QuickBooks Online Complex Issues And Advanced Techniques

How To Prove An Entire Set Of QuickBooks Online Records Are Correct To The Last Detail

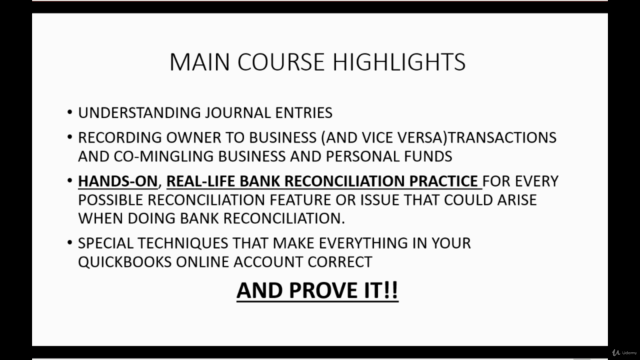

What you will learn

How To Prove Your Entire Set Of QuickBooks Online Records Are Correct To The Last Detail

How To Use Every Advanced Feature Related To Customer's And Receivables In QuickBooks Online

How To Use Every Advanced Feature Related To Vendor's And Payables In QuickBooks Online

How To Manage File Attachements In QuickBooks Online

How To Record Credit Card Transactions In QuickBooks Online

How To Use Register Windows In QuickBooks Online

How To Record Journal Entries In QuickBooks Online

How To Record Owner To Business And Business To Owner Transactions In QuickBooks Online

How To Manage Owner's Equity Accounts In QuickBooks Online

How To Do Bank Reconciliation In QuickBooks Online

How To Do Credit Card Reconciliation In QuickBooks Online

How To Use Every Advanced Feature Of Bank Reconciliation In QuickBooks Online

How To Manage Every Common Mistake When Doing Bank Reconciliation

How To Reconcile Your Records With Customers And Vendors

How To Find And Correct Mistaken Classifiaction Of Expense Category

Why take this course?

Would you like to be able to guarantee that your entire set of QuickBooks online records are correct to The Last Detail? Then you should choose this course: QuickBooks Online Complex Issues And Advanced Techniques. It's the only course ever in history that teaches how to prove an entire set of accounting records in QuickBooks online are correct to the last detail!

This revolutionary new QuickBooks online instructional video series includes a video lesson for every advanced and complex issue, transaction or feature, that could ever be included in a transaction in QuickBooks that involves receivables, payables, banking, credit card or journal entry transactions.

Theses QuickBooks topics will be shown with real life examples and follow along step by step demonstrations that make for clear, effective tutorials and are the most helpful when learning QuickBooks online.

This course is the “sequel” to the original, top rated course right here on Udemy: “Mastering QuickBooks Online”. You are guaranteed that every “on the job” QuickBooks problem, challenge or issue has a QuickBooks solution and this course is the best way to learn them. It has the best QuickBooks help available for complex QuickBooks issues and advanced level transactions with details that involve extra attention and sometimes problem-solving skills applied to QuickBooks online.

Most of the QuickBooks topics here have been requested by students who took the original course. I have included every topic that was requested and many bonus QuickBooks Online topics to make for complete, easy and fun learning.

In fact, there's even a section that teaches about journal entries and owner's equity transactions for transactions between the owner of the business and the business itself. You will learn how to record QuickBooks transactions when the owner co-mingled funds with the business account by putting in non-business money in to, or taking money out of, your business for non-business spending. There’s no better QuickBooks Online help with these topics then the video class lectures right here in this ground-breaking course. The list of topics in this course is so extensive that you really need to read the topic list below very carefully to make sure that it will include any topic that you're looking for:

• CUSTOMER REFUND RECEIPTS

• CREATING CUSTOMER CREDIT MEMOS

• CUSTOMER REFUNDS FOR PAID INVOICES

• RECORDING CUSTOMER PRE-PAYMENTS

• USING THE INVOICE DEPOSIT FEATURE

• SETTING UP AND RECORDING CUSTOMER DISCOUNTS

• SETTING UP CUSTOMER DISCOUNT TERMS

• CUSTOMERS AND ACCOUNTS RECEIVABLES EARLY PAY DISCOUNT

• RECORDING CUSTOMER BOUNCED CHECKS

• MANAGING CUSTOMER MONTHLY STATEMENTS

• RECONCILING RECEIVABLES WITH CUSTOMERS

• FIXING MISAPPLIED PAYMENTS

• USING FILE ATTACHMENT FEATURES

• PRINTING CHECKS IN QUICKBOOKS ONLINE

• RECORDING BILL PAYMENTS WITH PROCESSING FEES

• RECORDING CHECKS AND EXPENSE REFUNDS

• ENTERING VENDOR CREDIT MEMOS

• REFUNDS OF VENDOR PAID BILLS

• VENDOR DISCOUNT TERMS

• PREPAID VENDOR EXPENSES

• RECONCILING VENDOR STATEMENTS

• MANAGING COMPANY CREDIT CARD CHARGES AND PAYMENTS

• USING ACCOUNT REGISTERS WINDOW

• UNDERSTANDING AND MAKING JOURNAL ENTRIES

• UNDERSTANDING AND ENTERING OWNERS EQUITY TRANSACTIONS

• RECORDING EVENTS WHERE THE OWNER CO-MINGLES FUNDS

• REAL-LIFE HANDS-ON BANK RECONCILIATION PRACTICE

• USING ALL QUICKBOOKS ONLINE BANK RECONCILIATION FEATURES

• USING THE QUICKBOOKS ONLINE DISCREPANCY REPORT

• HOW TO ADJUST A BANK RECONCILIATION

• HOW TO UNDO A BANK RECONCILIATION

• PROVING ALL QUICKBOOKS ONLINE RECORDS ALL ARE CORRECT

• FINDING MISTAKEN EXPENSE CATEGORIES

• USING THE RECLASSIFY TRANSACTION TOOL

Among the more special things about this course is the revolutionary way that QuickBooks Online Bank Reconciliation is presented and practiced with real life, hands on challenges and solutions that you would normally only experience in a QuickBooks Online Bookkeeping job.

It includes reconciling with vendors and reconciling with customers and proving that your receivables and payables are independently verified and correct to The Last Detail. This follows from learning how to manage customer monthly statements and vendor monthly statements right from QuickBooks Online. You'll even learn how to make sure that you chose the right expense category and what to do to find out that all your expenses are classified correctly. We’ll even show what to do if they're not correct, so you can fix it and make it perfect.

Purchasing these QuickBooks Online classes comes with free unlimited questions that relate to the course material. I always get back to my students quickly. I enjoy helping with this because I think it helps everyone, everywhere if we all know how to keep financial records perfectly.

You will be better than everybody at QuickBooks Online once you finish this course

I'm sure it will give you everything you need, and I hope to see you there

-Mark

Screenshots

Reviews

Charts

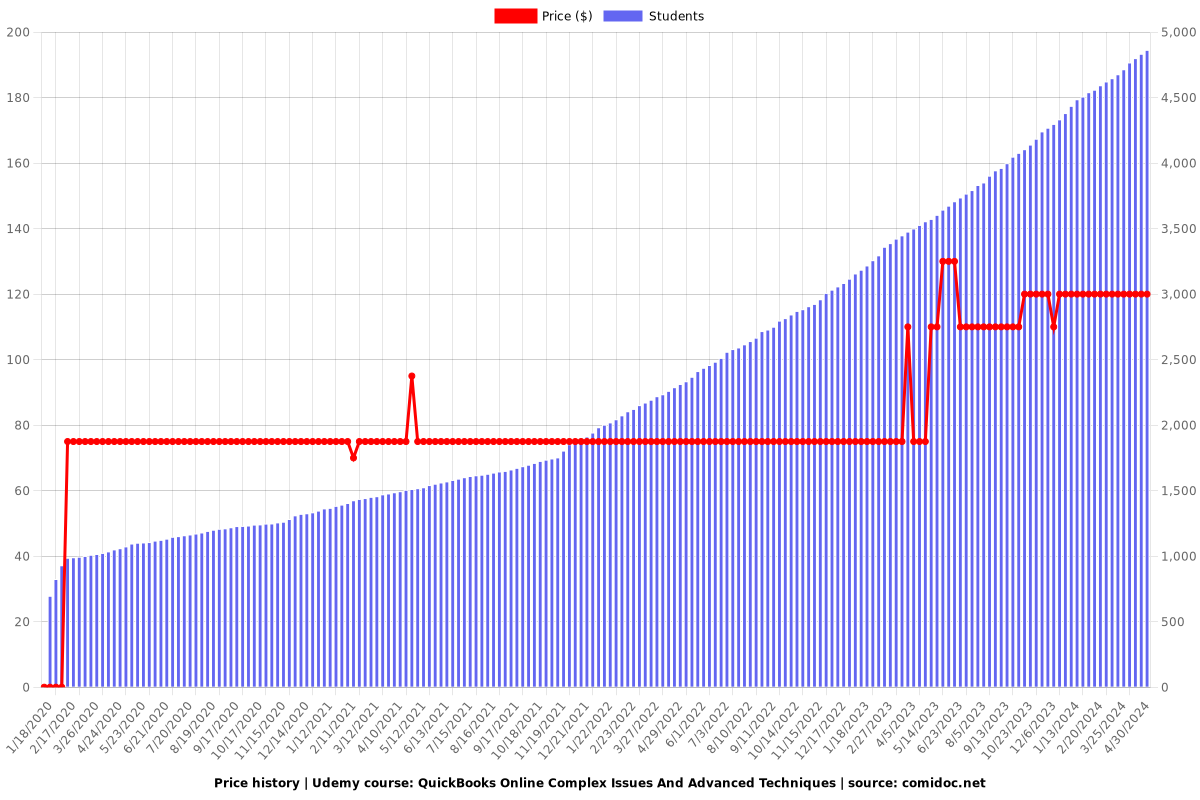

Price

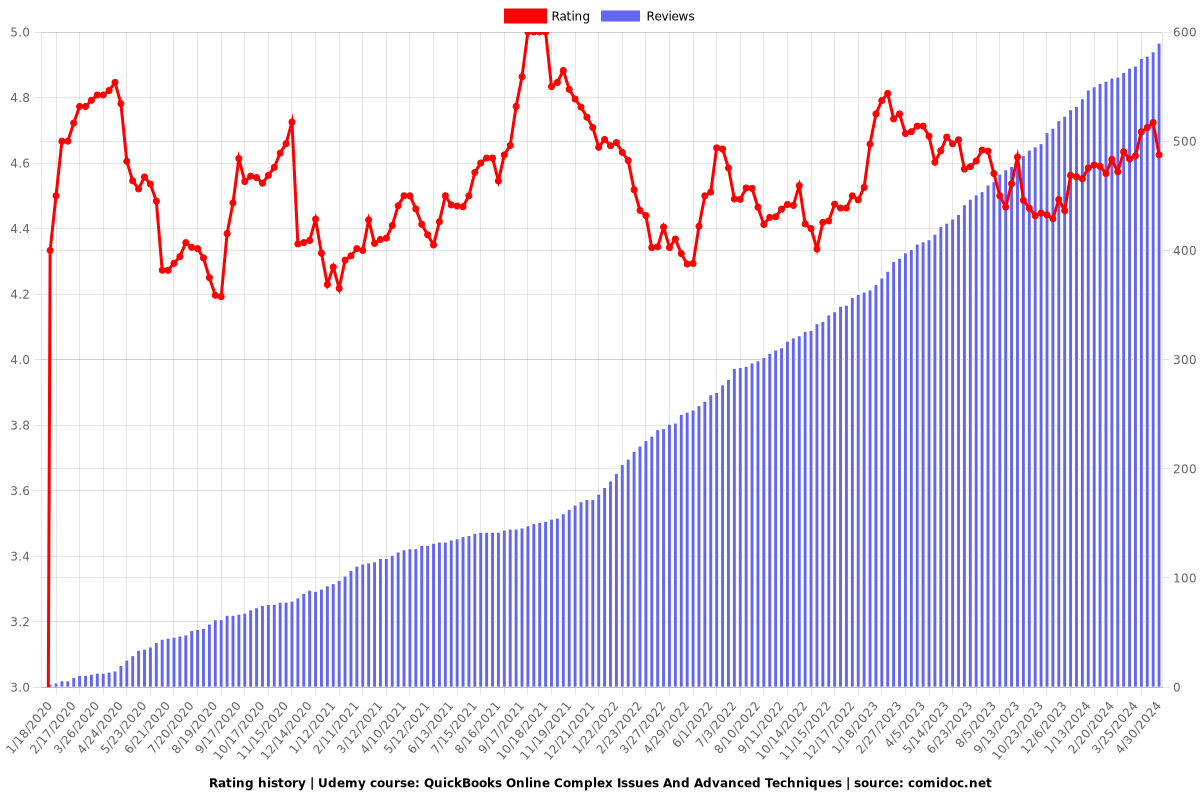

Rating

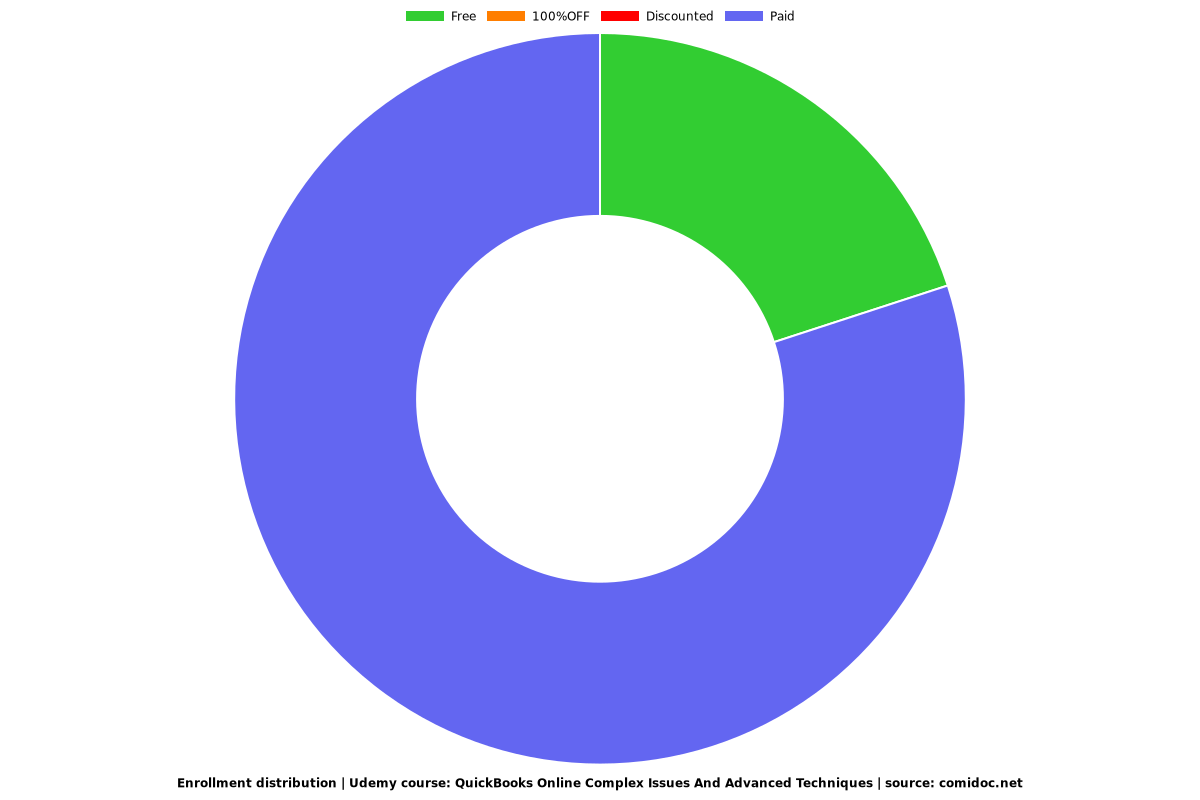

Enrollment distribution