Corporate Finance #2 Financial Ratios

Gain Financial Insights and Make Informed Decisions with Ratio Analysis in Corporate Finance

What you will learn

Define the concept of ratio analysis and explain its significance in corporate finance decision-making.

Apply the DuPont System of analysis to evaluate financial performance and assess the key drivers of profitability.

Calculate and interpret the return on investment (ROI) in various scenarios, demonstrating proficiency in evaluating investment profitability.

Analyze and interpret key ratios such as return on assets, total asset turnover, and profit margin to assess operational efficiency and financial performance.

Evaluate the financial health and risk profile of an organization using the return on equity and debt-to-equity ratios.

Calculate and interpret the accounts receivable collection period to assess the effectiveness of credit and collection policies.

Assess the organization's ability to meet its interest obligations using the times interest earned and fixed charge coverage ratios.

Conduct trend analysis of return on equity to identify patterns and trends in financial performance.

Utilize ratio analysis to compare and evaluate the performance of different divisions within an organization.

Construct a projected income statement and balance sheet using ratio analysis techniques to forecast future performance.

Why take this course?

In this comprehensive course, we will explore the essential principles of ratio analysis and how it can significantly impact decision-making from a corporate finance perspective.

Ratio analysis is a powerful tool that enables us to make informed projections about future performance based on past financial statements. By utilizing the balance sheet and income statement, which serve as the primary tools for ratio analysis, we can assess an organization's past performance and current standing. More importantly, ratio analysis empowers us to project future performance and gain insights into an organization's potential trajectory.

Throughout the course, we will delve into these concepts through a series of practice problems, utilizing Microsoft Excel for practical application. Each problem will be accompanied by a downloadable worksheet with step-by-step instructional videos. You will have access to preformatted Excel worksheets, including answer keys, to work through the problems in a structured manner and reinforce your learning.

By the end of the course, you will have a comprehensive understanding of ratio analysis and the renowned DuPont System of analysis. You will be able to apply key ratios, including return on investment (ROI), return on assets, total asset turnover, and profit margin calculations, to various scenarios. Additionally, you will grasp the significance of return on equity, debt-to-equity ratios, accounts receivable collection periods, times interest earned, fixed charge coverage, and return on equity trend analysis in assessing financial performance.

Furthermore, we will explore how ratio analysis can be used to compare different divisions within an organization, providing valuable insights for strategic decision-making. Lastly, you will learn to project future performance by constructing a projected income statement and balance sheet using ratio analysis techniques.

Join us on this dynamic journey to master ratio analysis in corporate finance. Enroll today and gain the skills to analyze financial data effectively, make sound financial decisions, and project future performance with confidence.

Reviews

Charts

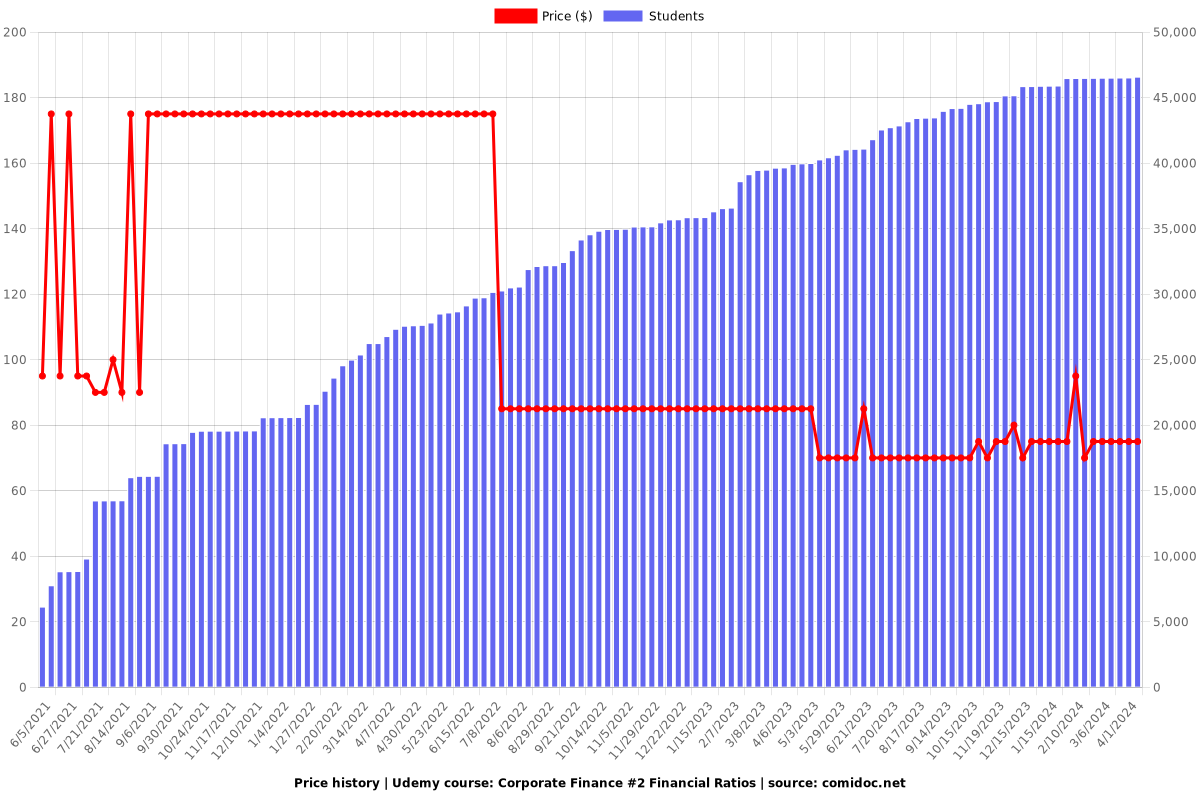

Price

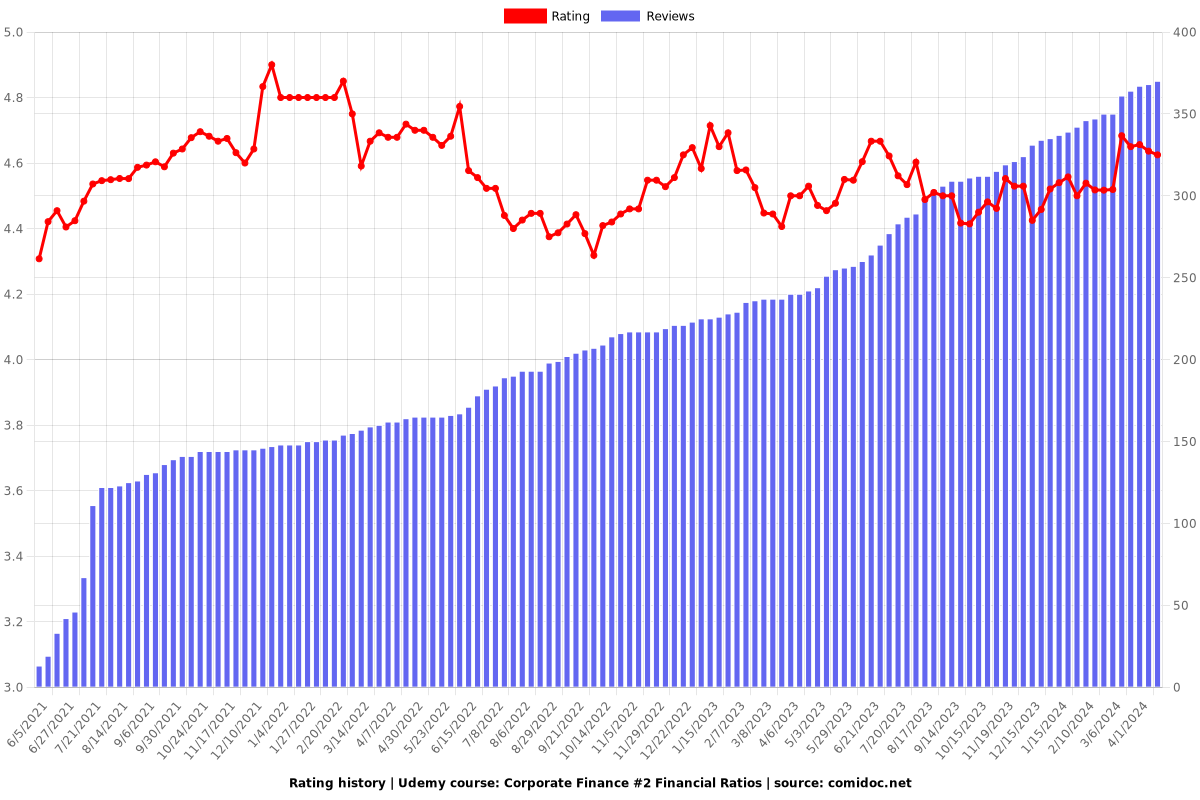

Rating

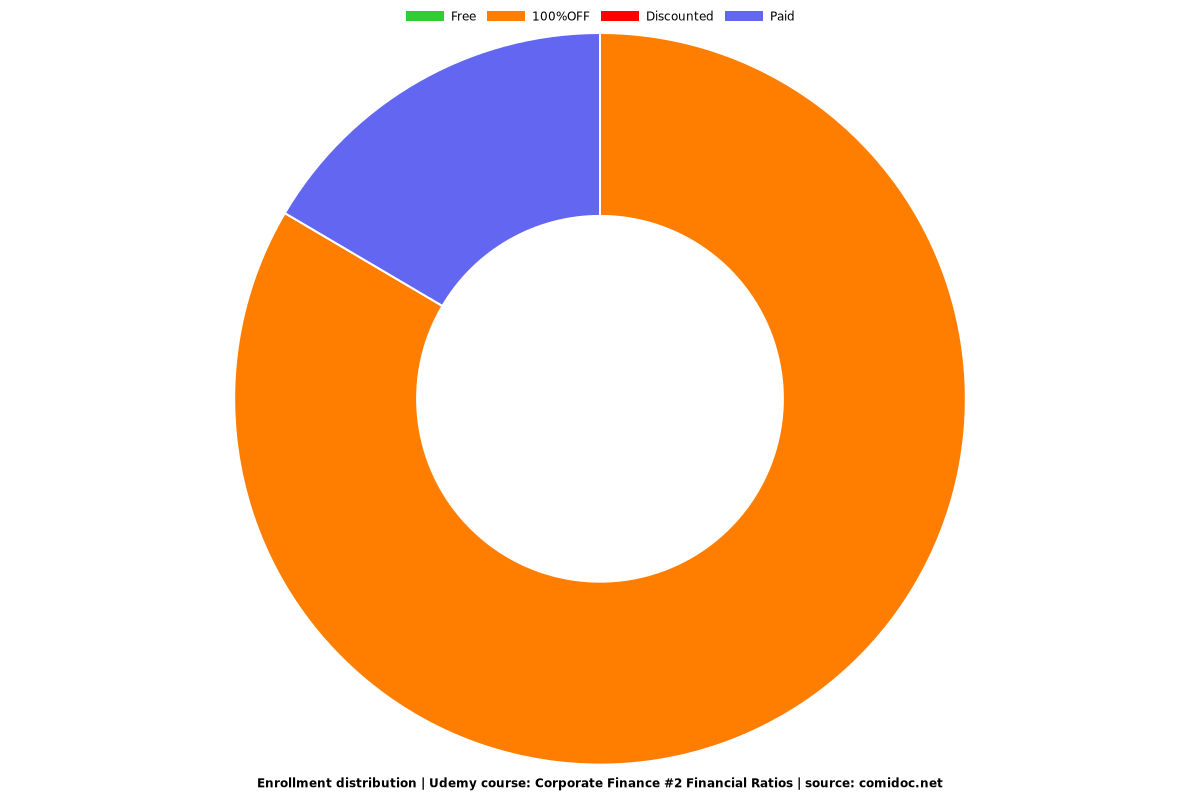

Enrollment distribution