Fibonacci trading with technical analysis

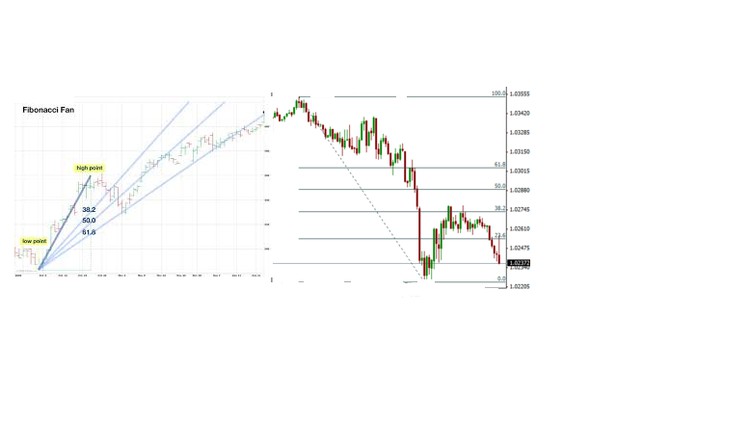

Fibonacci , Trendlines, candlesticks , Fibonacci fan ,Fibonacci Arc , Technical indicators, stock selection criteria etc

4.37 (43 reviews)

135

students

3 hours

content

Oct 2024

last update

$44.99

regular price

What you will learn

Intraday and swing trading in stock market

DAU theory

Pivot points , Fibonacci and trend lines

stock selection criteria and entry exit points

technical indicators

Candlesticks

Fibonacci - trendline, Fibonacci fan and arc trading

Trading phycology and qualities of good trader

Multiple choice Questions_ Answer self test objective type on course (Quiz)

Screenshots

Related Topics

3745484

udemy ID

1/3/2021

course created date

1/21/2021

course indexed date

Bot

course submited by