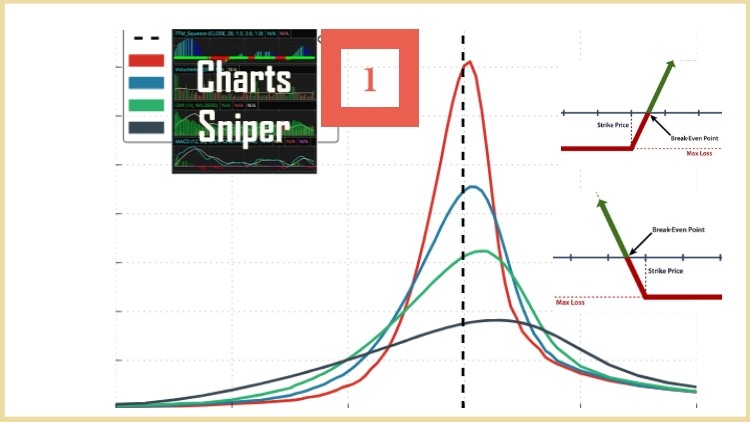

Charts Sniper O1 : Options - In-depth essentials

Comprehensive course that covers all the essential components of options for beginners with real world examples

4.65 (24 reviews)

92

students

4.5 hours

content

Mar 2020

last update

$34.99

regular price

What you will learn

Understand Options and various components of it

Understand Implied Volatility, IV Percentile

Understand Option greeks like Delta, Gama, Theta and Vega

Understand Call and Put strategies

Related Topics

2918030

udemy ID

3/27/2020

course created date

4/4/2020

course indexed date

Bot

course submited by