Level 2 - Mutual Fund Investing Masterclass

Learn asset allocation, investment management, selection of funds, fund houses & advisors. Prepare to take action steps

What you will learn

Key things to know before you start investing

Key investment management basics

Power of compounding

Investing Psychology

Key aspects and know hows of market

How to choose an investment advisor

How to evaluate a fund manager

How to select a mutual fund

Where to find mutual fund information and regular updates

Key TO DOs to get started

Why take this course?

This course is designed for a global audience and not to any particular domestic market. The concepts you will learn here are universal in nature and can be applied to any market in the world.

The Mutual Fund Investing Masterclass Program is a program that aims to help you achieve your financial goals in life.

The primary objective of the Level 2 - Mutual Fund Investing Masterclass is to help you "Strategise Your Investments"

So, by the time you are done with this course, you will have a far better understanding of Investment Planning & Asset Allocation in the context of Mutual Funds.

Following are the topics covered in this course :

Factors to Consider Before You Start Investing

Investment Plan

Investable Assets

Goals

Time Horizon

Risk

Return Expectation

Age Group

Taxes

Liquidity

Legal Constraints

Special Situations

Lumpsum Investment

Regular Investment

Portfolio Review Frequency

Investment Advisor

Investment Management Basics

The Power of Compounding

Investment Discipline

Investing Psychology

Asset Allocation

Diversification

Portfolio Monitoring

Changes to Investment Plan

Performance Assessment

Market Overview

Sectors

Economic Cycles

Technological Changes

Regulatory Framework

Global Market

Challenges

Opportunities

Interest Rates

The Stock Market

The Bond Market

The Commodities Market

The Real Estate Market

Before You Hire an Investment Advisor

Industry Experience & Background

Location

Past Performance

Client Testimonials

Market Expertise

Operational Resources

Employees

Client Profile

Digital Footprint

Fee Structure

Fund House Selection

Market Position

Assets Under Management

Experienced Managers

Product Portfolio

Client Testimonials

Research Capabilities

Overall Performance

Investor Education

Operational Ease for Investor

Fund Selection

Fund Inception Date

Assets Under Management

Benchmark

Fund Manager Profile

Fund Category

Risk Profile

Past Performance

Suitability

Category Performance

Critical Assessment

Expected Return

Key Information Sources

Comparison Websites

Fund Factsheet

Mobile Platforms

Financial Media

Investment Seminars

Online Events

Fund House Presentations

Fund House Conference Calls

Investor Meets

Investment Advisor

Books & DVDs

Investor Education Sites

Online Courses

Action Steps

Decide What You Want

Prepare a Basic Investment Plan

Start Talking to Potential Advisors

Start Fund House Selection

Start Comparing Funds

Invest in Your Education

Standard Disclaimer : The material presented here is for educational purposes only. Please do your own proper due diligence. There are risks involved in markets and mutual funds. Returns are never guaranteed. The concepts discussed in this course are applicable to any mutual fund industry in the world. However, the terminology may differ for different countries or markets. No representation or warranty is made as to the accuracy, completeness or fairness of the information and opinions contained herein. This course does not endorse any fund house or any mutual fund scheme. We are not registered investment advisors with any regulator or institution in the world. We do not provide any buy/sell recommendations. We do not provide any investment tips or trading tips. We do not provide investment advice. All of our content here is for educational purposes only. Please do your own due diligence before making any financial decision.

Screenshots

Reviews

Charts

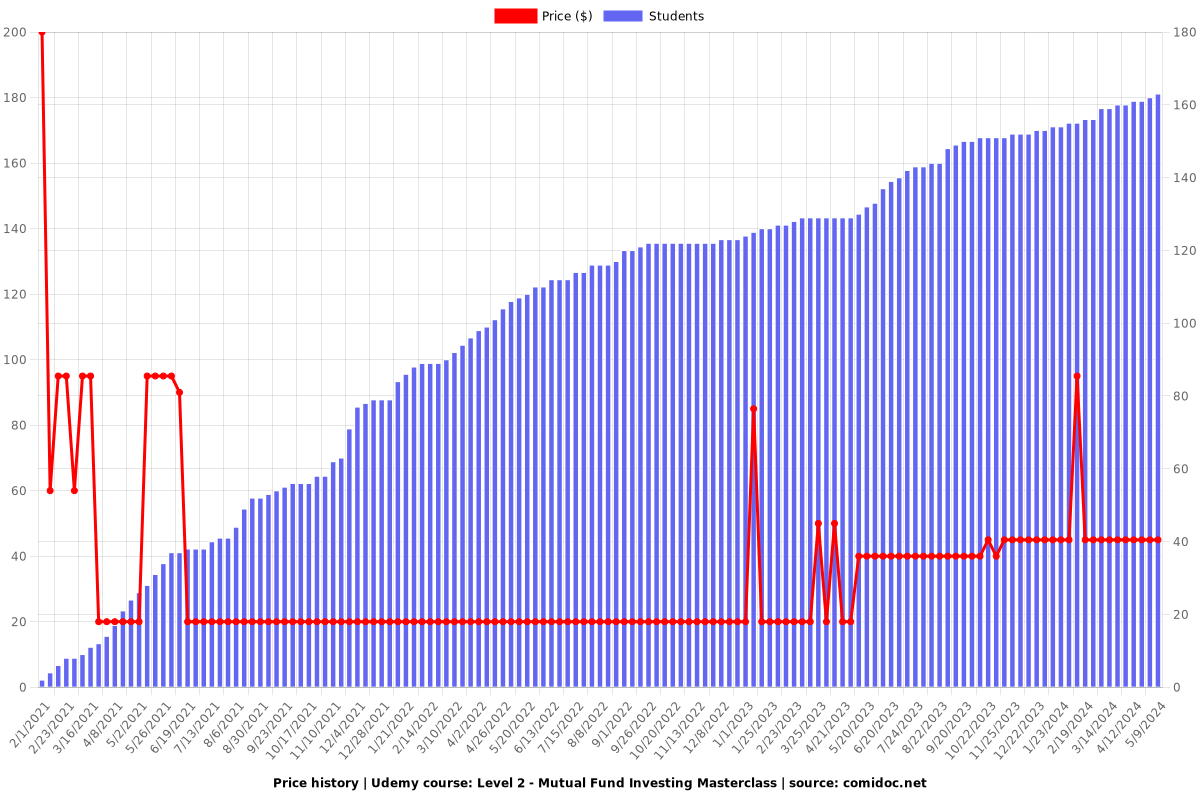

Price

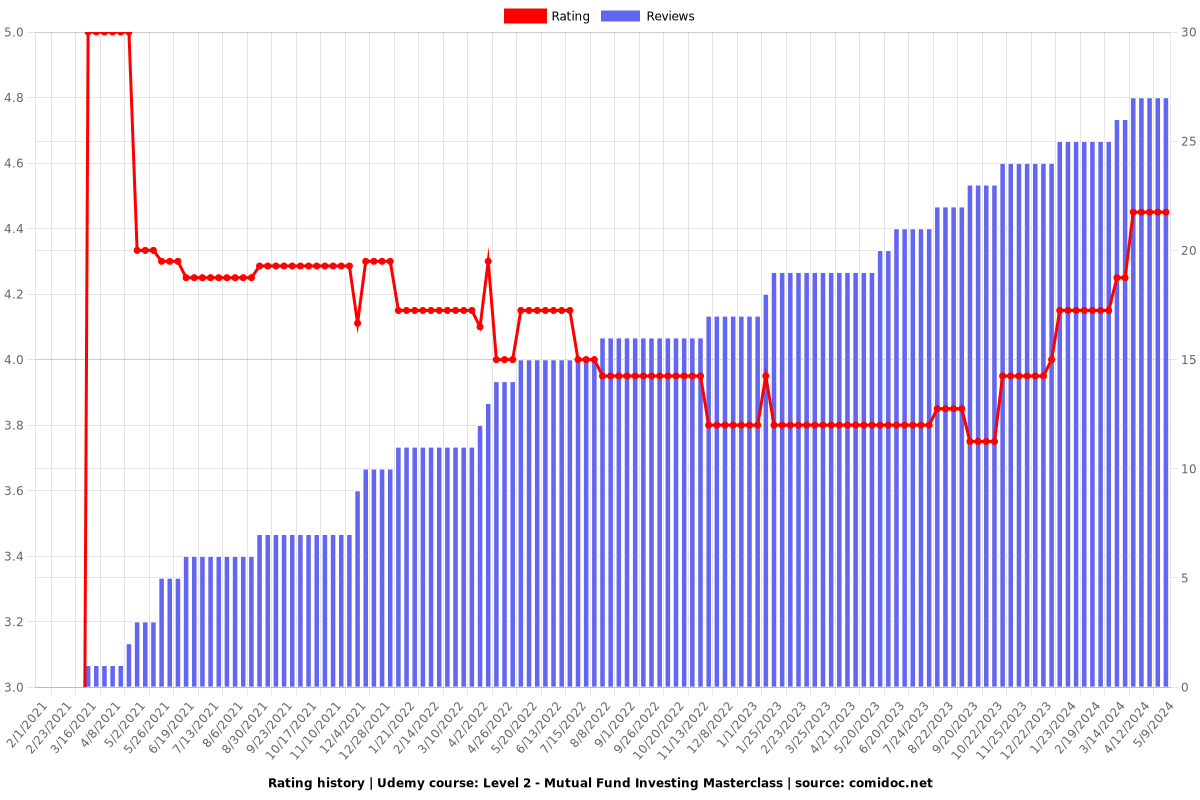

Rating

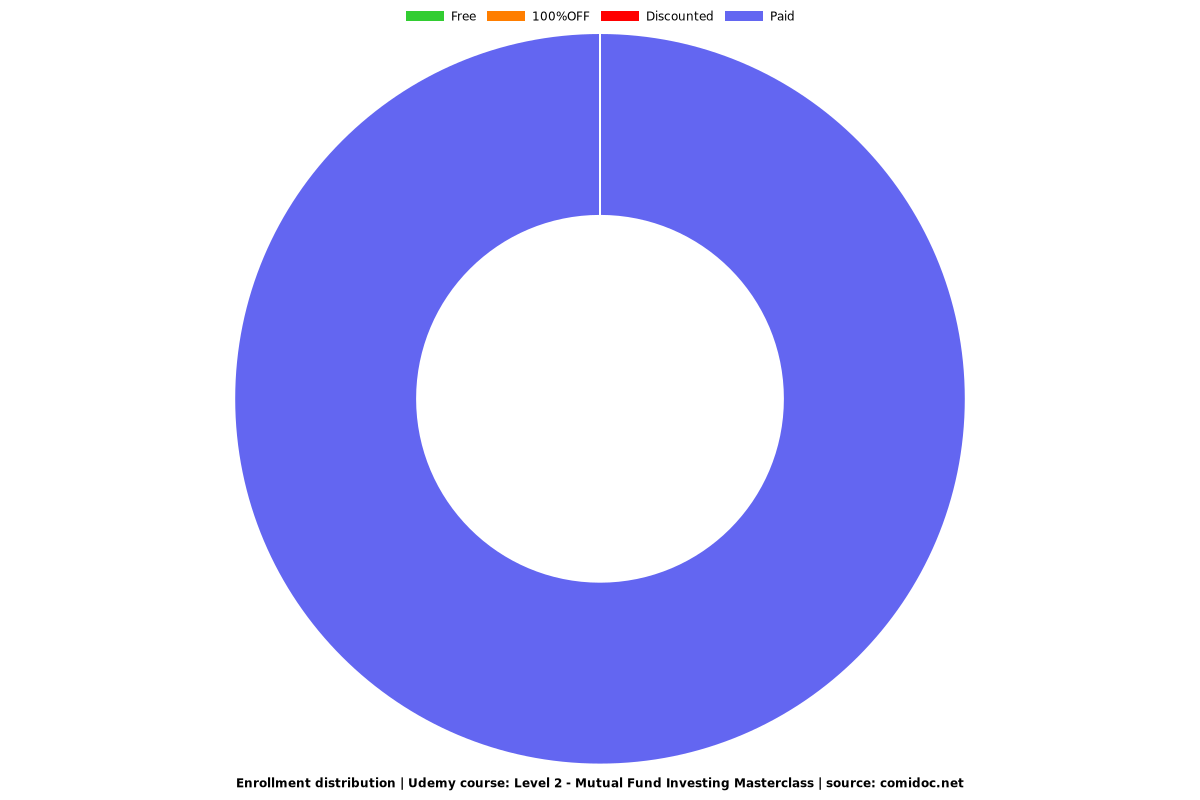

Enrollment distribution