Corporate Finance 101: Equity Valuation

A zoom-in, zoom-out, connect-the-dots take on FCF models, Dividend discount models, and equity valuation

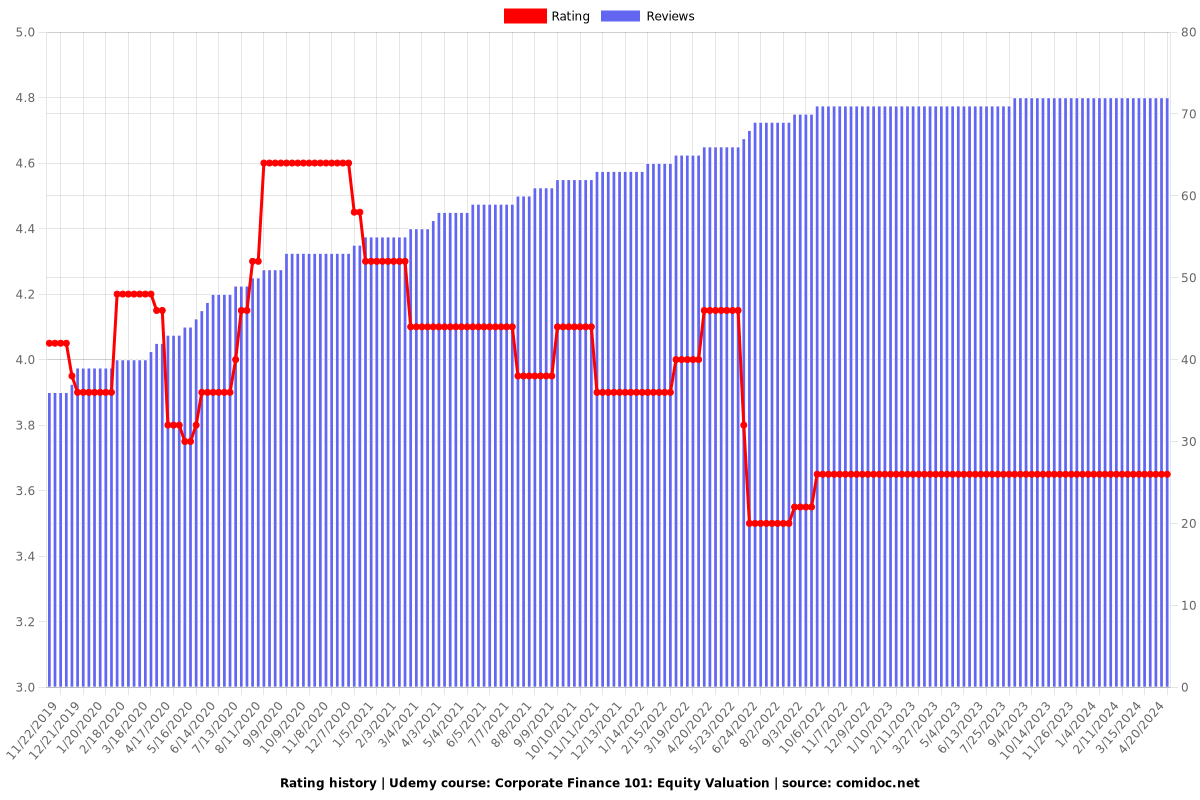

3.65 (72 reviews)

2,880

students

6 hours

content

Aug 2016

last update

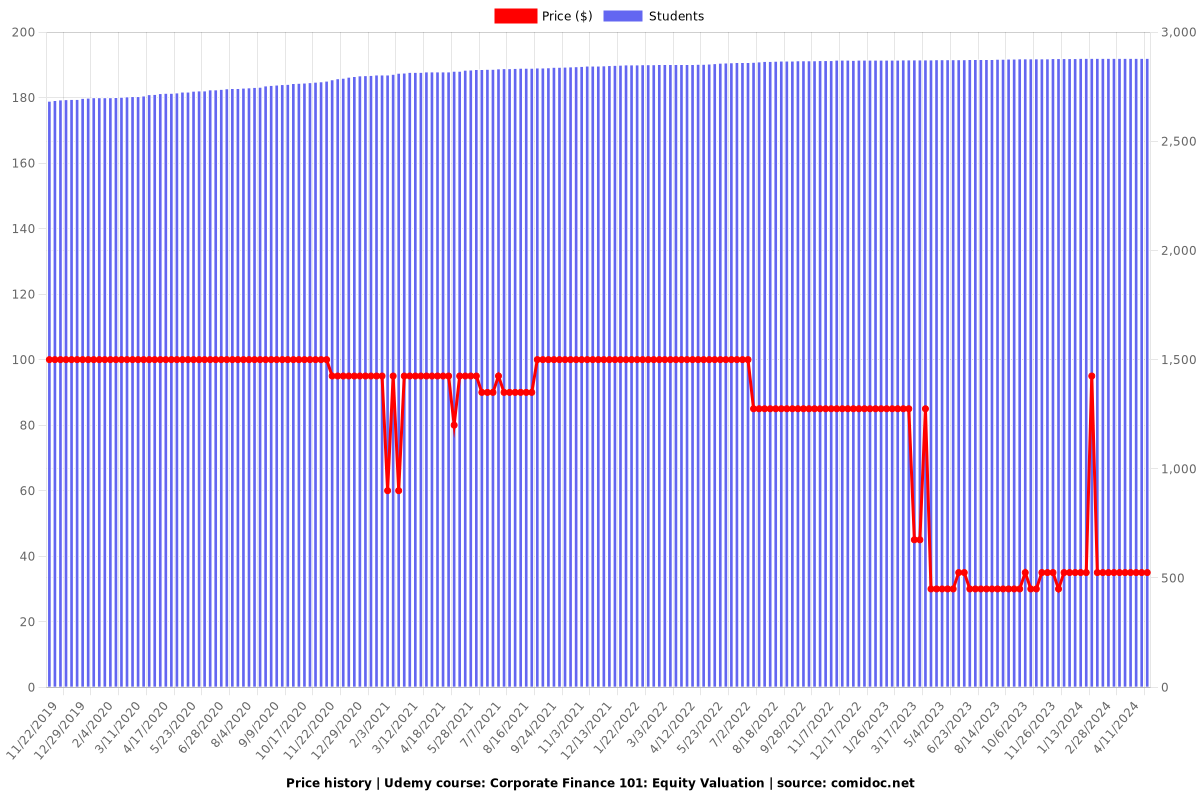

$34.99

regular price

What you will learn

Understand company valuation, the role of cash flows, risk and return

Apply important types of models: Dividend-Discount models, Free Cash Flow Models and Relative-Value models

Calculate the cost of capital to a company

Why take this course?

A zoom-in, zoom-out, connect-the-dots tour of Equity valuation

Let's parse that

- 'connect the dots': Equity valuation is conceptually complex - that's why plenty of folks mechanically follow the procedures, but don't understand the valuation they end up with. This course makes sure that won't happen to you.

- 'zoom in': Getting the details is very important in equity valuation - a small change in an assumption, and the value output by your model changes dramatically. This course gets the details right where they are important.

- 'zoom out': Details are important, but not always. This course knows when to switch to the big picture.

What's Covered:

- Equity Valuation Introduced: intrinsic value, price, valuation and market capitalisation.

- Absolute Valuation Techniques focus on getting a point estimate of a company's intrinsic value. This is invariably done by discounting a series of cash flows projected into the future.

- Net Present Value and Discounting Cash Flows: NPV is a crucial concept in finance - and in life. Understand what the present value of an asset is, how it relates to the rate of return on the asset, and how risky cash flow streams are handled.

- CAPM, Weighted Average Cost of Capital and Required Equity Return: These are key concepts required in valuing the risky stream of cash flows that represent a company's value.

- Dividend Discount Models: A family of absolute value models that discount the dividends from a stock. Despite their seeming simplicity, there is some real wisdom embedded into these models. Understand them.

- Free Cash Flow Valuation: FCF valuation is a serious valuation tool. Understand how to use it right - and when not to use it.

- FCFF and FCFE: The fine print on calculating Free Cash Flows to the Firm, and to Equity holders.

Screenshots

Reviews

Hithim

June 9, 2022

The absence of case studies on companies and Excel files for valuation models was not what I expected from this course. This is a course designed for beginners. However, the same knowledge is available online for free. It is a complete waste of time if you intend to pursue studies at the intermediate or advanced levels. It would have been preferable if the practical section or actual situations were presented on Excel.

Theofanis

September 19, 2020

Really good course for someone who is an absolute beginner. The instructor explains in simple terms the basics but I would really like some hands on experience.

Andrea

June 18, 2020

very helpful. would also be interested in a similar course that goes over multiples (e.g., p/e, ev/ebitda, etc)

Shreyash

April 22, 2020

The Course is very slow and not as expected and mentioned in the content. The valuation models are not elaborated and only time value of money is explained in each of the vide.

Shourya

February 12, 2020

Pretty amazing. Concepts got cleared. Totally recommend for the people wanting a career in core finance and valuation

Don

November 26, 2017

Material was well organized, well explained - thick accent slightly distracting. Topic covered very well.

Michael

November 24, 2016

I was expecting a combination of calculations and results interpretation and theoretical concepts. Was also expecting case studies. So far, only theoretical concepts are discussed.

Soumen

August 25, 2016

Wow. Just loved the simplicity and flow of the contents. I am right now in Sem 3 of MBA Finance. So I have this subject in this sem. This course just connected all the dots that my teacher never bothered. Especially in the 9th section explanation was so extraordinary.

The only thing missing was practice questions or cases.

Great work LoonyCorn

Charts

Price

Rating

Enrollment distribution

Related Topics

804298

udemy ID

3/26/2016

course created date

11/22/2019

course indexed date

Bot

course submited by