Financial Analysis - Business Valuation, DCF, IRR, and more

Learn to model the valuation of a company using DCF & multiples - Perfect for financial analysts, IB, and PE!

What you will learn

Build a complete, working discounted cash flow (DCF) model in Excel from scratch

Value a company using the DCF and multiples approach

Use IRR, ROE, and NPV to analyze a project's feasibility

Calculate the weighted average cost of capital (WACC)

Calculate the cost of equity using the Capital Asset Pricing Model (CAPM)

Determine the terminal value of a cash flow stream

Why take this course?

If you're in the finance or accounting world (or aspire to be), you need to know how to create a discounted cash flow model (DCF) to value a company or project!

What will you learn in this course?

Build a complete, working discounted cash flow (DCF) model in Excel from scratch, using a fictional private company

Value a company using the DCF and multiples approach

Use IRR, ROE, and NPV to analyze a project's feasibility

Calculate the weighted average cost of capital (WACC)

Calculate the cost of equity using the Capital Asset Pricing Model (CAPM)

Determine the terminal value of a cash flow stream

Don't worry, you don't need a deep background in finance or accounting to take this course! We'll start with the basics and walk you through piece by piece.

In this course, we’ll build a complete, working discounted cash flow (DCF) model in Excel from scratch, using a fictional private company. Our course will teach you how to calculate the cost of equity, WACC, and levered/unlevered beta.

With this knowledge, we’ll calculate the discounted free cash flow and the terminal value. From there, we’ll learn how to value a company using the multiples approach. We top off the course be learning how to analyze the financial viability of a new project using methods such as IRR, ROE, NPV, and break even.

What makes our course so awesome?

38 page easy to understand guide: Our workbook is super easy to understand and reference for later dates

Real world case-studies: In depth, real-world case studies using both real and fictitious companies

Fun: Light-hearted, fun, and enjoyable course (we never take ourselves too seriously)

Knowledgeable instructor: Nate is a CPA and has spent his career valuing companies and analyzing financial statements

No fluff: We don’t teach theory or waste your time with useless information. Everything we teach you can start applying TODAY

This course is the first part of a 3 part series on the financial statements. The first course focuses on learning the financial statements (Financial Statement Analysis) and the second on on financial modeling (Financial Modeling Bootcamp). We use the same case study in all three courses so your knowledge builds as you build your knowledge.

Let's start learning!

Screenshots

Reviews

Charts

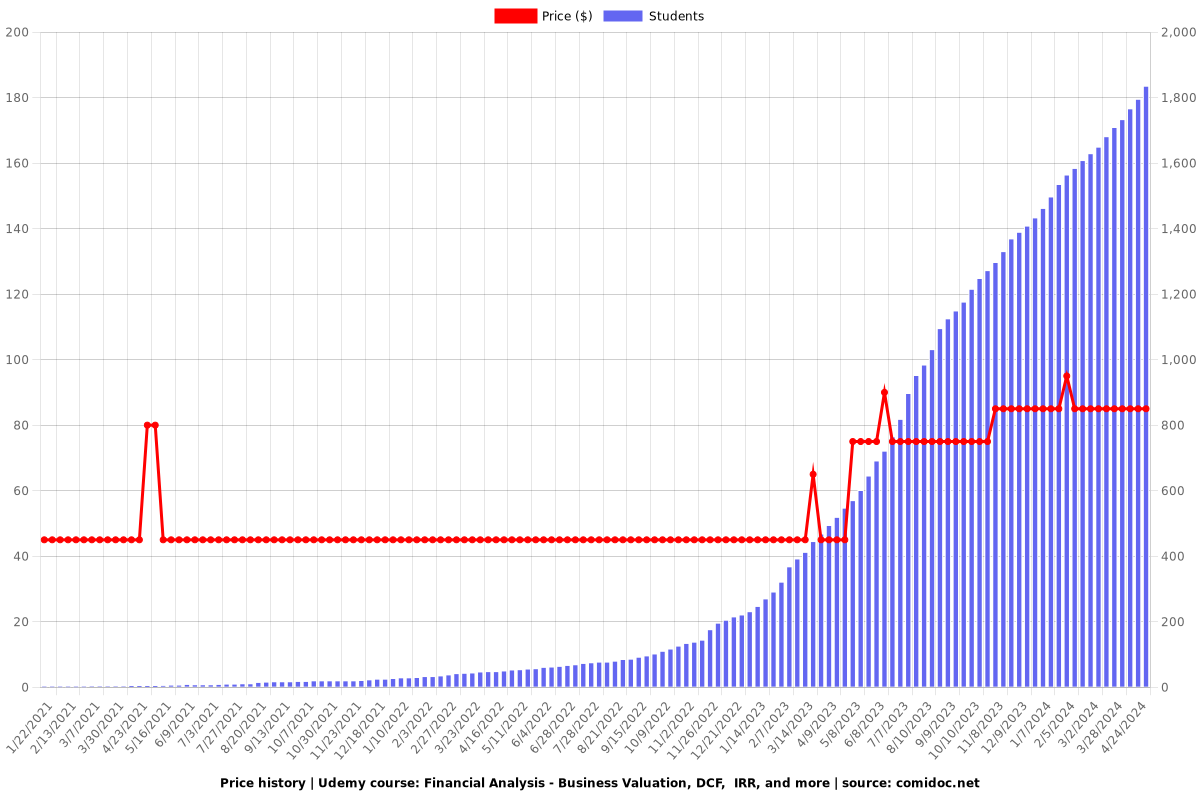

Price

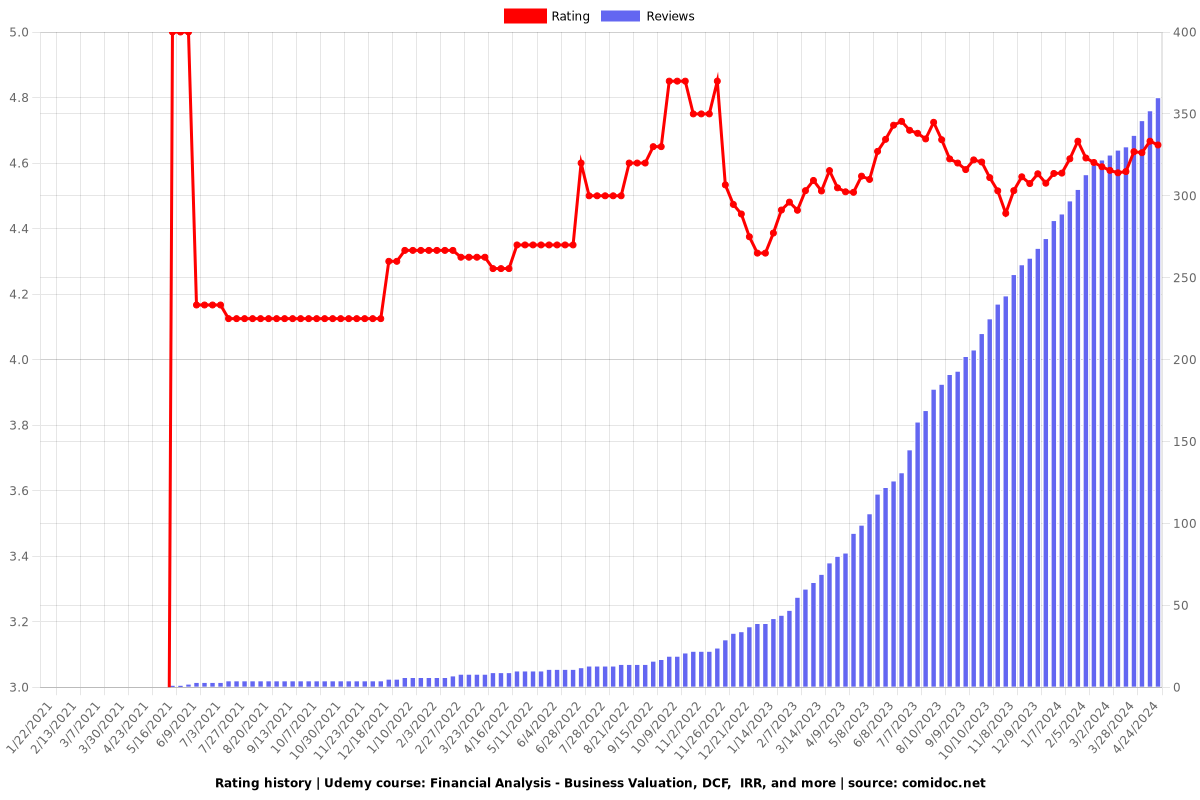

Rating

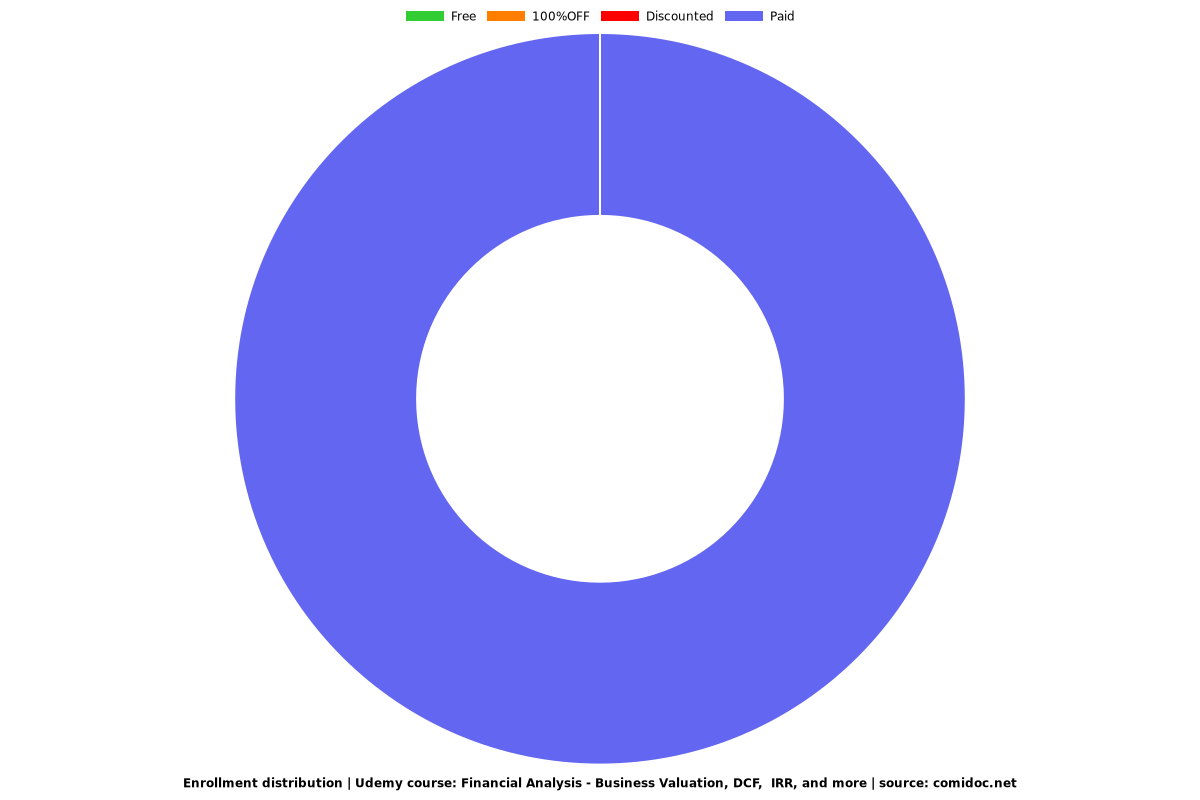

Enrollment distribution