Conditional Loan Approval Mortgage Training

Loan Processor & Mortgage Loan Originator Skills Training: 15 loan approval examples reviewed and explained in detail

What you will learn

You will learn what a conditional loan approval is.

You will learn how understand what conditions mean and how to overcome obstacles.

You will be able to close more loans by becoming more knowledgeable on one of the most important decision making documents.

You will know what specific mortgage abbreviations mean and how to play a part in the loan approval.

You will learn who takes care of what conditions so that the loan process flows smoothly.

You will understand the difference between different types of loan approvals and how you will need to approach each one.

Why take this course?

Are you planning to start a career as a loan processor, loan originator, or underwriter and don't know how to read and understand a conditional loan approval yet? I can guarantee that once you start working or if you are already working in the mortgage industry, you will see a conditional loan approval often. This course on "Conditional Loan Approval Mortgage Training" goes over 15 real life examples of loan approvals. As your instructor, I will go into detail on every aspect of a conditional loan approval so that you can master this important document on every loan.

But what is a conditional loan approval? This is a document that's provided by the underwriter that tells you if a borrower has been approved for a loan or not and what conditions need to be submitted to be able to close on the loan. Having closed hundreds of mortgage loans in the past, I can tell you that this is what makes or breaks deals and is the reason why some people earn twice as much as other people.

How is this course broken down?

Section one goes over important definitions and aspects of a conditional loan approval.

Section two goes over the first 5 conditional loan approval examples plus a practice exam at the end to reinforce what you’re learning.

Section three goes over the next 5 conditional loan approval examples that include different variations and situations you will see in real life plus a practice exam at the end to reinforce what you’re learning.

Section four goes over the last 5 conditional loan approval examples which will include additional situations you will normally see when performing your job plus a practice exam at the end to reinforce what you’re learning

Section five explains the importance of loan approvals and possible situations that may come up.

What's included in this course?

15 real life conditional loan approvals

3 practice tests to confirm you're understanding the content

1 downloadable pdf for a blank mortgage loan commitment

Instructor assistance any time as a current student

The main benefits of this course:

- Real life mortgage conditional loan approvals explained in detail

Loan processors and mortgage loan originators that know how to interpret loan approvals end up closing loans faster, which means you are more productive and will be paid more.

- Detailed explanations on how to proceed with specific loan conditions on FHA, Conventional, and VA loans

- Close loans faster than your peers

- Minimize errors and impress superiors

- Learn to quickly analyze an entire loan scenario and loan criteria

- Become familiar with terms such as CIC, LTV, DTI, FHA case numbers, MI, UFMIP, LOX, and many other terms.

- Learn to determine what the cash to close is and if borrowers will have any seller credits

Don't wait until the day of your interview. Start now with these loan approval examples and master a key component of closing loans.

Once you complete this course on Conditional Loan Approval Mortgage Training (Loan Processor & Mortgage Loan Originator Skills Training: 15 loan approval examples reviewed and explained in detail), a course diploma will be available to you when all sections have been completed at 100% which you can save or print. For instructions on downloading your course diploma you can go to: https://support.udemy.com/hc/en-us/articles/229603868-Certificate-of-Completion

Your instructor

Joseph Correa is the founder and CEO of Finibi Mortgage, a licensed mortgage brokerage business based out of Orlando, Florida. Having closed hundreds of mortgage loans and processed many of them, he has the necessary processing knowledge to help you become a success. In the past, he has also owned a correspondent lender business and invested in real estate.

Screenshots

Reviews

Charts

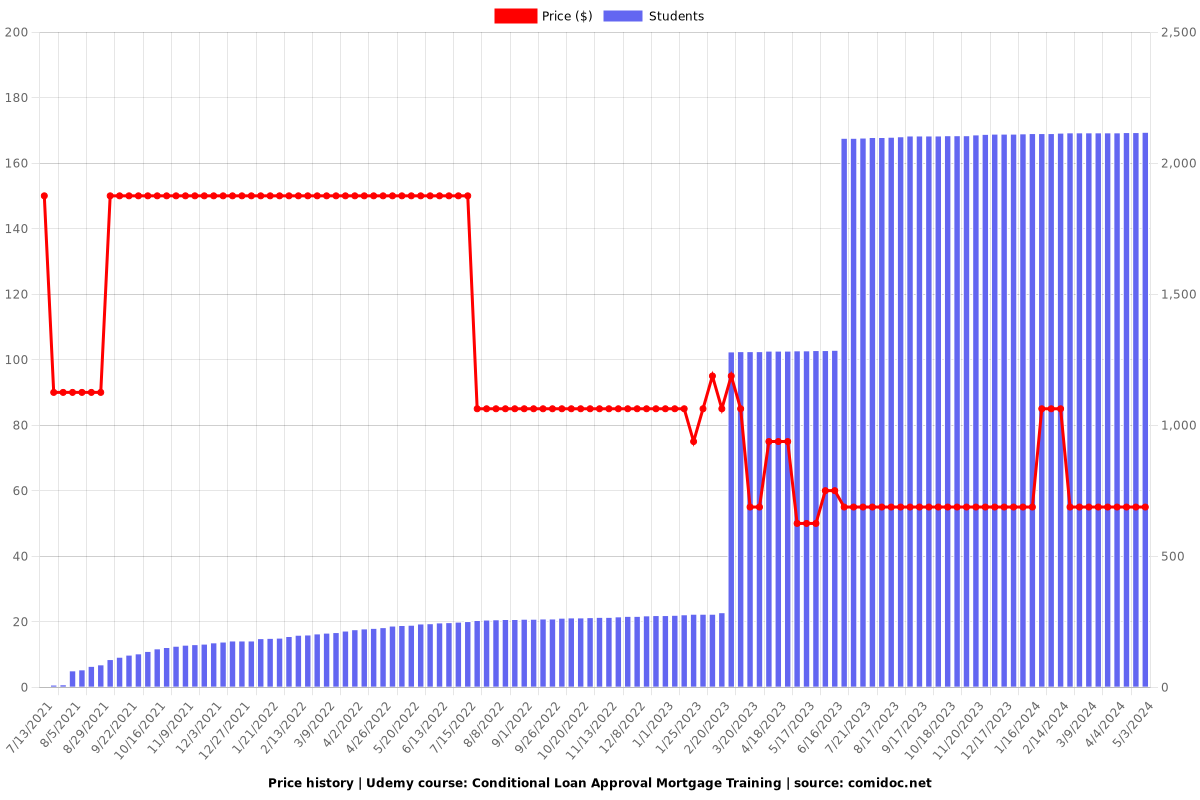

Price

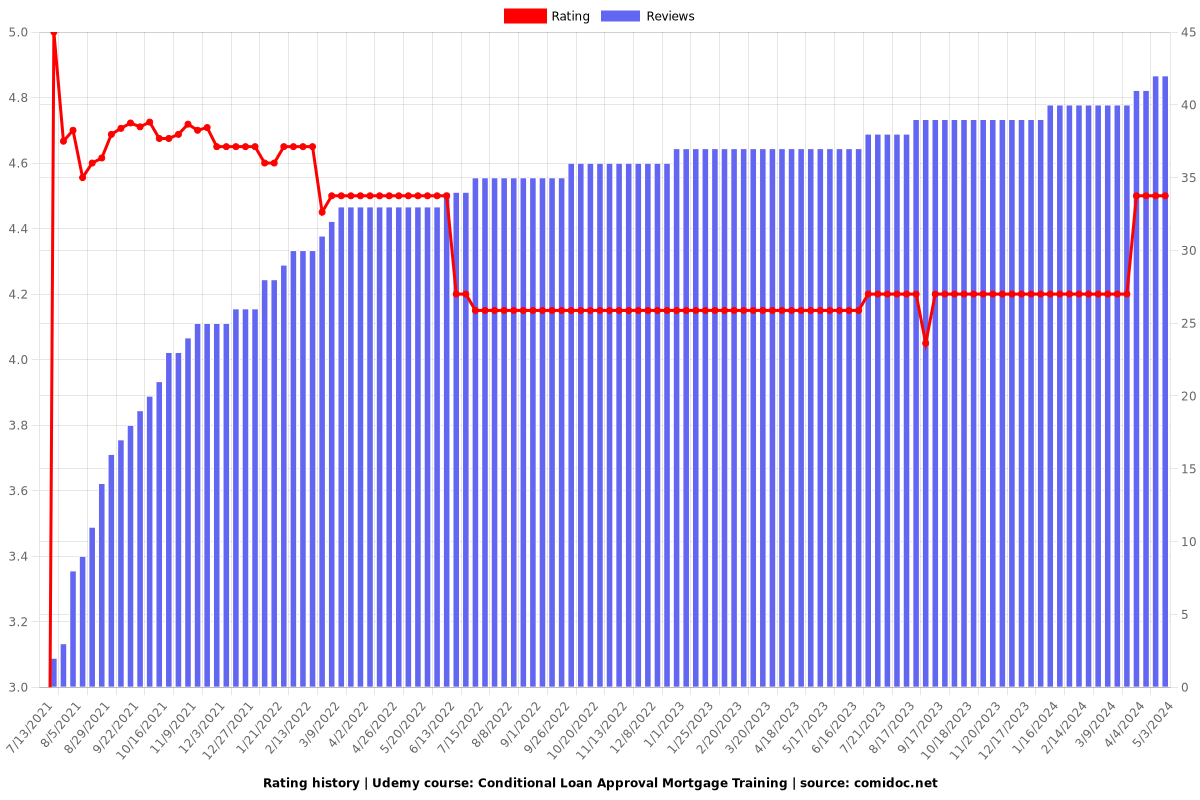

Rating

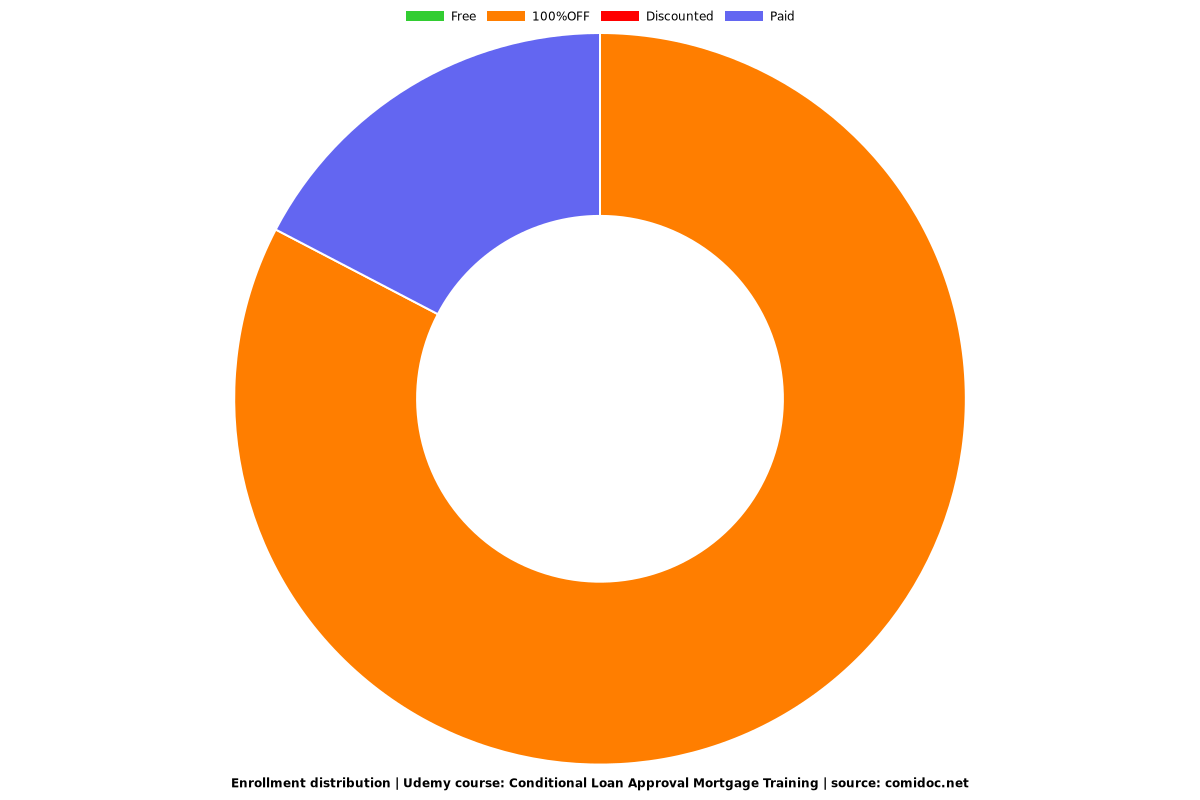

Enrollment distribution