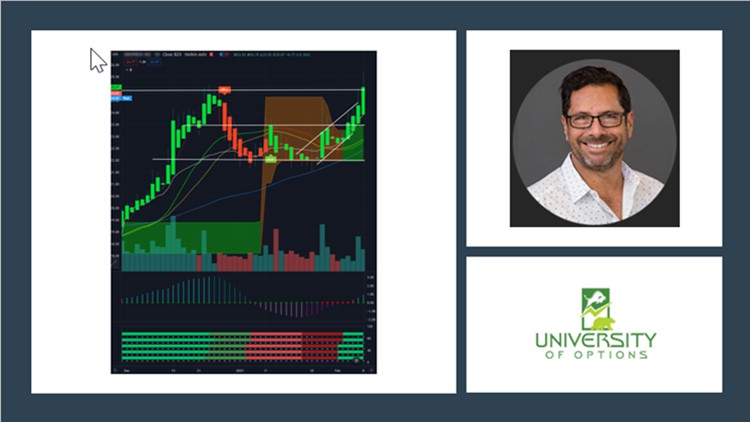

Catching a short squeeze pattern and trade with call options

Using Low Cost Call options to exploit big moves in market.

4.72 (48 reviews)

272

students

2.5 hours

content

Feb 2021

last update

$49.99

regular price

What you will learn

This course teaches the very specific art of finding a stock before it breaks out.

When you buy a stock as it is breaking out, your risk is reduced dramatically

We use low cost Call Options which require minimal capital and provide huge returns or 100-600% per trade!

Learn how to place a stop loss so that your risk is minimal

Learn how to pick trades that earn you AT LEAST $3.00 for every $1.00 you put at risk

For our beginners, you can learn the very basics of options trading

Screenshots

3831192

udemy ID

2/7/2021

course created date

2/15/2021

course indexed date

Bot

course submited by