Level 2 - Japanese Candlesticks Trading Mastery Program

Learn Advanced Candle Patterns & Know How to Use Candlesticks with Bollinger Bands, Stochastics & Powerful Round Numbers

4.75 (437 reviews)

2,297

students

8.5 hours

content

Sep 2024

last update

$74.99

regular price

What you will learn

Find Out Why "The Doji" Pattern is called as the "The Magic Doji" & Why is it a Potent Reversal Signal

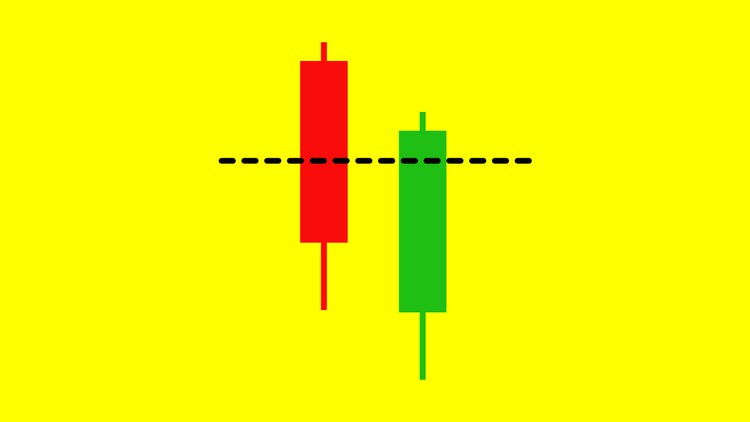

Learn Why "The Window" is "The Most" Powerful Candlestick Patterns of all you might have known before

Understand Why it is not wise to Ignore "The Stars, Shadows & Real Bodies", because of the Market Clues they provide

Learn How to Combine Candlesticks with Bollinger Bands to Trade From the Correct Side of the Market

Understand Why Stochastics When Combined with Candlesticks can provide Important Trade Confirmations

Find out the Power of Round Numbers in Combination with Candlesticks to Increase the Likelihood of Your Trades Working Out

Screenshots

Related Topics

2840960

udemy ID

2/28/2020

course created date

3/22/2020

course indexed date

Bot

course submited by