Business Valuation

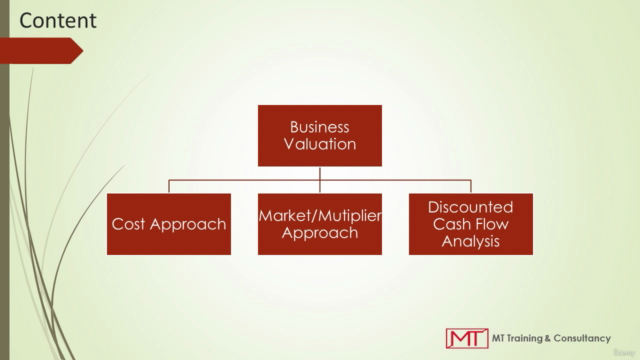

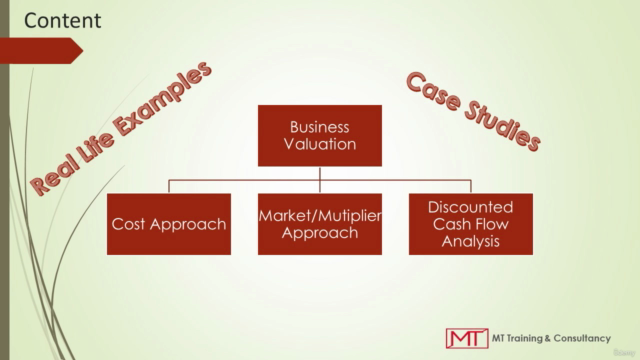

Understanding the basics and terminology of the three main methods of Business Valuation: Cost Approach, Multiplier Appr

What you will learn

You will learn the basic appraisal concepts and main terminology of Business Valuation with several examples · You will understand the three main approaches for

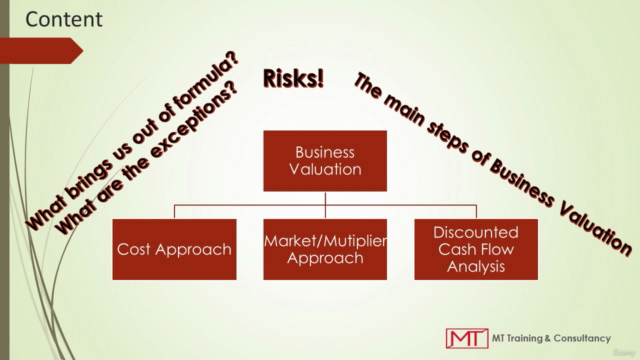

· You will learn how to identify and, analyse the risk premium of the firm and determine the discount rate, growth rate and terminal year in DCF anyalysis accor

· You will learn how to analyse the calculated fair value and some important terms which would help us in our final decisionmaking such as: Premise of Value, En

-You will be able to analyse and interpret the business value conclusion by evaluating both the story of the company and the numbers.

Why take this course?

Business Valuation

-You will learn the basic appraisal concepts and main terminology of Business Valuation with several examples

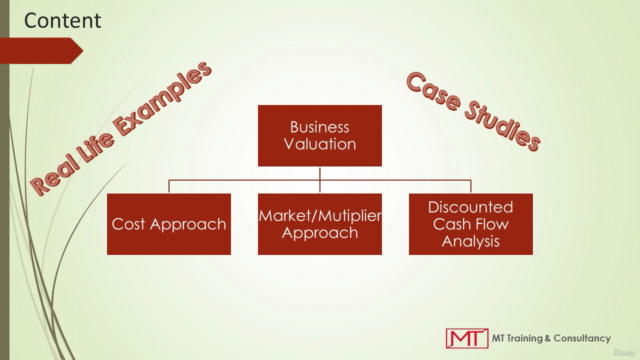

· You will understand the three main approaches for valuation: Cost Approach, Multiplier Approach and Discounted Cash Flow Analysis with real life examples and case studies.

· You will learn how to identify and, analyse the risk premium of the firm and determine the discount rate, growth rate and terminal year in DCF anyalysis accordingly .

. You understand how to calculate the Fair Value of the target company by using, Earnings Multiple, Equity Multiple and Sales multiple seeing real life examples from global firms such as: Microsoft, Whatsapp and China Unicom.

· You will learn how to analyse the calculated fair value and some important terms which would help us in our final decisionmaking such as: Premise of Value, Enterprise Value, Going-Concern Value, Liquidation Value and Market Capitalization. You will understand how to calculate and use the Enterprise Value and Liquidation Value.

· You will understand the main steps of valuation process including how to decide which Valuation approach to use and what type of adjustments shall we make on the company financials.

-You will be able to analyse and interpret the business value conclusion by evaluating both the story of the company and the numbers.

Screenshots

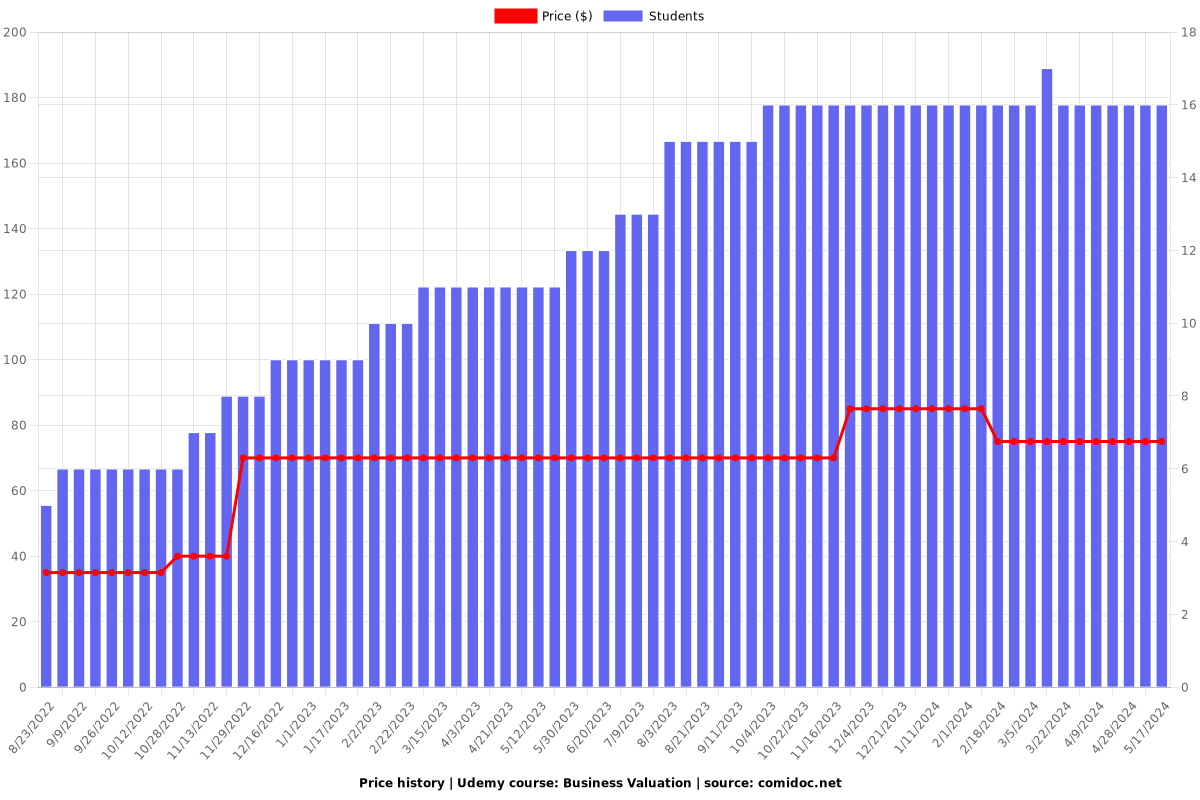

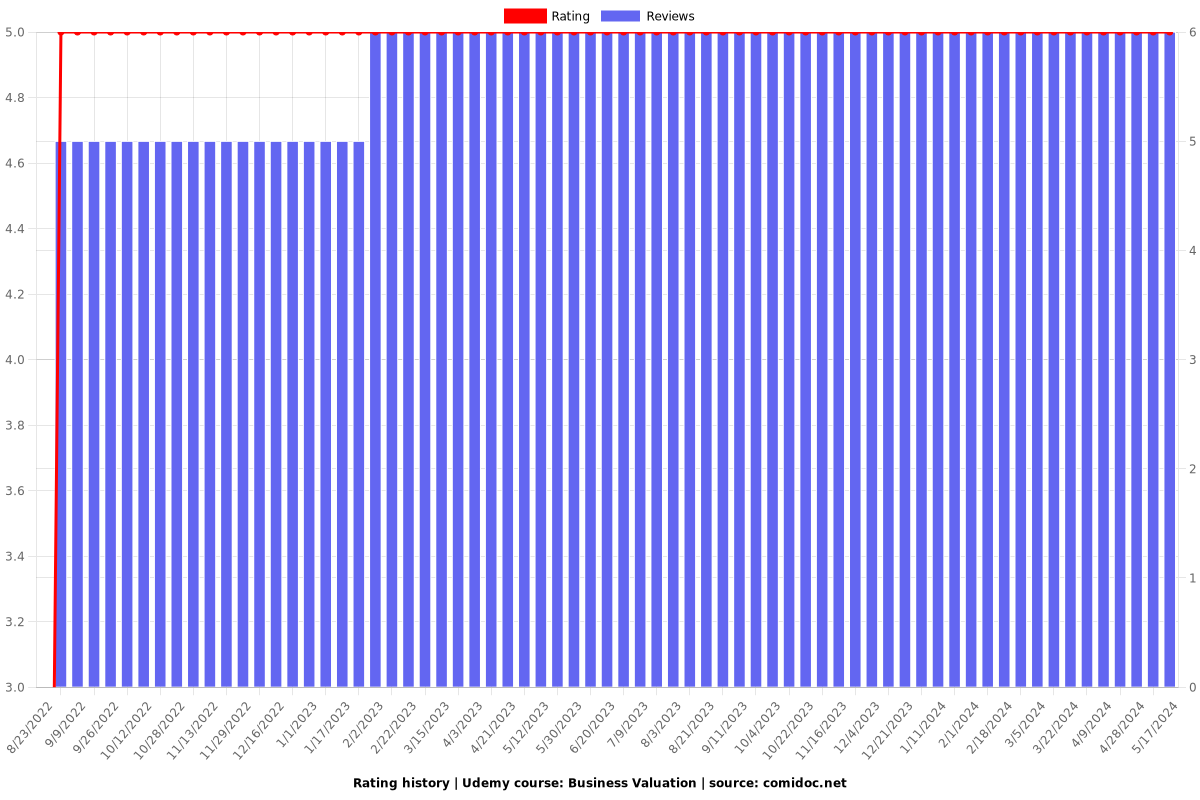

Charts

Price

Rating

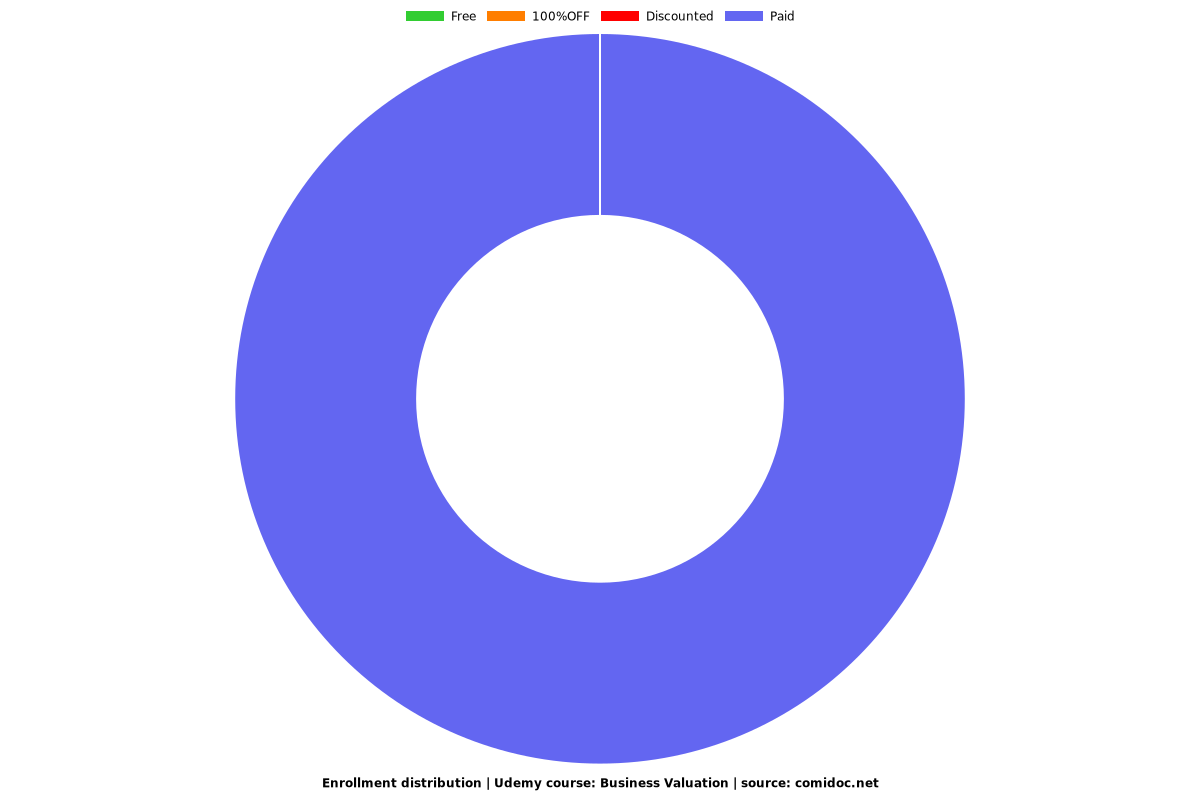

Enrollment distribution