Dividend Champions and Dogs of the Dow High Yield Investing!

This course lifts you to mastery over the hottest proven income stock strategies from the Dogs of the Dow to the S&P 10.

What you will learn

Selecting the strongest rising dividend income stocks will be as simple as filling a grocery list.

Running a double digit or above income producing dividend stock portfolio will be a snap.

Protecting your precious capital gain profits with risk reduction strategies such as stop-loss orders will be as simple and as clear to you as tic-tac-toe.

Following simple proven dividend stock income systems from “Dogs of the Dow” to “Stocks for the Long Run” will take you little time under low stress — each dividend investing system you will learn is endorsed by top finance professors from Wharton to Harvard business schools.

Harvesting needed stock dividend income every month or quarter will be as simple as one-two-three using this dividend champion approach.

Why take this course?

ATTENTION: Updated Thursday, August 25, 2016, 12:35 P.M.

---

As Seen on NBC News, ABC News, CBS News, Fox News, News Channel Ten, Hawaii News Now, Louisiana News Channel, Travel Weekly, The Post Gazette, and The Christian Science Monitor...

Breaking News: How Much You’d Earn With a 25% Average Annual Return?

From the Desk of Daniel Hall J.D., Attorney at Law

Dear Fellow Investor:

Hi, my name is Daniel and if you want to succeed with buying income then pay very close attention.

Here's a special message for every business owner who needs to make their money work as hard as possible but doesn't know an effective way to consistently generate income safely. Many business owners suffer from the idea that almost any dividend stock is a good investment.

But nothing could be further from the truth.

Take Banco Popular [BPOP]. This darling-of-Wall-Street boutique banking stock was trading around $18 at the beginning of the century. By 2009 it traded at $1.63.

No dividend paid is large enough to cover a retirement crushing 91% loss such as this.

So, if you're a business owner or stock investor seeking to buy rising income generating stocks, then this is exactly what you're looking for.

+++++ THE BUZZ ABOUT THIS UDEMY EXCLUSIVE COURSE IS PALPABLE +++++

"Hi Scott; You are the only Academic Research Professor that I have ever heard of who has studied and gathered together the required volumes of market data needed to understand how to successfully invest/trade the markets and have the burning desire to stay with it and make it work for you. What makes it special and notable is your desire to show others the right path." -CW on 11/11/2015

+++++ THE BUZZ ABOUT THIS UDEMY EXCLUSIVE COURSE IS PALPABLE +++++

I'd like to introduce you to our cutting edge Udemy exclusive course "Buying Income: How To Buy Dividend Stocks For Maximum Cash Flow Income." Our course shows you how to buy dividend stocks that not only generate reliable income but also have a higher probability of increasing in value over time.

With "Buying Income: Dividend Stocks For Maximum Cash Flow Profit!" this breakthrough resource helps you …

- Evaluate dividend growth stocks not just for income potential but also for stock price appreciation.

- Build predictable income now with cash-flowing dividend stocks while minimizing risk.

- Build absolute independent confidence in your investment making decisions.

- Minimize your tax burden by arranging your investments in a tax savvy way

- Time your investments correctly to increase income and potential growth while minimizing your risk.

... and much, MUCH more!

And what makes this even better?

Now you never have to deal with buying bad dividend stocks blindly. You know what I mean.

These go down in value based on bad recommendations and advice from CNBC talking heads and investment newsletter emails!

Which also means you're sitting there right now likely feeling stuck in the mud. You feel just like most people locked in worthless stocks who started out investing for dividend income — and got the shaft!

These inflation draggers not only have poor returns but are even more likely to tank deeper into the abyss over time...

This Revolutionary Course Cures Your Suffering from Bad Advice and Unclear Training

And best of all... you'll start seeing results immediately with "Buying Income: Dividend Stocks For Maximum Cash Flow Profit!" in less than a week. Reduced tuition for this life transforming course is a pittance at $299 considering the benefits you’ll receive.

Here are some facts.

The historical return of the stock market has been 12% on average per year. Standard deviation is 20%.

That means that about a third of the time investors will score 32% returns blindly buying dividend stocks — you’ll learn why inside. My colleague Dr. Scott Brown will show you how to increase your probability of extracting higher — and possibly much higher — returns than 12%.

What if you achieved 25% year-after-year in your dividend stock investing by simply focusing on the ones that actually rise? We can’t promise your returns but this scenario is well within the realm of statistical probability.

A one-lump investment of $25,000 today turns into $2,168,400 in just 2 decades. This much cash invested in special dividend stocks — you will discover inside — would generate between $43,368 and $108,420 in annual dividend income for your family.

But get this — it come in even in your sleep!

A $25,000 investment contributed between an individual 401k and a Roth IRA done year-after year earning 25% grows into $10,716,885 over that same period. This would kick off between $214,337.70 and $535,844.25 in Champagne dream life-style annual dividend income!

So again, if you're a business owner looking for a safe way to buy income generating stocks, understand this:

- The sooner you start the sooner you can make your income grow buying quality dividend producing assets — shares of common stock in up-trending dividend paying firms.

- The market is ripe for these types of investments, if snooze you will lose.

- The price in this training sporadically increases — and NEVER decreases — so enroll now.

This watershed Udemy course "Buying Income: Dividend Stocks For Maximum Cash Flow Profit!" from attorney Daniel Hall, J.D. & finance professor Scott Brown, Ph.D. holds the key to your success with buying income from the stock market.

AND for immediate viewing you have Live Dividend Stock Investment Examples! [$1,995 Value].

You will know which dividend stocks are rising within seconds after enrolling.

Think of the financial safety and comfort of your loved ones. I urge you not to delay one day more,

Attorney Daniel Hall, J.D.

Accredited Investor and Founder of …

DANIEL HALL COMBINED ENTERPRISES

1001 Harbor Lights Drive Corpus Christi, TX 78412-5342 USA

P.S. This just in,

"There is no one like you [Dr. Scott Brown] that I know of who is this transparent. That is what makes your service and education so valuable. Please keep on. The honesty is real and refreshing and makes me learn something. Don't baffle us with [BS]. You are the real deal. ...and you can quote me on that. If you post this please only use my initials." Thanks, -LB, Pacific Northwest 09/01/2015

P.P.S. “The way you are teaching your

strategy makes the terms trader, investor, short term, long term, irrelevant

and with little meaning. Putting this out front in your intro might be

meaningful.” –Charlie White, USA 11/7/2015

P.P.P.S. This is a risk free offer. Udemy offers you a 30 day money back guarantee.

* This course is updated every week except for when Dr. Brown goes on holiday.

Screenshots

Reviews

Charts

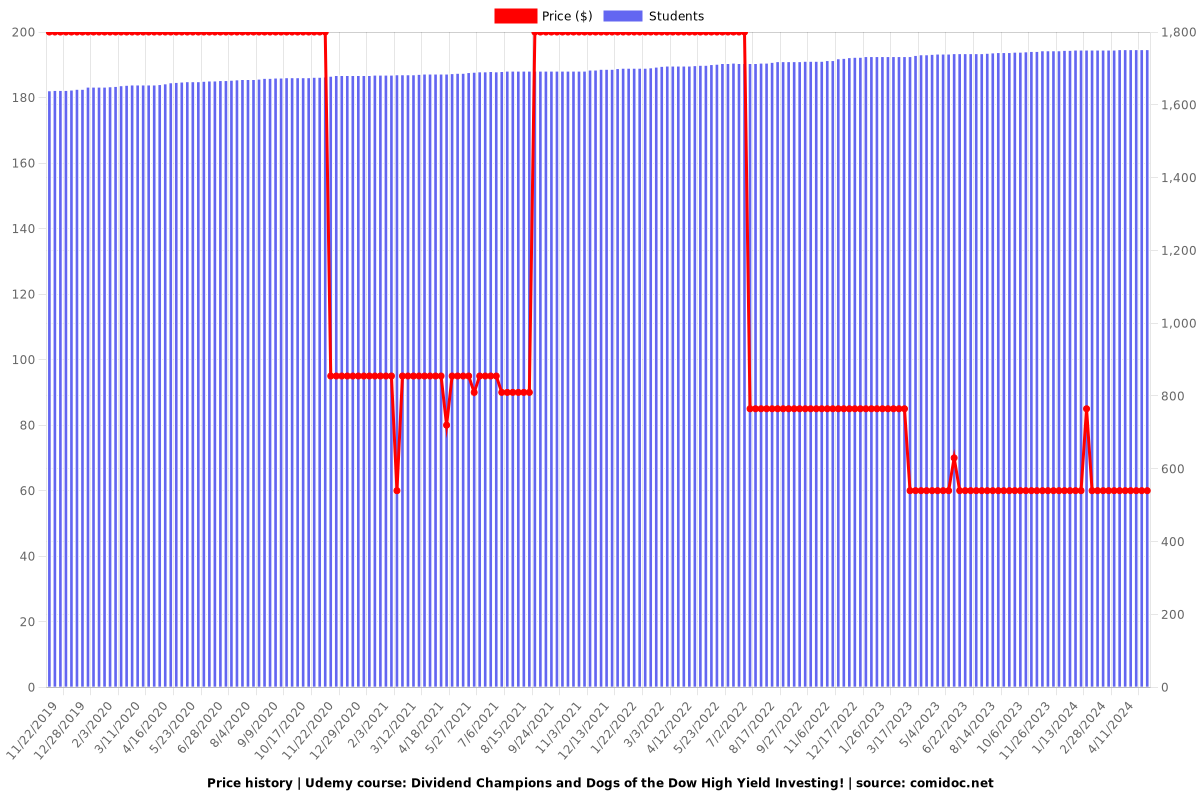

Price

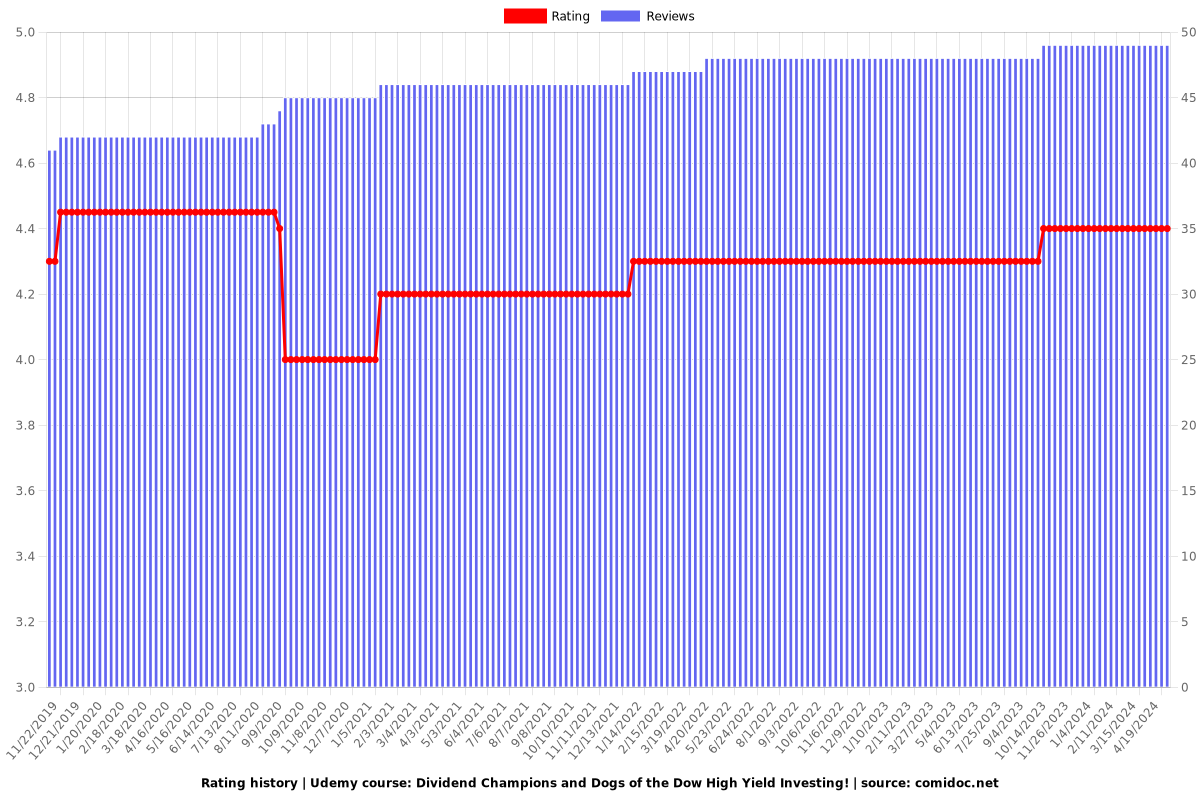

Rating

Enrollment distribution