How to Prepare, Read and Analyse a Company Balance Sheet

A practical first step in company analysis

What you will learn

Understand the individual components of a company balance sheet.

Understand the practical use of a balance sheet.

Diagnose the health status of a company.

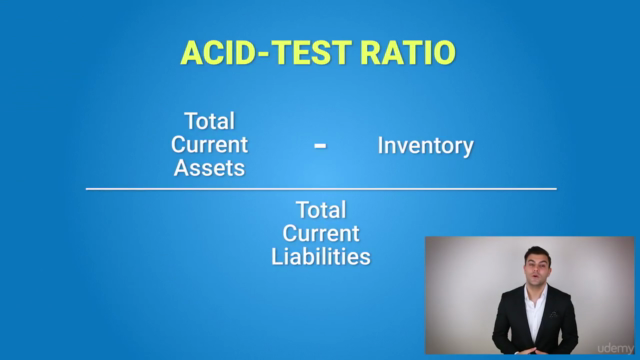

Use financial ratios to analyse the context of a company's operations.

Build a balance sheet from scratch using any company's financial information.

Why take this course?

The Duomo Initiative presents: "How to Prepare, Read and Analyse a Company Balance Sheet".

A practical, step-by-step course that will accelerate your understanding of how to perform this critical aspect of company analysis.

The course is presented in the distinctive Duomo style; engaging and interactive, as seen on the popular YouTube Channel.

If you're an investor looking to improve the depth of your equity analysis...

Or an entrepreneur wanting to calculate your company's solvency...

Or simply someone that wants to expand their horizons by learning more about the financial world around them...

Then this is the course for you!

Featured in this package are nearly 2 hours of practical and theoretical lessons, detailed text modules and a quiz at the end of every section to test your understanding.

You will also receive a supporting spreadsheet, to aid you in completing all the practical activities.

The content of the course has been put together following proven principles for accelerated learning. This means it will challenge you to stay focused and work hard, but is still suitable for complete beginners with no previous accounting or financial experience.

This course will be presented by Nicholas Puri and has been written by Dr. Alexander Cassar, a director at PuriCassar AG and a qualified accountant since 1990.

Screenshots

Our review

Charts

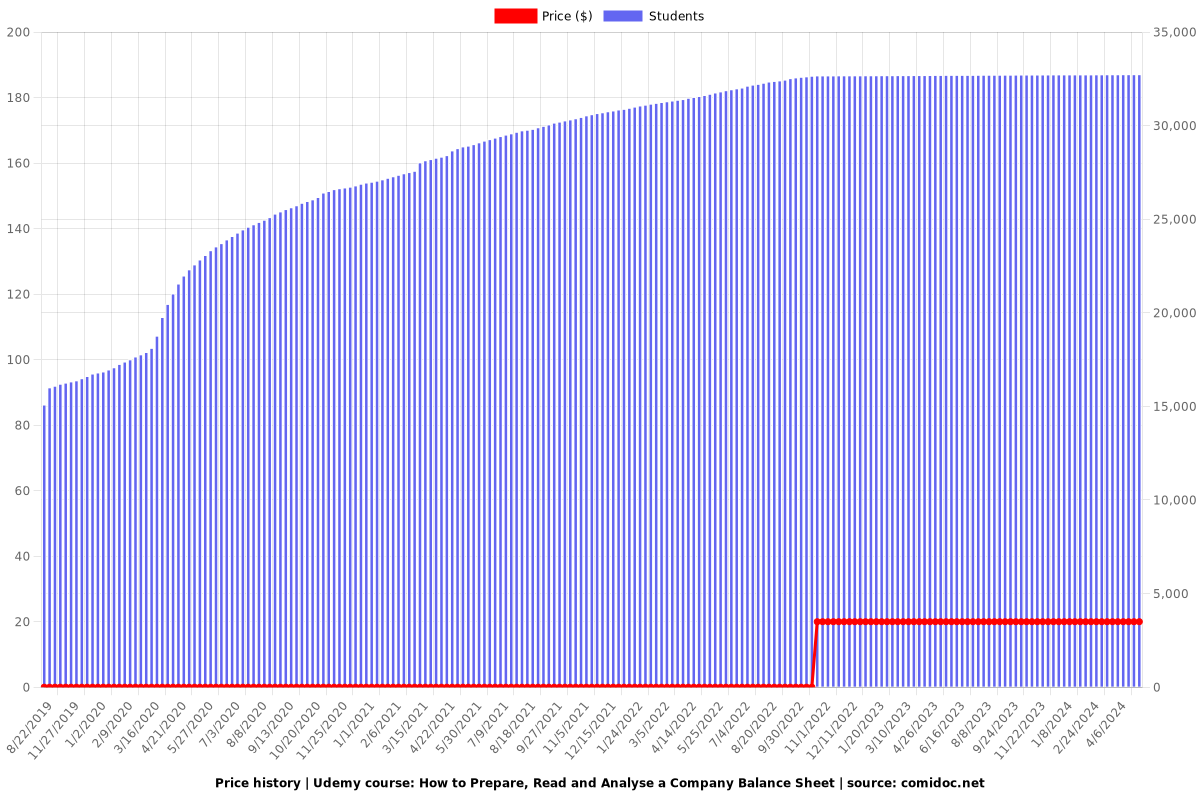

Price

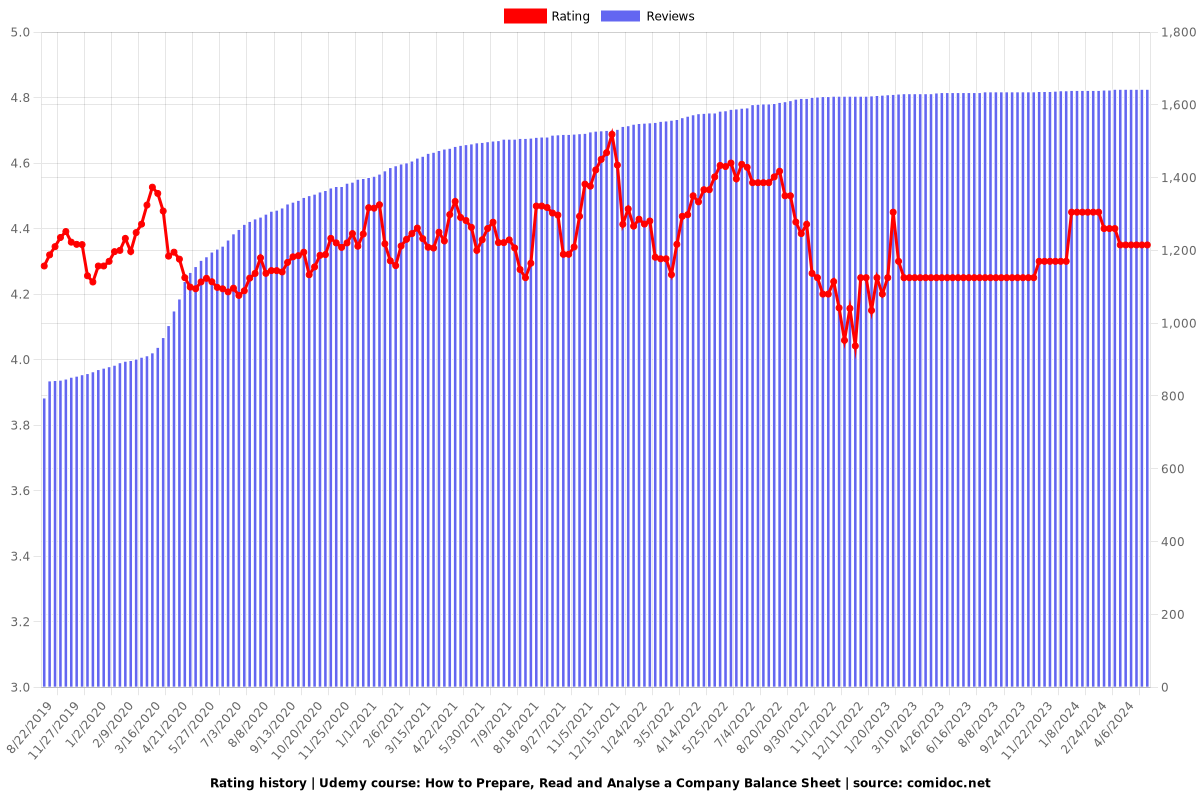

Rating

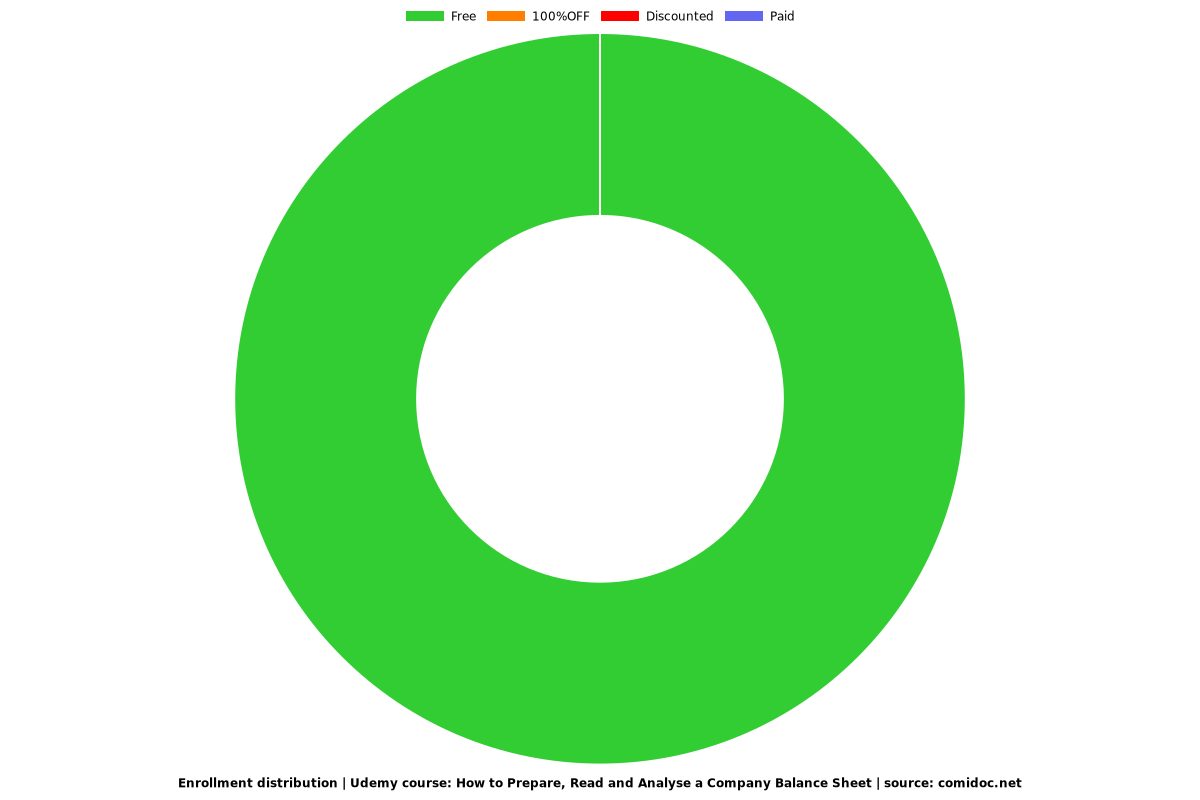

Enrollment distribution