Build a DCF Valuation Model

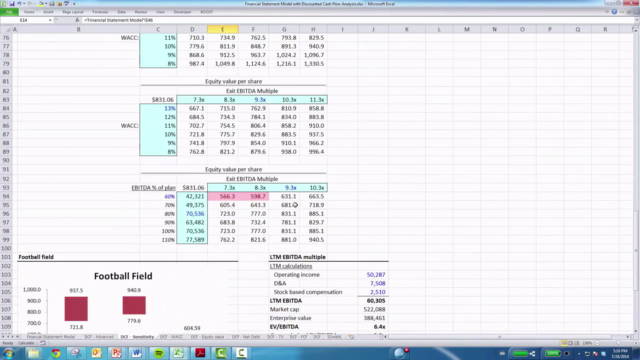

Learn how to build a "Wall Street quality" DCF valuation model. Includes a complete DCF model in Excel.

What you will learn

At course completion, you will have developed a comprehensive "Wall Street quality" DCF model from scratch.

Why take this course?

DCF analysis is both academically respected and widely used on Wall Street as a primary method of valuation. Many finance interview questions specifically test a candidate's understanding of the DCF. The step-by-step modeling course uses a real case study approach and is designed to mimic the experience of an financial analyst.

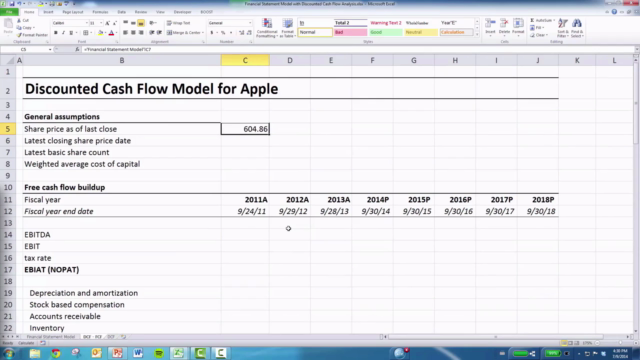

This course builds on Wall Street Prep's financial statement modeling course to teach trainees how to build a working discounted cash flow (DCF) model in Excel from scratch.

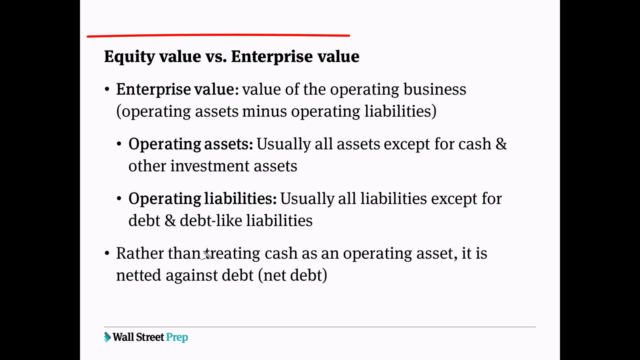

Along the way, you will learn how to estimate the weighted average cost of capital (WACC) in the real world, and build several commonly used approaches to calculating terminal value. Finally, we will use data tables to analyze a broad range of scenarios given different assumptions.

Screenshots

Reviews

Charts

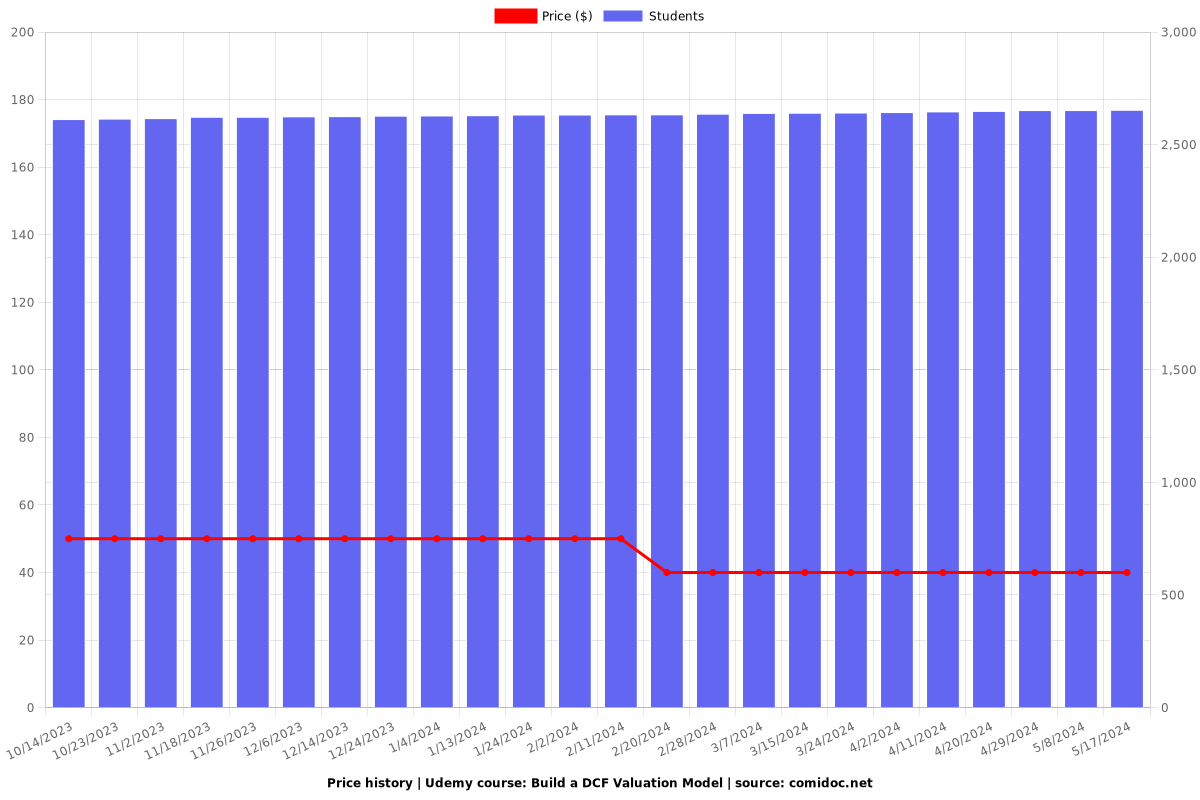

Price

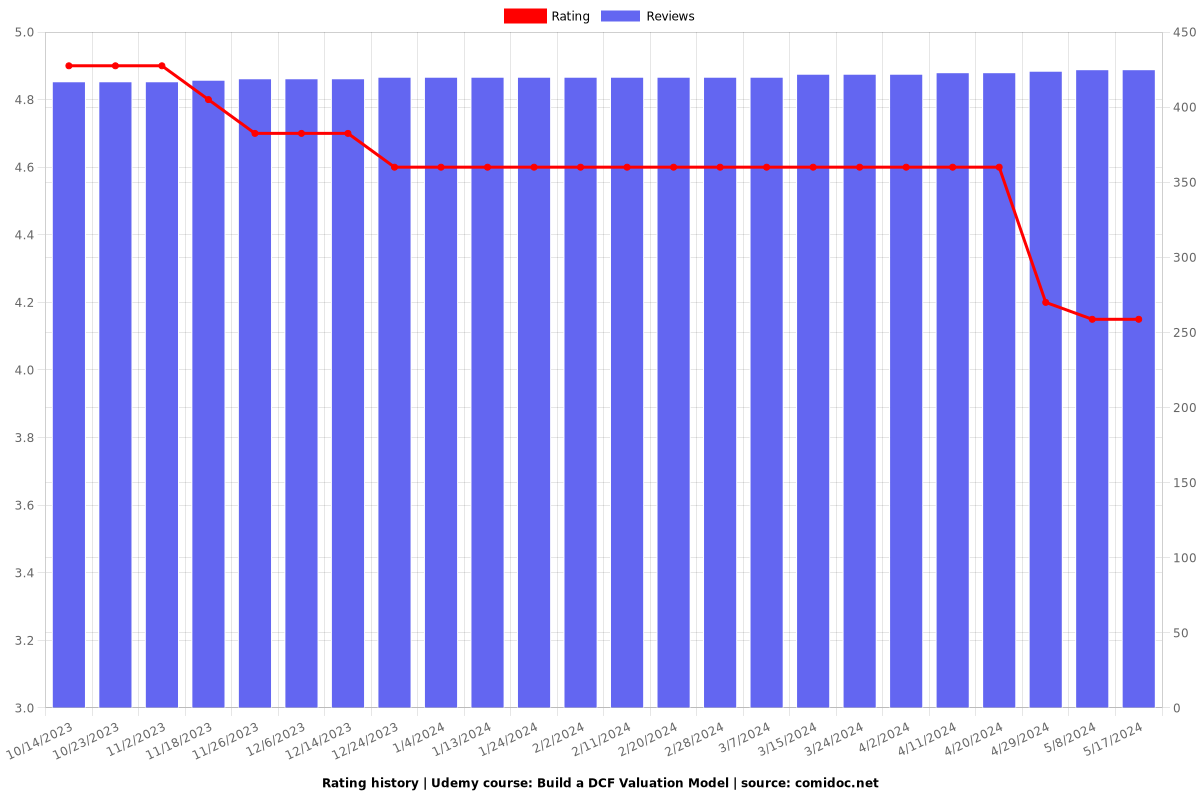

Rating

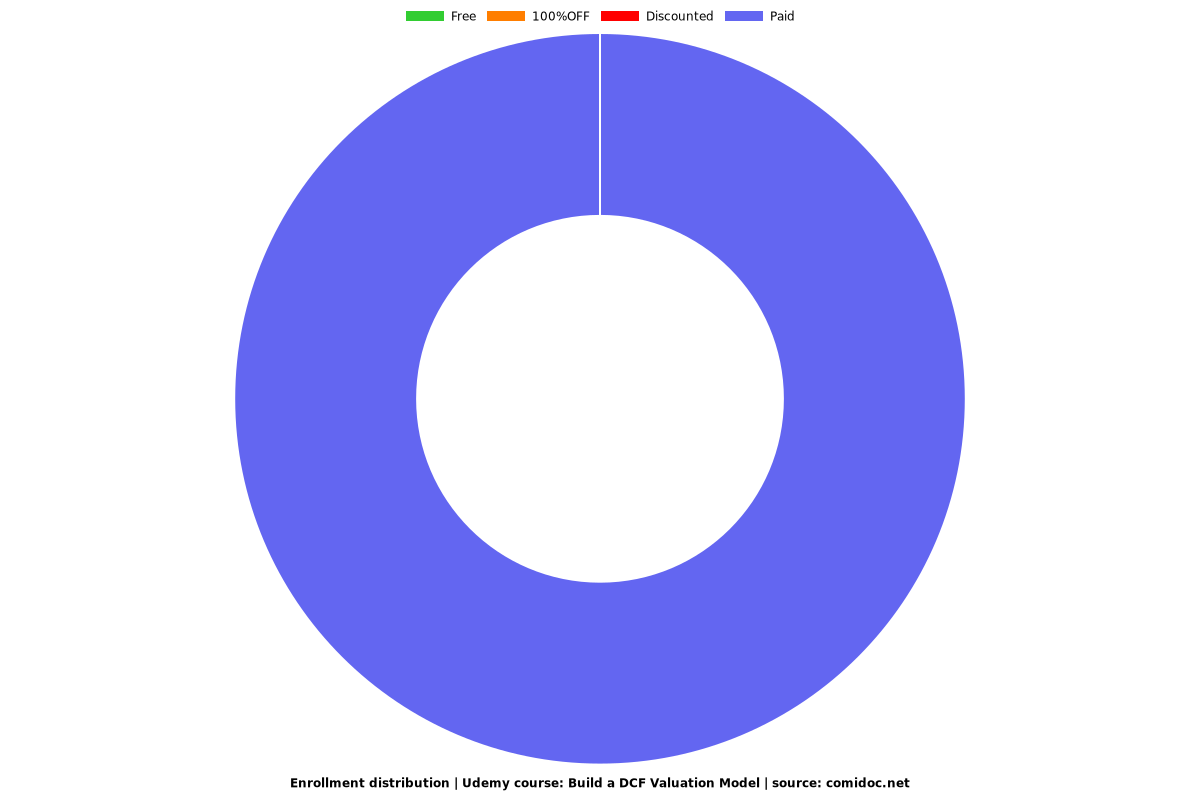

Enrollment distribution