Time Value of Money & Capital Budgeting - Present Value

Mastering Financial Decision-Making: Time Value of Money & Capital Budgeting for Long-Term Success

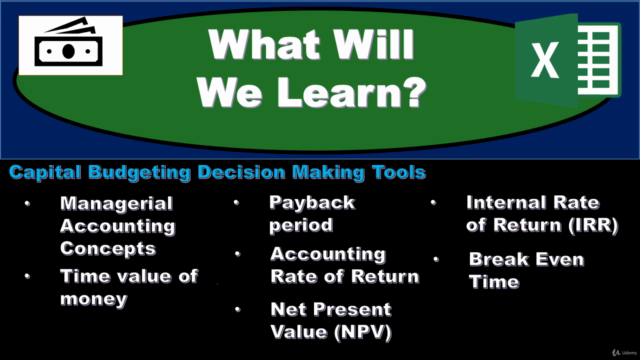

What you will learn

Analyze the importance of the time value of money in long-term decision-making, demonstrating a deep understanding of its impact and implications.

Apply various methods, including formulas, tables, and Excel functions, to calculate present value and future value in different scenarios.

Evaluate capital budgeting decisions using net present value (NPV) analysis, internal rate of return (IRR), and accounting rate of return, considering the time

Synthesize and compare different decision-making tools, such as payback period and internal break-even time calculations, to make informed long-term decisions.

Create financial models and perform calculations using spreadsheet software to assess the financial feasibility and profitability of capital projects.

Evaluate and interpret the results of financial analysis, providing insights into investment opportunities and their potential impact on organizational success.

Design strategic financial plans considering the time value of money and capital budgeting principles to optimize resource allocation and achieve long-term goal

Apply critical thinking skills to analyze and solve complex financial problems related to the time value of money and capital budgeting decisions.

Reflect on ethical considerations in financial decision-making, considering the impact on stakeholders and the broader business environment.

Why take this course?

This comprehensive course is designed to provide learners with a deep understanding of the time value of money and its application in capital budgeting decisions. Whether you are an aspiring finance professional, an entrepreneur, or an individual looking to make informed long-term financial choices, this course equips you with the essential tools and knowledge needed to excel.

In this course, we will delve into the core concepts and objectives of managerial accounting, shifting our mindset from financial accounting to managerial decision-making. By exploring the time value of money, we will cover key topics such as present value, future value, and their practical calculations using formulas, tables, and Excel functions.

One of the main focuses of this course is to emphasize the significance of time value of money in both business and personal decision-making processes. Capital budgeting decisions, which involve substantial dollar amounts and impact multiple periods, serve as ideal scenarios for understanding and applying the concepts related to the time value of money.

We will start by thoroughly explaining present value analysis, enabling you to calculate and apply the present value of a single amount and present value of an annuity using various methods, including formulas, tables, and Excel functions. Through numerous examples and practice exercises, you will gain hands-on experience in manipulating data and calculating present values effectively.

The course will also cover future value analysis, providing you with a solid understanding of calculating and interpreting the future value of a single amount and future value of an annuity. We will explore different approaches to these calculations, including formulas, tables, and Excel functions, empowering you to make informed decisions about future financial outcomes.

Additionally, we will examine the practical application of time value of money and other decision-making tools in capital budgeting. By running multiple scenarios and case studies, we will explore how capital budgeting decisions, which involve long-term implications and the consideration of the time value of money, can be analyzed and evaluated effectively.

You will learn how to calculate and interpret the payback period, a useful tool for assessing when the initial investment will be recovered. We will also discuss the accounting rate of return and its relevance in evaluating profitability within capital budgeting decisions.

A significant part of this course will focus on net present value (NPV) analysis, the primary tool for considering the time value of money in capital budgeting decision-making. Through numerous examples and practical exercises, you will gain expertise in using NPV calculations to evaluate investment opportunities and make informed long-term decisions.

Furthermore, we will explore the internal rate of return (IRR) and its relationship to NPV. By comparing and contrasting these metrics, you will develop a comprehensive understanding of their implications in assessing project profitability.

Lastly, we will analyze internal break-even time (BET) calculations, providing you with the ability to determine the time required to break even on a capital investment, while taking into account the time value of money.

Throughout the course, you will engage in practical exercises, real-world case studies, and hands-on applications using spreadsheet software, enabling you to develop the skills and confidence needed to make sound financial decisions.

Join us on this exciting journey to master the art of long-term decision-making. Enroll today and unlock the key concepts and tools that will propel your financial decision-making abilities to new heights.

Screenshots

Reviews

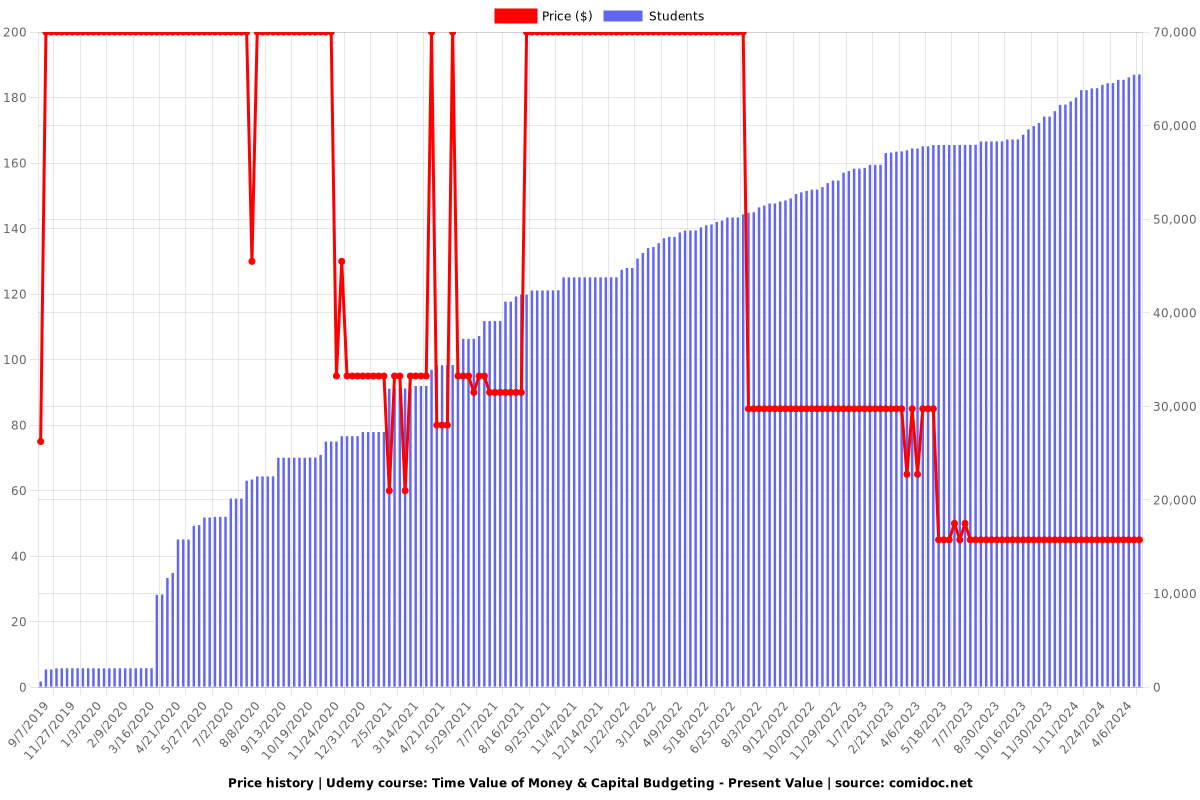

Charts

Price

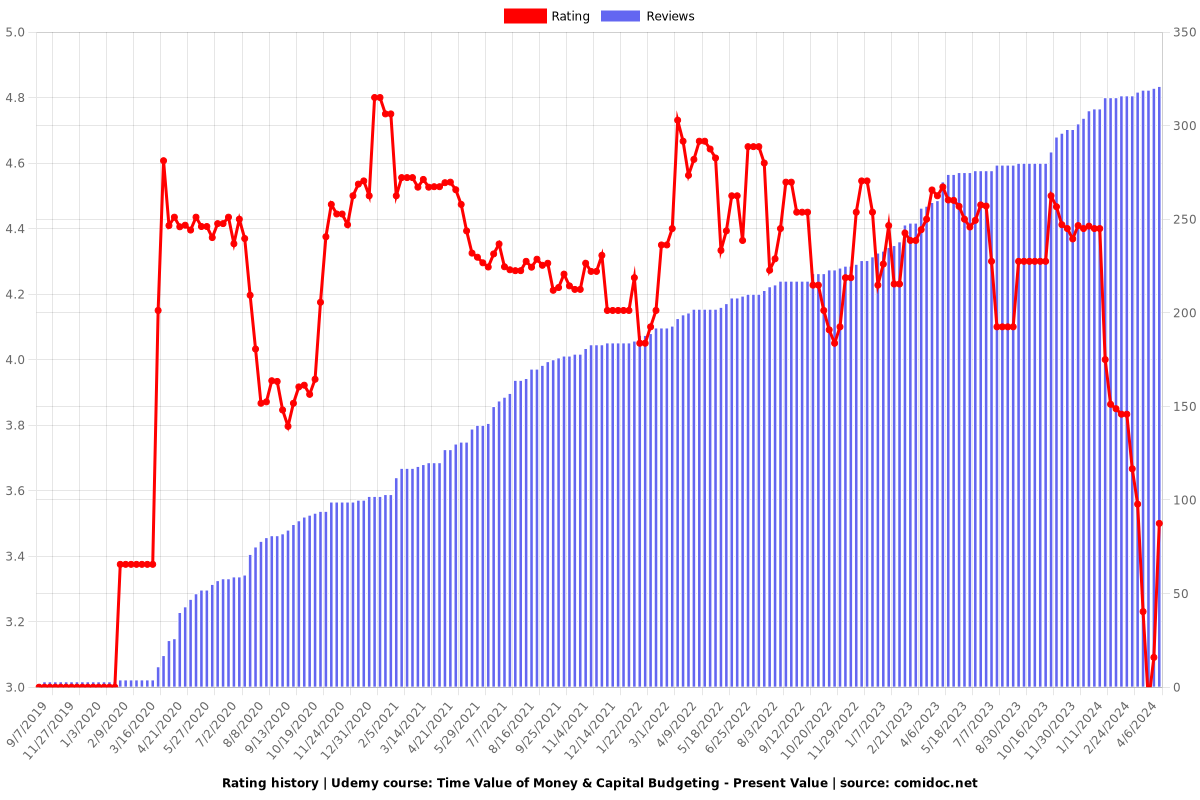

Rating

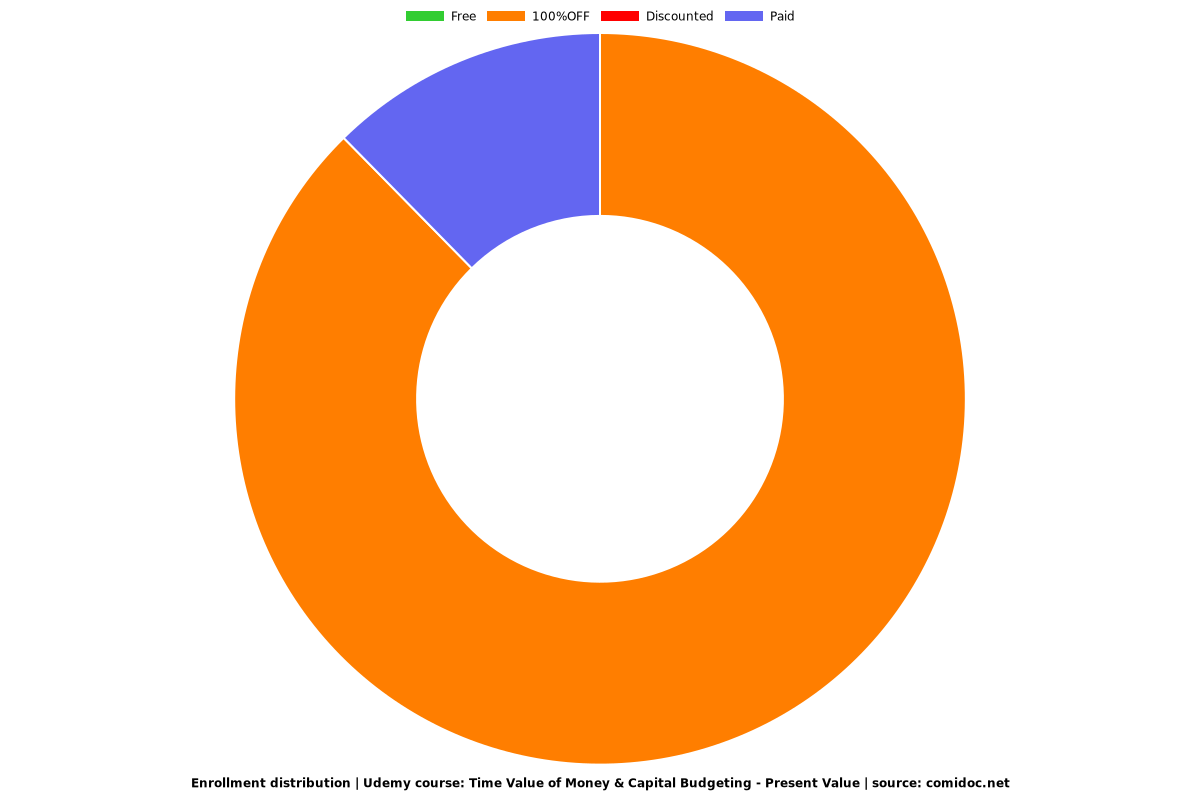

Enrollment distribution

Coupons

| Submit by | Date | Coupon Code | Discount | Emitted/Used | Status |

|---|---|---|---|---|---|

| Lee Jia Cheng | 3/26/2020 | F03E62B4F5D7978F13FA | 100% OFF | 40000/6326 | expired |

| Lee Jia Cheng | 4/10/2020 | 6F7E6CE86A05F4B95287 | 100% OFF | 40000/1722 | expired |

| - | 4/21/2020 | 7F69065B78E00823366D | 100% OFF | 40000/4064 | expired |

| Angelcrc Seven | 5/13/2020 | 048D3EF1D6CCA4CE72ED | 100% OFF | 40000/1452 | expired |

| Angelcrc Seven | 5/26/2020 | 44321278C5E8DEE85344 | 100% OFF | 40000/869 | expired |

| - | 7/4/2020 | E05E802ABA8F633562C4 | 100% OFF | 40000/1788 | expired |

| - | 7/27/2020 | 413287E205E0EAE7708D | 100% OFF | 40000/1877 | expired |

| - | 8/7/2020 | E2BD81F421DA9C33856C | 100% OFF | 40000/453 | expired |

| Angelcrc Seven | 9/6/2020 | 7674403DC2A2CB3C1A14 | 100% OFF | 40000/1976 | expired |

| - | 10/24/2020 | 9950D1369CBDBE7A3AED | 100% OFF | 40000/23 | expired |

| - | 11/9/2020 | 353099189D7E0DA4964C | 100% OFF | 40000/1620 | expired |

| - | 12/8/2020 | 8752C4F708D98A56044A | 100% OFF | 40000/532 | expired |

| - | 1/2/2021 | 92101979DDE3EC9BDCE6 | 100% OFF | 40000/435 | expired |

| - | 2/9/2021 | 864136359B292F64CA6F | 100% OFF | 40000/4579 | expired |

| - | 3/15/2021 | C1E2221B7D56AC63E9BC | 100% OFF | 40000/259 | expired |

| - | 4/11/2021 | 4AB14F5774441D385A34 | 100% OFF | 40000/2062 | expired |

| - | 5/12/2021 | B4505D6B10EC74113E3E | 95% OFF | expired | |

| - | 5/24/2021 | 707D42296B4CA3CA1FAE | 100% OFF | 40000/2729 | expired |

| - | 6/22/2021 | 991ECC91288E7339C4C1 | 100% OFF | 40000/1813 | expired |

| - | 7/26/2021 | 98A0E9AEA7888DFDE74A | 100% OFF | 40000/1985 | expired |

| - | 10/18/2021 | E559862F6B8910ADBD8F | 100% OFF | 40000/1323 | expired |

| - | 1/21/2022 | 1541498DC26A263EBC72 | 100% OFF | 1000/981 | expired |

| - | 2/10/2022 | BC5A8511CC4BE24E375A | 100% OFF | 1000/954 | expired |

| Ignacio Castro | 2/17/2022 | 314D48C9CD548DF5CD32 | 100% OFF | 1000/602 | expired |

| Angelcrc Seven | 2/26/2022 | AB815E8DA1DA300D0A1D | 100% OFF | 1000/612 | expired |

| Angelcrc Seven | 3/10/2022 | 47390BAF4B17C2A8BD9C | 100% OFF | 1000/403 | expired |

| Angelcrc Seven | 3/17/2022 | CCAD7CA752A905C87443 | 100% OFF | 1000/427 | expired |

| - | 3/24/2022 | FC4AC01DCF80C3F7C1B2 | 100% OFF | 1000/240 | expired |

| - | 4/10/2022 | BB2864C40CC512D21500 | 100% OFF | 1000/452 | expired |

| Angelcrc Seven | 4/19/2022 | D89493848CB0C91E71EF | 100% OFF | 1000/215 | expired |

| Angelcrc Seven | 5/14/2022 | 7A17A3A37668E7901E4A | 100% OFF | 1000/327 | expired |

| Ignacio Castro | 5/23/2022 | 468F67F61F43D0455855 | 100% OFF | 1000/298 | expired |

| - | 6/16/2022 | BC87E6AFC095F4AE999E | 100% OFF | 1000/177 | expired |

| - | 6/20/2022 | 7F8C76DF3E2D64BE9D7E | 100% OFF | 1000/270 | expired |

| - | 7/11/2022 | 69B0EA810BB481F23BBD | 100% OFF | 1000/281 | expired |

| - | 7/18/2022 | A7044AD54A5E7278BA94 | 100% OFF | 1000/213 | expired |

| - | 8/7/2022 | 020DBB4BCB0545B7F175 | 100% OFF | 1000/528 | expired |

| - | 8/21/2022 | 7BE952EE6FE015AF2EA8 | 100% OFF | 1000/256 | expired |

| - | 9/8/2022 | 6DBE6647D882587E9767 | 100% OFF | 1000/204 | expired |

| Angelcrc Seven | 9/19/2022 | 401832522577C336F94A | 100% OFF | 1000/284 | expired |

| - | 9/26/2022 | 4504D0ACB8A95F5C31ED | 100% OFF | 1000/504 | expired |

| - | 10/6/2022 | B1E1422BB647BE10654A | 100% OFF | 1000/175 | expired |

| - | 10/13/2022 | 6688858D47DF6493710B | 100% OFF | 1000/158 | expired |

| - | 10/20/2022 | 240B52BEE8BC319398A1 | 100% OFF | 1000/127 | expired |

| - | 11/7/2022 | D7C461E674B70E08C470 | 100% OFF | 1000/269 | expired |

| - | 11/14/2022 | A7F0D6BEFE1B9EC81DDF | 100% OFF | 1000/434 | expired |

| - | 11/21/2022 | 6B4CEC51EAAC1EEFF64F | 100% OFF | 1000/261 | expired |

| - | 12/6/2022 | 90019230F3E311A72C0B | 100% OFF | 1000/831 | expired |

| - | 12/14/2022 | 866DF78236F989B3A103 | 100% OFF | 1000/168 | expired |

| - | 12/24/2022 | EE9826658BE0704313B3 | 100% OFF | 1000/252 | expired |

| - | 1/17/2023 | 8DDC31D02042FB9AE36D | 100% OFF | 1000/324 | expired |

| - | 2/9/2023 | 4A991F03B35A3592B013 | 100% OFF | 1000/584 | expired |

| - | 2/27/2023 | 2423347BDA804F0D2041 | 100% OFF | 1000/46 | expired |

| - | 3/30/2023 | FC6136DE79CA9E48FB78 | 100% OFF | 1000/189 | expired |

| - | 4/13/2023 | D16E54246642088D8CBE | 100% OFF | 1000/219 | expired |

| - | 4/30/2023 | 4EEC82F988327E838BE6 | 100% OFF | 1000/123 | expired |

| - | 8/4/2023 | CCA519FEC8719F9D3A31 | 100% OFF | 1000/355 | expired |

| - | 9/18/2023 | CFE6D41A815229BDE87C | 100% OFF | 1000/196 | expired |

| - | 10/16/2023 | A53F1DA3981BCC9D2E8B | 100% OFF | 1000/405 | expired |

| - | 10/23/2023 | C2B4ADA209A47C7A19A0 | 100% OFF | 1000/666 | expired |

| - | 11/3/2023 | 83815CE25DE7D8CE46A4 | 100% OFF | 1000/350 | expired |

| Kevin2001 | 11/13/2023 | 6429EF9483BD95155902 | 100% OFF | 1000/314 | expired |

| - | 11/21/2023 | D2CAE3B906CA8AD95090 | 100% OFF | 1000/681 | expired |

| - | 12/8/2023 | 7CB80A82254938ECCBFF | 100% OFF | 1000/570 | expired |

| - | 12/21/2023 | D9496A00CD0A6DFB7A2F | 100% OFF | 1000/695 | expired |

| - | 1/7/2024 | 40FC0DD837D162C46B71 | 100% OFF | 1000/329 | expired |

| - | 1/15/2024 | 893E0A82286E200DE4B7 | 100% OFF | 1000/433 | expired |

| - | 2/29/2024 | 80D30A902BA343C57A27 | 100% OFF | 1000/437 | expired |

| - | 3/20/2024 | ADD1EF470F6DBA5C9BA7 | 100% OFF | 1000/352 | expired |

| - | 4/8/2024 | 491CC6FBC531FC9330CD | 100% OFF | 1000/298 | expired |

| - | 4/17/2024 | A7352718265C3C673FDB | 100% OFF | 1000/234 | working |