An insider's view of Basel 3 Derivative capital in MS Excel

This course is designed for any professional who want to work in Risk/Capital management desk of an Investment Bank.

What you will learn

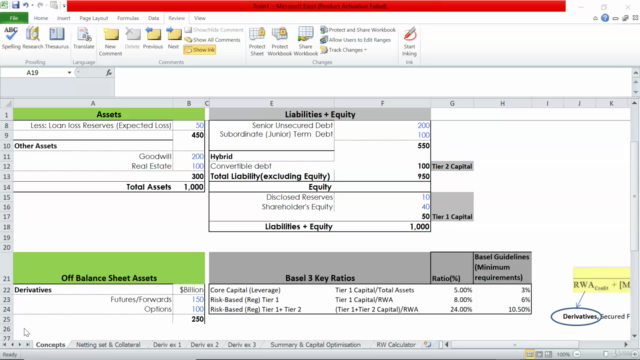

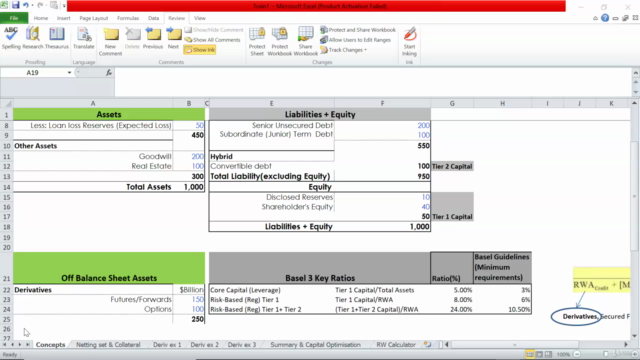

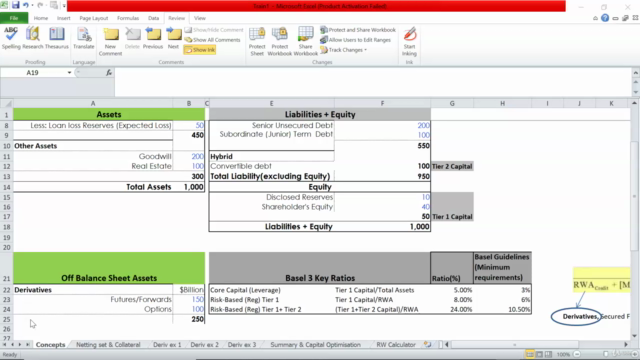

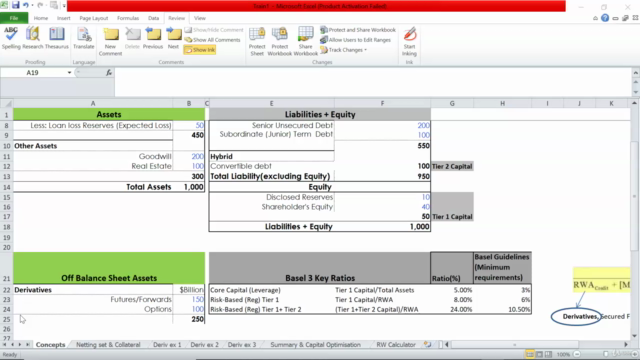

A full understanding of counterparty credit risk capital calculation for Derivatives as per Basel 3 in Excel including capital optimisation strategies.

Excel sheet provided as part of the course for conceptual understanding, doing simulations and scenario analysis.

This is currently the most hot/challenging topic for investment & commercial banks.

The course covers all the necessary concepts and integrates bank's balance sheet, Basel 3 key ratios, RWA derivation and Basel 3 derivatives capital.

The calculation involves all scenarios and simulation from scratch in Excel step by step which assumes the student needs no previous experience of Basel 3.

After this course, i can guarantee you will not only gain knowledge and appreciation of Basel 3 derivatives calculations but will know in detail how banks calculate & optimise their derivative capital.

This is not a theoretical Basel 3 course, which you will find plenty online. This is targeted for students and professionals who want a senior/consultant role in banks.

The course is for all levels from beginners to advance. This course gives you an insider's view of capital management for Derivatives.

You will also learn how banks model internal rating based risk weights using Merton and Vasicek credit risk models step by step.

Why take this course?

This course offers an unbelievable Return on Investments. This is not a theoretical course like thousands available online for Basel 3. I have spent years in designing this course in MS Excel (Excel sheet provided as part of this course for conceptual understanding, doing simulations and scenario analysis) through my over 10 years of risk management consulting experience across several Investment Banks in Basel 3 and Capital Optimisation. When you take this course, you will feel, you are sitting in a bank's risk management desk as it's outlined in a way exactly resembles how banks analyse real data from their front office system.

Learn, understand & simulate in Excel- Derivative capital calculation by understanding all components what makes Exposure at Default( EAD): Notional Amount, Mark to market, Gross/Net EAD, Gross/Net PFE (Potential future exposure), Incurred CVA (Credit Value Adjustment), Risk weighted Assets (RWA) & Capital impact under Standardised (STND) Approach used by 50% of banks - A look up table which is based on counterparty exposure class [ Sovereign, Institutions, Corporates] and their external rating given by rating agencies like Moody's, S&P, Fitch and Internal.

Also calculate Risk weighted Assets (RWA) & Capital impact under more advanced Internal Rating Based (IRB) Approach used by remaining 50% of big banks which needs Regulator's approval - Derive risk weights of counterparty through variables like Probability of Default (PD), Loss Given Default (LGD), Weighted average maturity (WAM). Most importantly understand these concepts.

We will also take a deep dive into various capital optimisation strategies of reducing RWA and improving capital ratios. My expertise include capital management, which i will share details with you which is currently used in most banks and will be the most important KPI for all big banks in future.

As a part of Premium lectures, enter into advanced risk modelling concepts where we derive internal rating risk weights in excel for all counterparties with given PD, LGD, correlation, weighted maturity by using Merton & Vasicek model for credit risk. I will take you step by step and make everything absolutely easy to understand, so you can explain it to others!.

I always assume when training in banks, audience have no previous background of Basel 3 or capital management, so students don't need any previous background (only basic excel knowledge is needed). Post this course, you can easily get a great job in Risk/Capital management within any top IB's or Commercial banks. Even if you don't want a career in Risk/Capital management, you would know in great depth about the hottest topic in banking industry. Happy learning!

Screenshots

Reviews

Charts

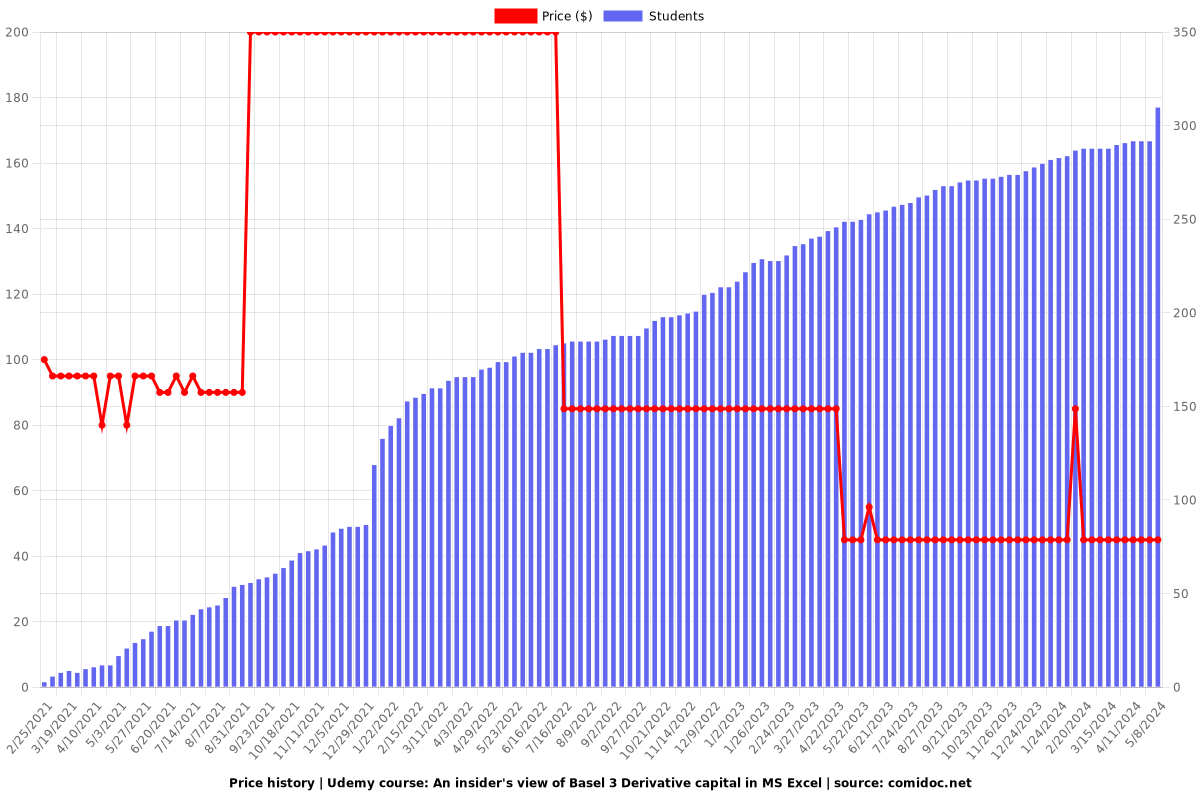

Price

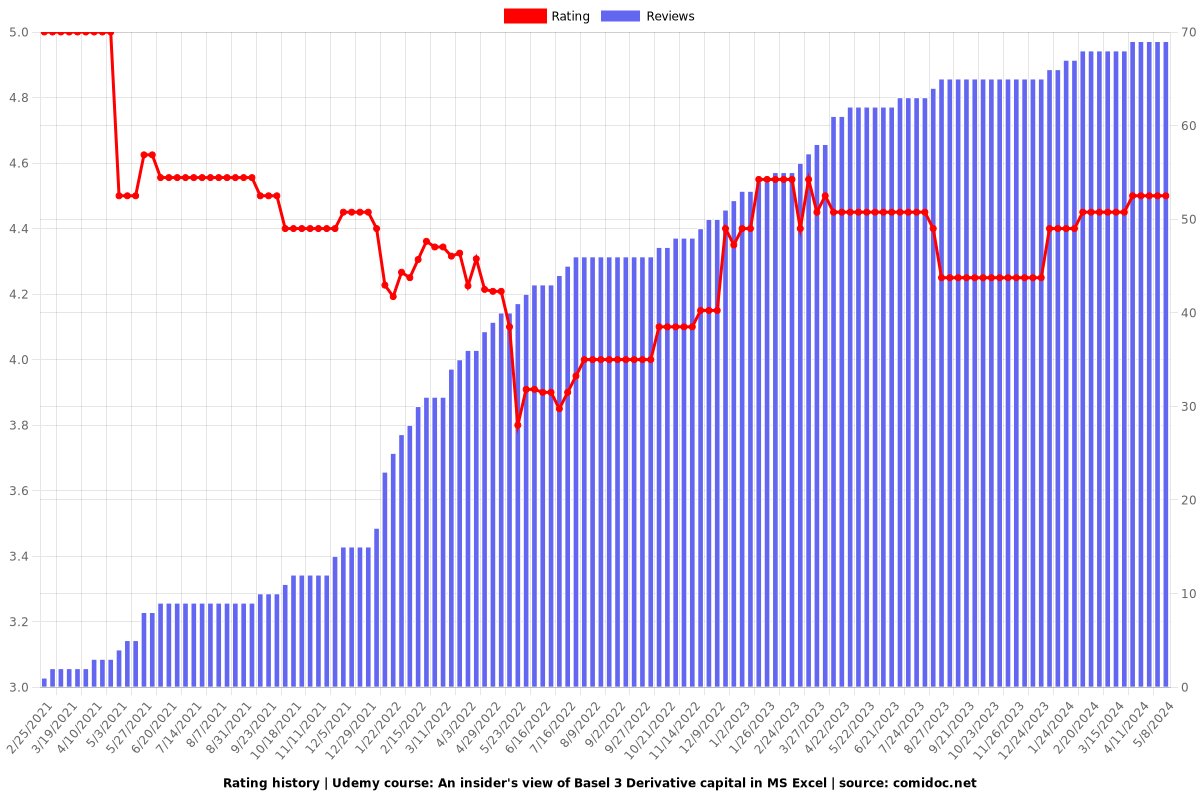

Rating

Enrollment distribution