and Internal Rate of Return (IRR) Method. It also includes separate lecture wherein logic for using current price in calculating cost of capital is explained.

Cost of Preference shares using Approximation method and Internal Rate of Return (IRR Method)

Cost of Equity and Retained Earnings using Dividend Price Model, Earnings Approach model, Gordon's growth model, Realized Yield Approach, Capital Asset Price Model is explained along with examples. Besides Calculation of Growth Rate for Gordon's growth model, Beta , Types of Risks - Systematic and Unsystematic risks are explained in separate video lecture along with examples.

This section is concluded by calculating weighted average cost of capital (WACC) and Marginal cost of capital.

Module 6 : Leverages

(From Section 20 to Section 23)

Here we will be learning about different types of Leverages - Operational Leverage, Financial Leverage and Combined Leverage. This will be followed by Formula to calculate degree of operating leverage (DOOL/DOL), degree of Financial leverage (DOFL/DFL) and degree of combined leverage (DOCL/DCL). Operating and Financial break even points are analyzed in separate lectures and relationship of break even points with leverage is discussed. Some other topics include relationship between Margin of Safety and Operational leverage, Relationship between Break even point - Fixed cost and operational leverage, Why financial leverage is known as trading on equity and double edge sword.

Module 7 : Capital Structure

(From Section 24 to Section 33)

It includes meaning of capital structure and capital structure theories. Following theories are discussed in this module : Net Income approach, Traditional Approach, Net Operating Income approach, Modigliani and Miller approach , Trade off theory and pecking theory. Along with this following topics are also discussed - meaning of arbitrage with solved illustrations, Indifference points, Over capitalization and under capitalization.

Module 8 : Capital Budgeting

(From Section 34 to Section 49)

It begins meaning of Capital Budgeting and purpose of Capital Budgeting. This is followed by process of capital budgeting and types of Capital budgeting decisions - Replacement and Modernization decisions, Expansion decisions, Diversification decisions, Mutually Exclusive decisions, Accept or Reject decision, Contingent decision.

Other terms such as incremental cashflows, Tax Benefit on Depreciation, Opportunity cost and Sunk cost, Working capital costs, allocated overhead costs are also explained in separate tutorials along with illustrations. This is followed by types of cashflows for new project and replacement project along with basic principles of calculating cashflows.

All Capital Budgeting Techniques i.e Payback Period Method, Payback Reciprocal Method, Accounting Rate of Return (ARR) Method, Discounted Payback period method, Profitability Index method (PI) , Net Present Value Method (NPV) , Internal Rate of Return Method (IRR) and Modified Internal Rate of Return (MIRR) are discussed in detail along with meaning , Illustrations , advantages and disadvantages. Reinvestment assumptions and anomalies in Net Present Value Method (NPV) and Internal Rate of Return Method (IRR) method along with reasons and examples are discussed separately.

Capital Rationing Meaning and Capital Rationing for Divisible and Indivisible projects is discussed along with solved illustrations.

Methods to analyze Mutually exclusive projects with different tenures - i.e Replacement chain Method and Equivalent annualized criterion method are also included along with solved examples.

Module 9 : Risk Analysis in Capital Budgeting

(From Section 50 to Section 55)

It begins with different types of risks involved in capital budgeting. This includes Project Specific risk, Company Specific risk, Industry Specific risk, Competitive risk, Market risk, Risk due to economic factors and International risk.

The following techniques of Risk analysis are explained along with example in separate video lectures :

Statistical Technique - Probability

Statistical Technique - Variance and Standard Deviation

Statistical Technique - Coefficient of Variation

Conventional Technique - Risk adjusted discount rate

Conventional Technique - Certainty Equivalents

Sensitivity Analysis

Scenario Analysis

Module 10 : Dividend Decisions

(From Section 56 to Section 62 )

It begins with the introduction on dividend decisions that includes separate video lectures on Significance of Dividend decisions, Forms of Dividend, Relationship between Retained Earnings and Growth, Factors affecting dividend decisions, Dividend Policies and types , Dividend policies for mature companies and growth companies.

It is followed by explanation of following theories of Dividend Policy :

Modigliani and Miller Hypothesis

Walter's Model

Gordon's Model

Dividend Discount Model - No Growth, Constant Growth and Variable Growth

Graham and Dodd Model

Linter's Model

Each Theory consists of video lectures explaining assumptions, formula , solved illustrations , advantages and limitations.

The module ends with explanation of Stock Splits.

Module 11 : Working Capital

(From Section 63to Section 70 )

This module begins with meaning significance and types of working capital.

The other sections includes following topics :

Optimum working capital

Operating Cycle and Working Capital Cycle - Meaning, Concept and Calculation along with comprehensive solved example

Estimation of Working Capital in detail that includes estimation of each and every component of working capital along with solved illustration.

Working Capital on Cash cost basis- Meaning, Concept and Calculation along with comprehensive solved example

Impact of Double Shift on Working Capital - Meaning, Concept and Calculation along with comprehensive solved example

Module 12 : Treasury and Cash Management

(From Section 71 to Section 75 )

It begins with meaning of Cash management along with functions of Treasury and Cash Management. It is followed by preparing of Cash Budgets - Both for long term and Short term along with solved illustrations.

Further it is followed by Cash Management Models and Theories. It includes William J Baumol's EOQ Model and Miller Orr Cash Management model.

It ends with lectures on recent developments in Cash Management Systems and Management of Marketable securities.

Module 13 : Inventory Management

(Section 76)

This includes various topics related to Inventory management such as Reorder Level, Reorder Quantity, Minimum stock level, average stock level , Maximum stock level, Danger level and buffer stock along with solved illustration on inventory management.

Module 14 : Management of Receivables and Payables

(From Section 77 to Section 81)

This module includes following topics :

Management of Debtors - Meaning and Objectives

Credit Policy - Meaning and Factors affecting credit policy

Approaches to evaluation of Credit policies along with the solved illustrations- Evaluation of Credit policies on Total Approach and Evaluation of Credit policies on Incremental Approach.

Financing receivables

Factoring services

Forfaiting

Innovations in receivables management

Monitoring of receivables

Management of Payables

Cost of Payables - Calculation along with solved illustration

Module 15 : Working Capital Finance

(Section 82)

This module includes following topics :

Meaning an types of Working capital Finance

Spontaneous working capital finance

Intercorporate debts and deposits

Commercial Papers

Bills discounting, Rediscounting and Factoring

Forms of Bank credit for working capital finance

Thus, this course provides complete understanding about basics of Corporate Finance or Management Finance. Hope you enjoy it.

Tip : It is better to solve illustrations along with lectures for better understanding of concept.

Happy Learning !

Charts

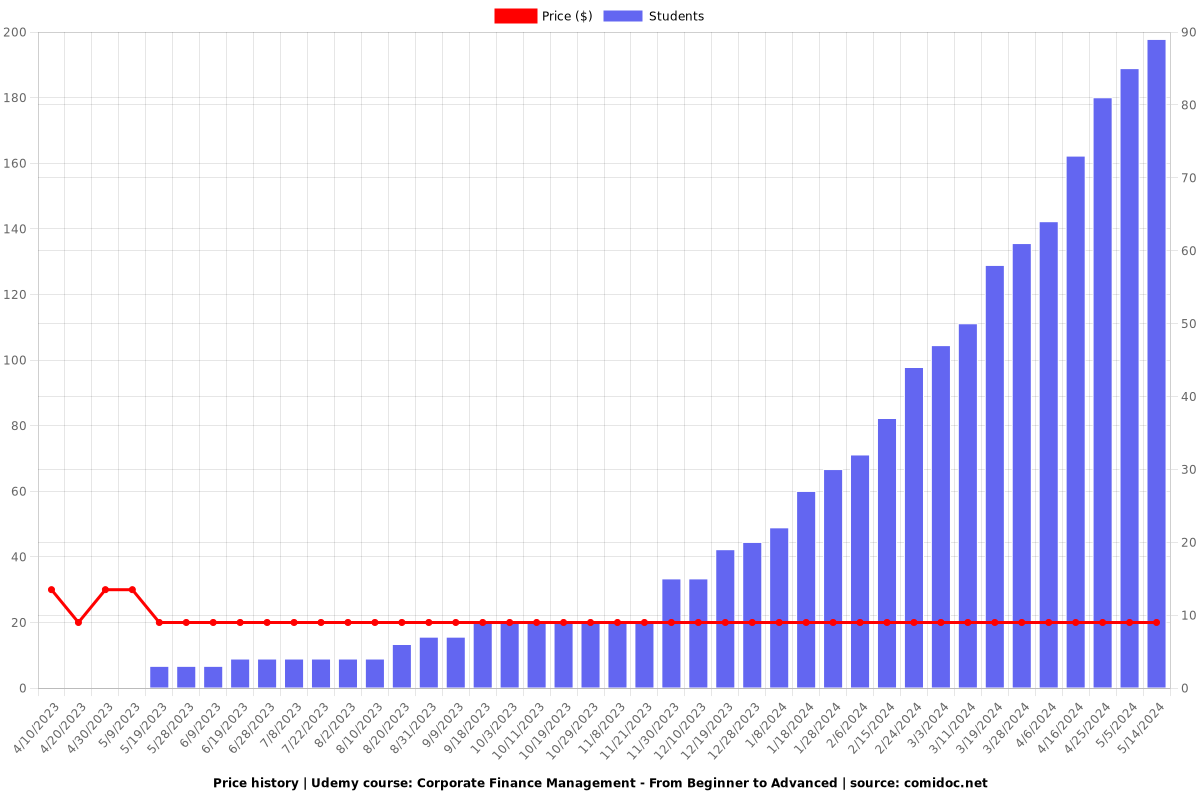

Price

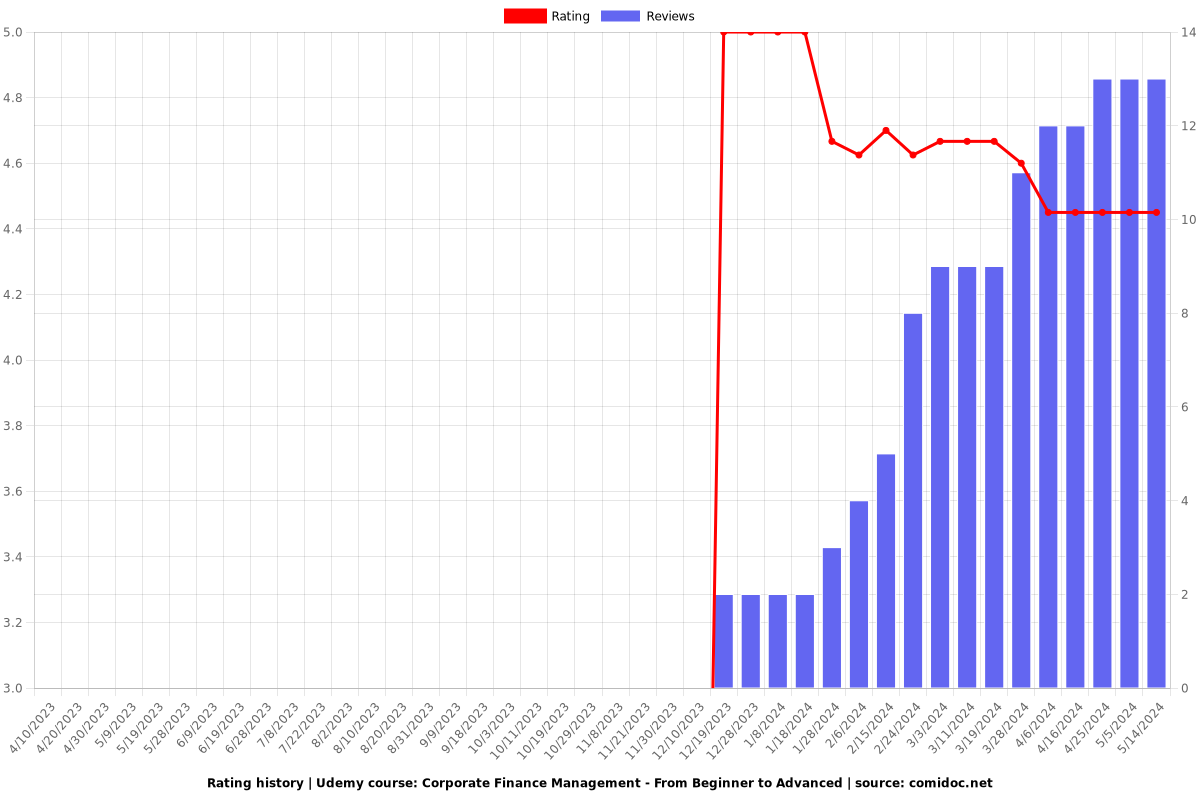

Rating

Enrollment distribution